This second piece in a three-part series utilizes the newest tool in ISS Market Intelligence’s Simfund family: Simfund Total Market. Leveraging the module’s expansive coverage across asset classes, investment vehicles and geographies, this research series explores growth and changes across vehicles and structures spanning retail and institutional markets during a time of intense market volatility and shifting investor preferences.

The pursuit of scale and growth opportunities has led asset managers around the world to diversify their product array to target new investor types, new markets, and new distribution partners. No longer a “one-trick pony,” the traditionally mutual fund-dominated asset management shelf is giving way to a plethora of product wrappers catering to diverse clienteles and distribution opportunities. New opportunities bring new challenges; each new product avenue opens up opportunities to scale up and monetize the investment management IP but also introduces asset managers to a new cadre of competitors.

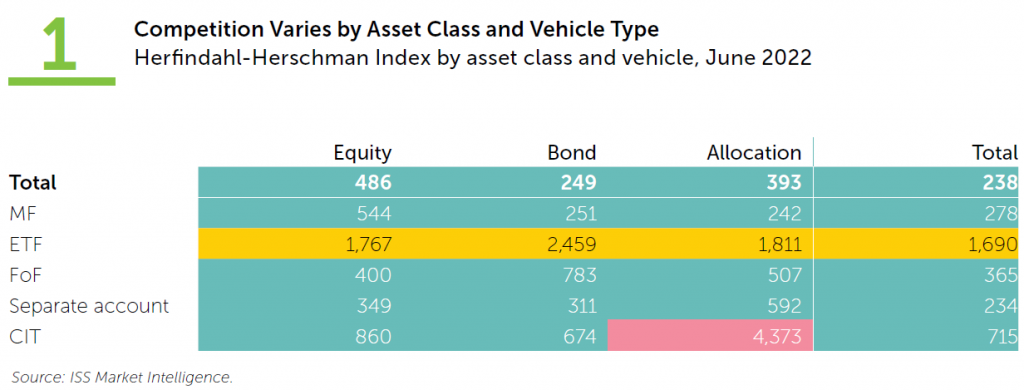

The previous look at insights derived from Simfund’s Total Market module explored what asset classes are most popular in which vehicle as well as competition within investment vehicles. The Herfindahl-Hirschman Index (HHI) helped measure relative market share of different firms between prominent vehicles like mutual funds, ETFs, and separate accounts, pointing to the shifting dominance of managers within each vehicle type.

Data derived from the HHI showed that ETFs were the vehicle with the lowest level of market competition, with an over seven times higher market concentration across all asset classes compared to mutual funds, and a nearly 10 times higher concentration amongst bonds. The only cross tabulation with a higher measure of market concentration were allocation CITs due to being a considerably small market in comparison, $772 billion worldwide, with Vanguard controlling nearly two-thirds of that segment.

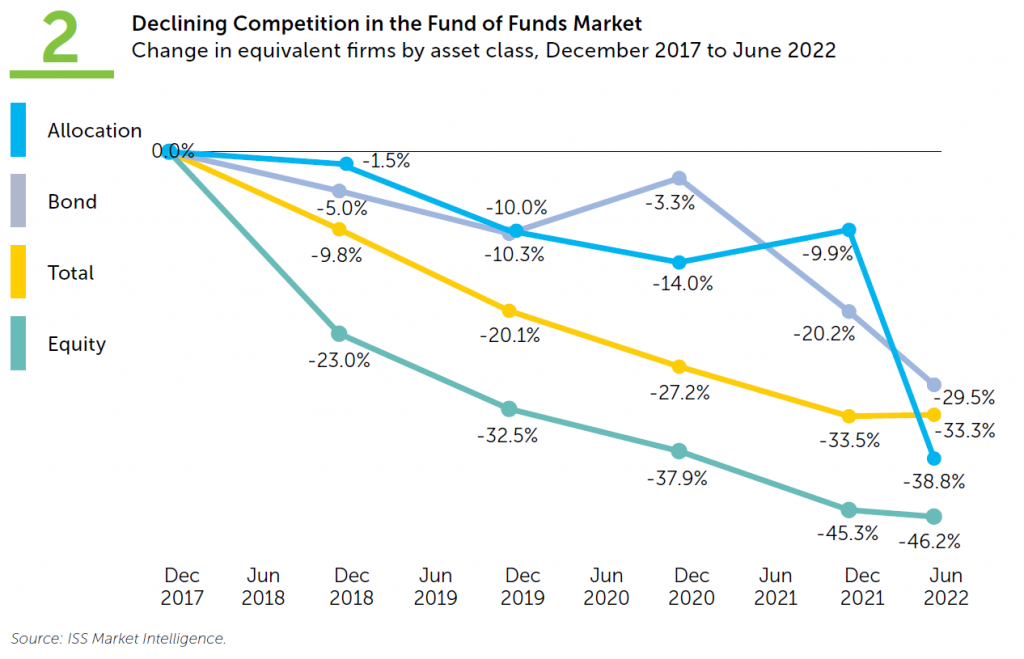

Even with those much higher levels of concentration, the ETF market has ultimately seen a long-term improvement in levels of market competition. The number of equivalent firms, which measures how many firms would exist in the market if they were equally sized, increased by 13.7% between year-end 2017 and June 2022. Among other vehicle types, trends in market concentration have varied greatly.

Although overall market concentration remains low, funds of funds have seen considerable declines in market competition across all asset classes. The overall number of equivalent firms for the vehicle has fallen by 33.3% since 2017, while competition in equity fund of funds has fallen even more precipitously, by 46.2%. Bond fund of funds have shown the most resistance to declining competition; however, their lower starting point means that as of June 2022, there are fewer than 13 “effective” firms in the global market. This increasing market concentration has been driven by just a handful of firms; Fidelity has seen its market share grow from just 15.9% at the end of 2020 to over 22.3% through this year, while Brazil’s Itaú has increased its market share from 9.2% to 10.2%. The fund of funds structure may provide a particular advantage to top tier players who can field large lineups and invest in proprietary products when creating cross-strategy solutions.

The race for fixed income flows

The picture is more complex when analyzing the bond market. While the fixed income market has seen an overall decline in competition, falling a modest 10% since year-end 2017, various vehicles within the asset class have seen significant movement in levels of concentration. Fixed income funds of funds, as discussed above, have seen a near 30% decline in “effective” firms, whilst fixed income separate accounts have seen comparatively little change with a 2.3% increase between 2017 and 2022. Mutual funds, constituting half the fixed income market, are also the largest driver of competition in the asset class though the number of equivalent firms declined by a mere 4.0%.

While bond ETFs are among the most concentrated of the segments, with their HHI in the “oligopoly” range, the market seems open to disruption, with a near 25% increase in equivalent firms over the last five years. Traditionally the realm of active strategies, fixed income has lent itself well to traditionally active structures, such as the mutual fund or SMA. As the active ETF continues to grow in popularity, it seems reasonable to expect more players to enter the fixed income ETF market.

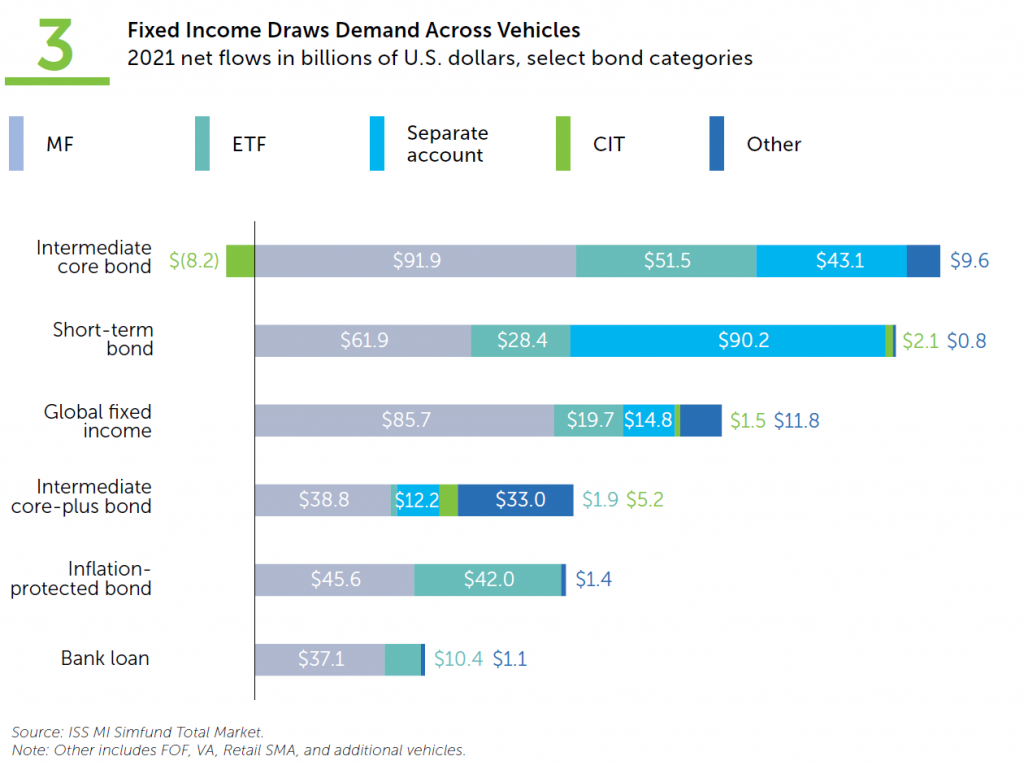

A look at leading inflow bond categories helps underline how varied demand can be within the fixed income space. Figure 3 highlights select categories which saw relatively balanced inflows across vehicles during 2021, prior to the most recent pullback in flows. Intermediate core holdings remain one of the most central ways for investors to access bond strategies and also recorded comparatively balanced aggregate inflows for the largest vehicle types.

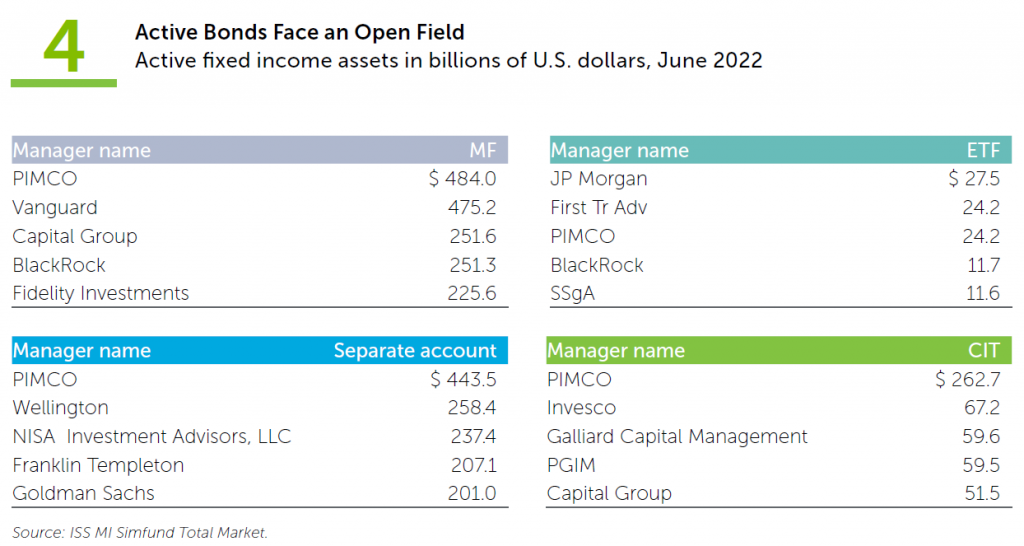

As investors in bond funds demonstrate flexibility in choosing between different vehicles, they are also open to working with a variety of providers. This is particularly the case within the active market, where leading managers by vehicle differ even more extensively. Figure 4 displays the top five active bond managers by assets across mutual funds, ETFs, separate accounts, and CITs. These rankings reflect PIMCO’s dominance throughout the market, holding onto the top spot across three product structures and ranking third among active ETFs. Still, not only is Vanguard close behind PIMCO on total assets in active bond mutual funds, but the additional players vary substantially between each vehicle.

While this market may be a particularly competitive one, that fact serves as little comfort in a rising rate environment that has recorded severe withdrawals. The rankings and sales activity across categories fortunately suggest that opportunities will remain open when markets return to more “normal” conditions. Coupled with higher yields as interest rates settle into a higher level than the previous decade, the return of investors to fixed income strategies will create opportunities for managers in a variety of structures, potentially driving market concentration down further.

By: Alan Hess, Associate Vice President, U.S. Fund Research, ISS Market Intelligence

Liam Stewart, Senior Research Analyst, U.S. Fund Research, ISS Market Intelligence