The infamous 20th century bank robber Willie Sutton said he robbed banks “Because that’s where the money is.”

The modern retail investment product order has revolved around the mutual fund—a nearly century old technology—because that is where the money is.

Or where at least where it was.

The established mutual fund-centric order has come under increasing threat in recent years. As investors demand better returns, reduced investment expenses, and lower tax exposure, sales have shifted from mutual funds and toward ETFs and separately managed accounts (SMAs), challenging asset managers to deploy their capabilities across multiple fronts.

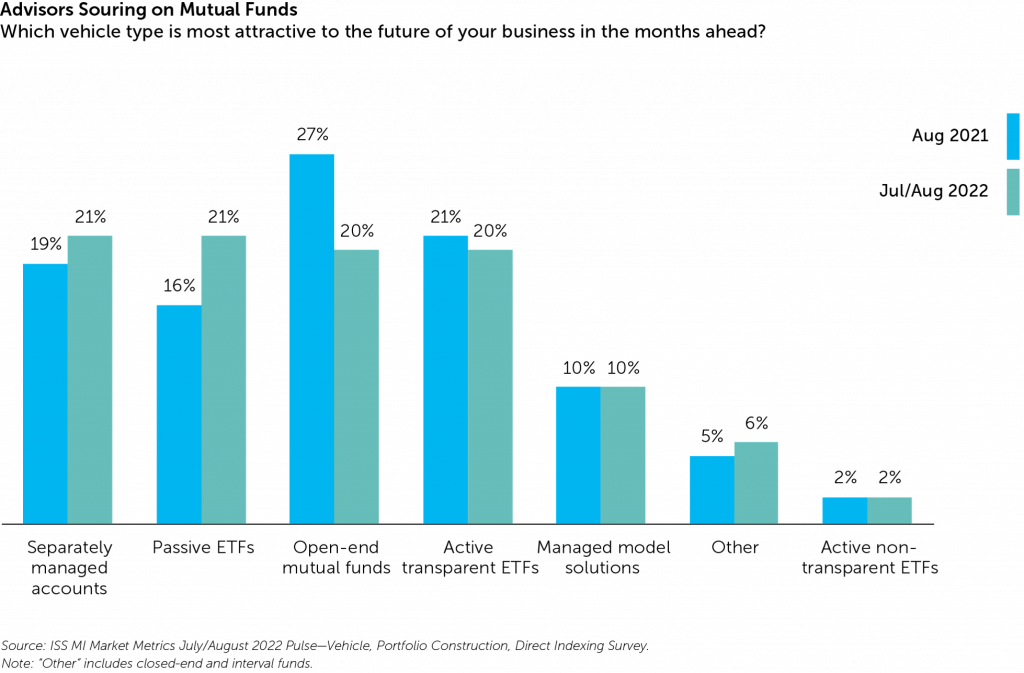

Data from the recently published State of the Market—Intermediary Distribution report show these mutual fund alternatives as increasingly attractive to a key constituency for fund managers. In an August 2021 survey, ISS MI’s Market Metrics team asked financial advisors to name which investment vehicle is most important to the future of their business. Open-end mutual funds remained more popular than any alternative among survey respondents, with 27% giving the vehicle top billing. Passive ETFs trailed notably behind, with the vehicle as the top choice for just 16% of participants.

Over the past year, however, mutual funds have lost considerable ground, mainly at the expense of passive ETFs. As the chart above illustrates, a slightly larger percentage of advisors identify ETFs as most important (22%) over mutual funds (21%). No single vehicle appears poised to dominate advisors’ futures. Advisors now prefer funds, ETFs (both passive and active transparent), and SMAs in roughly equal measure. Interest in active non-transparent ETFs remains stagnant and small.

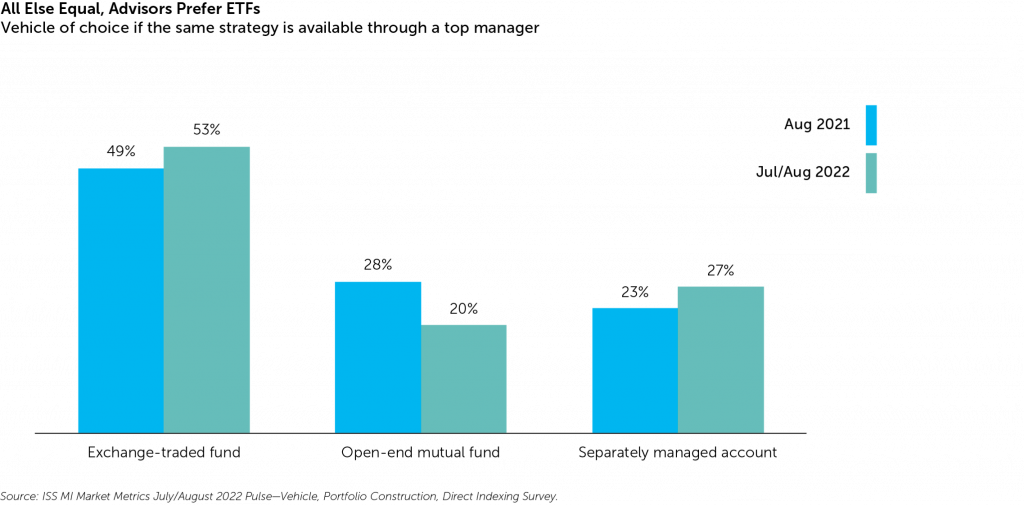

The abrupt shift in advisor preferences could reflect how much market conditions changed between the two surveys. It also may be a harbinger of what is to come. In fact, when we asked advisors to name their vehicle of choice if the same strategy was available through a mutual fund, ETF, or SMA, 53% chose ETFs, up from 49% last year, as the chart above shows. RIAs gave ETFs top billing, with 75% listing ETFs as their vehicle of choice. Even in the broker and bank channels, where sentiment for mutual funds remains warmest, a majority of advisors said they would choose an ETF over a mutual fund with the same strategy.

Wither the mutual fund?

While advisors expect more of tomorrow’s sales to come from somewhere else, the fund assets they already oversee will probably generate more of their revenues for years to come. Data from the Investment Company Institute’s (ICI) 2022 Factbook indicates that 79% of U.S. households with fund holdings outside defined contribution plans invest through intermediaries, leaving advisors in control of, and generating fee revenues from, the better part of the nearly $15 trillion in non-DC household assets. In our business, assets do the talking, and mutual funds will still speak loudly.

Status quo bias is not the sole factor sustaining the mutual fund’s relevance. Advisors still see it as the best vehicle for active management. “I like the active management and the diversification that comes with open-end mutual funds,” a survey respondent wrote. Active management’s flexibility remains a key selling point, especially in fixed income. “I definitely want active managers in certain categories like fixed income in this rising rate environment,” another respondent said.

The mutual fund has been the standard for retail managed products for so long that more active strategies are available through the vehicle than any other managed product. “Advisory platforms make it very efficient to get the actively managed mutual fund investments that we like to recommend. Many managers we prefer only offer open ended formats,” one advisor told us.

Undoubtedly, the availability of active management continues to broaden beyond mutual funds, and advisors’ comfort level with active ETFs is growing. Active mutual fund providers cannot count on lack of attractive alternatives as protection for much longer.

Toward an all-of-the above product strategy

Old technologies disappear when they no longer serve users as well as the alternatives. This may be true of mutual funds someday, but probably not for decades, if ever. Newer portfolio management technologies may be better choices for a growing number of circumstances, but not necessarily for every client and not in all asset classes. The mutual fund will remain one tool in the advisor’s growing toolkit.

With intermediaries expecting access to the right tool for the job, asset managers will need the organizational strength to execute equally well across product types. For the foreseeable future, success will require meeting client needs in different ways at the same time.

______________

Simfund Enterprise subscribers can access the State of the Market—Intermediary Distribution Report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence