Introduction: Net Zero Is a Challenging Terrain

Transitioning to a Net Zero world is arguably the defining challenge of our time. “Net Zero” signifies achieving a balance between the amount of carbon emissions released by human activity and the amount removed from the atmosphere. As outlined in the Paris Agreement, limiting global warming to 1.5°C above pre-industrial levels – a threshold considered vital for a safe climate – necessitates achieving this balance by 2050. This requires a fundamental and comprehensive overhaul of how people produce, consume, and move.

The scale of this undertaking is immense. The six largest greenhouse gas emitters – China, the United States, India, the EU, Russia, and Brazil – accounted for 63% of global emissions in 2023, highlighting the need for truly global cooperation. While momentum is building, with over 100 countries, 12,000 companies, 1,100 cities, and 600 financial institutions committed to the “Race to Zero,” current progress is insufficient. Despite Net Zero targets now covering 85% of the global population, emissions continue to rise, making the 1.5°C pathway increasingly unattainable.

A significant hurdle lies in “hard-to-abate” sectors. These carbon-intensive sectors – including Energy, Materials, Utilities, and Industrials – represent a disproportionately large share of global emissions and require particularly innovative and determined action. Defined as “priority sectors” by the Net Zero Asset Owners Alliance (NZAOA), their transformation is crucial for a successful transition to a low-carbon economy. The sectors are considered priority sectors due to their significant contribution to global emissions.

This article delves into the challenges and emerging trends within these vital, yet complex, sectors. The article explores how companies are responding to the Net Zero imperative, drawing on an assessment of over 8,600+ publicly traded companies, including all those featured within the Climate Action 100+ initiative, to understand the ambition and, crucially, the action being taken to deliver on Net Zero pledges.

ISS ESG Analysis of Net Zero Commitments

ISS ESG conducted Net Zero analysis of 8,600+ publicly listed companies worldwide, including those in key global indexes. The Net Zero analysis focused on the high GHG-emitting “Priority Sectors” such as Energy, Materials, Cement, Utilities, and Chemicals, etc. ISS ESG’s Net Zero analysis also includes all companies from the Climate Action 100+ initiative (CA100+).

The analysis is based on publicly disclosed Net Zero commitments, medium-term (interim) GHG reduction targets (falling within the time frame of 2025 to 2035), decarbonization plans, and incorporation of climate-related risks into financial accounts. ISS ESG’s Net Zero research employs a dynamic methodology that recognizes the varying materiality of GHG emissions across sectors.

The Current Status of Net Zero Commitments

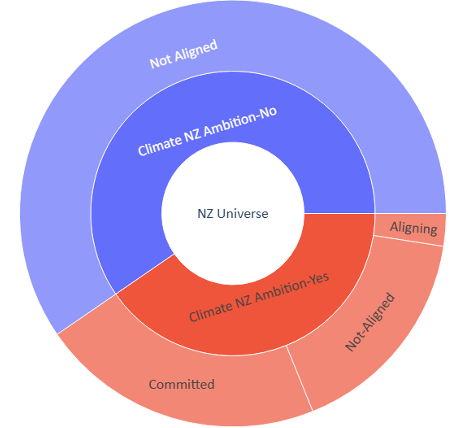

Figure 1 represents the current state of Net Zero commitments and alignment for the full universe of companies within ISS ESG coverage (8,600+ Net Zero Universe).

Figure 1: Net Zero Ambition and Alignment Status across the Research Universe

Note: Red = Net Zero ambition, Blue = No Net Zero ambition

Source: ISS ESG

Only 40% of the companies in the universe have declared Net Zero ambition and the remaining 60% have no Net Zero ambition.

The companies with Net Zero ambition can be categorized according to their Net Zero Alignment status. Net Zero Alignment status is a derived data point based on the Net Zero Investment Framework (NZIF), which takes into account a company’s Net Zero ambition, mid-term targets, decarbonization strategy, and material GHG emission disclosures.

Net Zero Alignment provides three classifications for companies – “Aligning,” “Committed,” and “Not Aligned” – based on their actions towards Net Zero. The alignment classifications are determined by a company’s GHG emissions reduction target, emissions disclosure, and decarbonization strategy.

Net Zero Commitments in Hard-to-Abate Sectors

The World Economic Forum in its Net Zero Industry Tracker estimates that hard-to-abate sectors account for 40% of global greenhouse gas (GHG) emissions; therefore, reducing global emissions requires companies in these sectors, in particular, to set GHG emission reduction targets.

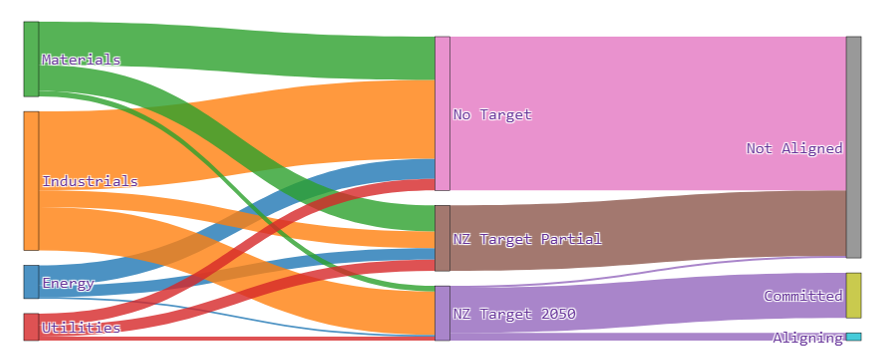

The analysis indicates that 56% of companies within hard-to-abate sectors have not set any GHG reduction targets by 2050. Only 22% of companies have set GHG emission reduction targets encompassing all Scope 1, 2, and 3 emissions, while the remaining 22% have targets covering only Scope 1 and 2 emissions (partial targets).

Deeper analysis into companies with regards to interim GHG reduction targets, emissions disclosure, and decarbonization strategy indicates that only 3% of companies are Aligning and 16% of companies are Committed to Aligning. Sankey graphs (Figure 2) show the flow of companies between Net Zero targets and Net Zero Alignment status.

Figure 2: Net Zero Target and Alignment in Hard-to-Abate Sectors

Source: ISS ESG

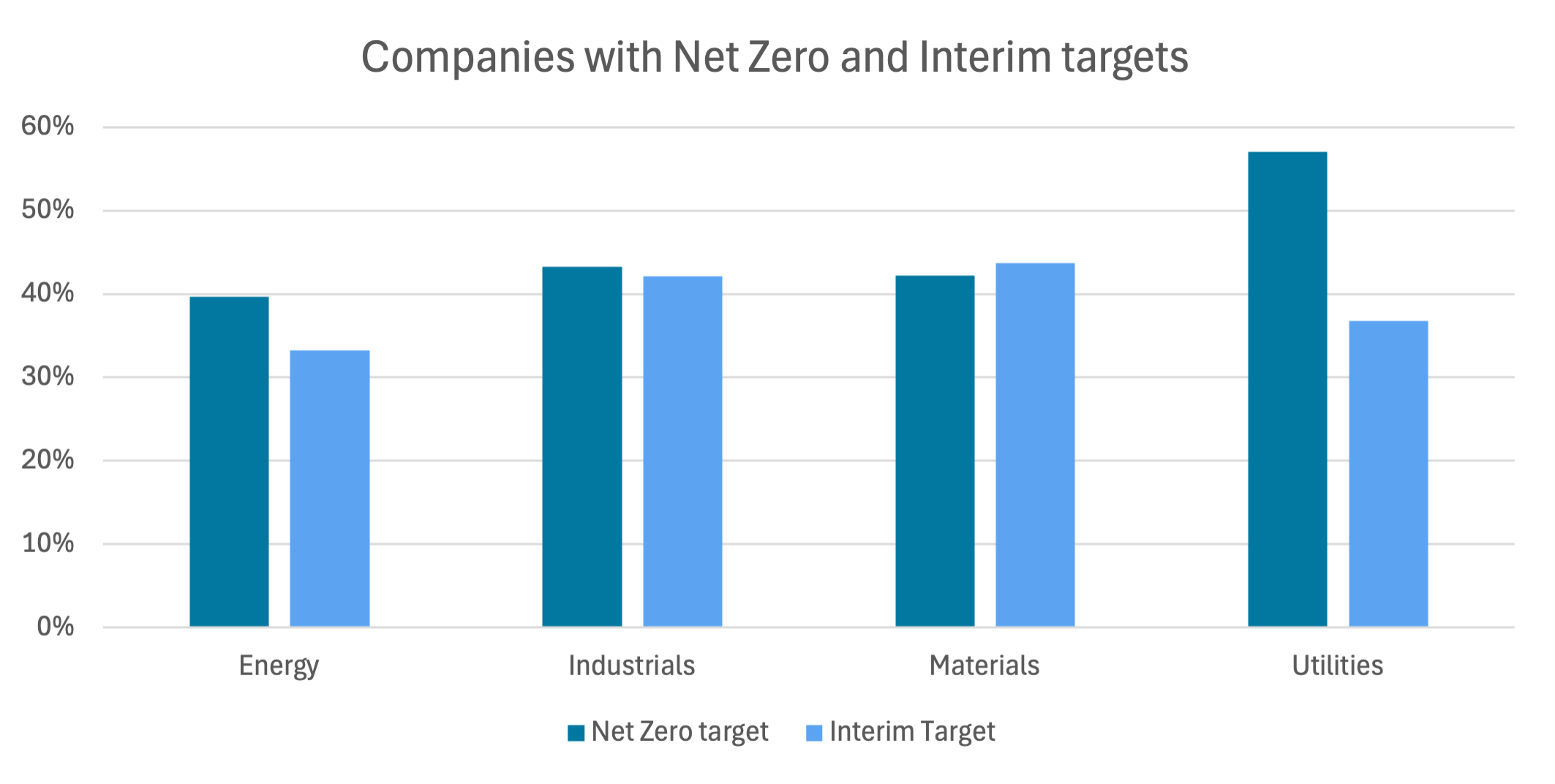

Drilling down further into the hard-to-abate sectors shows that 57% of utility companies have set targets to achieve Net Zero emissions by or before 2050. Within this sector, 37% of companies have set interim emissions reduction targets aimed at decreasing emissions between 2025 and 2035 (Figure 3).

Figure 3: Net Zero and Interim Targets in Hard-to-Abate Sectors

Source: ISS ESG

A similar trend is observed in the Industrials and Materials sectors, with 43% of industrial companies and 42% of materials companies expressing ambitions to reach Net Zero. Further, 42% of industrials companies and 44% of materials companies have set interim targets.

The Energy sector is generally considered the most challenging to decarbonize; however, the findings reveal that 40% of companies in this sector have committed to Net Zero, while 33% have established interim targets.

Emission Trends for Hard-to-Abate Sectors from 2021 to 2023

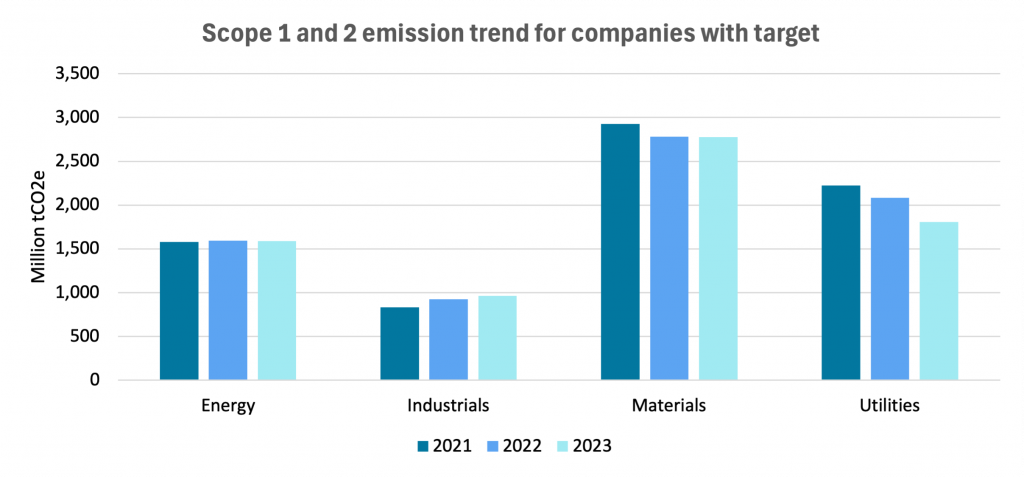

An evaluation was conducted to analyze Scope 1 and 2 emissions trends across four hard-to-abate sectors. The evaluation’s focus was on companies that consistently reported emissions data for the years 2021 to 2023 and have set either Net Zero, interim, or both types of emission reduction targets.

The findings reveal varying emission trajectories across sectors (Figure 4). In the Energy sector, total Scope 1 and 2 emissions have shown a slight increase over the three-year period, indicating limited progress despite climate commitments.

Figure 4: Scope 1 and 2 Emissions Trends for Companies with Net Zero and/or Interim Target(s)

Source: ISS ESG

In the Industrials sector, emissions have followed an upward trend, suggesting that decarbonization efforts have yet to translate into tangible reductions. Conversely, in the Materials sector, a decline in emissions was observed between 2021 and 2022. However, emissions remained largely unchanged from 2022 to 2023, indicating a plateau in progress.

The Utilities sector notably demonstrated a consistent decline in Scope 1 and 2 emissions over the three-year period, reflecting more sustained efforts toward emissions reduction. An increase in renewable energy integration within the Utilities sector played a major role in emissions reduction. This sectoral comparison underscores the uneven pace of decarbonization across industries, highlighting the need for accelerated and more effective implementation of climate targets.

Analysis of Key Decarbonization Levers Used by the Companies

The strategies a company chooses to reduce its emissions can be shaped by a variety of factors. These include its geographical location, the composition of its assets, capex requirements, and technology availability, as well as local policies and practices. The decarbonization initiatives are broadly classified into these seven levers:

- Improving the energy efficiency of industries: Companies are increasingly using various technologies to improve the energy efficiency of their production processes. This can be achieved through process optimization or by using energy-efficient equipment and industrial automation.

- Improving the energy efficiency of buildings: Companies also try to reduce emissions from office buildings, where they try to reduce energy consumption through building automation, insulation, installing products that consume less electricity, etc.

- Switching fuels used for transport: Fossil fuel-based company vehicles, especially in sectors such as mining, materials, and heavy industry, etc., are responsible for high emissions. Therefore, electrifying the fleet or using low-carbon fuels for vehicles are considered effective strategies for reducing emissions.

- Electrification of industrial processes: Substantial reductions in emissions from production processes can be achieved through the electrification of industrial operations. By utilizing renewable energy to power these processes, it is possible to reduce emissions substantially. This approach is particularly vital for sectors such as steel, aluminum, and cement.

- Switching from fossil fuels to renewables: Generation and consumption of renewable energy can be leveraged by companies from all the hard-to-abate sectors to reduce emissions.

- Decarbonizing the supply chain: Supply chain decarbonization is essential for minimizing scope 3 emissions. This can be achieved through various strategies, such as reducing emissions by procuring low carbon products and setting engagement targets for suppliers on emission reduction, among other initiatives.

- Sales of low-carbon products: Companies can prioritize the design and production of energy-efficient products throughout their use phase while also exploring low-carbon substitute materials.

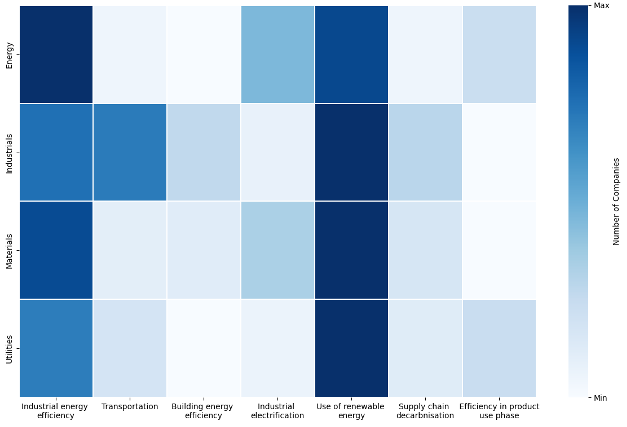

Figure 5 illustrates the findings from the analysis of seven decarbonization strategies implemented by various companies in the hard-to-abate sector. This assessment revealed that, for most sectors, the “use of renewable energy” lever is the most commonly used approach. The second-most-frequently-used lever is “industrial energy efficiency,” which many companies depend on to reduce their emissions. In the Energy sector specifically, industrial energy efficiency ranks as the most-used lever, while the second-most-used lever is use of renewable energy.

Figure 5: Decarbonization Levers Reported by Companies

Source: ISS ESG

To achieve their emissions reduction targets by means of these seven levers, companies are exploring several new technologies. The adoption of these technologies is dependent on their technology readiness level (TRL), which indicates the maturity of the technology.

Major decarbonization technologies, such as Carbon Capture, Utilization & Storage (CCUS), are being widely explored as part of climate action plans across hard-to-abate sectors, and massive investment is required for commercial-scale use. Other sector-specific emerging technologies and their TRLs are listed in Figure 6.

Figure 6: Decarbonization Technologies’ Readiness Levels and Use by Sector

Note: TRL values are 1-3 = Concept; 4 = Small Prototype; 5-6 = Large Prototype; 7-8 = Demonstration; 9-10 = Early Adoption; 11 = Mature

Source: World Economic Forum

Dependence on Carbon Offsets and Carbon Removal Technologies

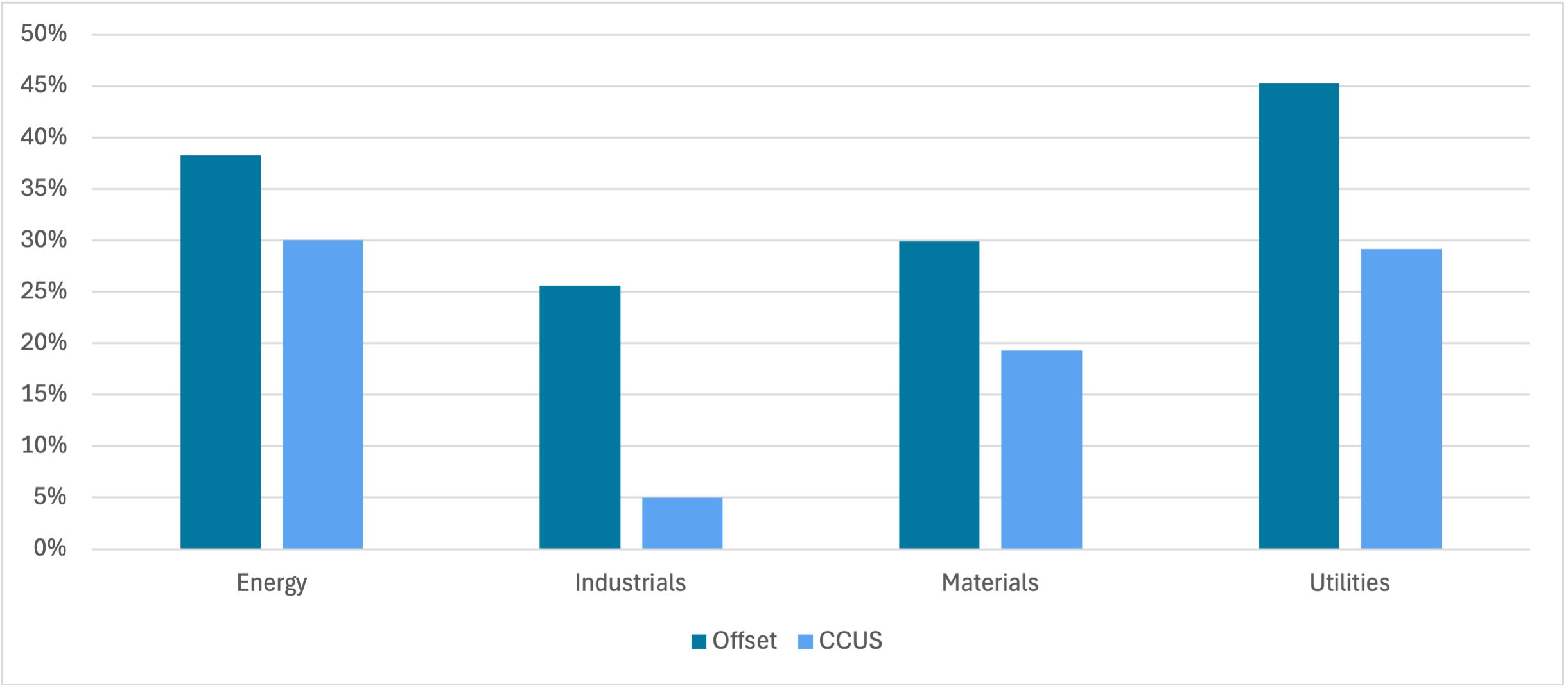

The analysis covers decarbonization strategies of companies that have set Net Zero or interim emission reduction targets. The analysis further examines the extent to which these companies rely on carbon offsets/credits and CCUS as part of their decarbonization strategies.

In the Energy sector, 49% of companies have set Net Zero or interim targets and 38% of Energy sector companies plan to use carbon offsets, while 30% plan to use CCUS technologies to reduce emissions (Figure 7).

Figure 7: Companies with Net Zero and/or Interim Targets That Plan to Use Offsets or CCUS

Source: ISS ESG

In the Industrials sector, 55% of companies have set Net Zero or interim targets. Among all companies in this sector, 26% plan to use offsets and 5% plan to use CCUS.

In the Materials sector, 53% of companies have committed to Net Zero or interim targets. Among all companies in this sector, 30% plan to use carbon offsets, and 19% plan to use CCUS solutions.

The Utilities sector demonstrates the highest level of commitment, with 62% of companies setting Net Zero or interim targets. Among all companies within the Utilities sector, 45% of companies plan to use offsets, and 29% plan to use CCUS to achieve their goals.

This sector-by-sector overview highlights varying levels of engagement with decarbonization strategies, indicating a growing but higher reliance on carbon offsets and carbon capture technologies.

Conclusion

This analysis reveals a complex and uneven landscape in the decarbonization of hard-to-abate sectors. While Net Zero commitments are increasingly common, translating ambition into tangible emissions reductions remains a significant challenge. A considerable number of companies lack comprehensive targets encompassing all relevant scopes, and many rely heavily on carbon offsets and nascent carbon removal technologies, raising questions about the long-term credibility of their plans.

However, opportunities exist. Companies demonstrating leadership through aggressive emissions reduction targets, strategic investments in proven decarbonization levers – such as renewable energy integration and industrial electrification – and proactive engagement with supply chain emissions are best positioned to navigate the transition to a low-carbon economy.

Explore ISS STOXX solutions mentioned in this report:

- Identify climate risks and seize investment opportunities with the ISS ESG Net Zero Solution

By:

Amitkumar Vyawahare, Head of Climate and Nature Analytics, India, ISS ESG

Tanish Gangurde, Net Zero Research Associate, ISS ESG

Bicky Boro, Net Zero Analyst, ISS ESG.