Introduction

Transitioning to a Net Zero emissions economy by 2050 entails risks linked to policy, technology, and economic development uncertainties. Companies may try to manage these risks and also address market opportunities through their governance systems, defined by the International Sustainability Standards Board (ISSB) as “the governance processes, controls and procedures an entity uses to monitor, manage and oversee climate-related risks and opportunities.” When assessing companies’ climate performance, investors are increasingly paying attention to their climate governance systems.

This piece examines the importance of effective corporate climate governance. ISS ESG data on Net Zero and Climate Governance can clarify whether companies with a climate governance structure in place are more likely to have robust Net Zero transition plans.

Climate Governance in the Net Zero Reporting Landscape

Many existing reporting guidelines on climate governance are built on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), created in 2015 by the Financial Stability Board (FSB) to provide a reporting framework for organizations to disclose “clear, comparable and consistent information about the risks and opportunities presented by climate change.” Governance is the first pillar of the TCFD recommendations and includes recommended disclosures on 1) “the board’s oversight of climate-related risks and opportunities” and 2) “management’s role in assessing and managing climate-related risks and opportunities.”

The ISSB Standard on Climate-related Disclosures, which is taking over the work of the TCFD, keeps essentially the same disclosure requirements on governance, with the only difference being that the disclosure relating to the “oversight of climate-related risks and opportunities” is not limited to the board but also includes a “committee or equivalent body charged with governance” or any “individual(s) responsible for oversight of climate-related risks and opportunities.”

In line with the TCFD or ISSB recommendations, many frameworks that provide tools for assessing companies’ Net Zero alignment, such as Climate Action 100+ (CA100+)’s Net-Zero Company Benchmark, IIGCC’s Net Zero Investment Framework (NZIF), the Transition Pathway Initiative (TPI), or the Glasgow Financial Alliance for Net Zero (GFANZ) framework for Measuring Portfolio Alignment, include climate governance indicators. These indicators mainly relate to board oversight of climate change/Net Zero transition planning, executive remuneration linked to climate performance, and climate skills assessment.

ISS ESG Data on Climate Governance

ISS ESG, building on extensive experience and expertise in the field of ESG, offers a comprehensive set of Environmental (E), Social (S), and Governance (G) datapoints. Table 2 provides an overview of the factors from ISS ESG’s Governance QualityScore and E&S Disclosure QualityScore database that investors can leverage to identify their exposure to companies that either comply or do not comply with regulatory and/or framework requirements on climate governance.

Table 1: ISS ESG Factors on Climate Governance

CLIMATE GOVERNANCE

| CLIMATE GOVERNANCE INDICATORS | ISS ESG FACTORS |

| BOARD OVERSIGHT | Board Oversight – This factor indicates whether the company describes the board’s oversight of climate-related risks and opportunities. Climate Committee – Independence (%) – This factor indicates the % of independence of the committee responsible for climate. |

| EXECUTIVE REMUNERATION | Short-Term and Long-Term Incentive Plans: Climate Performance Measures Disclosure – This factor indicates the level of disclosure on climate-related performance measures for short-term or long-term incentive plans for executives. Compensation Policy – This factor indicates whether the compensation policy explicitly mentions specific science-based targets for reducing GHG emissions, with a reference to the 2°C scenario. |

| CLIMATE SKILLS | Number of Directors with Climate Skills – This factor indicates the number of directors with climate skills. (This factor is exclusively applicable to companies with headquarters in the U.S. or Canada). |

Source: ISS ESG

Board Oversight of Climate Change

The UN High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities’ report, released during COP27, commented that transitioning to a Net Zero pathway will involve strategic decisions by companies on capital allocation, research and development, and skills and human resource development. Board oversight of Net Zero transition planning can help companies embed their Net Zero targets into their corporate strategy and take the actions needed to meet these targets.

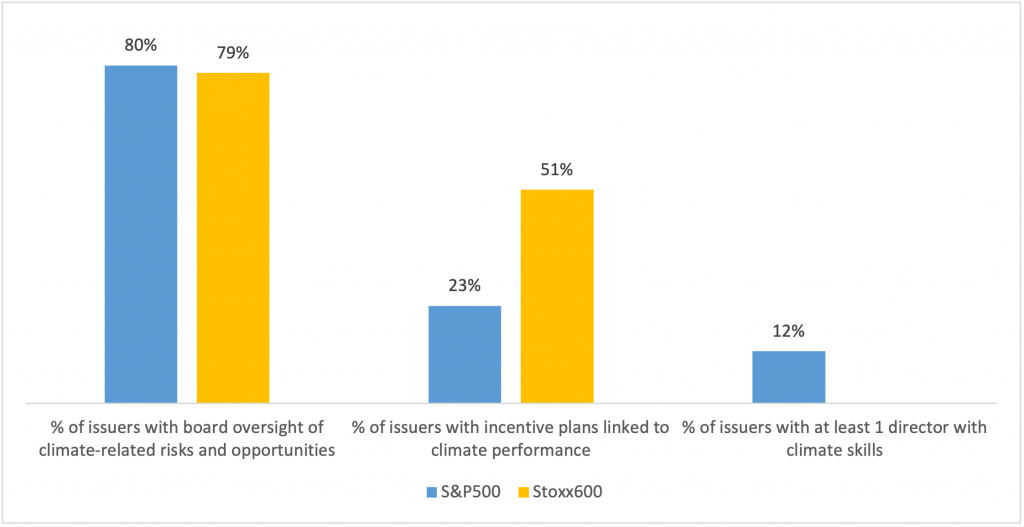

ISS ESG data on board oversight of climate-related risks and opportunities suggests that the vast majority of large European and U.S. companies acknowledge the importance of this governance element since, as of July 2023, around 80% of Stoxx Europe 600 and S&P 500 companies disclose having board oversight of climate change (Figure 1).

Figure 1: S&P 500 vs. Stoxx 600: Climate Governance Indicators

Source: ISS ESG, S&P 500 and Stoxx Europe 600 data as of July 2023

Executive Remuneration

Integrating climate-related performance metrics into executive compensation is one way to hold management accountable for achieving climate goals and capturing climate transition opportunities. Moreover, investors, especially in Europe, are increasingly expecting climate metrics to be integrated into executive compensation plans.

As of July 2023, the proportion of Stoxx Europe 600 companies incorporating climate performance into executive compensation was 51%, more than double the corresponding proportion of S&P 500 companies (see Figure 1). These percentages show that while the inclusion of climate metrics in executive remuneration by large companies remains relatively low, it is a more mature practice in Europe than in the United States. As an ISS study notes, regulatory differences may be the reason for this discrepancy, since “the consideration of stakeholders’ interests in board decision making is foreseen in the law and/or the local corporate governance code in several European countries, including the UK, the Netherlands, France, Germany, Spain, and Italy.”

Climate-Related Skills

To address climate-related risks and opportunities and make informed decisions, board members and management staff may have received training on climate change and may have the skills to assess its impact on their business. Climate-related skills can contribute not only to implementing an effective climate strategy but also to increasing the resiliency of companies and their ability to seize opportunities in a rapidly evolving regulatory and market environment.

Figure 1 indicates that climate skills at the director level may be relatively limited: in July 2023, only 12% of S&P 500 companies had at least one director with such skills (climate skills information was not available for Stoxx 600, as this information currently covers the U.S. and Canada regions exclusively). Nevertheless, given that as recently as September 2022, only 5% of S&P 500 companies had one or more directors with climate skills the presence of climate skills seems to be growing rapidly at the board level.

Good Climate Governance No Guarantee of Good Climate Performance

A basic step a company can take to address climate change is disclosing its material GHG emissions, i.e., the GHG emissions identified as relevant and material for its sector (this can sometimes include Scope 3 emissions). Various standards across the globe, both for investors or companies, have emissions disclosure as the first step to address climate risks, given that what is not measured cannot be dealt with.

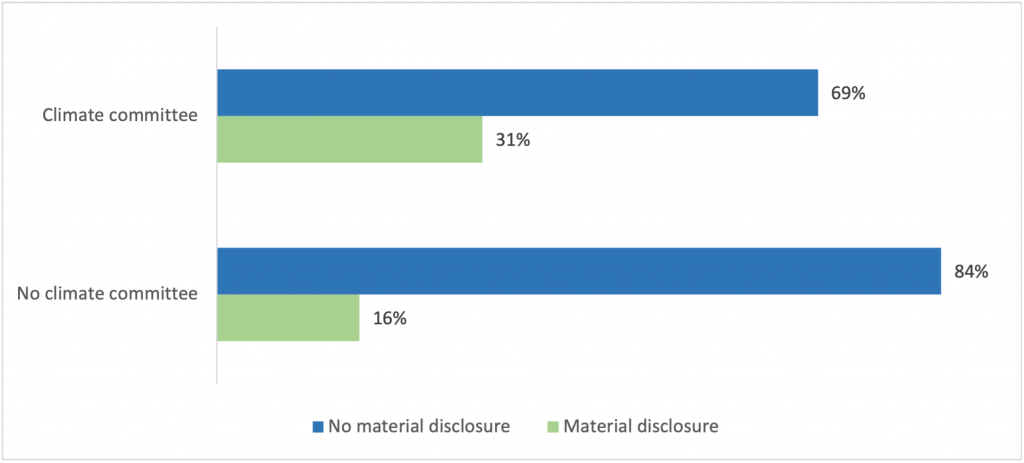

An ISS ESG analysis of around 3,000 companies for which ISS ESG has climate governance and Net Zero data shows that the presence of climate governance factors does not guarantee that companies will disclose emissions. Among companies with no climate committee, 84% have not disclosed their material GHG emissions. However, among companies that do have a climate committee, non-disclosure decreases to only 69% of companies (Figure 2).

Figure 2: Material GHG Emissions Disclosure and Climate Committee

Source: ISS ESG

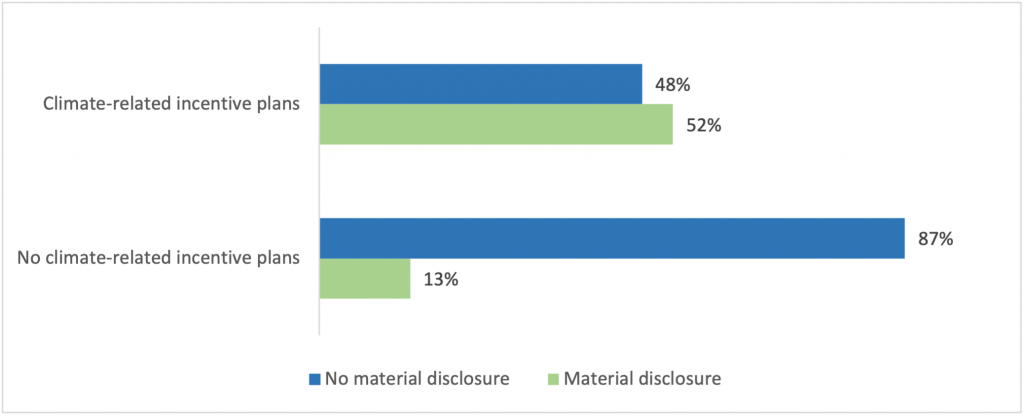

Moreover, while 52% of the companies that have incentive plans linked to climate performance also disclose material GHG emissions, 48% of the companies with incentive plans do not (Figure 3).

Figure 3: Material GHG Emissions Disclosure and Climate-Related Incentive Plans

Source: ISS ESG

The data thus indicates that the presence of climate governance measures is associated with only a slightly higher likelihood of better performance on emissions disclosure. This finding suggests that climate governance measures alone do not guarantee that climate risks will be adequately addressed from an investor’s perspective.

A similar picture emerges when looking at a much more ambitious climate performance indicator, ISS ESG’s Net Zero Alignment. This indicator identifies the issuer’s level of alignment with a Net Zero pathway by factoring in the presence of a Net Zero by 2050 target, an intermediate target to be met before reaching Net Zero, material GHG emissions disclosure, and a defined decarbonization strategy.

A company is considered “committed to aligning” if it has set a Net Zero target for 2050 and “aligning” if, beyond the 2050 Net Zero target, it also has set an intermediate target and has a decarbonization strategy. A company with no targets is considered “not aligned.” Because material GHG emissions are the primary data point a company with any climate ambition can be expected to report, disclosure of such emissions is a prerequisite for a company to be considered as “committed to aligning” or “aligning.” In the absence of material GHG emissions disclosure, a company is automatically categorized as “not aligned.”

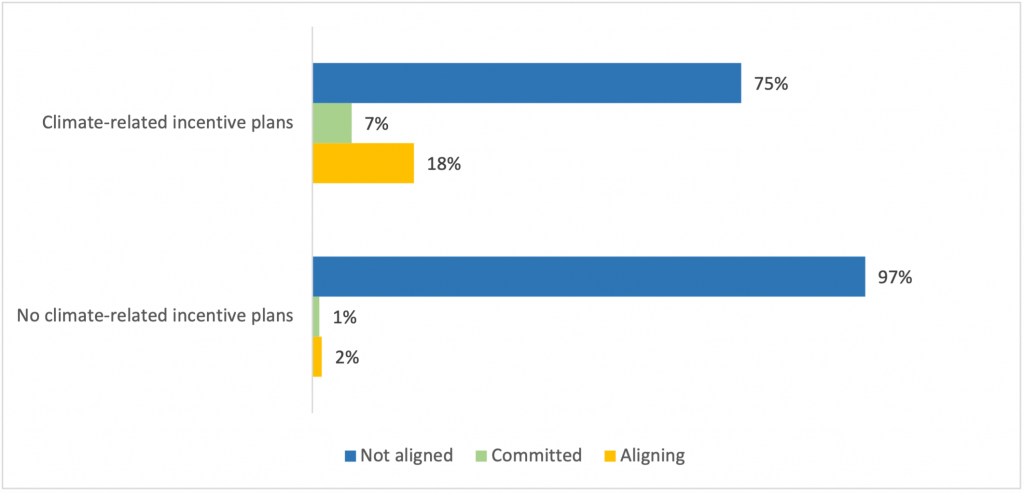

Among companies that have an incentive plan linked to climate performance, 25% are aligning or committed to align with Net Zero, while only 3% of companies with no linked incentive plan are aligning or committed to align (Figure 4).

Figure 4: Net Zero Alignment and Climate-Related Incentive Plans

Source: ISS ESG

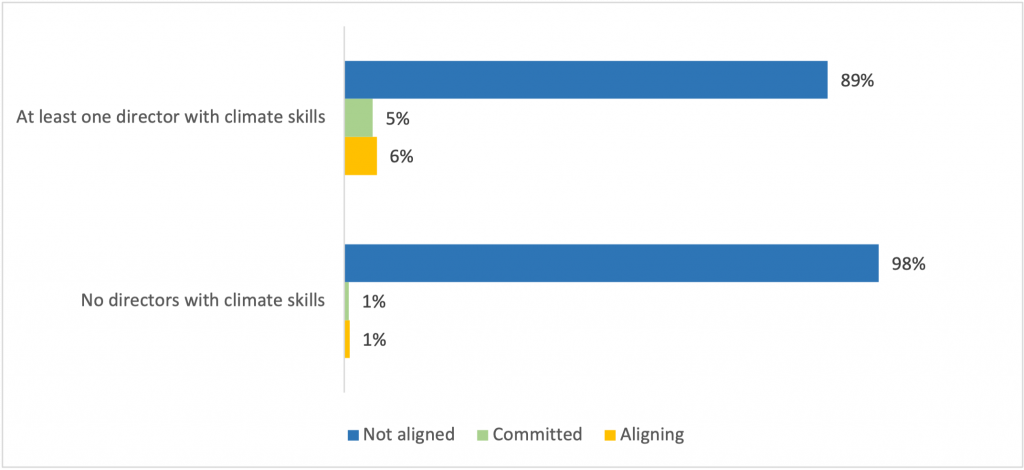

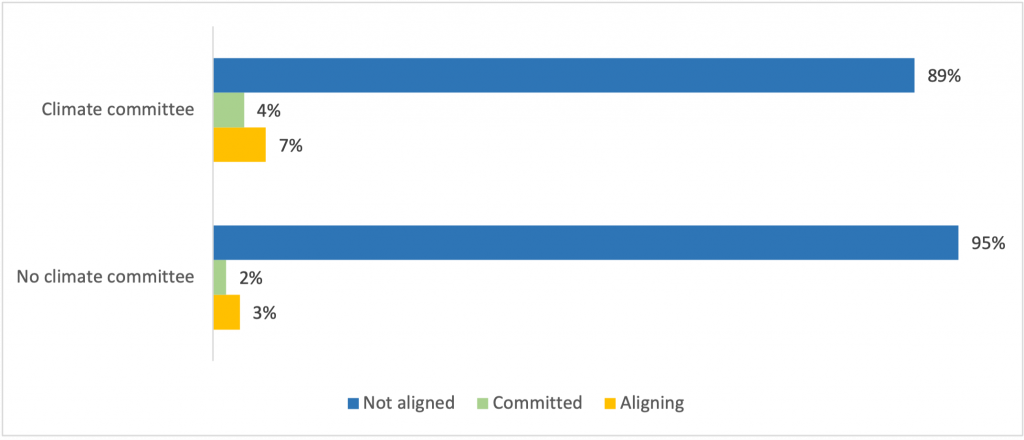

Among companies that have one or more directors with climate skills (Figure 5) or a climate committee (Figure 6), 11% are Net Zero aligning or committed to align, while only 2% and 5% of companies with no directors with climate skills or no climate committee are aligning or committed to align.

Figure 5: Net Zero Alignment and Directors with Climate Skills

Source: ISS ESG

Figure 6: Net Zero Alignment and Climate Committee

Source: ISS ESG

Of the three governance drivers analyzed, the factor on executive renumeration (incentive plans) linked to climate performance seems to have the most positive relationship with Net Zero alignment. However, it is important to note that the data on directors with climate skills applies only to the U.S. & Canada, a region known for a generally lower commitment to aligning with Net Zero.

Conclusion

Climate governance faces growing investor scrutiny and is increasingly being incorporated into frameworks such as the Climate Action 100+ (CA100+) and the Net Zero Investment Framework (NZIF). Companies seeking resilience against climate change and compliance with current climate governance recommendations may consider governance measures such as board oversight of climate-related risks and opportunities, linking executive remuneration to climate performance, and senior leadership with adequate climate skills.

Available evidence suggests climate governance measures are positively associated with GHG emissions disclosure and progress towards Net Zero. As more historical data becomes available, assessing whether companies are more likely to achieve GHG emissions reduction through better governance will become easier.

The evolving regulatory landscape, coupled with increasing investor demand, may contribute to companies setting up strong climate governance systems. Investors interested in companies’ climate governance and their broader progress toward Net Zero can find support from ISS ESG’s Governance QualityScore, E&S Disclosure QualityScore, and Net Zero Alignment.

Explore ISS ESG solutions mentioned in this report:

- ISS ESG’s Governance QualityScore supports investors as they consider governance in their quality analyses and incorporate unique compensation, board, and shareholder responsiveness data into management assessments.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By: Patricia Dörig, Sr. Associate, Climate Methodology, ISS ESG

Ritika Iyer, Analyst, Climate Methodology, ISS ESG

Livia Wack, Sr. Associate, Climate Analytics, ISS ESG