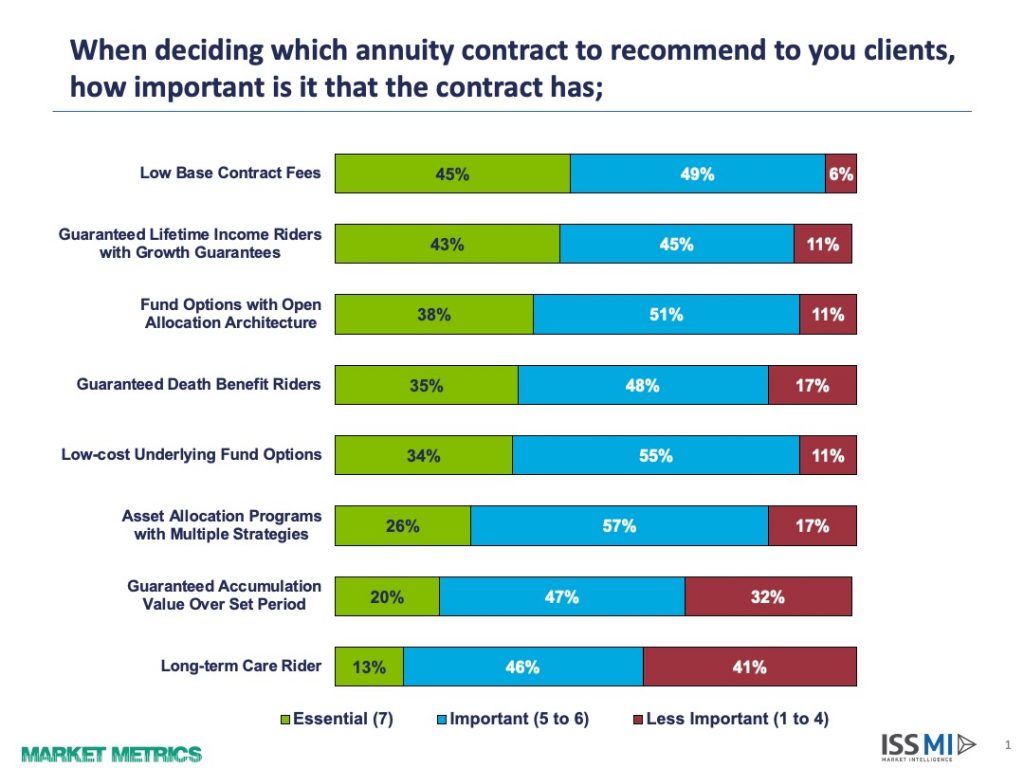

In a recently completed ISS Market Intelligence survey, the importance of guaranteed lifetime income and of low fees- on both the contract and underlying fund levels were the leading factors when recommending a variable annuity contract. The survey targeted advisors who invested 25% or more of their client dollars in variable annuities (VAs), including registered index-linked variable annuities (RILAs). Of those advisors surveyed, 87% are Independent, 7% Bank and 6% Wire/Regional; splits that result in a unique view into the Independent channel. Considering that breakdown, on the product development front, insurers have made fee-based contract designs a heavy focus among new contract registrations over the past several years. These low-cost contracts feature a wide variety of underlying fund options and have also included lifetime income guarantees with friendly treatment of withdrawals for advisory fees.

The survey also suggested the importance of a contract’s underlying funds with associated fees and asset allocation options as top concerns. The themes of investment choice and cost clearly emerge. The survey identified that, for 89% of advisors, open allocation funding options are either “essential” or “important” with the same total percentage eyeing the cost of those investments, a likely result of the respondents considering the “all-in” contract cost.

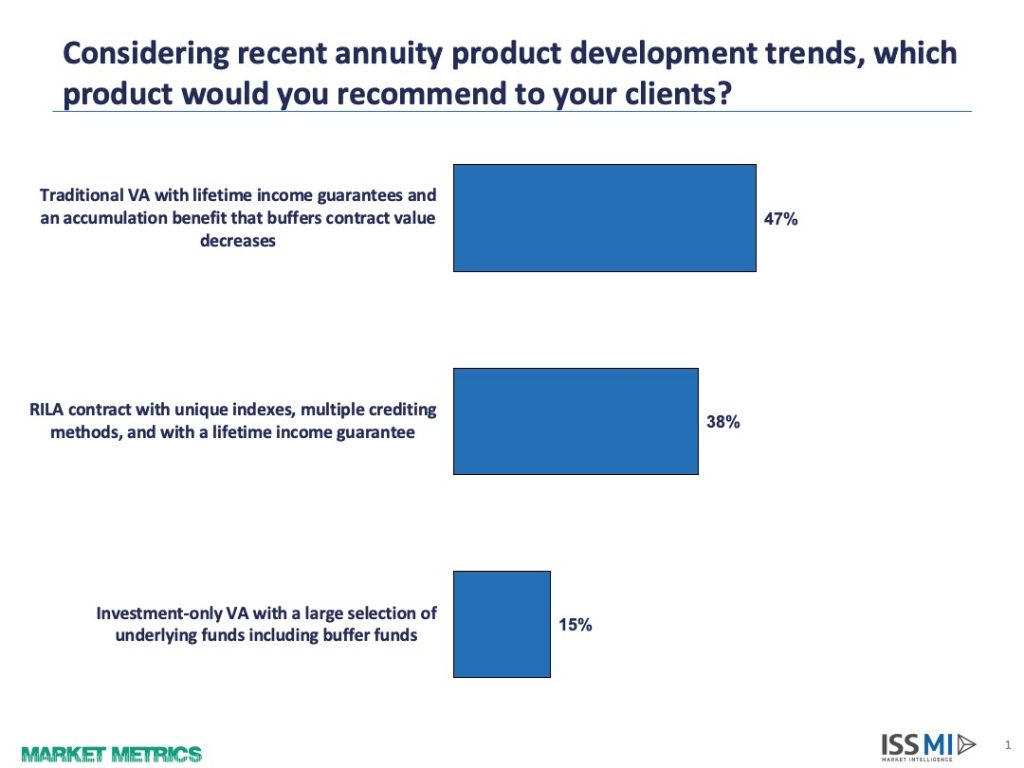

Despite the runaway success of RILAs over the past several years, 47% of advisors surveyed were most likely to recommend a traditional VA with a lifetime guarantee and guaranteed accumulation benefit. Considering the responding advisor’s channel, the results may be affected by a limited number of fee-based RILA contracts, but several insurers have registered new fee-based RILA contracts over the past year. Insurers have recently moved to increase the richness of their guarantees, as interest rates tick upwards. With market volatility top of mind, products and features that guarantee income and provide principal protection are differentiators and in-demand with advisors.

To learn more about ISS MI’s offerings, visit https://www.issgovernance.com/market-intelligence/market-metrics-advisory-research/.

By: Jeff Hutton, Associate Vice President, ISS Market Intelligence AnnuityInsight.com