Insurance companies base their business models around assuming and diversifying risk. They pool risk from individual payers and redistribute it across a larger portfolio. Most generate revenue by charging premiums in exchange for insurance coverage (risk underwriting), and reinvesting premiums into other interest-generating assets.

Among the risks affecting insurance companies are ESG-related risks. Climate change is a particular concern for insurance companies with high asset intensities, which are subject to heavy physical climate value at risk.

Investors considering opportunities in insurance companies may wish to examine insurance companies’ underwriting policies, in addition to information provided by the ISS ESG Corporate Rating and ISS Economic Value Added solutions. Some patterns in insurance companies’ ESG and EVA performance are described below.

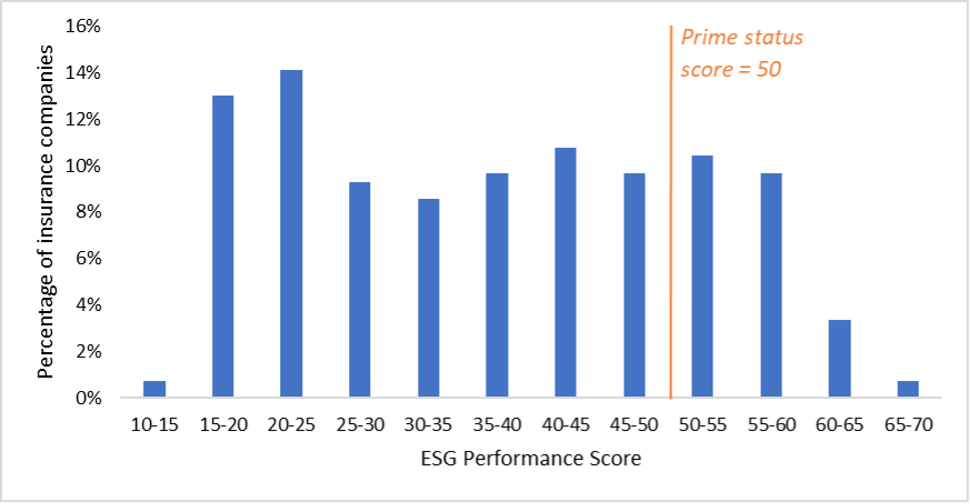

Overall ESG Rating Scores of Insurance Companies

Most insurance companies in the ISS ESG Corporate Rating universe score relatively low in their overall ESG rating performance (Figure 1). Approximately 75% of our 250+ insurance companies score below 50 (Prime threshold), while more than 25% of insurance companies score below 25.

Figure 1: Insurance Companies – Breakdown of ESG Rating Performance Scores

Source: ISS ESG

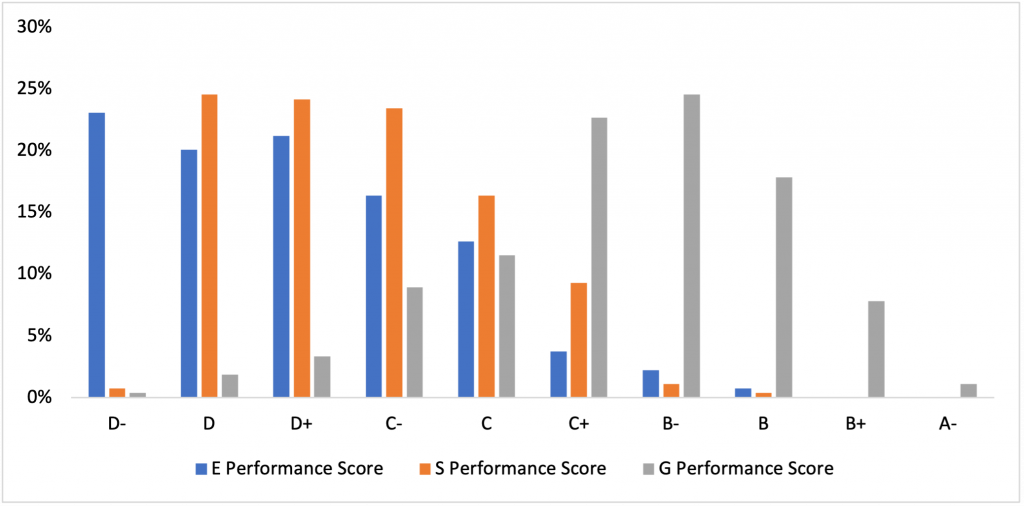

When breaking down these performance scores, it appears that insurance companies score the highest in their Governance (G) pillar performance scores, followed by their Social (S) performance scores, and their Environmental (E) performance scores (Figure 2).

Figure 2: Insurance Companies – Breakdown of E, S, G Performance Scores

Source: ISS ESG

Insurance companies’ relatively sound Governance practices are likely due to longer and more well-established mandatory reporting requirements around governance issues meant to protect the long-term viability of financial markets and consumers.

Among Social issues, Diversity, Equity, and Inclusion efforts have increased in recent years, which has led to companies publishing more relevant and transparent policies to promote a welcoming, diverse, and discrimination-free workplace.

The Environmental pillar is now receiving more attention because of both various countries’ Net Zero commitments and the wide coverage of COP 26. Nevertheless, insurance companies are still relatively new to navigating the complex landscape of greenhouse gas (GHG) accounting and climate change mitigation/adaptation strategies.

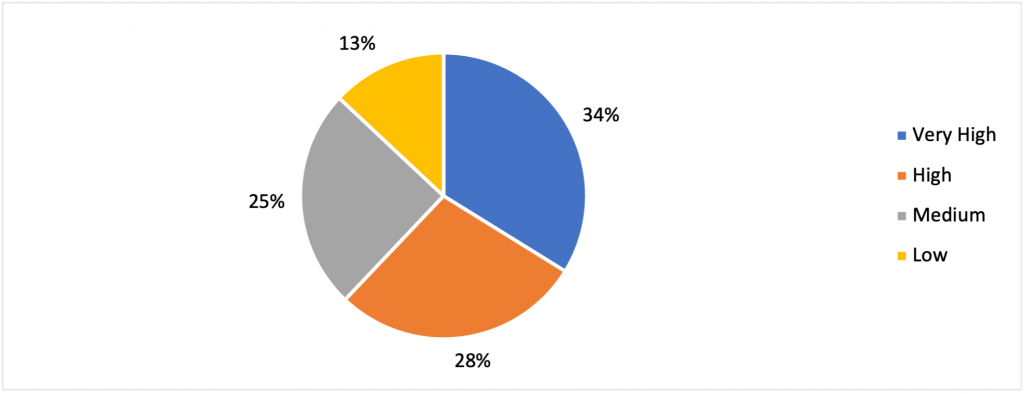

More than 60% of insurance companies have high or very high ESG disclosure transparency. Across the many ESG issues with varying material implications, climate change has been on the top of the agenda for most insurance companies.

Figure 3: Insurance Companies – Breakdown of ESG Disclosure Transparency Levels

Source: ISS ESG

Climate Change Risks and Mitigation Strategy (CCRM)

Governments and regulators are increasing disclosure requirements, as momentum on disclosure frameworks is accelerating. For example, the ISSB published its first two IFRS Sustainability Disclosure Standards, including on climate-related disclosures, in June 2023, to take effect from 2024. Nevertheless, investigation of climate change risks-related disclosures based on the existing ISS ESG universe of 250+ insurance companies indicates that companies’ performance has been lacking.

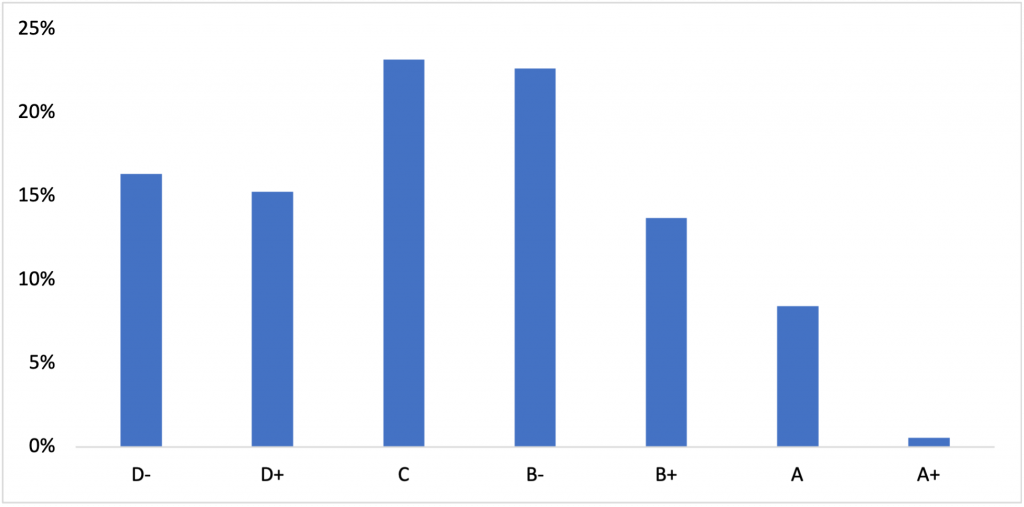

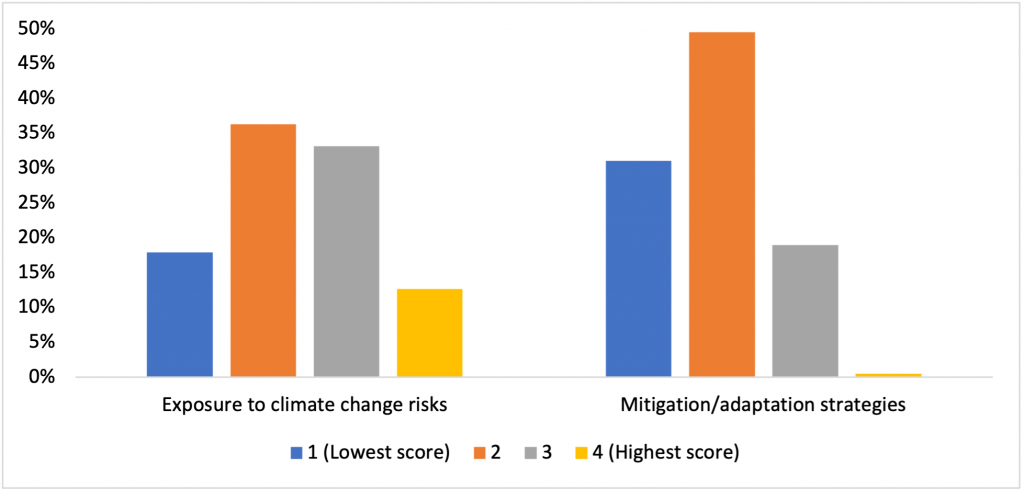

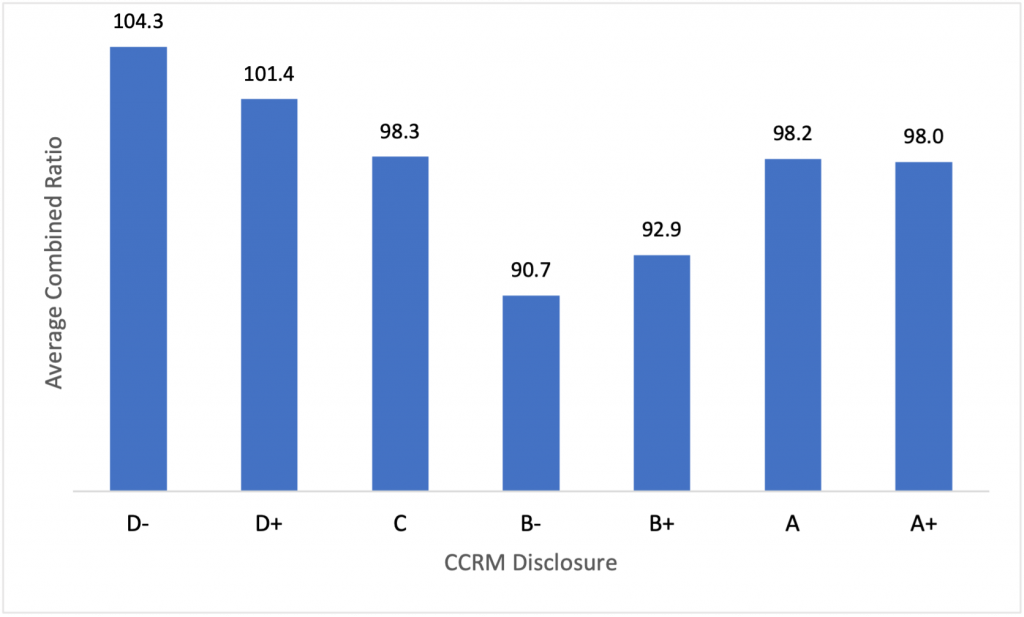

The ISS ESG Corporate Rating examines companies’ disclosures on important and relevant industry risks related to climate change and whether companies have climate change adaptation and mitigation strategies in place. Figure 4 displays the performance for the relevant disclosure of the Climate Change Risks and Mitigation Strategy (CCRM) indicator.

Figure 4: Insurance Companies – Breakdown of CCRM Disclosure

Source: ISS ESG

Most insurance companies have adequate (C and above) CCRM disclosure, despite generally low E performance scores (as seen in Figure 2). The combination of adequate disclosure with low E performance scores suggests that more needs to be done to embed climate change considerations into insurance business and investment, instead of simply addressing climate change disclosure on a broader strategy or policy level.

CCRM and Financial Sustainability

Climate change risk manifests in physical and transition risks, which can affect the financial sustainability of companies. Figure 5 shows that more than 40% of insurance companies have scored 3 or above in their disclosure on climate change risk exposure, but less than 20% have scored 3 or above in their disclosure of mitigation and/or adaptation strategies.

Figure 5: Insurance Companies – Breakdown of Climate Change Risk Exposure Disclosures, and Mitigation/Adaptation Strategies Disclosures

Source: ISS ESG

CCRM and Underwriting Guidelines

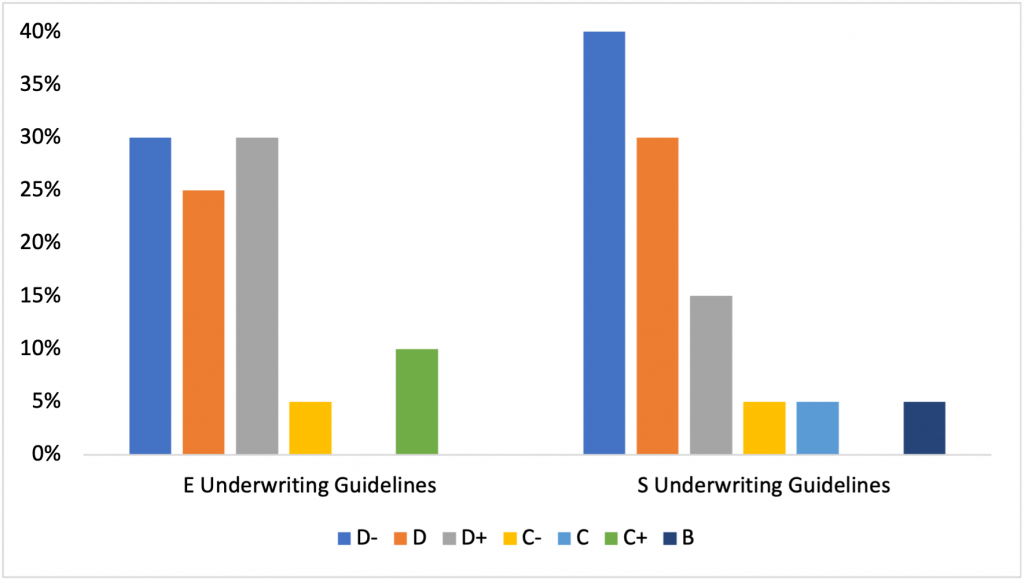

Insurance companies generally play an integral role in supporting individuals, companies, and communities through the whole risk-management cycle, from risk identification to risk transfer and recovery. Excluding insurance coverage of environmentally harmful projects such as fossil fuel development and integrating ESG considerations into insurance companies’ underwriting policies would both help manage and mitigate the insurance company’s own climate change risks. Such measures would also contribute to the broader global decarbonization movement through a potential reduction in companies’ indirect, insurance-associated emissions.

The UN Environment Program (UNEP) has launched an industry-wide guide to assist insurance companies in integrating ESG risks into their underwriting policies. However, the uptake of ESG integration into underwriting guidelines remains slow. Figure 6 shows that the majority of insurance companies scoring B+ and above on CCRM disclosure record below D+ scores on their Environmental and Social underwriting guidelines. (Figure 6 covers insurance companies with scores of B+ and above for CCRM disclosure, although they currently do not make up the majority, to study how these companies perform in their underwriting guidelines.)

Figure 6: B+ and above CCRM Disclosure Insurance Companies – Breakdown of Underwriting Guidelines Performances

Source: ISS ESG

Failure to integrate ESG into underwriting guidelines partially explains why insurance companies’ E performance scores are negatively impacted (see Figure 2). This tendency further highlights the importance of companies not only addressing their climate change risks on a policy level but also incorporating such policies into their material business activities.

ESG and EVA Performance of Property & Casualty and Multi-line Insurance Companies

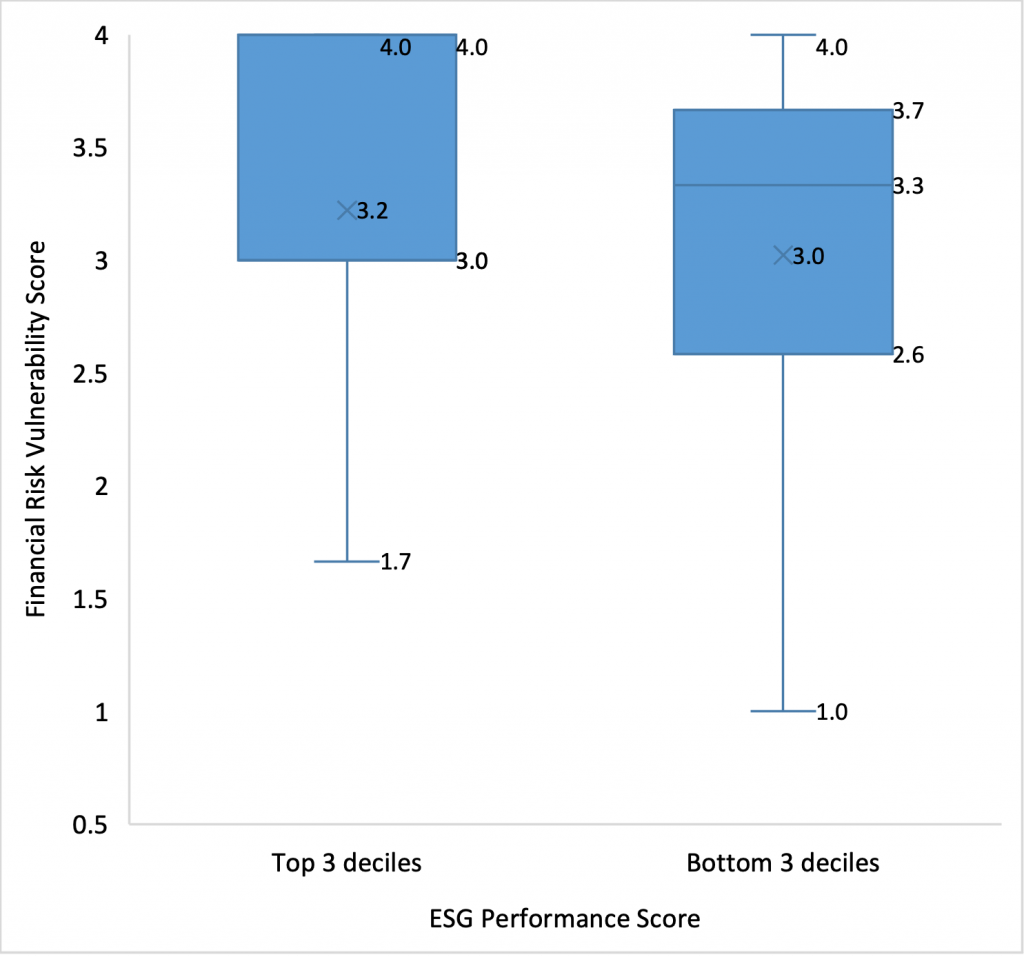

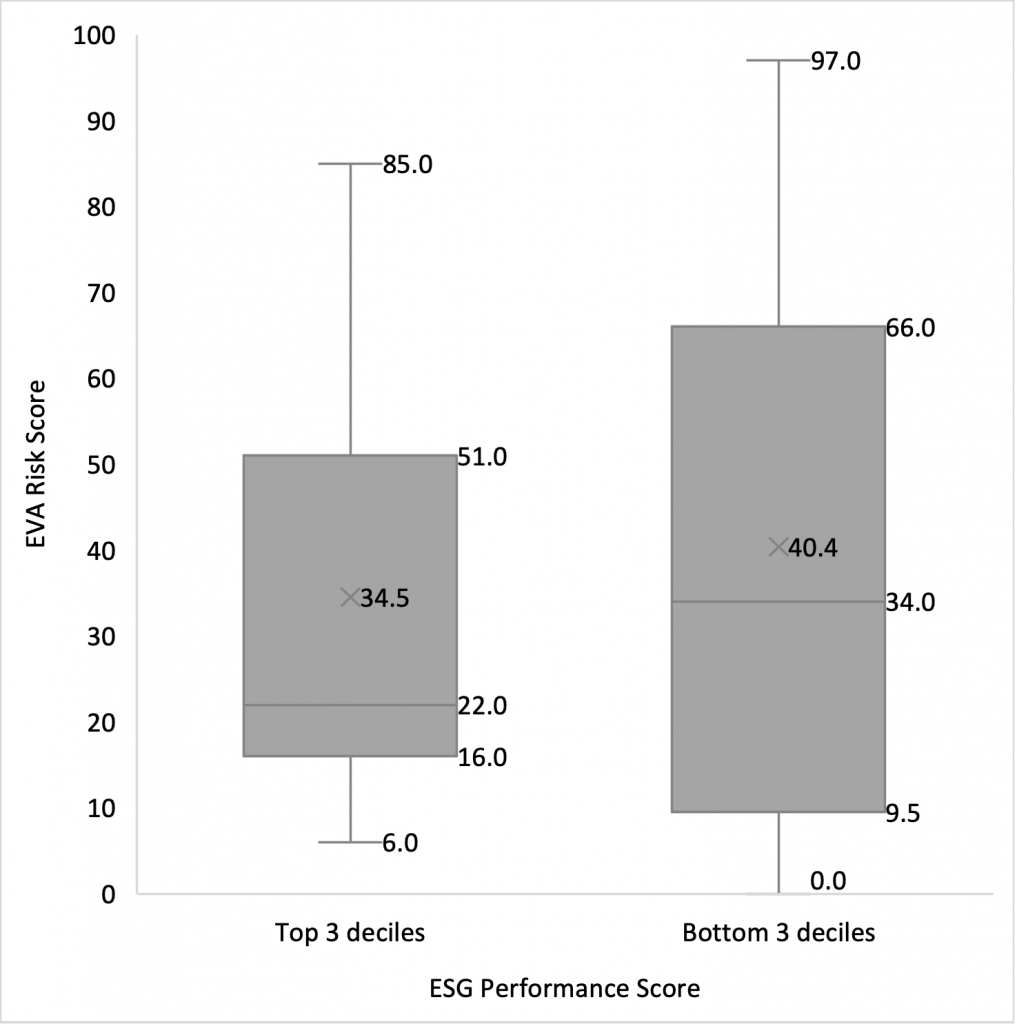

Figure 7 shows that insurance companies in the Top 3 deciles of ESG Performance Score have better Financial Risk Vulnerability Scores than peers in the Bottom 3 deciles. This suggests that the Top 3 deciles may have stronger balance sheets and better cash generation.

Figure 7: Insurance Companies – Breakdown of ESG Performance, and Financial Risk Vulnerability Scores

Source: ISS ESG

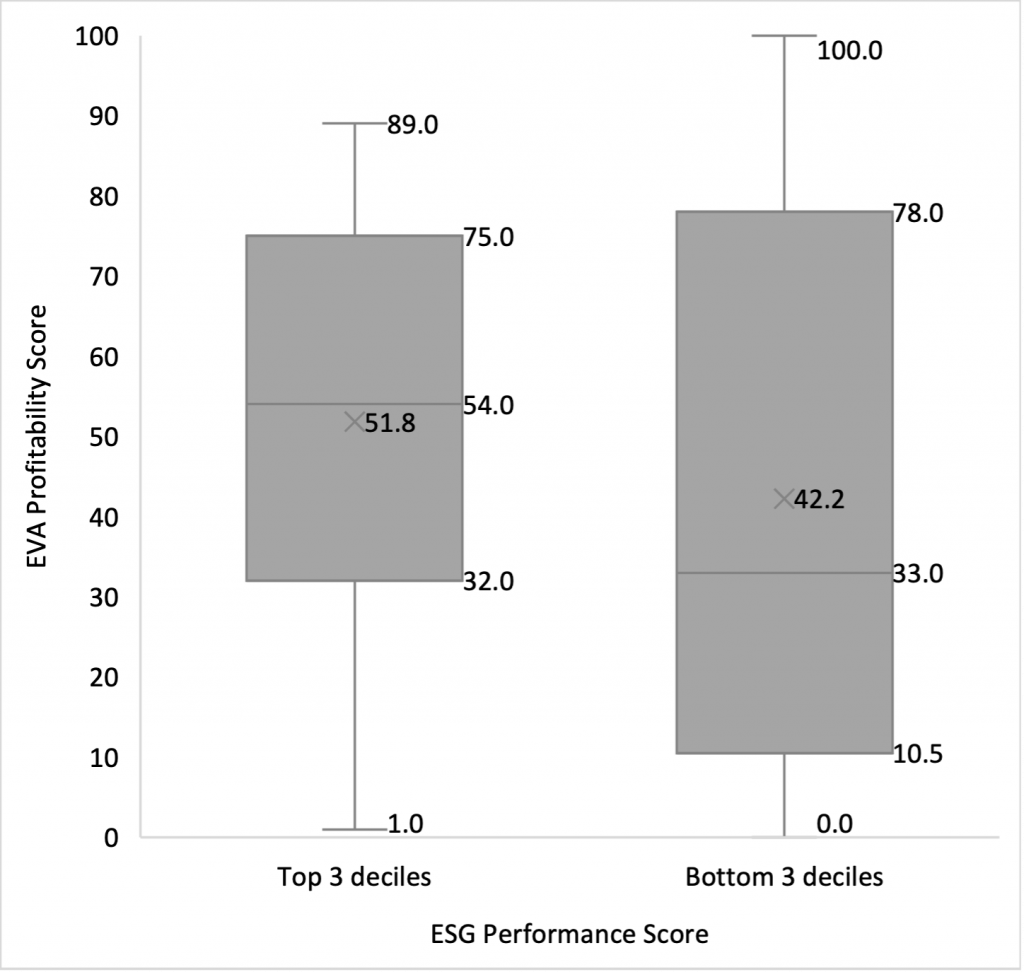

As per Figures 8 and 9, insurance companies in the Top 3 deciles of ESG Performance Score also tend to have higher profitability (higher EVA Profitability Score), lower risk (lower EVA Risk Score), and greater certainty in financial performance (lower dispersion in both EVA Profitability Score and EVA Risk Score) than peers in the Bottom 3 deciles.

Figure 8: Insurance Companies – Breakdown of ESG Performance, and EVA Profitability Scores

Note: The EVA Profitability Score (higher is better) is the percentiled ranking of the firm’s EVA profitability and trend. A score of 69 indicates that the firm’s EVA profitability and trend ranks better than 69% of the peers.

Source: ISS ESG

Figure 9: Insurance Companies – Breakdown of ESG Performance, and EVA Risk Scores

Note: The EVA Risk Score (lower is better) is the percentiled ranking of the firm’s EVA volatility and vulnerability. A lower score indicates less risk, such that a score of 44 suggests that the firm is less risky than 56% of the peers.

Source: ISS ESG

Combined Ratio and ESG Ratings

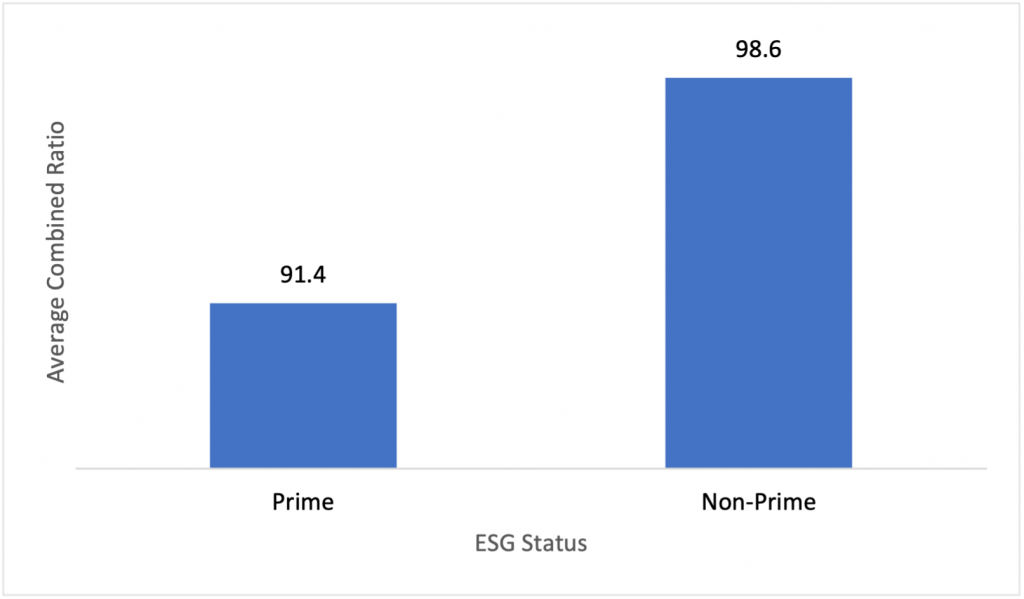

An insurance company’s combined ratio, which is the sum of incurred losses and expenses divided by total earned premiums, indicates the insurance company’s underwriting performance and daily operations. Besides underwriting performance, insurance companies also typically have investment income, but the combined ratio does not include this investment income. The combined ratio is usually expressed as a percentage: a ratio below 100% indicates that the insurance company is making underwriting profit, while a ratio above 100% indicates that it is paying out more money in claims than it is receiving from premiums.

Figure 10 shows that ISS ESG Prime-rated insurance companies have a lower average combined ratio (91.4%) than their Non-Prime-rated peers (98.6%). This indicates that Prime insurance companies on average experience lower loss and expense as a fraction of their premiums.

Figure 10: Prime vs. Non-Prime Insurance Companies – Breakdown of Average Combined Ratios

Source: ISS ESG

Figure 11 shows that insurance companies scoring D+ and below on the CCRM indicator were found to have an average combined ratio exceeding 100%, indicating lower efficiency and profitability.

Figure 11: Insurance Companies – Breakdown of CCRM Disclosures and Average Combined Ratios

Source: ISS ESG

Life and Health Insurance Companies Can Play a Part Too

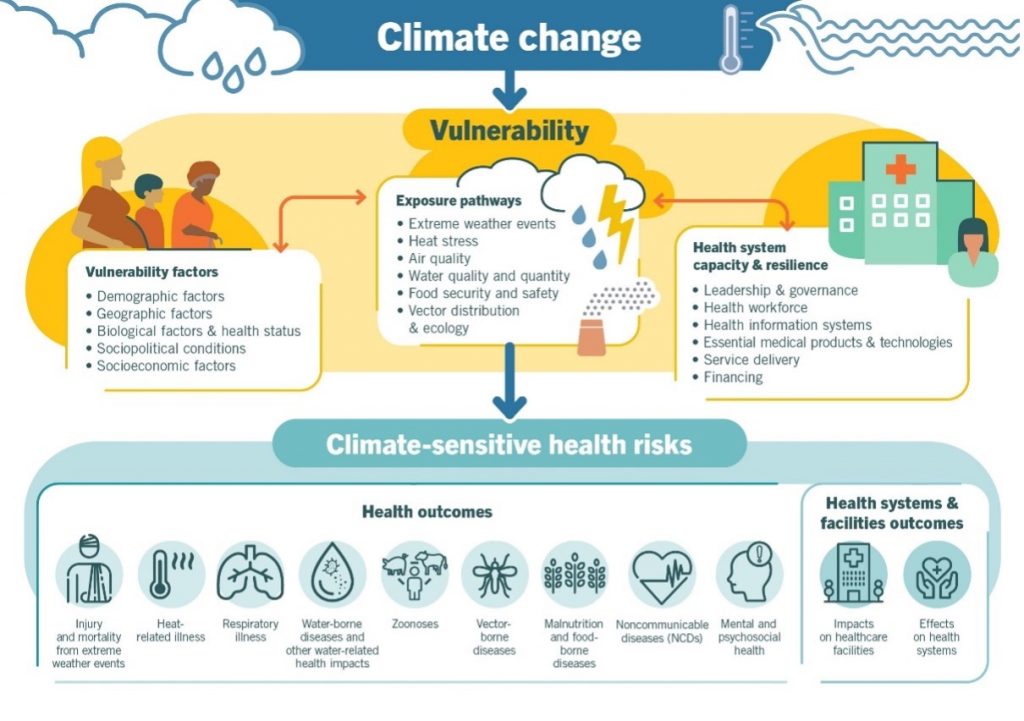

Integrating E and S risks into insurance underwriting is applicable not only to insurance companies with property & casualty business and associated uninsurable assets, but also to life & health insurance companies.

The World Health Organization (WHO) projects that climate change may result in 250,000 additional deaths a year from 2030 to 2050. Climate change may have health-related impacts such as vector-borne diseases and heat-related stress (Figure 12), which could contribute to increased mortality and ultimately affect insurance companies’ claims and payouts.

Figure 12: Climate Change and Health

Source: WHO

Possible options for life & health insurance companies to incorporate ESG risks and to seize opportunities may include the following:

- Regarding underwriting, insurance companies can conduct risk analysis and impact assessments of specific climate change-related medical conditions on life and health insurance claims. Insurance companies can also identify emerging climate-related health impacts and consider developing related products with sound actuarial principles to close coverage gaps.

- Regarding investment, insurance companies can reduce and/or eliminate high-emission industries from their investment portfolios. They can also direct funding into technologies that enhance climate resilience, such as renewable energy and energy efficiency projects. Also, by identifying the most significant contributors to their financed emissions and insurance-associated emissions (scope 3 category 15 emissions), insurance companies could be better placed to implement effective emission reduction strategies.

As insurance companies seek to address ESG-related risks and opportunities, investors may wish to further explore tools and solutions such as ISS ESG Corporate Rating and ISS EVA.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the F in ESGF using the ISS EVA solution.

By: Cindi Toh, Associate, Corporate Ratings, Financials, ISS ESG.

Khai Oh, Associate, Corporate Ratings, Financials, ISS ESG.

Roberto Lampl, Sector Head of Industrials, Financials & Real Estate, ISS ESG.

Gavin Thomson, Global Director of Fundamental Research, ISS EVA.

Casey Lea, Global Director of Quantitative Research, ISS EVA.