After Two-Year Surge in Demand, ESG Fund Assets Still Have Room to Run

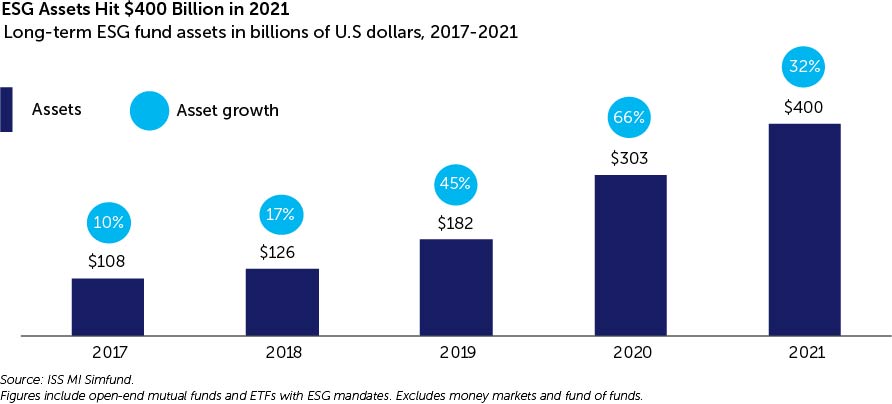

Widely publicized estimates of ESG-themed investments peg assets under management (AUM) in the tens of trillions. Retail ESG fund assets have grown at breakneck speed, but as ISS MI’s new State of the ESG Fund Market Report details, their numbers are much smaller. Long-term ESG mutual funds and ETFs finished 2021 with $400 billion in AUM (see below). This represented growth of more than 30% compared to 2020 and was 10 percentage points faster than all long-term funds.

Even with market share doubling over the past five years, ESG funds represent just 1.4% of long-term AUM.

Based on interest alone, there is plenty more room to grow. Reported interest in ESG investing has been strongest among younger investors, but it has expanded across age groups in recent years. However, a stark gap between interest and investment action remains. For example, while three out of four retail investors under the age of 45 said they were interested in ESG in a recent survey conducted by the CFA Institute, less than one in five were invested in an ESG strategy.

One explanation for this mismatch is what psychologists call social desirability bias. Investors may indicate interest in ESG to express socially desirable behaviors like care for the environment or a belief in gender and racial equality without necessarily putting their money where their mind is.

Another explanation is that ESG fund buyers are simply early adopters. As the ESG market’s growth phase matures, the gap between interest and investment will shrink. In this scenario, structural barriers to ESG adoption will fall with time, bringing in new ESG investors into the fold.

Barriers to further ESG adoption, such as choice, access, and regulation, are falling, pointing to a future where more investors get what they say they want.

As ESG products proliferate, more investors will find their niche

The ESG fund boom is relatively young. It took 2020’s extraordinary confluence of a global pandemic, civil unrest, and historic wildfires for ESG fund sales to explode, with long-term flows surged to $59 billion. As the table below illustrates, the pace of growth slowed slightly in 2021—organic growth decelerated from 32% to 19%—though, in dollar terms, long-term ESG fund flows virtually matched 2020’s giant haul.

Surging sales and relatively low market share have attracted new competitors to the ESG fund arena, Fund managers launched a record 133 new ESG funds, well above the 75 new offerings that debuted in 2020. The 2021 vintage exhibited more of a global flair, with international equity funds making up a plurality of the launches. Bond funds also proliferated. More than twice as many went live in 2021 than in the prior year. Product development also shifted toward ETFs—especially active ones. Almost as many active ETFs (37) came online as passive ones (42).

More asset class diversity, especially in the fixed income arena, expands ESG funds’ addressable market, which historically has been concentrated in equity funds (together, U.S. and international equity strategies make up 90% of ESG fund AUM).

While managers with already-developed ESG lineups shifted their product focus to specific ESG factors or themes like carbon reduction and alternative energy, broader approaches remained more common in 2021. Many large players’ ESG lineups are still immature, explaining why they tend to prioritize developing more diversified approaches first.

However, as the ESG field becomes more crowded, product and brand differentiation will become increasingly important. During this phase, copying or making modest improvements upon existing products no longer cuts it. Fund managers will find new ways to satisfy differing ESG preferences to continue to grow. More differentiation will shrink the gap between investment product and investor fit.

Growing access to fund platforms driving ESG adoption

Investors do not make decisions in a vacuum. Advisors, gatekeepers, and other third parties shape their opportunity set. Without availability on fund platforms and placement on gatekeepers’ recommended lists, investors will have a tough time translating their interest in ESG into action.

If lack of access was a barrier to adoption before, it is not any longer. Through quarterly holdings data filed with the SEC, ISS MI is able to track the growth of ESG ETFs on advisor platforms. As of September 2021, the 13 largest advisory platforms, including Envestnet, Morgan Stanley, and LPL Financial, controlled $76 billion in AUM—a 250% rise over $10 billion in AUM 12 months earlier. Overall, platform ETF assets represent approximately 25% of total ESG ETF AUM.

Financial institutions are not required to disclose mutual fund holdings, but evidence suggests increasingly widespread adoption on advisory platforms as well. Active advised ESG fund AUM tracked by ISS MI’s Simfund Distribution platform grew by 40% in 2021—twice the growth rate of active ESG mutual fund assets overall. Assets rose from $77 billion to $108 billion over the year.

Regulators promoting ESG adoption

While the beginnings of the current ESG fund boom coincided with the presidency of Donald Trump, his administration attempted to stymie the trend’s advance. In its final weeks, the Labor Department approved rules restricting use of ESG factors in defined contribution (DC) plans. By contrast, the Biden White House’s regulatory agenda stresses ESG priorities, especially in climate.

As part of a rollback of Trump-era rulemaking, the Biden administration unveiled new Labor Department rules in 2021 that would make it easier for plan sponsors to include ESG funds within retirement plans. The rules, which should be finalized in 2022, classify ESG investments as compatible with fiduciary duty. The immediate impact is to expand investor access to ESG funds within the nearly $10 trillion DC market. Longer term, the impact could be broader. If ESG considerations are fiduciary concerns in the retirement plan context, fiduciaries should increasingly see them as such in other contexts as well.

Living up to ESG’s promise

In the CFA Institute’s survey of ESG investors, 71% of retail investors attributed their interest in ESG at least partly to a desire to express their values or to positively impact society or the environment. With values mattering at least as much as risk and return, fund managers used to competing on conventional grounds like performance and cost will also need to appeal to investors’ ability to make change.

Fortunately, money managers know how to win investor trust. Time-tested ways of building it—long-term thinking, transparency, honoring commitment, and good communication—apply here. Fund managers will need to make their ESG principles—and what they have done to advance them—clear. Firms that preach sustainability on one hand and ignore holdings’ carbon footprints on the other will turn off ESG fund buyers. Managers must prove their ESG bona fides with evidence of activism, transparency into their own ESG practices, and examples of how ESG factors impact investment decisions. Those that cannot risk lacking the credibility they will need to succeed.

Simfund Enterprise subscribers can access the State of the ESG Fund Market Report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence