The launch of ChatGPT ignited a race to measure the potential impact of artificial intelligence (AI) on the global labor market. Researchers pored over job classification systems to estimate the proportion of tasks that could be eliminated by AI agents, whose marginal costs approach zero. Several studies have concluded that a sizeable chunk of today’s work could eventually be done by machines.

History suggests the macroeconomic impact on employment and wage levels is highly uncertain. However, as companies drive AI adoption in the workplace, the biggest winners might be those that optimize the complementary nature of labor and capital.

Investors might want to search for opportunities not only among companies enabling AI-driven innovation but among those making strategic investments in human capital alongside those in technology. The metrics collected under the ISS ESG Corporate Rating suggest that systematic employee training and career development remain underappreciated among many companies.

Exposure to AI is Significant Across the Broader Labor Economy

Sensational claims are commonplace when AI and jobs are mentioned together: ‘AI Could Steal Over 80 Million Jobs in the Next 5 Years,’ or ‘300 Million Jobs Could Be Affected by Latest Wave of AI.’ Without additional context, these statements connote mass unemployment. Studies on the topic create a much more nuanced picture, while acknowledging the high degree of uncertainty in their estimates.

The OECD estimates that 27% of global jobs are at high risk of automation from AI and other technologies. Briggs and Kodani (2023) estimate that nearly 18% of work globally (and one-quarter of work in the United States and Europe) could be automated by generative AI alone. This is consistent with a recent study (2023) from the Pew Research Center and another by Sytsma and Sousa (2023) suggesting that 19% and 15% of Americans, respectively, are in jobs with high exposure to AI.

Further, according to Daugherty et al. (2023), an estimated 40% of U.S. working hours may be impacted by large language models (LLMs) more broadly. Routinized tasks may be automated away (e.g., credit authorization), while others may be augmented with AI-powered tools (e.g., biomedical engineering).

The impact of AI will vary by job function and industry and may have uneven effects at the country level. Data entry and clerical work are highly vulnerable. Banking and insurance appear to have high potential for both automation and augmentation via generative AI. The impact of automation on the retail and wholesale sector may be particularly disruptive to developed economies such as the U.K., where the sector accounts for 12% of employment.

The Macroeconomic Response to Automation Is Not…Automatic: Impacts on Employment and Wages Are Highly Uncertain

Attributing changes in aggregate employment or wages to any single technology or industry is difficult, if not impossible. Acemoglu and Restrepo (2019) argue that there is a false dichotomy regarding the impact of AI. Rather than ensuring the doom of labor or increasing labor demand and wages, they suggest a model of capital and labor substitution comprised of several effects.

Automation, such as AI, always displaces labor from one or more tasks. This displacement may be offset by other effects, such as productivity gains that expand the overall economy and spur demand for goods, services, and additional capital that can lead to the creation of new tasks for workers. In addition, some forms of automation do not displace labor at all, but rather deepen automation through more advanced machines (e.g., quantum computers) – augmenting aggregate demand.

The World Economic Forum predicts that jobs leveraging AI will grow rapidly, including a 40% jump in the number of AI and machine learning specialist jobs by 2027. AI may also help lower the entry barrier for a lot of jobs that have traditionally required specialized skill sets.

Brynjolfsson et al. (2023) found that AI reduced the productivity gap between less experienced and more skilled customer service employees. The AI models were essentially trained on the interactions of the most effective employees and were successful in accelerating the progression of new workers up the learning curve.

Nevertheless, Acemoglu and Restrepo and others caution that the forces countering displacement from automation are not themselves automatic. Finding new jobs for those displaced by automation can be a slow process. Often, there is a mismatch between the skills of displaced workers and the new jobs being offered, requiring training and education. Acemoglu and Restrepo (2018) highlight the 80 years of stagnant wages in the wake of the British Industrial Revolution.

Sometimes the switch to new forms of employment after automation can be rapid. Feigenbaum and Gross (2020) demonstrate that the rapid automation of telephone switching over a 20-year period in the early 20th century failed to dent the employment prospects of young women in the United States, despite a drop of as much as 80% in the number of young women working as telephone operators.

Distributional effects also need to be considered. Feigenbaum and Gross note that relatively older female telephone operators were less likely to be employed at all and more likely to be employed in lower-paying jobs after automation. Humlum’s (2021) study of Danish manufacturing indicates higher overall wages following automation, but reduced wages for line workers and outsized gains for technicians and engineers.

If the benefits of automation accrue to a small proportion of workers, productivity gains may be muted. Productivity growth has declined among OECD nations over the past 10 to 15 years despite fast-paced technology development, particularly from digitalization, and the benefits have been concentrated among the highest-performing firms.

Different Regulatory Responses to Robots Are Possible

One proposed response to this situation is a robot tax on firms whose automation contributes to job losses. One former technology company executive called for a 98% tax on AI models to ‘slow them down a little bit.’ Compensating displaced workers by establishing a universal basic income is another idea being proposed.

Costinot and Werning (2022) find the optimal tax on robots, at least in the United States, is roughly 1-4% of value added, based upon the empirical impacts of automation and trade on the distribution of wages. Notably, this optimal tax gets even smaller as automation deepens and the marginal impact of incremental robots declines.

Others, such as Humlum (2021), conclude that robot taxes are an inefficient means of redistributing income. Further, Seamans (2021) cites firm-level research showing that robot-adopting companies tend to have increasing employment compared with their non-adopting peers – a pattern which could potentially be an argument for a robot subsidy rather than a tax.

Skills May Affect AI’s Impact

Gal et al. (2019) demonstrate the complementarity between digital technology adoption and human and organizational capital. Firms with deficiencies in the latter did not reap the full productivity benefits of digital adoption relative to their more able peers.

If a company’s success in adopting new technologies is determined by the union of technology with skills and managerial competence, corporate disclosures may offer insights into companies’ capacity to make effective use of AI. The ISS ESG Raw Data and ESG Corporate Rating offerings track company practices that may contribute the requisite skills and managerial expertise to fully exploit new technologies.

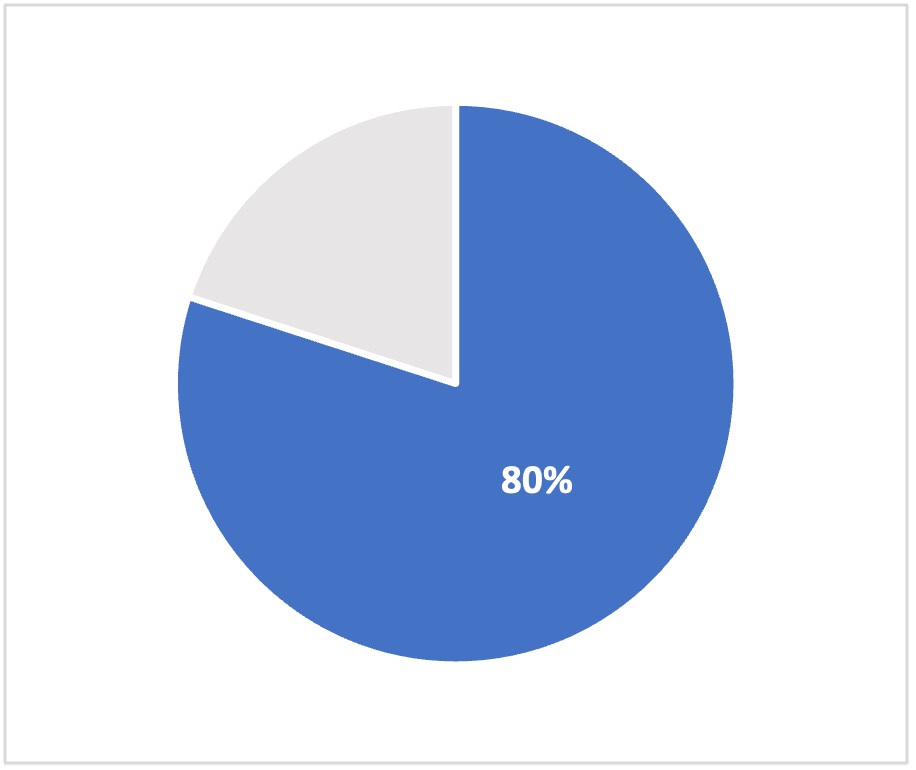

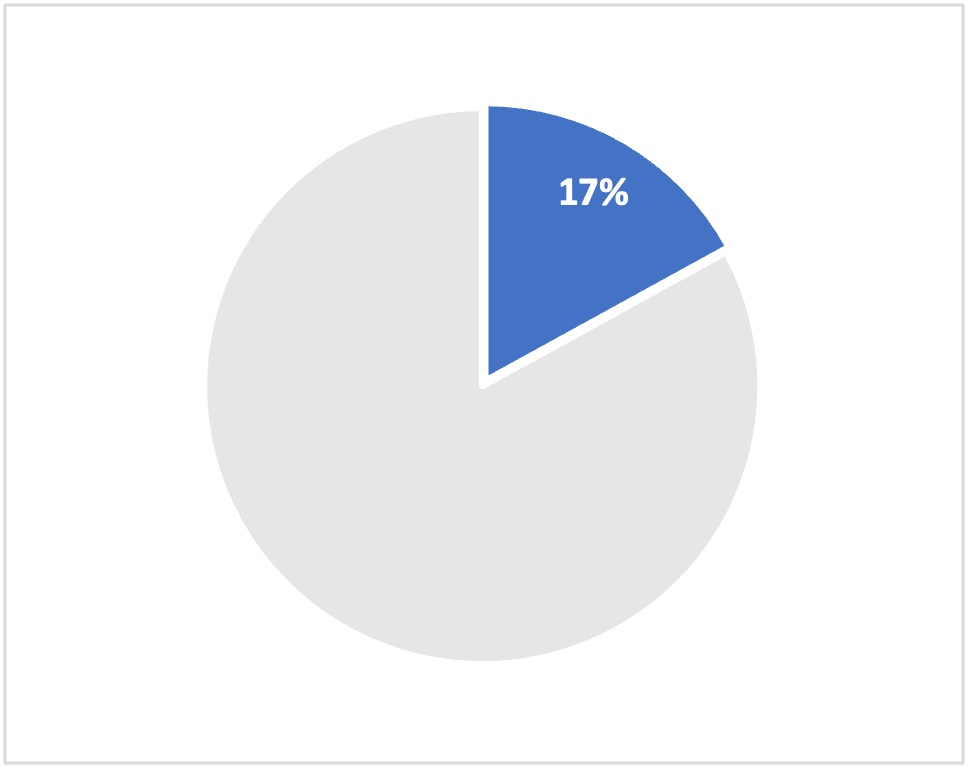

Most companies in the ESG Corporate Rating universe of more than 8,100 companies – approximately 80% – disclose a systematic approach to identifying their training needs (Figure 1). However, fewer than 1 in 5 rated companies track and publicly disclose, by employee category, the average annual number of hours employees spend in training.

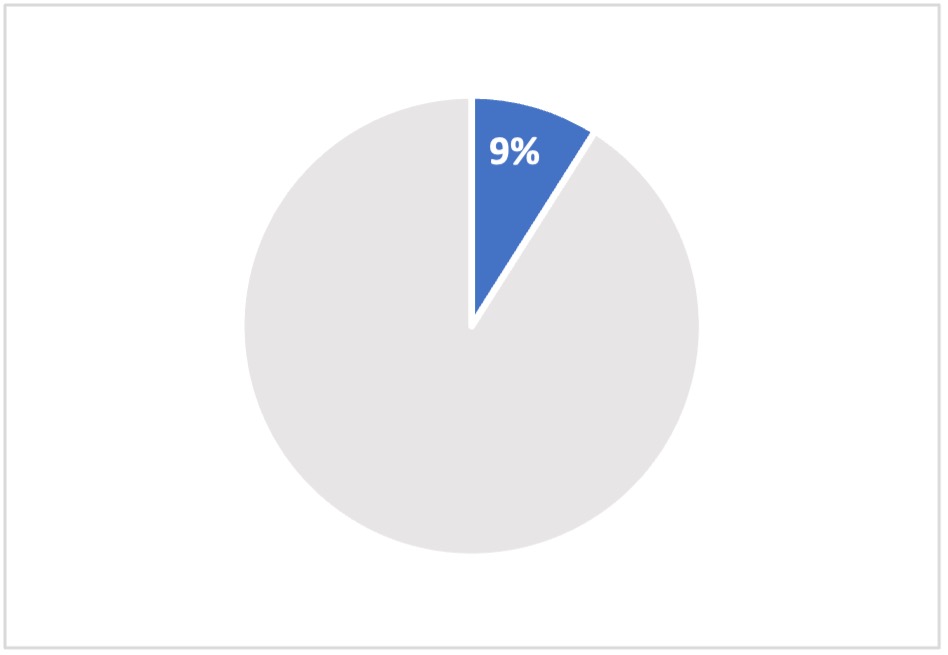

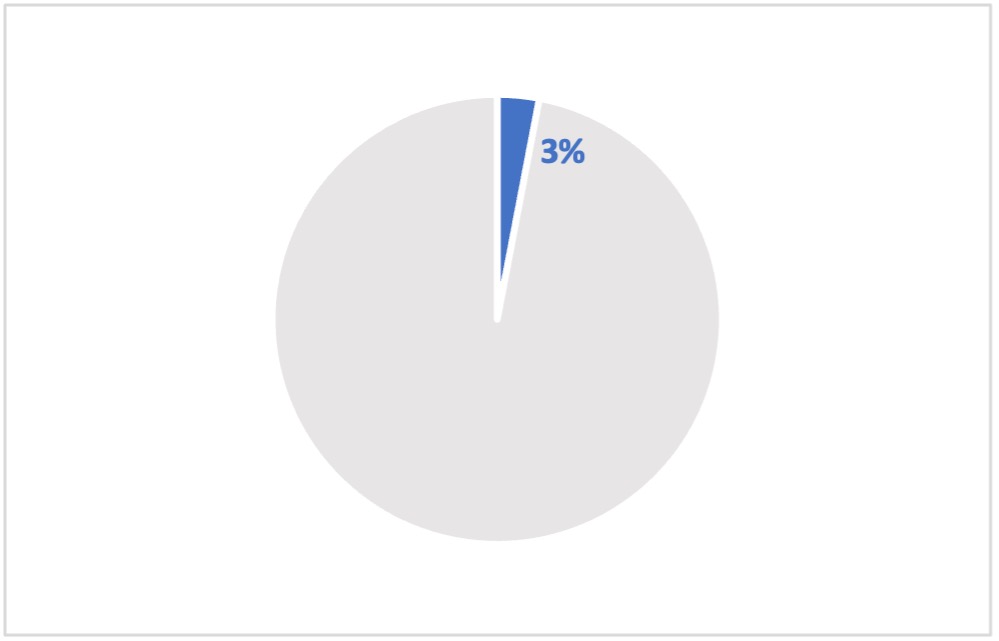

Figure 1: Corporate Training Practices

Disclose Systematic Approach to Identifying Training Needs | Disclose Average Annual Training Hours, by Employee Category |

Disclose Metrics on Employee Career Development Reviews | Evaluation of Training Programs  |

Note: The ISS ESG Corporate Rating universe covers more than 8,100 companies.

Source: ISS ESG

Less than 1 in 10 companies disclose the metrics on employee career development reviews, and just 3% of companies evaluate the effectiveness of their training. The small subset of companies conducting each of these four practices might be better prepared to incorporate AI and other technologies into their business.

Investors Might Focus upon Human Capital Strategies in Conjunction with AI Adoption

Competition forces companies to explore the potential of AI for their businesses today, particularly as few restraints on the technology are in place. The most immediate check on the ability of some companies to use AI may be concessions won by labor unions. But as fewer than one in eight workers globally is unionized, this is not likely to be a broad-based impediment. Further, regulation to potentially constrain AI development and use may take another two years in most major economies.

As noted above, human capital metrics might provide the best clues on which portfolio companies could make the most productive use of AI. There is no AI model powerful enough to run a corporation without humans (at least not yet). The set of workplace tasks expected to be augmented by AI is significant, and new tasks will likely be created.

Companies that upskill their workforce, invest in career development, and recruit the talent needed to manage and integrate new technologies may well be better positioned for long-term value creation. The ISS ESG Corporate Rating can assist investors in identifying companies with these characteristics.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By:

Joe Arns, CFA, Sector Head of TMT ESG Research, ISS ESG

Peter Mofokeng, Corporate Ratings Analyst, ISS ESG

Vikram Shree Vyas, Corporate Ratings Analyst, ISS ESG

Iona Sugihara, Corporate Ratings Specialist, ISS ESG