Grid bottlenecks have become one of the most significant challenges to the global clean energy transition. In 2023, some news reports indicated that countries with ambitious decarbonization and energy transition plans are facing serious hurdles to connect solar and wind power to consumers, largely because of insufficient grid infrastructure and capacity.

These challenges are present in China. Despite leading in renewable energy development, China has experienced grid bottlenecks and serious renewable power curtailment as early as the mid-2010s.

One option for addressing bottlenecks is developing ultra-high voltage power lines, grid-scale storage, and smart grids. Investors looking to promote the clean energy transition may be interested in pursuing opportunities in these key industries, and several ISS solutions such as ESG Corporate Rating, SDG Impact Rating, or SDG Solutions Assessment can help them in this area.

Expanding Renewable Energy Capacity but Limited Consumption

A World Leader in Renewables

China has been a leader in renewable energy development, topping the list of the world’s total renewable energy capacity generators as early as 2006. That year China had 135.5 GW capacity, with the United States in second place at 124.7 GW.

The capacity gap between the world’s first- and second-largest developers of renewable energy has grown even more prominent over the last two decades. In 2022, China’s total renewable energy capacity reached 1160.8 GW, nearly 3.3 times the United States’ capacity of 351.7GW. In solar and wind power expansion specifically, China has had the world’s largest solar power electricity generation capacity since 2015 and the largest wind power generation capacity since 2016.

Many wind and solar power projects were developed in northern China, which has the most abundant wind and solar energy resources, with the support of local governments intending to stimulate economic growth, generate tax revenues, and create job opportunities. Local government support for wind and solar power developers, combined with the rollout of favorable policies and generous subsidies from China’s central government, resulted in a surge in renewable power capacity.

Grid Bottlenecks and Renewable Energy Curtailment

Despite the dramatic growth in China’s renewable power generation capacity, some installed energy generation capacity has not been connected to the grid due to a lack of grid facilities. Installed capacity for wind power, for example, increased from 743 MW in 2004 to 145,362 MW in 2015. Only 70-80% of installed capacity was connected to the grid, however.

The lack of grid connection resulted from a combination of rapid expansion of wind capacity by developers and the time-consuming processes required for grid companies to receive permits from the central government and build grid connections. While wind or solar developers can usually obtain permits and commence operation within a year, grid companies require more than two years to get permits from the central government and to build grid facilities.

Curtailment of renewable power is another challenge associated with grid bottlenecks, one which might be even more difficult to address. Curtailment means that even if electric power generated by renewable sources is physically connected to the grid, some of it might not be absorbed by the grid.

While China’s energy needs are mostly generated from economic centers in the east and south-east coastal regions of China, the most abundant sources of solar and wind energy are often found in the northwest and northeast of China, where local consumption is limited. The process of building ultra-high-voltage transmission lines takes even longer than building grid facilities. Without sufficient long-distance transmission lines and upgraded grid facilities, grid companies typically curtail electricity generated from solar and wind sources.

Trying to integrate wind and solar power into grid systems can lead to renewable power curtailment in China in other ways. The intermittency of renewable electric power creates challenges for the resilience of electricity grids, especially long-distance transmission lines. In extreme cases, wind and solar electric power can generate too much electricity for low local demand and must be cut off to ensure the stability of the overall electricity grid and prevent further or widespread power outages. The techno-economic challenges entail more advanced energy storage technologies, upgraded grid networks, and higher costs in relation to renewable power integration.

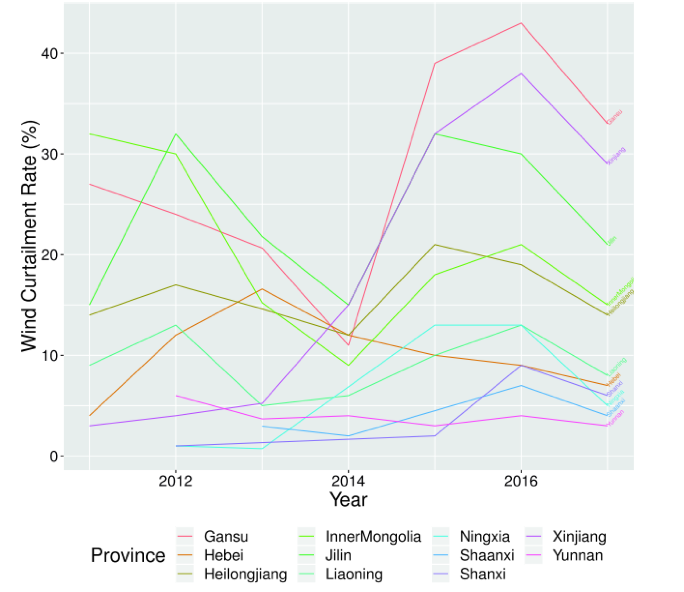

Figure 1 illustrates the wind power curtailment rate in 11 major wind-power-producing provinces of China between 2011 and 2017. Wind power curtailment was most serious in 2016, with some sparsely populated and less developed provinces such as Gansu and Xinjiang curtailing around 40% of wind power generation capacity. Thus, around 40% of wind power capacity went unused, with no generation to provide electricity to consumers in Gansu and Xinjiang provinces in 2016. The loss for wind power producers in China amounted to an estimated US$2.7 billion that year.

Figure 1: Wind Curtailment in Key Provinces of China, 2011-2017

Source: Energy Research & Social Science 68 (October 2020): 101531.

Clean Energy Transition Hampered

Grid bottlenecks and persistent renewable energy curtailment in China hamper its clean energy transition progress. Replacing coal in power systems with alternative energy sources, especially renewable energy, is generally acknowledged to be key to the clean energy transition. However, evaluating progress in the clean energy transition involves not merely tracking how rapidly renewable power installations are created but also examining how coal-based electricity consumption is being replaced with consumption from renewable sources. China’s experience with coal and renewable energy illustrates this.

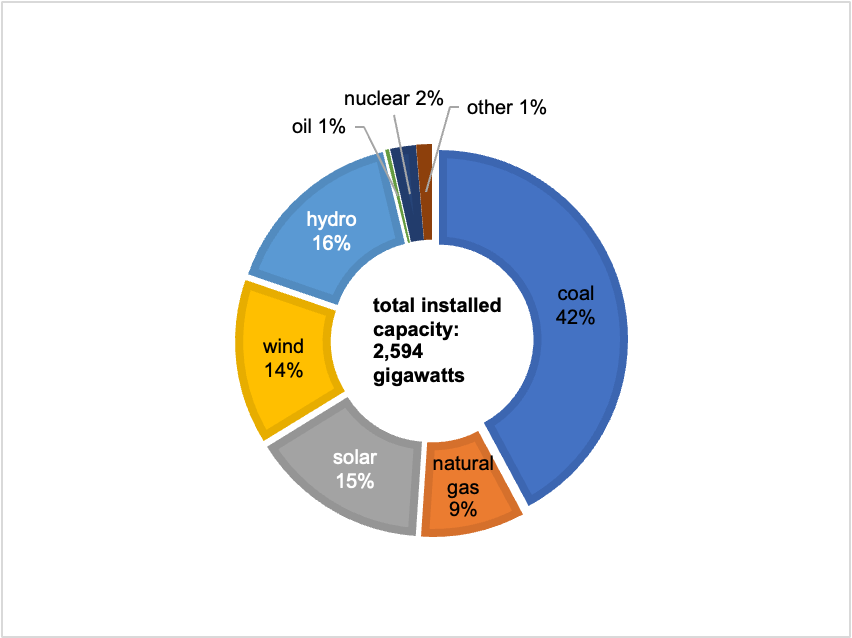

Figure 2 shows that the share of coal in China’s power system, as measured by installed generating capacity, accounted for 42% in 2022. This marked a significant decline from coal’s 76% share in 2008. The decline is largely because of the dramatic growth in installed renewable power capacity.

Figure 2: China’s Installed Electricity-Generating Capacity by Type, 2022

Note: Because of rounding, percentages might not add up precisely to 100.

Source: U.S. Energy Information Agency, International Energy Statistics

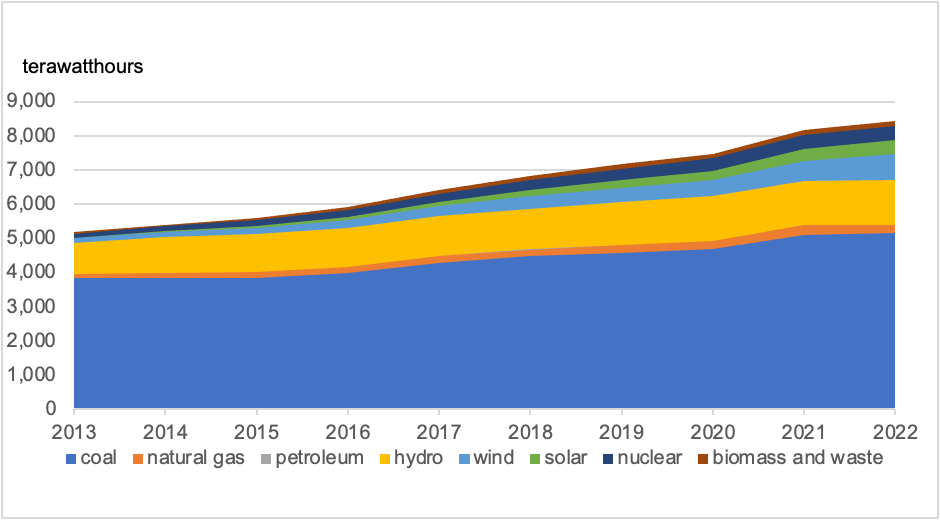

Nevertheless, a breakdown of China’s electricity consumption in 2022 shows that 64% of its electricity use is still derived from fossil fuels, primarily coal-fired power (Figure 3).

Figure 3: China’s Net Electricity Generation by Fuel Type, 2013-2022

Source: U.S. Energy Information Agency, International Energy Statistics

The significant gap between coal- and renewables-based installed capacity on the one hand and coal- and renewables-based electric power consumption on the other indicates the importance of installed capacity for renewable power. Installed renewable capacity does not inevitably translate into actual renewable power generation and consumption. The clean energy transition thus depends on whether newly added clean energy capacity is rapidly and fully used to replace fossil fuel consumption, especially coal use.

Possible Solutions and Actionable Insights: Drawing Lessons from China

Multiple policy reforms and regulatory measures have been introduced to address the challenges to renewable energy described above. Possible solutions include streamlining the permitting process for grid projects, issuing policies to require state-owned grid companies to fully purchase generated renewable power, and mandating compensation for curtailed wind and solar power.

Some scholars have pointed out that China’s new policy paradigm “would face tremendous challenges from existing institutions and vested interests.” However, China’s experience offers some actionable insights for investors.

Because rapid expansion of solar and wind power capacity is partly driven by generous subsidies, China phased out some types of solar and wind power development subsidies in 2021, instead investing heavily in ultra-high-voltage power lines, grid-scale storage, and smart grids, which are key to addressing the challenges of grid bottlenecks.

Investors interested in contributing to these critical inputs to a clean energy transition may be interested in looking for opportunities in these key industries beyond the renewable electricity sector. The ISS ESG Corporate Rating can help investors to identify renewable energy developers with solid ESG performance. The SDG Impact Rating and SDG Solutions Assessment measure the impact and contribution of companies and publicly traded funds and portfolios towards the UN Sustainable Development Goals. These tools can enable investors to identify whether a company’s product and service portfolio has direct and substantial positive impacts on the achievement of global environmental objectives, including whether the company has put financing and investment into smart grids and battery storage to enhance renewable power systems.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

By:

June (Juan) Chen, PhD, Associate, Energy, Materials & Utilities, ISS ESG