A review of remuneration data disclosed by Brazilian publicly listed companies analyzed by ISS during the 2023 proxy season identified a group of companies (19 issuers1) with the uncommon practice of remunerating a non-executive director, specifically the chair of the board in all cases, higher than compensation paid to the CEO. Although this scenario is the exception in the market, this pay practice is disproportionally seen among companies with a founder and/or controlling shareholder serving as board chair. In all but one case, the non-executive chair is classified by the company as non-independent.

In Brazil, shareholders are asked to approve a binding annual say-on-pay resolution granting the board authority to allocate a global remuneration cap to its administrators, including board members, statutory executives, and fiscal council members (when installed). While compensation disclosure is not individualized, regulatory requirements mandate disclosure of the highest compensation paid by the company to a non-executive director as well as to an executive, which are generally assumed to refer to the board chair and CEO, respectively. (This article refers to these disclosures when discussing chair and CEO remuneration).

Boards have full authority to allocate the shareholder-approved compensation cap among the administrators (generally statutory executives and board members) once the annual binding resolution is approved by shareholders. Therefore, the practice of paying larger remuneration to a non-executive chair than to the company’s CEO raises concerns about potential conflict of interests, when a significant portion of the annual global remuneration cap is used to compensate founders and/or controlling shareholders at a potentially disproportional level, and potentially at the expense of the interests of non-affiliated minority shareholders.

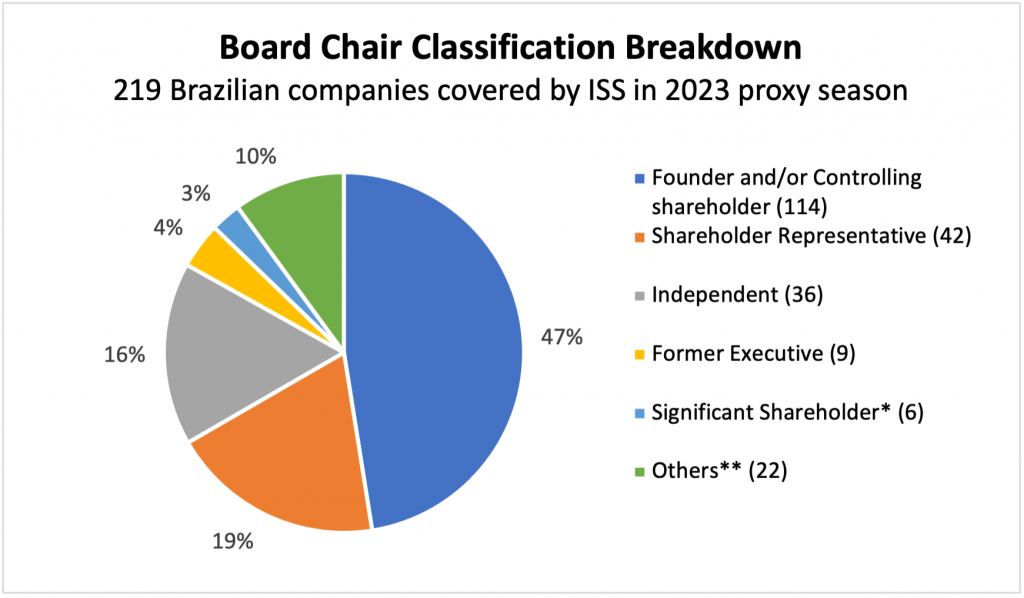

The graph below illustrates the breakdown of the board chair classification of the 219 Brazilian companies with say-on-pay proposals analyzed by ISS in the 2023 proxy season. Based on ISS data, 114 companies (47 percent) have founders and/or controlling shareholders serving as board chair, while independent chairs are present at only 16 percent of the companies analyzed.

* Holders of 10 percent or more of the company’s total share capital but not part of the controlling group.

**One issuer with the CEO serving as chair; 17 cases in which the chair was classified as non-independent by the company with no specific disclosure of relationship between the chair and the issuer; and four company-classified independent chairs reclassified as non-independent by ISS due to tenure of 12 years or more.

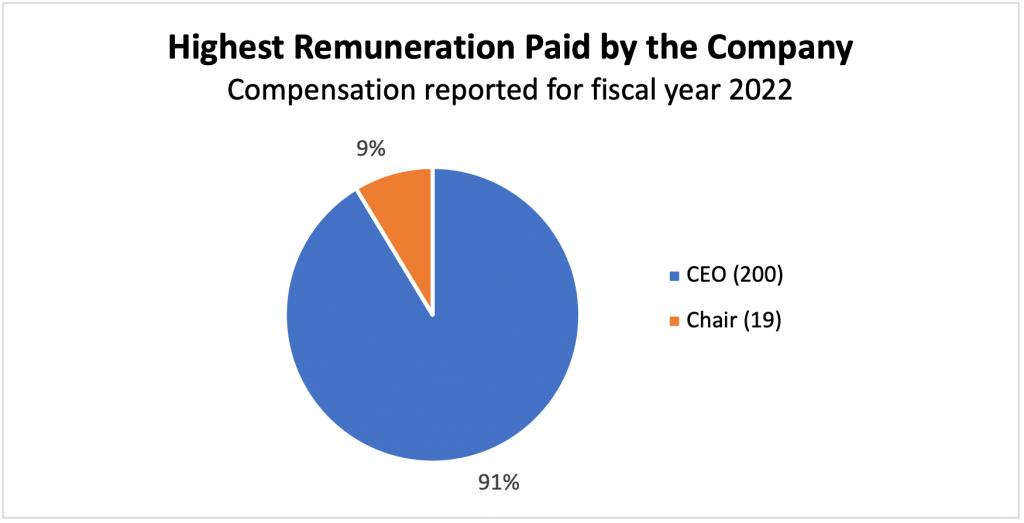

As noted above, companies where the largest compensation is paid to the non-executive board chair remain the exception in Brazil, and represent only 9 percent of the say-on-pay proposals analyzed by ISS in the 2023 proxy season.

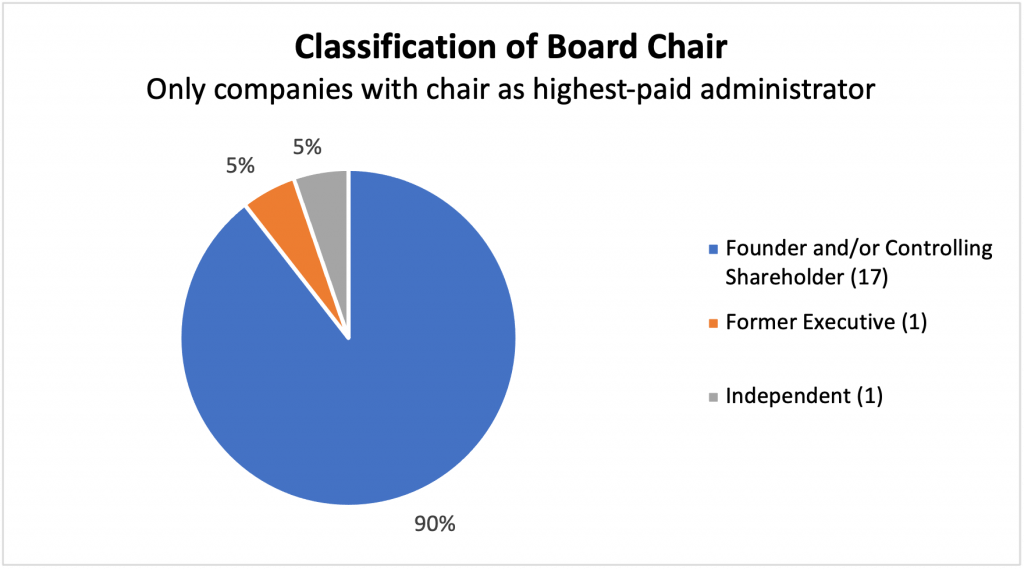

A closer examination of these 19 companies in which the largest compensation for 20222 was paid to the non-executive board chair reveals a strong prevalence of founders and/or controlling shareholders serving in such leadership board seat, or 17 out of the 19 identified cases, as represented in the graph below.

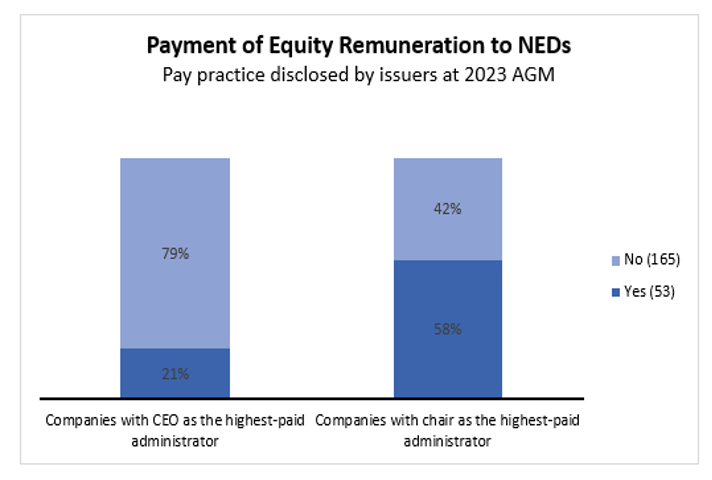

It is also noteworthy that the awarding of equity compensation to non-executive directors, generally considered a problematic pay practice, is more commonly seen among the companies where the board chair is the highest-paid administrator. Eleven of the 19 companies identified by ISS under this scenario, or 58 percent, grant equity compensation to non-executive directors, compared to 21 percent of the issuers that adopt the more common practice of paying their highest remuneration to the CEO.

Conclusion

The practice of controlling shareholders and/or founders receiving remuneration higher than the CEO while serving as non-executive board chairs raises conflict of interest concerns. Additionally, a majority of the companies in this group also grant equity-based compensation to their non-executive directors, which may include the board chairs, which is not considered best governance practice.

In 2024 and beyond, the key problematic compensation practice discussed in this paper will be flagged under ISS’ updated Benchmark Proxy Voting Guidelines for Brazil per a policy change approved and disclosed in 2022, to be effective as of February 1, 2024 (following a one-year grace period). Starting in the 2024 Brazilian proxy season, ISS benchmark research will generally no longer recommend support for binding resolutions seeking to approve global compensation caps of companies whose board chair is paid more than the CEO. However, additional consideration will be given in the event a company provides a compelling rationale for this practice.

[1] Aeris Industria e Comercio de Equipamentos para Geracao, Ambipar Participacoes e Empreendimentos SA, Azul SA, Banco BTG Pactual SA, BRB Banco de Brasilia SA, Companhia Brasileira de Distribuicao, Diagnosticos da America SA, Fras-Le SA, Grupo Mateus SA, Grupo SBF SA, Grupo Ser Educacional SA, Irani Papel e Embalagem SA, Lojas Renner SA, Magazine Luiza SA, Meliuz SA, MRV Engenharia e Participacoes S, Natura &Co Holding SA, PBG SA (Brazil), Porto Seguro SA. Out of these 19 companies, 15 are listed in the Novo Mercado segment, the Sao Paulo stock exchange (B3) listing segment with the highest level of corporate governance standards.

[2] Fiscal year under review at the 2023 proxy season.

By: Ana Luiza Farias, Samuel Carvalho, Latin America Research, ISS Governance