Below is an excerpt from ISS-Corporate’s recently released paper “Canadian Compensation Peers: Competing With the U.S. for Talent or Escalating Executive Pay?” The full paper is available for download from the ISS-Corporate online library.

Selecting appropriate peers for benchmarking executive pay is often a challenge for publicly traded corporations. Shareholder concerns over ratcheting up pay compete against the need to attract and retain top executive talent. Achieving an appropriate balance between these competing factors should be reflected in a corporation’s executive pay benchmarking peer group. Currently accepted best practice is for corporations to choose peer companies that are similar in terms of industry and size, including factors such as market capitalization and revenue. This is intended to reduce the use of higher paying “aspirational peers” that a company normally wouldn’t normally compete with for executive talent.

For Canadian corporations, achieving this balance can be particularly challenging because the competition for executive talent largely involves a mix of Canadian and U.S. corporations. Additionally, institutional investors have raised concerns that the use of U.S. corporations as compensation peers in Canada could result in the ratcheting up of executive pay in Canada.

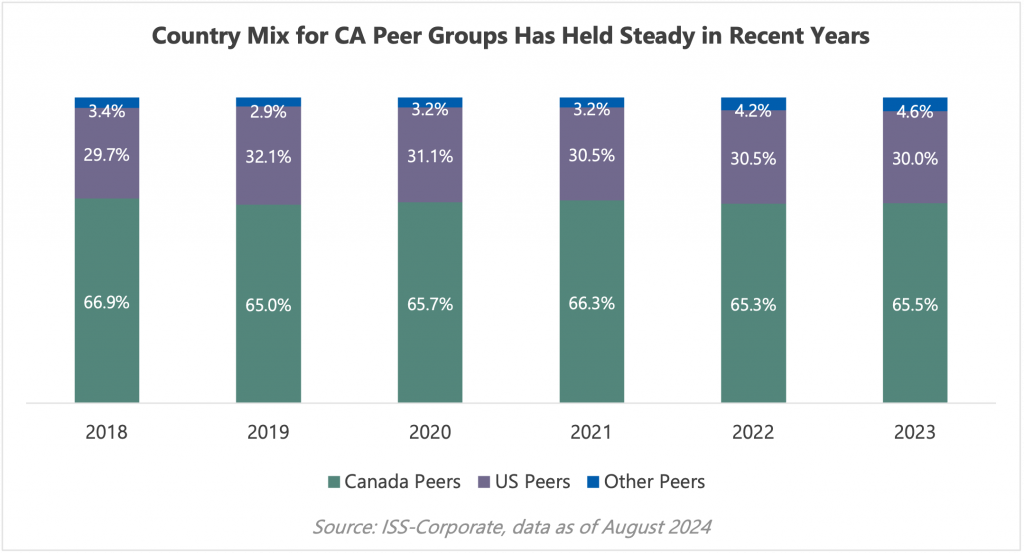

Executive pay is generally higher in the U.S. than Canada, so a peer mix that is heavily weighted towards U.S. corporations could exacerbate the pay escalation concerns raised by investors. To determine whether Canadian corporations have given in to the temptation of using peer mixes weighted more heavily towards higher paying U.S. companies, ISS-Corporate examined the peer selections among the S&P/TSX composite over the last six years.

Interestingly, the mix of Canadian and U.S. corporations as compensation peers in the S&P/TSX composite has remained largely consistent over the past six years at around 30% of peers that are domiciled in the U.S. The small proportion of peers from “other” countries are mainly from the United Kingdom.

Despite relatively consistent country peer mixes at an aggregate level, there have been peer group composition shifts in both directions (i.e., U.S. and Canada) across industries over the last six years.

By: Ted Seaton, Vice President, Compensation & Governance Advisory, ISS-Corporate