Investment trends do not form in a vacuum. They are impacted both by coincident developments within the investment arena and broader social and/or regulatory changes*.

Environmental, social and governance (ESG) investing is no different. ESG has emerged at a time when investors and society are examining and reprioritizing their values, which is then reflected in the evolution of their individual and collective investment objectives.

Reflections on “value” are often the consequence of a new philosophy emerging, which is precisely what was observed when passive investing emerged. The emergence of passive investing led to a significant reevaluation of where value is generated throughout the investment supply-chain. Although it began as a question of the value of security selection, it arguably sparked a broader conversation among the investment community. Beyond security selection and active management facing additional scrutiny, so too have adviser fees been brought into the spotlight. What started as a relatively contained debate led to the development of roboadvisers, the shifting of adviser narratives and large investors bringing investment capabilities inhouse. It only takes a spark to a light a fire.

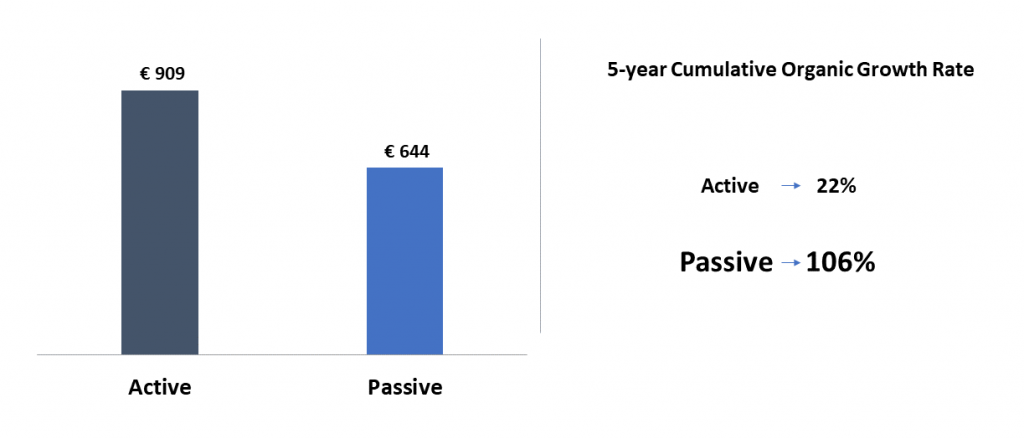

Cumulative 5-year fund flows (in billions) – July 2022

Fires, however, do not spread in a linear fashion. As has been seen with the active-passive debate, the results are not binary. Opposed to active or passive, a whole spectrum of investment styles have emerged as value propositions have been regrown – think factor and thematic investing.

Simultaneous to reflections on the investment value narrative has been a growing societal focus on climate change and the impact of humans on planet Earth. And since the said humans are also increasingly relying on investments to help them address their financial needs, it is not a surprise that over time the societal and the investment themes cross-pollinated.

In this fashion, ESG investing has entered a centrestage that is already brimming with characters, subplots and tension. To understand the past, present and future of ESG we must move beyond questions such as “to ESG or not” and consider how ESG may redefine the plot.

ESG: Enter, stage right

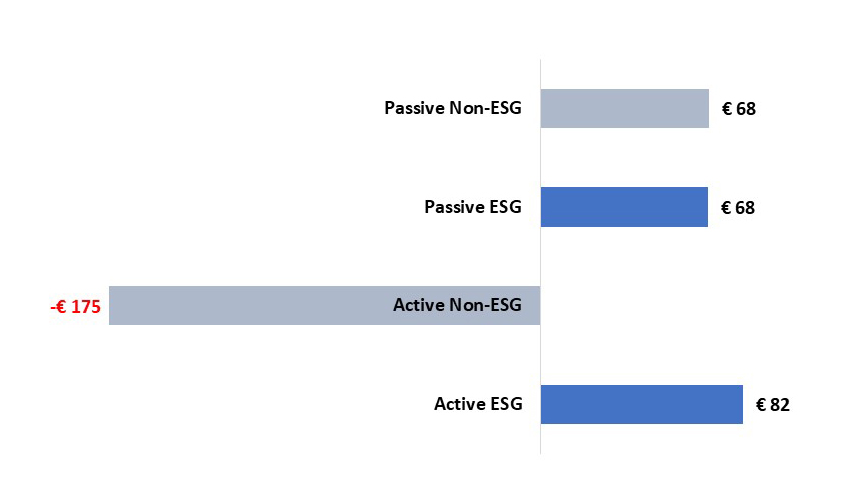

Recent evidence, based on fund flows (see chart below) in Ireland and Luxembourg, point towards ESG’s potential to redefine the narrative. Consider first that flows to funds with an ESG label in their name outsold funds without by approximately €150 billion to -€107 billion in the trailing 12 months to July 2022. Next, consider the breakdown of flows by active and passive and non-ESG and ESG. Whereas active funds as a whole saw significant outflows, there was a massive gulf in flows between those strategies with an ESG tilt and those without–a trend that interestingly does not carry over to passive funds. This latter fact hints that ESG flows may not simply reflect coincident trends, such as active-passive, but may in fact be changing the narrative around existing trends.

Trailing 12-month fund flows (in billions) – July 2022

Notes: The above analysis only examines regulated Luxembourg and Ireland domiciled funds. Focusing our attention on the two largest cross-border domiciles provides insight into broader European investor appetite but is influenced by how funds domiciled in these markets are used by investors. For example, institutional investors use of regulated cross-border vehicles will be influenced by such factors as pricing and tax treatment of domestic pension and UCITS options relative to UCTIS in these domiciles.

How investors incorporate ESG into their investment policies and balance ESG preferences alongside alpha generation, risk management and cost may well determine tomorrow’s winners and losers. Asset managers may therefore find it worthwhile to actively assist investors in defining those preferences. For active managers, an increased focus on ESG impact and alpha generation may provide a new lifeline for those managers looking to remain at the core of investors’ portfolios. A focus on risk management and cost management, however, likely leads to investors adopting passive ESG strategies at the core of their portfolios.

Of course, words will not be enough. The trajectory of ESG investing may also be tied closely to the economic environment it grows up in. Although ESG funds can have a dual objective of financial performance and ESG impact, investors’ reasons for investing almost always boils down to achieving a financial goal. Consequently, the stickiness of ESG flows may ultimately be determined by their relative performance to non-ESG funds over the next decade. Equally, for active funds to remain ahead if not on par, investors will have to be able to connect any cost differential with passive alternatives with the additional return and/or ESG benefit provided. Much of the loss of active funds to passive funds over the past decades has had to do with a failure of belief in active funds’/managers’ value narratives. A long-lived bull market, based on a concentrated number of stocks, and a shift in the focus of advisor practices did not help either.

That investors, retail and institutional, are demonstrating an increasing preference for ESG cannot be doubted. The fund flows speak for themselves. At a high-level it is also observable that demand exists for both active and passive strategies. Unanswered though is who are these buyers and what makes a fund standout? These are the questions that we will examine in Act 2: We know what ESG demand was, but not what it may be. In Act 2 our investigation will delve further into ISS MI Simfund’s share class data to see what we can learn about retail and institutional investors preferences for active, passive and ESG funds.

With so much at stake in terms of assets and flows, expect evolution, potentially even revolution, in our ESG story and above all else, expect to find yourself captivated. Stay tuned!

Want to learn more about how your funds compare on ESG characteristics and fund flows? Talk to us today.

*Note: Read more information on ISS ESG’s latest updates on global sustainability regulatory initiatives.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence