Retirement savers ended 2022 on shakier ground than the year prior. Capital markets experienced their sharpest annual declines since 2008, with both equity and bond markets feeling the sting from higher interest rates. As detailed in ISS MI’s State of the Market – Defined Contribution 2023 report, savers were able to benefit from tight labor markets and a hot economy, though heightened inflation acted as a headwind. Meanwhile, the impact of aging demographics continued apace, serving as an ongoing drain on defined contribution (DC) account balances and posing long-term consequences for the managers navigating a shifting DC landscape.

Rallies and downturns

2021 was a strong year for returns and an exceptional year for demand in the fund market. Assets held in long-term mutual funds and ETFs soared to $27.5 trillion according to ISS MI Simfund, an increase of 18.3% over the prior year. Investor net inflows demonstrated an even more exuberant reaction, as they surpassed $1 trillion for the year, an all-time record.

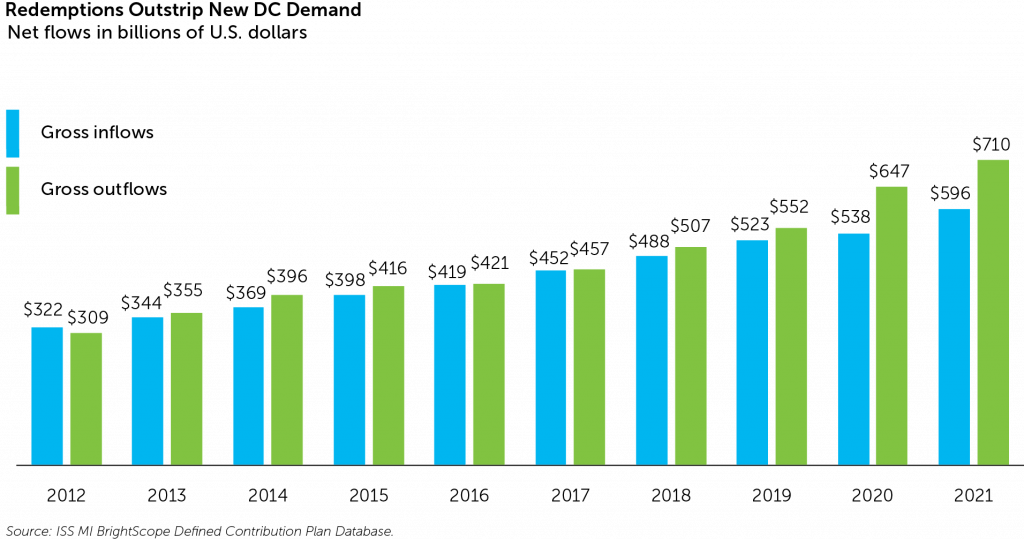

Data from ISS MI BrightScope indicates strong markets also lifted defined contribution assets to record levels at $8.4 trillion by the end of 2021. Record withdrawals, however, pushed outflows to peak levels, continuing a nine-year consecutive streak of net redemptions. The pull of demographics had a sizeable effect as older workers retired and drew from their long built-up retirement savings. This has not been a problem of declining new demand, as gross inflows hit another record level in 2021. Outflows just happened to be higher and have remained at the elevated levels witnessed in 2020. The table below displays gross sales and redemptions for DC plans throughout the last decade.

With redemptions from retirement plans substantial even in up markets, they are unlikely to record a drastic turnaround in 2022 given the year’s downturn in performance. Fortunately, the behavior that can make retirement such an appealing channel for asset managers prevailed through much of the year, with many retirement investors recording consistent savings and contribution rates. Additionally, the hot labor market and rising labor force participation rates across age cohorts should help stem the pace of withdrawals from DC plans.

In DC arena, CITs take center stage

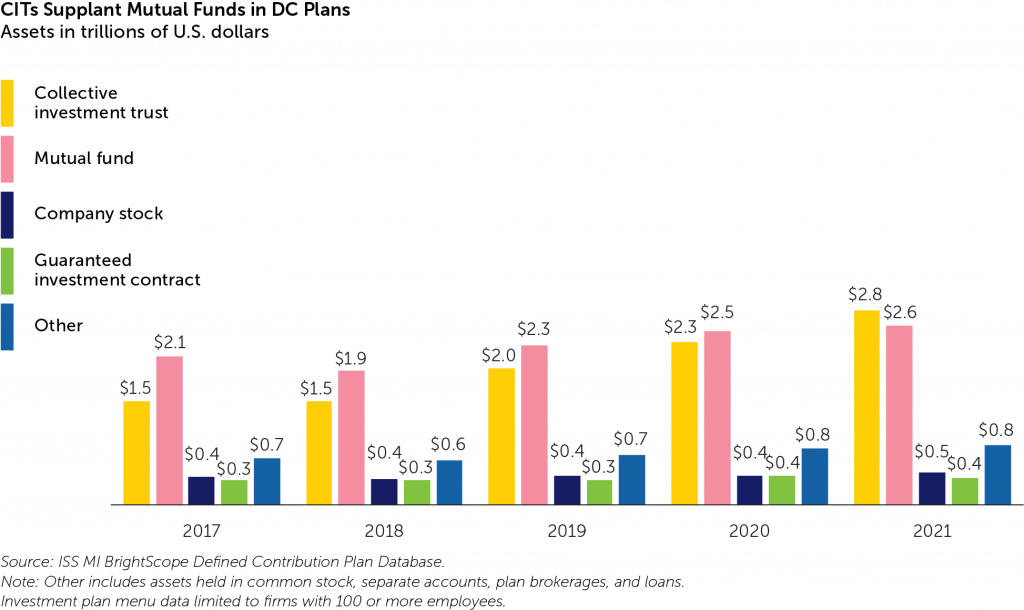

DC plans are slower to follow the latest product development trends. They have largely eschewed ETFs, which have had a tremendous influence on the retail market, while alternatives have also not made extensive inroads, either in the liquid form seeing a revival in the retail market or through private alternative strategies used in defined benefit plans. Large changes do still come to retirement plans, as evidenced by the now central role played by Collective Investment Trusts (CITs). This vehicle has translated marginal advantages, particularly in cost, into significant increases in market share, ultimately capturing a plurality of DC plan assets as of the end of 2021 as detailed below.

The top end of the market has been critical in driving CIT growth, as plans managing over $1 billion held over 50% of their assets in CITs. However, this may pose more immediate future problems for CITs as they come into a dominant DC position. The largest plans have also been the largest source of DC net redemptions, with plans holding $1 billion or more in assets experiencing twice the magnitude of net outflows as the rest of the market.

The full report is available to Simfund Enterprise subscribers for access on the Simfund research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

Authored by:

Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence