On 12 October 2022, the High Court of Australia unanimously rejected a legal attempt by mining giant BHP Billiton Limited to prevent non-resident shareholders of Australia from participating in the collective action against the company. BHP initially sought an application in Federal Court seeking to exclude claims from shareholders who live outside of Australia, as well as those who acquired BHP shares on the London and Johannesburg exchanges. The Federal Court dismissed the application, and BHP appealed to the Full Federal Court and then to the High Court.

In its recent decision, the High Court put an end to the three-year legal effort by BHP to restrict foreign participation in the collective action. In particular, the High Court found that Part IVA of the Federal Court of Australia Act does not contain any limitation on the geographic or territorial restrictions on who can be group members. BHP’s argument to the contrary ignores the Australian Constitution and the legislation passed by the Commonwealth Parliament, according to the Court.

The specific case against BHP – one of the most egregious alleged ESG-related failures – arises from the November 5, 2015 catastrophic collapse of the Fundão tailings dam, which is part of Samarco’s Germano iron ore mining complex in Minas Gerais, Brazil (jointly owned by BHP and Vale S.A). The environmental failure of the dam caused the release of mining waste leading to significant property damage and loss of life. Specifically, the disaster:

- Released 50 million cubic meters of mud, rich in toxic metals and flooding that devastated downstream villages

- Created a tragic humanitarian crisis as hundreds of people were displaced and cities along the Doce River suffered water shortages due to pollution

- Triggered approximately USD $5.6 billion to fix the resulting damage

- Led to 19 fatalities

Following the dam collapse, BHP’s share price plunged about 20% between November 6, 2015 and November 30, 2015, causing a loss of $25 billion in market capitalization.

Soon thereafter, shareholders alleged BHP failed to comply with its continuous disclosure obligations by failing to adequately inform the market of the risks and consequences of failure of the dam, which had been beset with problems for years, and engaged in misleading and deceptive conduct. Following the collapse, internal documents were leaked that exposed executives were aware of the possibility of severe problems.

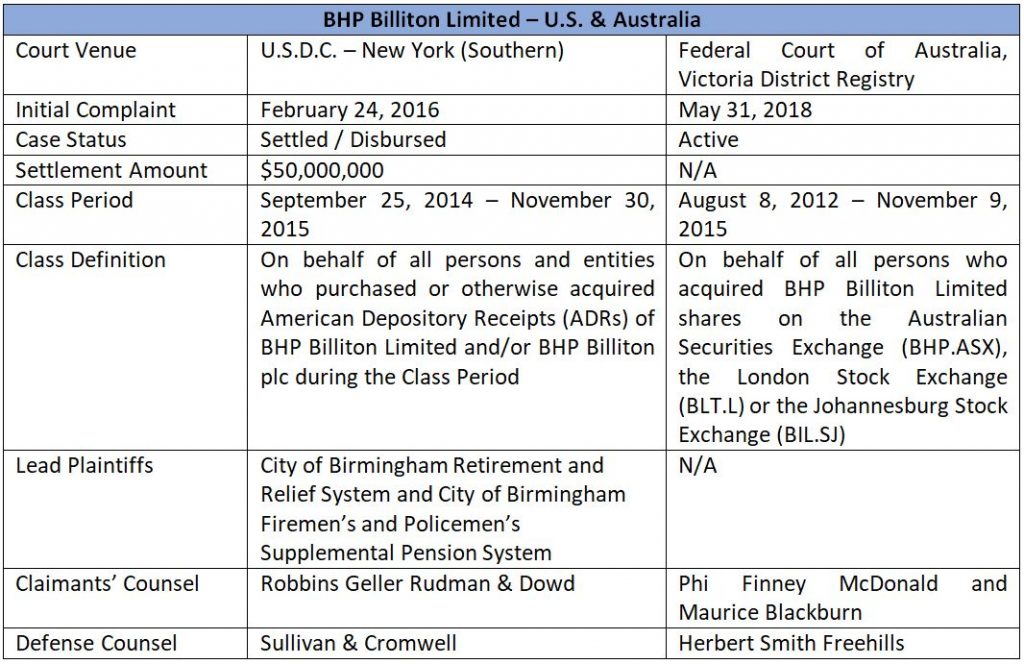

In the U.S., shareholders filed a complaint on February 24, 2016 against BHP in the Southern District of New York on behalf of investors who purchased American Depositary Shares (“ADRs”) of BHP. Allegations stated BHP made materially false and misleading statements to investors during the period from September 25, 2014 through November 30, 2015, in violation of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

In April 2019, following more than three years of litigation, BHP agreed to resolve the U.S.-based class action for $50 million. Almost two years later, in March 2021, the court appointed Claims Administrator, Gilardi & Co., disbursed proceeds to all eligible claimants.

The Australian shareholder action, on the other hand, was filed on behalf of all investors who acquired BHP shares on the Australian, London and Johannesburg stock exchanges between 8 August 2012 to 9 November 2015. The case, run by Australian-based class action firms Phi Finney McDonald and Maurice Blackburn, alleges the mining company breached its disclosure obligations under the Corporations Act.

The High Court of Australia’s ruling is a promising outcome for investors overseas who are seeking to participate in collective actions in Australian federal courts. In fact, the class action may be worth “hundreds of millions” of dollars. The decision further corroborates that Australia’s collective action regime is the most established outside North America, and in fact, may go further in providing foreign investors’ access to courts than the U.S. has in recent decisions restricting entry.

ISS Securities Class Action Services will continue to closely monitor the BHP collective action in Australia – and share updates to its clients and the investment community, as developments occur.

By: Jeff Lubitz, Managing Director, ISS Securities Class Action Services, and Jarett Sena, Director of Litigation Analysis, ISS Securities Class Action Services