Featuring guest contributor: Sindhu D Janakiram, Co-Founder & CEO at Refugee Integration Insights*

Every three seconds another person is forced out of the rhythms of normal life and into crossing a border to find safety. From 2010 to 2020, the world’s total refugee population doubled to over 26 million people. While this sharp increase was in part driven by acute emergencies such as the Syrian refugee crisis, such crises alone do not tell the full story. According to the United Nations High Commissioner for Refugees (UNHCR), vulnerable people living in some of the most fragile and conflict-affected countries are often disproportionately affected by climate change.

Refugees are on the frontlines of the climate emergency in part because many are living in climate “hotspots,” where they typically lack the resources to adapt to an increasingly hostile environment. A recent Bloomberg feature details the destructive effects of climate change on Africa:

Extreme weather events have exploded in Africa. … In 2020, the most severe flood in Sudan in 60 years displaced more than 500,000 people. … Africa loses 4 million hectares of forest each year to land degradation, Lake Chad has shrunk by 90% in the last 40 years and the glaciers on Mount Kilimanjaro are melting…A record 4.3 million people were displaced in 2020 in Sub-Saharan Africa alone due to weather events and conflicts, GCA (Global Center on Adaptation) estimates.

This climate-driven refugee crisis will only intensify as ecological disasters drive mass migration and greater armed conflict, which could displace more than 1 billion people by 2050.

As the rate of refugee displacement grows, solutions that address only refugees’ immediate needs will become increasingly unsustainable, as the institutions who typically provide these services – governments and non-governmental organizations (NGOs) – are drained of the resources and political will to support a population that does not vote or hold any outsized influence in society. Moreover, even when capital and goodwill are available, governments and NGOs are often incapable of adequately responding to acute refugee crises because these institutions can be hampered by a limited scope, organizational bureaucracy, and red tape.

The current Ukrainian refugee crisis illustrates the limitations of governmental and NGO refugee support. European governments and international NGOs have responded with an unprecedented campaign to support those fleeing (for example, Poland has taken in more than 3.9 million Ukrainians thus far) with resettlement and basic services such as housing, hygiene, and sustenance. However, these solutions are not typically geared towards a pathway to refugee self-reliance. With 77% of refugees “caught up in situations of long-term displacement,” European governments and NGOs are generally unable to provide commensurately long-term solutions to Ukrainian refugees.

“We are witnessing a changed reality in that forced displacement nowadays is not only vastly more widespread but is simply no longer a short-term and temporary phenomenon.” — Filippo Grandi, UN High Commissioner for Refugees

Instead of feeding into such cycles of perpetual aid, refugee solutions are needed that:

- account for the scale of climate change’s disproportionate impact on refugees;

- are not categorically resource-constrained the way public sector and NGO solutions often are;

- can be mobilized to respond to acute crises with minimal red tape; and

- support refugees’ holistic needs and lead to economic integration and self-reliance.

It is in this context that the private sector has stepped up to support refugees through a variety of interventions, including hiring; entrepreneur support; education and skills development; products and services; and philanthropy. These activities pay dividends for both the refugees and the corporations, boosting corporate diversity and inclusion performance, improving human rights practices, improving brand sentiment (per a survey of US consumers), and mitigating social risks as the “S” in ESG gains importance for companies and their shareholders and stakeholders. As Edelman’s 2020 Institutional Investors Trust Report highlights, “social” “climbed to the most important ESG priority for U.S. Investors.”

Direct action to economically integrate refugees is one of the best tools the private sector can utilize to mitigate the effects of the climate crisis (like helping support the millions of Africans described above by offering a pathway to self-reliance). At the same time, implementing refugee programs is one of the best ways to support vulnerable women (like the 94% of Ukrainian refugees who are women and children). Refugees are everybody and almost anyone can become a refugee. That is why solving the big issues of our time requires consideration of refugees’ holistic needs.

Despite increasing investor interest and corporate refugee support, the rapidly growing sustainable finance sector is lagging behind the trend. Of the tens of trillions of dollars in global sustainable investments, less than $50m is earmarked for refugees, with no investable products in the public markets. As companies spend growing volumes of resources on refugees, there is an emerging opportunity for these initiatives to be tracked in a similar way to corporate sustainability action on climate change and gender equality. Traditionally, a lack of data and research on refugee corporate action has left investors unsure where to direct their capital to help tackle this issue. Until now.

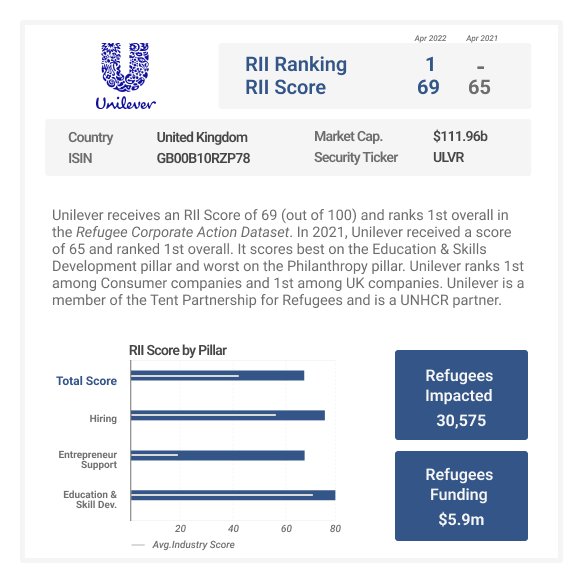

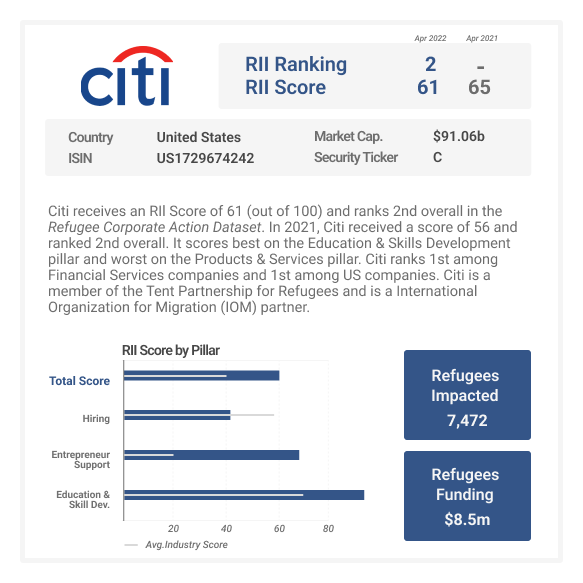

Refugee Integration Insights (RII) is the first independent provider of corporate refugee data and insights. RII tracks global corporate refugee action through the first-of-its-kind Refugee Corporate Action (RCA) Dataset. The RCA Dataset is composed of structured qualitative and quantitative metrics and scores on thousands of global companies’ activities and contributions towards refugees. RII data is collected from public sources such as sustainability reports, industry reports, nonprofit data, and news reports. RII also has exclusive access to refugee hiring data from Upwardly Global, an NGO that matches qualified refugees with jobs at major global companies and a partner of RII.

RII has developed the Refugee Lens Scorecard, a proprietary methodology assessing corporate refugee action along six pillars.

Source: RII

The Scorecard is weighted so that corporate action that enhances refugee economic integration and self-reliance (hiring, entrepreneur support, and education and skills development) is valued more highly than lower-impact actions such as philanthropy or donating products and services. The use of this kind of data allows for the exploration of causal links between solutions that positively impact the “E” and “S”. This aids in evaluating the impact that companies have on the world at the community and individual livelihood level, rather than what can be seen as a traditional ESG formulation – the impact of the world on the company.

Select examples of corporate refugee action from RCA Dataset:

Source: RII

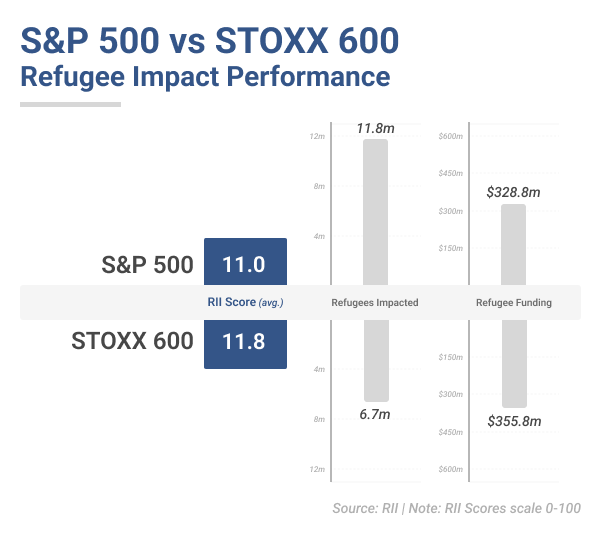

Since 2015, when many corporations began refugee initiatives, European companies have outperformed the rest of the world on refugee action. This can be traced to the fact that many Syrian refugees resettled in Europe (for example, Germany let in over 1 million Syrian refugees beginning in 2015), and the European business community responded with an industry-wide campaign of support.

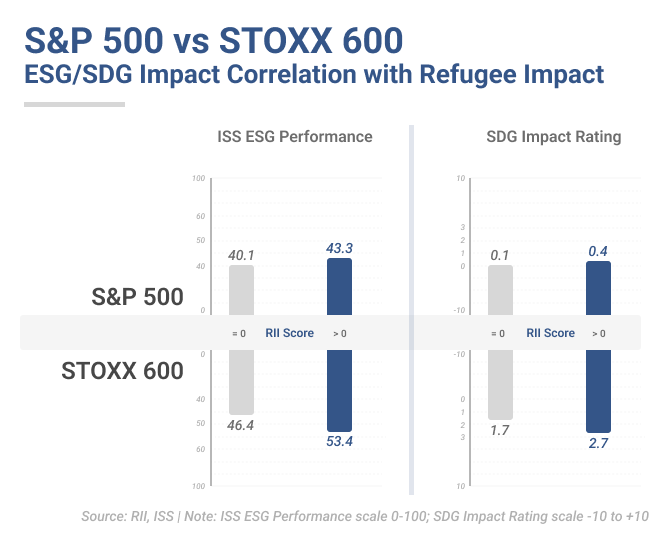

RII and ISS ESG data shows that strong-performing ESG and positively contributing Sustainable Development Goals (SDGs) firms demonstrate significant impact on refugee livelihoods. Moreover, supporting refugees has cross-applying benefits because supporting refugees often improves Diversity, Equity, and Inclusion (DEI) performance, a key driver of overall ESG performance. Similarly, at least 10 of the 17 SDGs and many of their underlying targets are directly relevant to refugee issues.

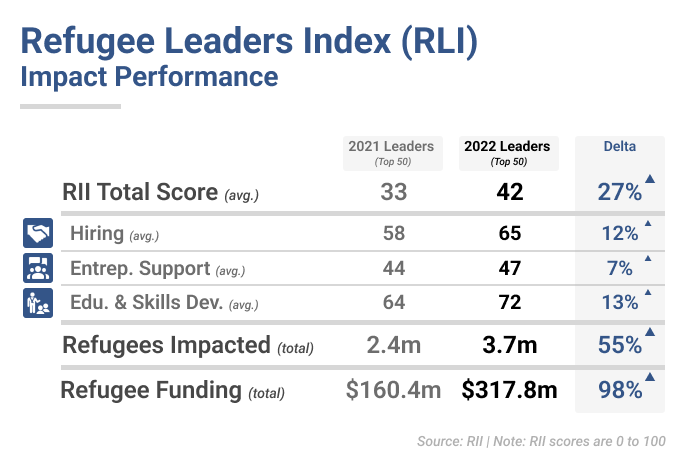

RII’s flagship Refugee Leaders Index (RLI) is the first index that tracks the top-performing global companies on refugee action.

Since Spring 2021 when RII launched the index, companies in the RLI have significantly improved their refugee impact scores across all Scorecard pillars. This level of increase is rare for a single-issue index across a diverse set of companies. While this increase was mostly driven by recent Ukraine support, even if Ukraine support is removed there is still a strong year-on-year increase in RII scores across all pillars.

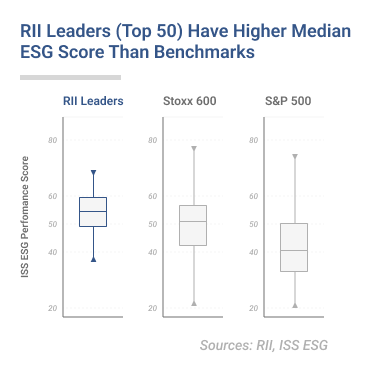

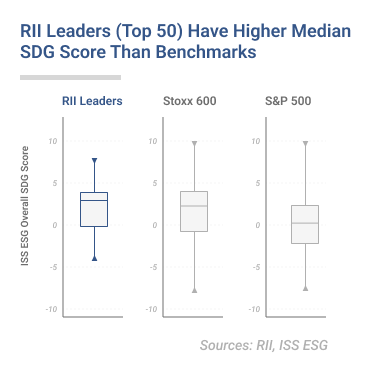

The Leaders index is a strong basket of companies when it comes to overall ESG performance and SDG Impact rating as well. In fact, the RLI outperforms the S&P 500 and STOXX 600 on ISS ESG Performance and SDG Impact Rating.

The median RLI company earned an ISS ESG score of 54.3 vs 50.9 for the Stoxx 600 and 40.7 for the S&P 500. Per ISS, scores greater than 50 are rated ISS ESG Prime for best-in-class ESG performance. 70% of RLI companies are rated ISS ESG Prime vs only 52% for the Stoxx 600 and 25% for the S&P 500.

A similar level of performance can be observed for the SDG Impact rating. An ISS ESG SDG Impact Rating score above 0 indicates a positive contribution to achieving the SDGs, including from products and services, operations, and controversies. The median RLI company earned an SDG Impact Rating score of 2.9 vs 2.1 for the Stoxx 600 and 0.2 for the S&P 500.

Conclusion

To truly prepare for the emerging challenges of climate change, solutions must be devised that apply to the most vulnerable in our society, a stateless people without the means or influence to tackle the issue on their own. The most effective solutions for refugees are those that facilitate refugee economic integration and self-reliance. The private sector is well placed to scale these solutions through hiring, entrepreneur support, and education and skills development, and has already begun doing so.

As responsible investors become more sophisticated, and new data sources emerge, the finance sector will increasingly be able to bring transparency to corporate refugee impact, offering the potential for investor capital to help scale this action to meet the growing needs of an accelerating crisis.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

* Editor’s Note: Neither Institutional Shareholder Services Inc. (ISS) nor its responsible investment unit and co-author of this paper, ISS ESG, endorse or recommend any commercial products, services, or policies espoused by Refugee Integration Insights, with which it is collaborating on this paper. Reference to or appearance of any specific commercial products, services, or policies by trade name, trademark, manufacturer, or otherwise, in this paper does not constitute or imply its endorsement, recommendation, or favoring by ISS or ISS ESG. The views and opinions of the co-authors expressed in this paper or in materials available through download from this paper do not necessarily state or reflect those of the ISS, ISS ESG, or their clients, and they may not be used for advertising or product endorsement purposes.

By: Sindhu D Janakiram, Co-Founder & CEO, Refugee Integration Insights. Hernando Cortina, Head of Index Strategy, ISS ESG.