With the opening 2022 World Cup matches underway in Qatar, Grupo Televisa S.A.B. recently agreed to a $95 million settlement with shareholders, resolving bribery allegations of FIFA officials.

On November 23, 2022, the Mexican multi-media company filed a Form 6-K with the U.S Securities and Exchange Commission announcing the resolution, which noted that $21.5 million will be paid from the company itself, and the remaining balance paid from various D&O insurance policies.

Earlier in 2022, Grupo Televisa and U.S.-based Univision merged to form a $4.8 billion media empire that unites the two companies’ Spanish-language production holdings and now reaches 60% of the television audience in the U.S. and Mexico, or an audience of 100 million Spanish speakers in across North America. Grupo Televisa also owns Club America, a Mexican professional football club that plays in the country’s top division, Liga MX.

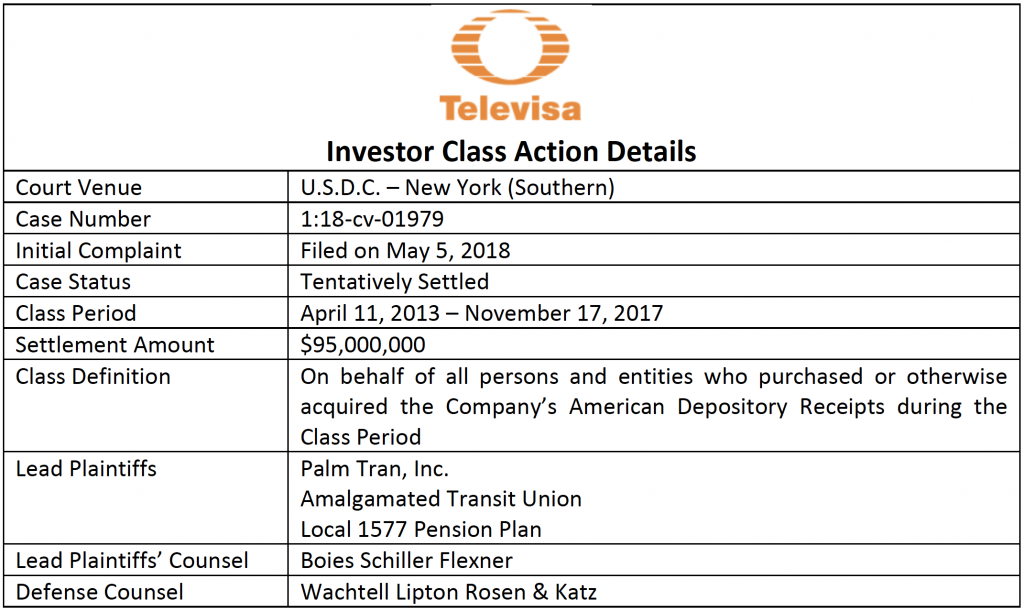

In what is believed to be the largest U.S.-based shareholder class action of a Mexican publicly traded company, the announced agreement ends litigation four-and-one-half years following the May 5, 2018 initial complaint filed in the Southern District of New York.

Shareholders of the company’s American Depository Receipts alleged Grupo Televisa intentionally carried out and concealed a bribery scheme of soccer officials in return for the broadcasting rights to four future World Cup tournaments. While Televisa has a long history of broadcasting the World Cup which has helped it meet financial targets, unbeknownst to investors, it was bribery that ultimately landed the media rights to this “crown jewel” of sporting events, according to the complaint. The wide-ranging FIFA corruption probe came to light in 2015 and has led to U.S. indictments of at least two dozen individuals and entities from 20 different countries.

Investors – in its original complaint filed back in March 2018 – alleged that throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operational and compliance policies. Specifically, the complaint alleges:

- To carry out the bribery scheme, Televisa conspired with an Argentine marketing company, Torneos y Competencies SA and its former CEO, Alejandro Burzaco, who testified in a 2017 criminal trial that Televisa paid millions of dollars in bribes to Federation Internationale de Football Association (“FIFA”) executives in exchange for broadcasting rights.

- The company hid the illegal payments to the public by way of its inadequately designed internal controls over financial reporting.

- The company made false and misleading statements about its internal controls over financial reporting, its World Cup broadcasting rights, and compliance with its code of ethics, all while failing to disclose it had engaged in an unlawful bribery scheme.

- In actuality, there were material weaknesses in the company’s internal controls over financial reporting, which it admitted in a Form 6-K in January 2018.

- As a result of the foregoing, Televisa’s ADRs traded at artificially inflated prices during the Class Period, and class members suffered significant losses and damages.

The governance failure by Grupo Televisa to maintain proper controls is one of a number of ESG related class actions where companies have been accused of bribing government or other officials. A few of the high-profile cases from the last five years include:

- Petrobras – $3 billion settlement in July 2018

- Cobalt International Energy – $389.6 million settlement in February 2019

- WalMart – $160 million settlement in April 2019

- Airbus – $5 million settlement in September 2022

- Fiat Chrysler – $5 million settlement in February 2022

- FirstEnergy – an active case currently litigating in the Southern District of Ohio

The $95 million payout covers claims against Grupo Televisa and two of its executives, Chairman (and former CEO) Emilio-Fernando Azcarraga Jean III and Board Member (and former CEO / CFO) Salvi Rafael Folch Viadero. The settlement comes about two weeks after the Second Circuit rejected defendants’ attempt to appeal the district court’s order defining the class, and before a decision on summary judgment.

ISS Securities Class Action Services will continue to closely monitor this action against Grupo Televisa – including the court’s review of the proposed settlement – and communicate updates to its clients and the investment community, as developments occur. The court’s approval will most likely occur well after FIFA’s crowning of the 2022 World Cup champion in Qatar on December 18th.

By: Jeff Lubitz, Managing Director, ISS Securities Class Action Services, and Jarett Sena, Director of Litigation Analysis, ISS Securities Class Action Services