This final piece in a three-part series utilizes the newest tool in ISS Market Intelligence’s Simfund family: Simfund Total Market. Leveraging the module’s expansive coverage across asset classes, investment vehicles and geographies, this research series explores growth and changes across vehicles and structures spanning retail and institutional markets during a time of intense market volatility and shifting investor preferences.

Public markets in 2022 created much cause for concern for a variety of investors. Broad market indices recorded double-digit losses as U.S.-domiciled active funds faced their strongest outflows on an aggregate and proportional basis. Rising interest rates and concerns about a future recession slammed both equity and fixed income markets, leaving fewer spots for investors to ride out the year. The acquisition of private alternative specialists and expanded offerings of alternative funds have coincided with challenging conditions facing traditional markets, which have in turn driven renewed investor interest in the asset class. Data from Simfund Total Market through the third quarter of 2022 underline this renewed demand, particularly within active funds.

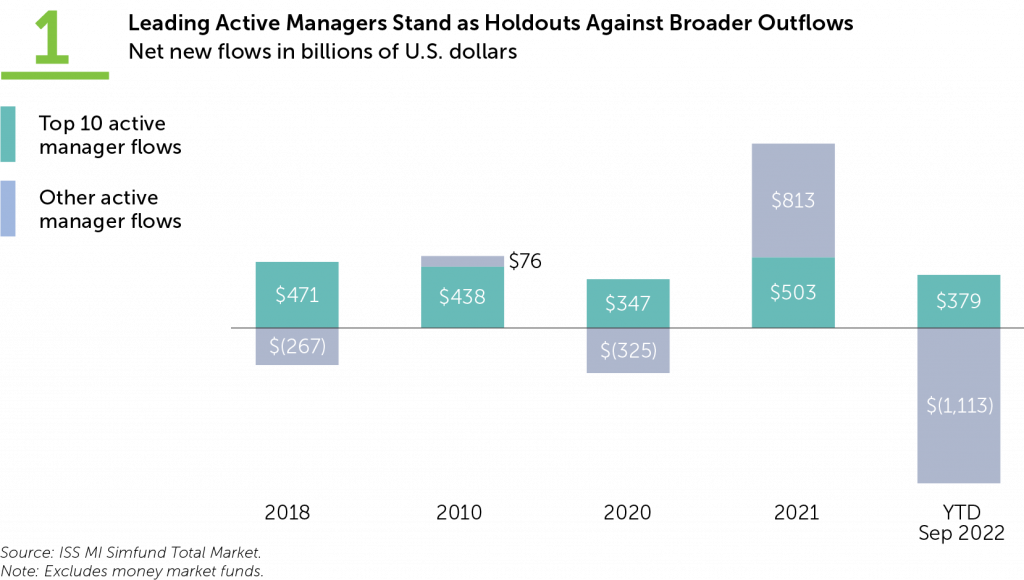

Previous entries within this series have explored the issue of market concentration through the lens of assets held by leading players. While a number of vehicles have recorded a greater dispersion in assets in previous years, flows in any given year can be quite concentrated. Top players may gather the bulk of net flows, leaving little for the rest of the universe. This can be particularly drastic within active markets, where leading managers may ultimately gather the entirety of positive net flows. Over the past three years ending in September 2022, the top 10 inflow-gathering active managers brought in 97.8% of the $767.1 billion in long-term flows garnered over that period. Figure 1 displays the aggregate net flows gathered by the 10 best-selling active managers in each year compared to the rest of the active universe.

In a market as difficult as 2022’s, alternatives acted as a relative holdout. Figures recorded by Total Market saw alternative funds gather $37.8 billion across vehicles in the first nine months of 2022, followed by commodity funds at $15.3 billion. Traditional asset classes suffered much more extensively, as equity funds witnessed net redemptions of $310.2 billion and bond funds bled $397.9 billion over the same period. Total Market strives to provide a lens into the entire investible universe. However, the opaque nature of hedge funds, private equity and other private vehicles limits full coverage of those areas, and the dataset today focuses predominantly on more liquid and registered alternative strategies.

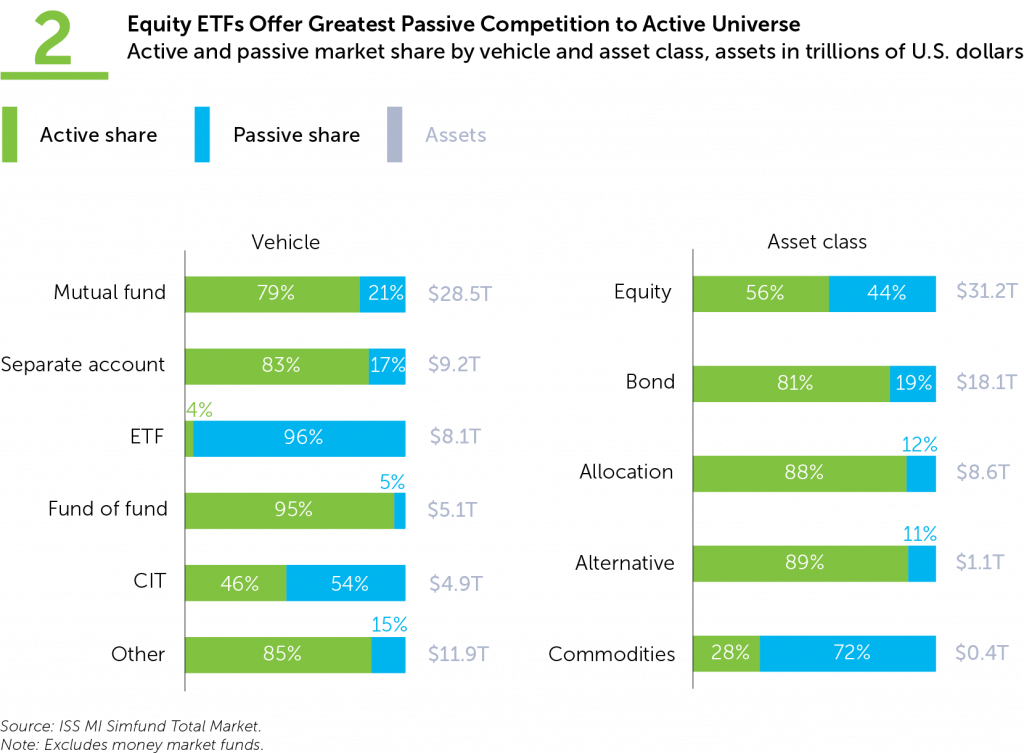

Active strategies remain the bulk of global assets in investment vehicles and will continue to drive revenues for the industry for the foreseeable future. The increasing market share of heavily passive ETFs have increased pressure on many managers, encouraging them to engage in their own price cuts or merger and acquisitions activity in order to remain competitive. Alternative assets’ heavy representation in active strategies (see Figure 2) can help enhance their appeal to players under pressure. Alternative strategies are admittedly a more niche market by definition and will not supplant traditional strategies as the core of many investors’ portfolios. Fortunately, they will likely prove more resilient to passive competition.

The existing passive alt options are predominantly leveraged and inverse funds which are intended as short-term trading vehicles and not designed for long-term holding. Alternatives can command potentially higher fees in part because of their higher barriers to competition. They may incorporate assets that are more difficult to access or require skills sets that many traditional asset managers do not possess. Given the incredibly diverse strategies and approaches employed by alternative funds, investors can also expect to see wider dispersions in return between top and bottom performers within and across different strategies. This raises the importance of due diligence on the part of investors as well as the potential payoff for managers who can deliver top quintile performance.

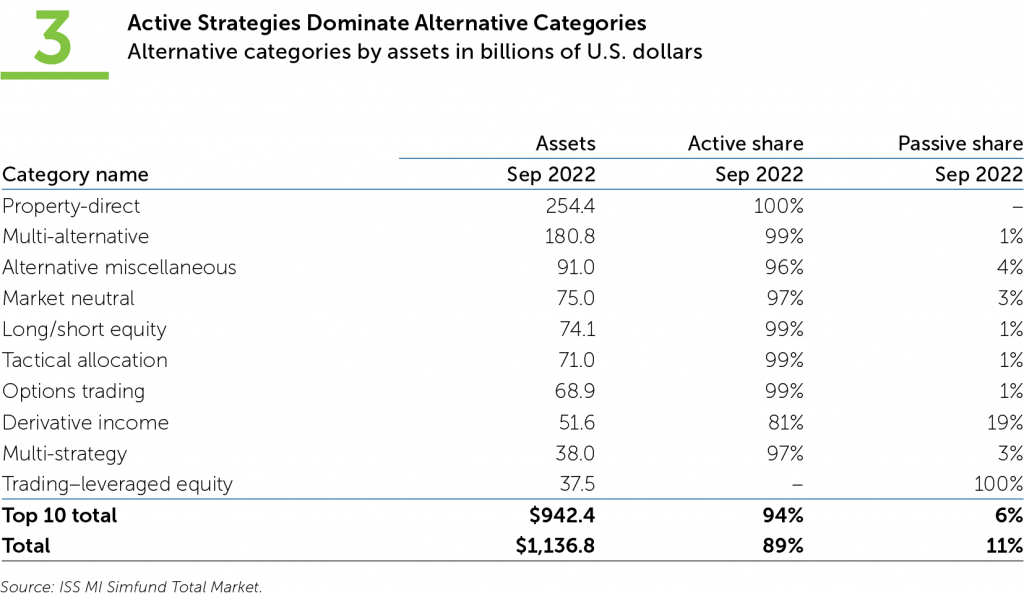

The largest alternative category in the data set, Property – direct, involves illiquid, directly-held real estate holdings. However, many alternative strategies in more retail-oriented vehicles will invest in public securities but depart from long-only strategies in employing greater shorting, hedging, or other less conventional methods. Multi-alternative, the second-largest category in the dataset and the largest alternative strategy held in open-end funds, encompasses products that employ a combination of alternative strategies, often tactically rotating between them. (Figure 3 displays the 10 largest alternative categories and the composition of active and passive funds in each category.)

As these strategies become more accessible to a non-accredited investor base, they have emerged most extensively in the more broadly available structures. Alternative assets captured in Simfund Total Market were predominantly in mutual funds as of the end of the third quarter, at $789.0 billion. ETFs and funds of funds were nearly tied behind them at $155.3 billion and $154.0 billion, respectively. In sharing these products outside institutional markets, managers will not only have to deal with the difficult task of investor education, but also investor loyalty. Previous iterations of liquid alternative strategies experienced a boom-and-bust cycle as investors piled in following drastic market corrections but then quickly returned to high-beta strategies during equity market rebounds. Stressing the long-term benefits of low correlation and diversification will be a continuing concern.

By: Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence

Liam Stewart, Senior Research Analyst, U.S. Fund Research, ISS Market Intelligence