Below is an excerpt from ISS ESG’s recently released paper “Bitcoin from a responsible investor’s perspective: Do the ESG risks outweigh the benefits?” The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

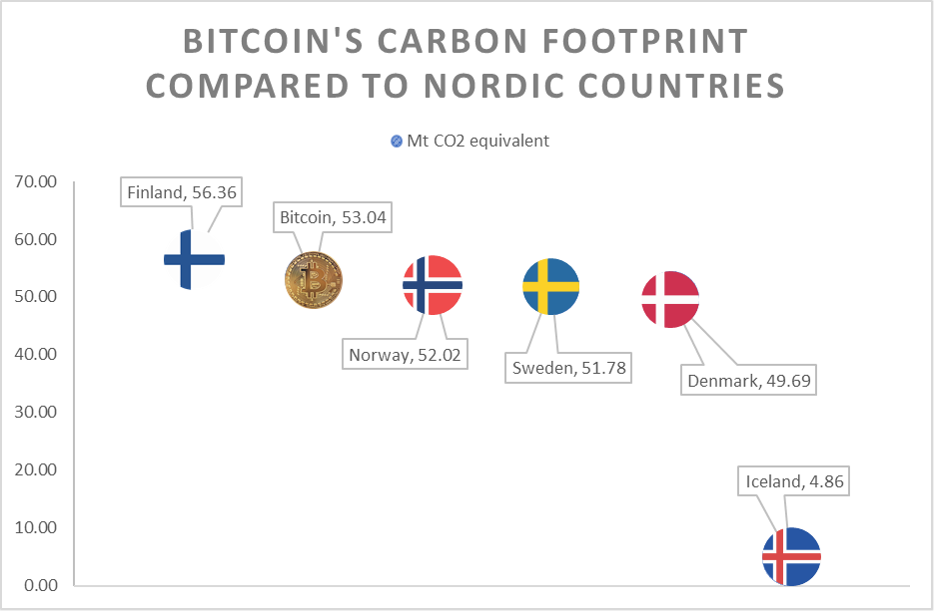

- Proof-of-work cryptocurrencies raise a range of concerns for responsible investors, particulaly on the topic of climate change risks.

- Climate impacts associated with the maintenance of the network can be seen to outweigh the benefit derived from a digital store of value.

- ESG data can be leveraged to assess companies involved in the wider Bitcoin ecosystem.

- The governance structure of Bitcoin has proven remarkably resilient in its relatively short history.

- Although there are initiatives to make Bitcoin less impactful for climate, the technologies and innovations that would enable such transition are not yet realized.

- Future iterations of digital assets may perform differently in terms of ESG risks.

Source: Country emissions data from ISS ESG’s Country Rating service (annual values, excluding Land Use, Land-Use Change and Forestry); Bitcoin’s emissions (annualized value) estimate from the Digiconomist’s Bitcoin Energy Consumption Index.

By Johanna Schmidt, Senior Associate, ISS ESG. Timo Honsel, Senior Associate, ISS ESG. Thiago Toste, Associate, ISS ESG.