Below is an excerpt from ISS-Corporate’s recently released article “Climate Lobbying: Investor Interest and Corporate Disclosures”. The full article is available on the ISS-Corporate online library.

The Role of Taxation in Corporate Sustainability

Climate lobbying – the alignment of a company’s climate commitment with its lobbying expenditures – has emerged as a trend in shareholder proposals in recent years. Often these proposals call for companies to “Review Public Policy Advocacy on Climate Change” or “Report on Corporate Climate Lobbying Aligned with [the] Paris Agreement.” This trend is part of a broader theme of shareholder expectations for companies to integrate climate considerations with other ESG matters (e.g., social justice – the “just transition”), rather than simply reporting on emissions reduction.

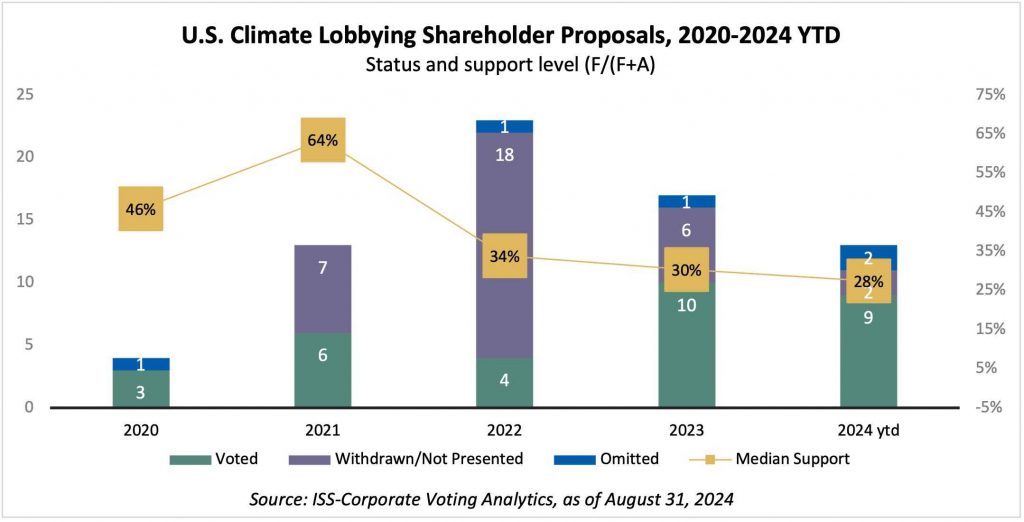

Outcomes of these proposals suggest that climate lobbying is a substantial concern among shareholders. Median support for voted proposals on climate lobbying in the U.S. peaked at 64% in 2021 (as shown in the chart below), after which the proportion of withdrawn proposals on this topic expanded, perhaps indicating that companies reached agreements with filers to avoid undesirable voting outcomes. In 2024, 9 climate lobbying proposals went to a vote with a median support level of 28% of votes cast, indicating a continued interest in this topic among proponents and investors.

By: Daniel Feinberg, Senior Associate, Sustainability Advisor, ISS-Corporate