On 14 June 2021 the European Union (EU) issued the first euro bond, backing its massive COVID-19 recovery fund agreed to in mid-2020. According to the European Commission the bond has raised around €20 billion. Under the NextGenerationEU financing instrument the EU plans to issue bonds amounting to a total of €800 billion in current prices during the next 5 years to finance the bloc’s post-pandemic recovery. The funding strategy aims to issue roughly €150 billion on average in debt each year until 2026, with the potential to replace Germany as the benchmark issuer in Europe. Around 30% of the total bonds issued, equivalent to around €250 billion, are planned to be issued as green bonds.

These bonds are particularly attractive for institutional investors due to the EU’s triple A credit rating, backed by individual member states. For responsible investors this raises the question of how the EU as a standalone issuer is performing on its ESG risks.

The ISS ESG Country Rating treats the EU as a sovereign state while also assessing its unique supranational institutions. Many third-party data providers such as the World Bank or the International Energy Agency provide quantitative data at an EU level. If a source does not provide an aggregated score for the EU, the ISS ESG Country Rating uses a weighted average of the member state scores. In qualitative assessments the entire EU is treated as a sovereign state with a focus on its supranational institutions such as the European Commission, European Parliament and the European Court of Justice, while also considering the performance of the respective member states.

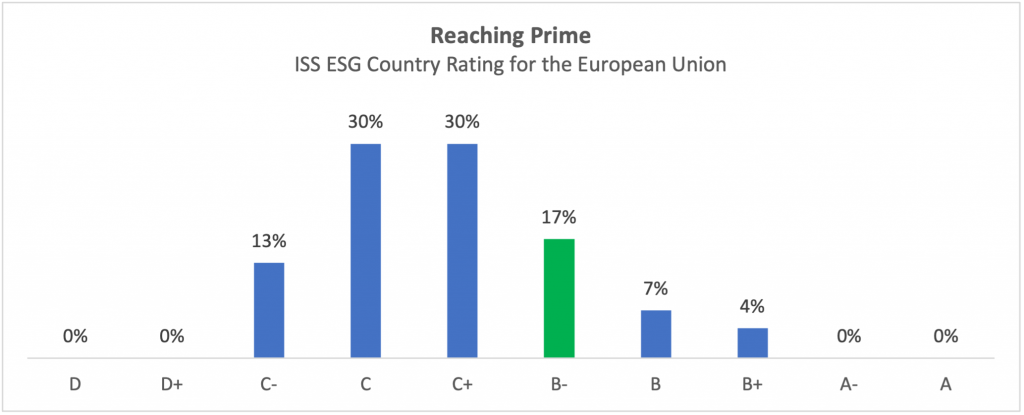

The following graph sets out the overall sustainability ratings for all countries within the ISS ESG Country Rating service. The ESG performance of the EU sits within a group of 17% of the covered universe (by number of countries) that score a relatively high B-, enough to achieve ISS ESG Prime Status, meaning that they fulfil ambitious absolute performance requirements.

Source: ISS ESG, 2021

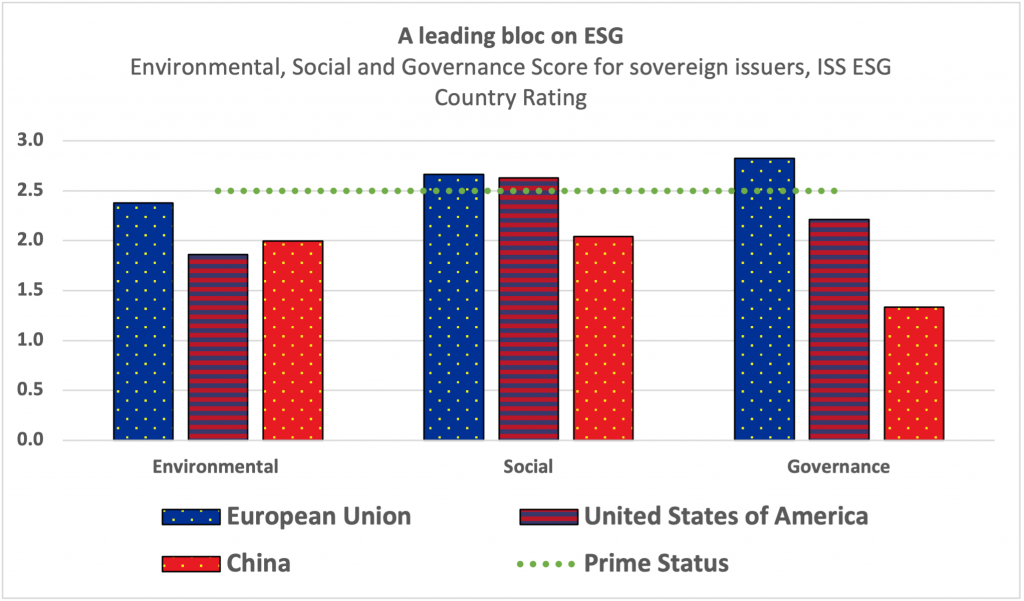

When diving deeper into the rating, however, the ESG risks of the EU are not equally distributed between the three main ESG pillars. While the bloc is performing well in the Social and Governance pillar, the Environmental rating is lagging, not atypical for industrialized countries. The bloc’s energy mix remains heavily reliant on unsustainable fossil fuels, translating into comparatively high greenhouse gas emissions. Moreover, natural resource exploitation, increasing water scarcity, marine pollution and large-scale biodiversity loss are of concern.

Despite the leading position the EU has taken in international climate policy, the bloc is currently not in line with its own ambitious climate targets. Following a large COVID-19-related blow to the EU’s industrial base (and therefore emissions) in 2020, it is expected to pick up speed again in the coming years, undoubtedly flattening the current decreasing GHG emissions trend. The €250 billion issued in green bonds will therefore be sorely needed to reach the EU’s climate goals.

For many the biggest achievement of the EU has been the creation of a lasting peace on the continent and overall robust institutions, results best considered under the heading of governance. Governance and social metrics are often mutually supportive, and the EU does score comparatively well on most nation-level social indicators. Many citizens worry that the integration of 27 states has been more an economic rather than a social experiment, however. This concern is borne out in the bloc’s poor performance regarding social cohesion – the worst rated topic in the EU’s social rating pillar. In recent years this disharmony has not only become apparent through a range of economic fundamentals, but has also been expressed in a surge of nationalist movements in some member states, culminating in the official departure of the United Kingdom at the end of 2020.

Does the EU’s funding strategy match its ESG risks?

The EU’s NextGenerationEU funding program is one of the largest financing vehicles of its kind, and has huge potential in terms of improving the lives and environment of many Europeans. The question remains, however: will the recovery bonds address the bloc’s predominant ESG risks?

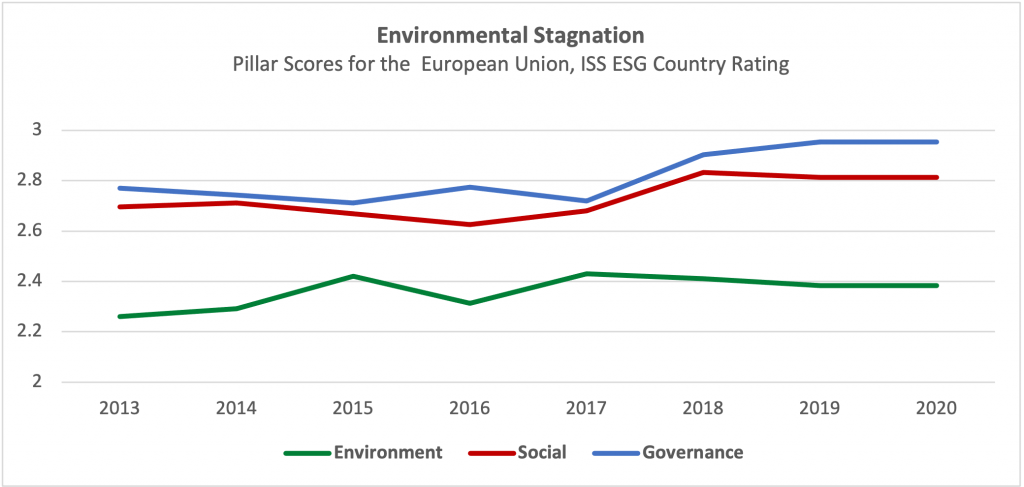

According to its funding strategy, the European Commission strives to spend 30% of its budget on fighting climate change, putting a green industrial transition at the heart of its planning. In the light of its ambitious climate goals this seems like a sensible budget allocation. It inevitably opens the discussion around investment and impact, however, one of the hot-button topics in ESG investing. All those green aspirations don’t necessarily make the EU funding program a green or sustainable issuance. Strategically allocating for green finance will make an impact, however, particularly in terms of further facilitating the sustainable bond market. ISS ESG Country Rating data demonstrates that the EU’s environmental pillar is consistently underperforming its other metrics.

Source: ISS ESG, 2021

Besides green aspects, another €8.1 billion are pledged to be funneled into rural development, while €50.6 billion supports a cohesion policy under the REACT-EU program, which provides recovery assistance for EU territories to help address the economic consequences of COVID-19. Considering that the divide between urban and rural areas in Europe is widening, and that cohesion is not only a social but also a political target in terms of what defines the European Union, this investment should be welcomed, especially as countries like China are making strong progress on the social dimension.

The EU’s NextGenerationEU funding program will result in a new benchmark for sovereign bonds, making it one of the world’s largest issuers. The EU compares very favorably to other major entities like the US and China, leading across each of the ISS ESG Country Rating’s E, S and G pillars. Much more work could be done on the E front, however, and emerging concerns around social cohesion are generating new challenges.

Together with its regulatory framework and the EU taxonomy for sustainable finance, allocating €250 billion for green bonds will generate a new benchmark for sustainable fixed income investments, not only in volume but also, if managed well, in ambition. ISS ESG research shows that the European Union should devote its funding as planned for green investments, but also should not take for granted its edge on the social and governance fronts.

Explore ISS ESG solutions mentioned in this report:

- Assess and manage the sovereign ESG risks within your fixed income portfolio using the ISS ESG Country Rating.

By Janina Magdanz, Country Rating Analyst, ISS ESG. Hendrik Leue, Head of Bespoke and Advisory Research, ISS ESG.