Introduction

In response to the pressing challenge of climate change, the concept of Net Zero has emerged as a pivotal strategy in the worldwide effort against greenhouse gas (GHG) emissions. The detailed concepts of Net Zero and various frameworks were discussed in the previous Insights piece Net Zero Pledges in Asia Pacific.

The Americas region, consisting of North, Central, and South America, plays a pivotal role in global efforts towards decarbonization. With its diverse industries, abundant energy resources, and substantial GHG emissions footprint, the region’s actions to achieve Net Zero emissions are crucial to effective global climate action and sustainable development. The Americas region is home to a diverse range of economies, each with its unique set of opportunities and challenges in the transition to a Net Zero economy. From the advanced industrialized economy of the United States to the emerging economies of Latin America, the region’s collective commitment to Net Zero is essential to achieve the global climate goals outlined in the Paris Agreement.

ISS ESG Assessments of Net Zero Commitments

ISS ESG conducted Net Zero analysis on 2,650 publicly listed companies worldwide, from the high GHG-emitting sectors such as Energy, Materials, Cement, Utilities, and Chemicals, etc. These sectors are considered ‘Priority Sectors’ due to their high emissions footprint as defined by the Net Zero Asset Owner Alliance (NZAOA). ISS ESG’s Net Zero analysis also included all companies from the Climate Action 100+ initiative (CA100+).

The assessment is based on publicly disclosed Net Zero commitments, medium-term GHG reduction targets, and decarbonization plans and incorporation of climate-related risks into financial accounts. ISS ESG’s Net Zero research employs a dynamic methodology that recognizes the varying materiality of GHG emissions across sectors. Sectors with high operational emissions, such as Cement, Steel, and Aviation, may not need to set Scope 3 emission targets, following the Climate Action 100+ methodologies benchmark.

Net Zero Commitments in the Americas Region

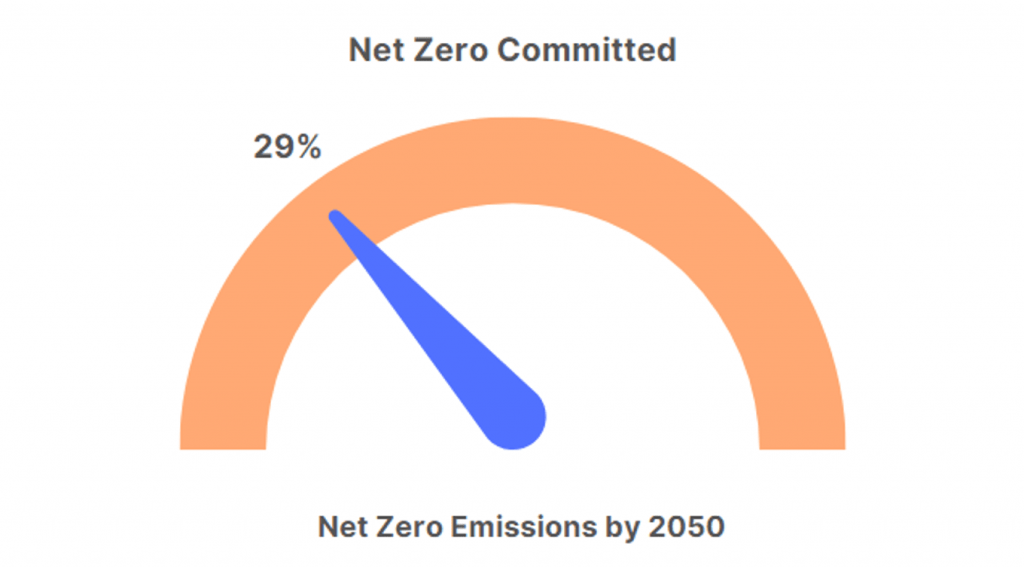

The research focused on 850 companies operating in priority sectors within the Americas region and provided insightful findings regarding their Net Zero commitments. The assessment revealed that 29% of these companies have made commitments to reach Net Zero by or before 2050, while the remaining companies are yet to make comprehensive Net Zero commitments (Figure 1).

Figure 1: Net Zero Commitment Declarations among Companies in Americas region (%)

Source: ISS ESG

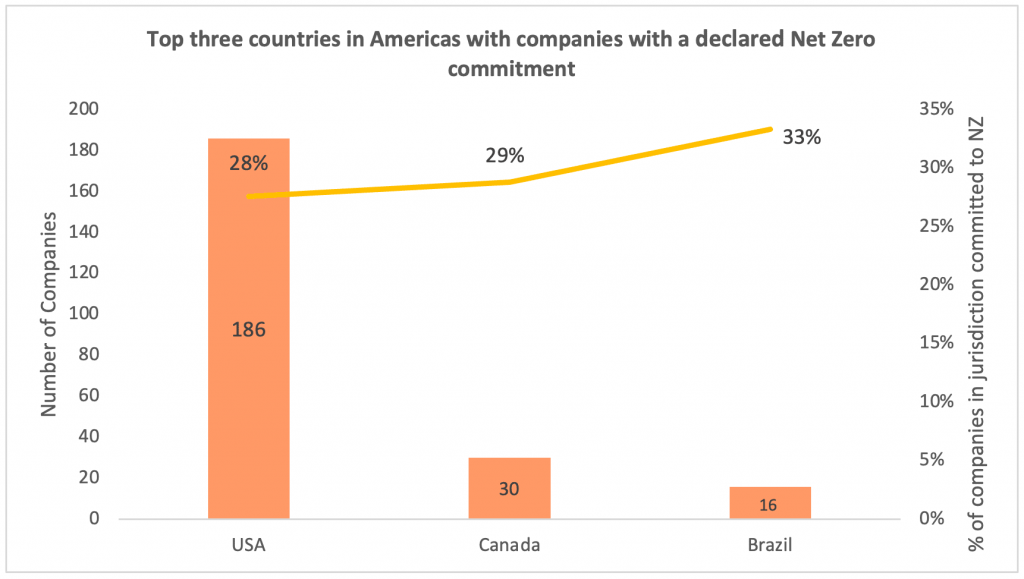

The majority of the companies analysed in these sectors were from the United States and Canada, with more than 75% originating from the United States alone. This suggests the significant role the United States can play in driving the Net Zero agenda in the Americas.

The highest number of Net Zero commitments were from the United States, followed by Canada, and then Brazil. Within the United States, 28% of the 669 analysed companies have committed to reaching Net Zero by 2050 or earlier (Figure 2). In Canada, 29% of assessed companies have made similar commitments. In Brazil, this commitment is even higher, with 33% of companies pledging to reach Net Zero.

Figure 2: Americas Companies with Commitments to Net Zero, by Country

Source: ISS ESG

Among the remaining countries of the region, such as Mexico, Chile, or Colombia, a total of 30 companies were analysed, and 12 of them have set a target to become Net Zero. These findings highlight the varying levels of commitment to the Net Zero goal across the Americas region, emphasizing the need for comprehensive actions to address climate change.

Net Zero Commitments among Priority Sector Companies

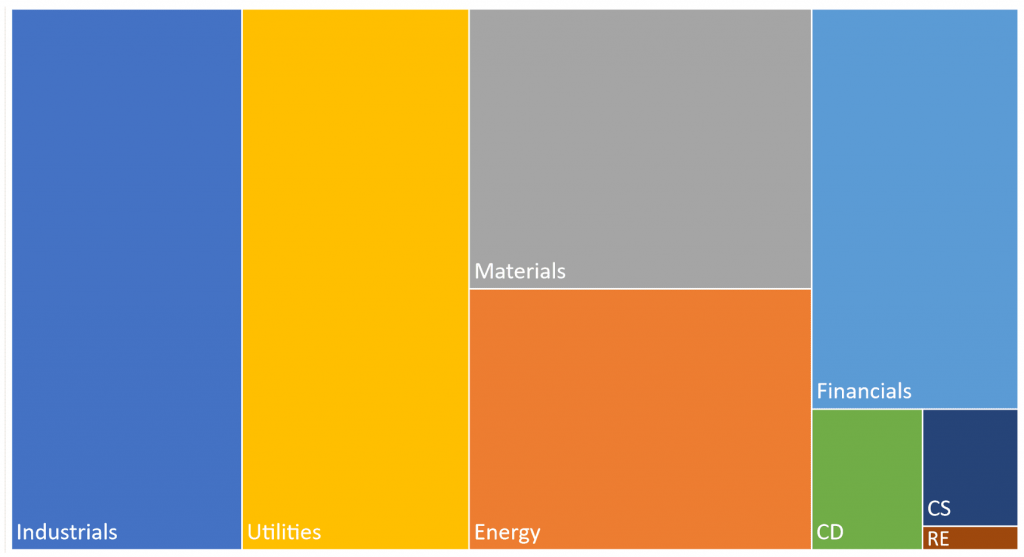

ISS ESG assessed companies from high emissions ‘Priority Sectors,’ as per the guidance of the NZAOA. These sectors include Energy, Utilities, Transportation, Cement, Aluminum, Steel, and Chemical. However, ISS ESG also assessed Capital Goods, and a limited number of Financial companies.

Regarding the classification by sector of Net Zero-committed companies in the Americas region (Figure 3), 23% of Net Zero commitments are from the Industrials and Utilities sectors each, while the Materials and Energy sectors accounted for 18% and 16%, respectively. The Financials sector accounted for 15% of Net Zero-committed companies. Other small percentages of commitments were observed from the Consumer Discretionary, Consumer Staples, and Real Estate sectors. These findings underscore the collective efforts of diverse industries in driving emissions reduction throughout the Americas.

Figure 3: Companies with Net Zero Commitments, by Sector

Note: Consumer Discretionary (CD), Consumer Staples (CS), RE (Real Estate)

Source: ISS ESG

Net Zero Commitment Coverage

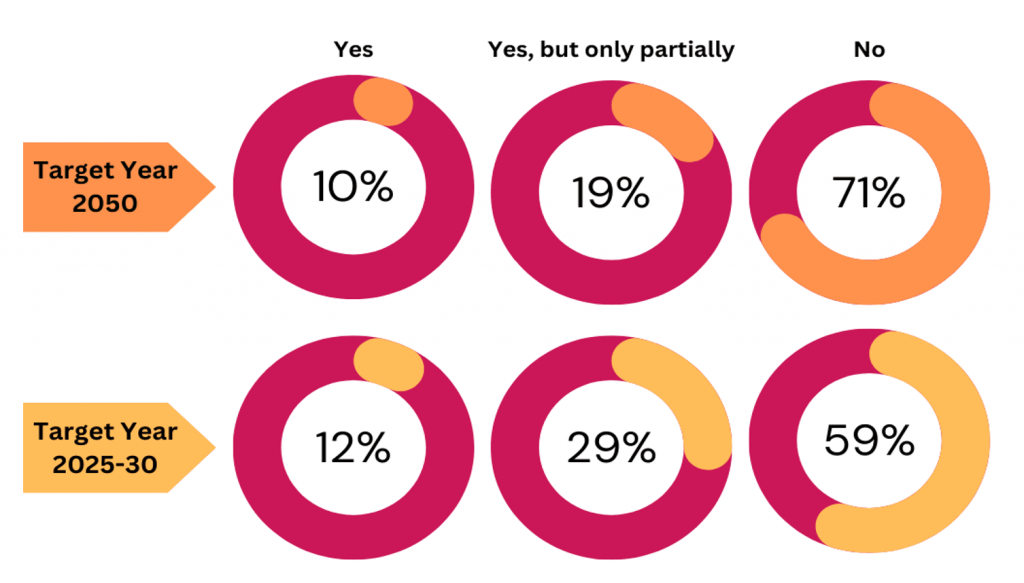

The Net Zero target is considered comprehensive if it covers more than 95% of the Scope 1 and 2 emissions along with those categories of Scope 3 that are material for the sector in which the company is involved. Such a target is in line with the Climate Action 100+ methodologies benchmark.

The analysis of companies in the Americas revealed that 10% (“Yes” category for target year 2050) of Net Zero-committed companies covered their GHG emissions from operations, including material Scope 3 emissions (Figure 4). However, 19% of the analysed companies with Net Zero-commitments have partial coverage, which means they did not cover 95% of Scope 1 and 2 emissions or material Scope 3 emissions. Such commitments are inadequate to be considered a serious effort towards a Net Zero future.

Figure 4: Companies with Targets Covering Material GHG Emissions

Source: ISS ESG

The number of companies with interim targets that meet emissions coverage requirements (“Yes”) is slightly higher than those with Net Zero targets. However, the number of companies with targets in the “Yes, but only partially” category is significantly larger in the case of interim targets than in the case of Net Zero targets. This indicates that even the larger number of companies that have set a different level of ambition on GHG emissions reduction targets than Net Zero targets still do not meet these requirements. Time will tell whether these companies increase their target levels in the coming years and take up the Net Zero path.

Decarbonization Strategy to Achieve Net Zero Commitment

One of the most important approaches to achieving Net Zero targets is decarbonizing emissions sources; a previous Insights piece on Net Zero in Europe examined various decarbonization strategies in detail. Around 75% of Net Zero-committed companies in the Americas revealed their decarbonization efforts aimed at achieving emissions reduction targets. These decarbonization efforts often include strategies such as decommissioning coal plants, switching the energy fuel mix, energy efficiency projects, and investing heavily in renewable energy projects.

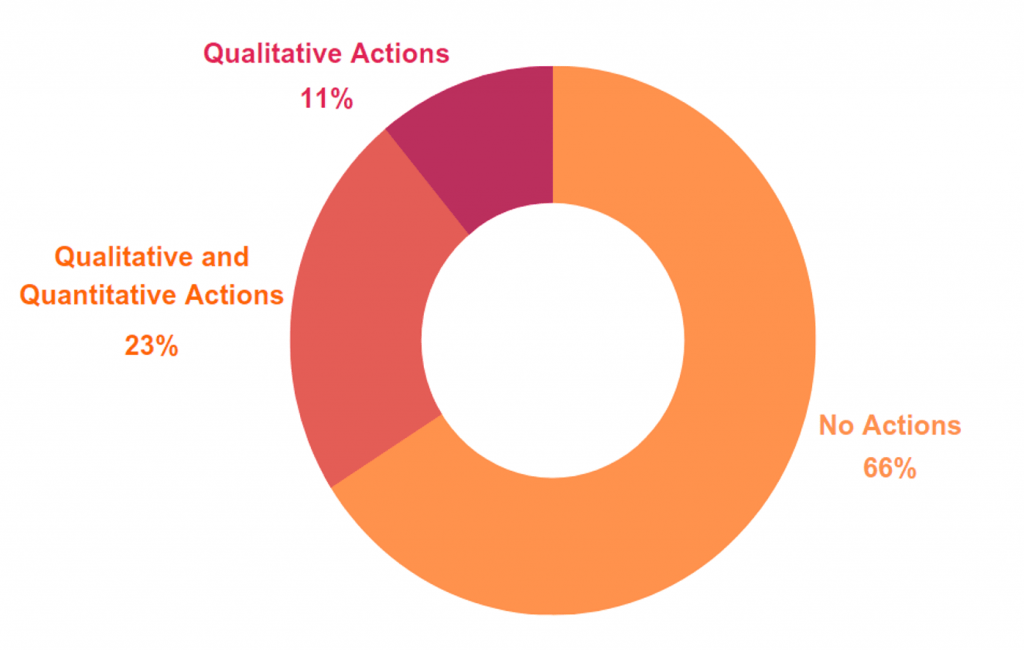

ISS ESG’s research on 850 companies in the Americas region indicated that a significant number of companies have yet to implement decarbonization strategies. Only 290 companies, 34% of the total, have taken steps towards decarbonization (Figure 5). Of these companies, 95 (11%) specified qualitative actions but did not provide specific, quantitative measures for their decarbonization actions. In contrast, 193 companies (23%) have not only outlined but also quantified their decarbonization measures. These numbers indicate that many companies have yet to develop and implement comprehensive, measurable, and robust decarbonization strategies.

Figure 5: Net Zero-Committed Companies, with Decarbonisation Strategy Status

Source: ISS ESG

In 2022, the United States enacted the Inflation Reduction Act (IRA), which contains provisions that aim to boost clean energy, reduce healthcare costs, and increase tax revenues. Around $370 billion will be disbursed for measures dedicated to improving energy security and accelerating clean energy transitions. The IRA may encourage companies to participate in a clean energy transition and other decarbonization activities.

Some companies relied heavily on carbon offsets for the achievement of Net Zero targets. However, the ISS ESG analysis did not consider offsets as steps towards Net Zero. Under Net Zero, carbon offsets are considered only for residual emissions, which are hard to abate, as per SBTi methodology.

Climate-Related Financial Risks

Incorporating climate-related risks into assessments of a company’s financial statements and calculations is crucial for understanding, managing, and disclosing the potential impacts of climate change on businesses and the financial system. Incorporating such risks enables better decision-making, enhances transparency, and supports the transition to a low-carbon economy. ISS ESG assesses these climate-related financial risks by considering if 1) an independent auditor acknowledges the material impacts of climate-related issues; and 2) a company’s published financial statements address the climate-related risks.

This research indicates that only 18 companies in the Americas region were incorporating climate-related financial risks into their accounts. This shows the majority of companies either are not assessing climate-related material impacts on their finances or lack transparency in reporting such information. Integrating climate-related financial risks into accounts enables risk assessment, which can build business resilience for long-term growth.

Net Zero Alignment Status

ISS ESG developed its Net Zero Alignment Criteria, as explained in a previous Insights piece on the Asia-Pacific region, using the Net Zero Investment Framework Implementation Guide (NZIF). The NZIF assesses a company’s material GHG emissions disclosure, its 2050 Net Zero ambitions, its interim emissions reduction target, and its decarbonization strategy to determine whether the company aligns with the Net Zero criteria. Companies that do not meet these criteria are designated as Not Aligned by the NZIF.

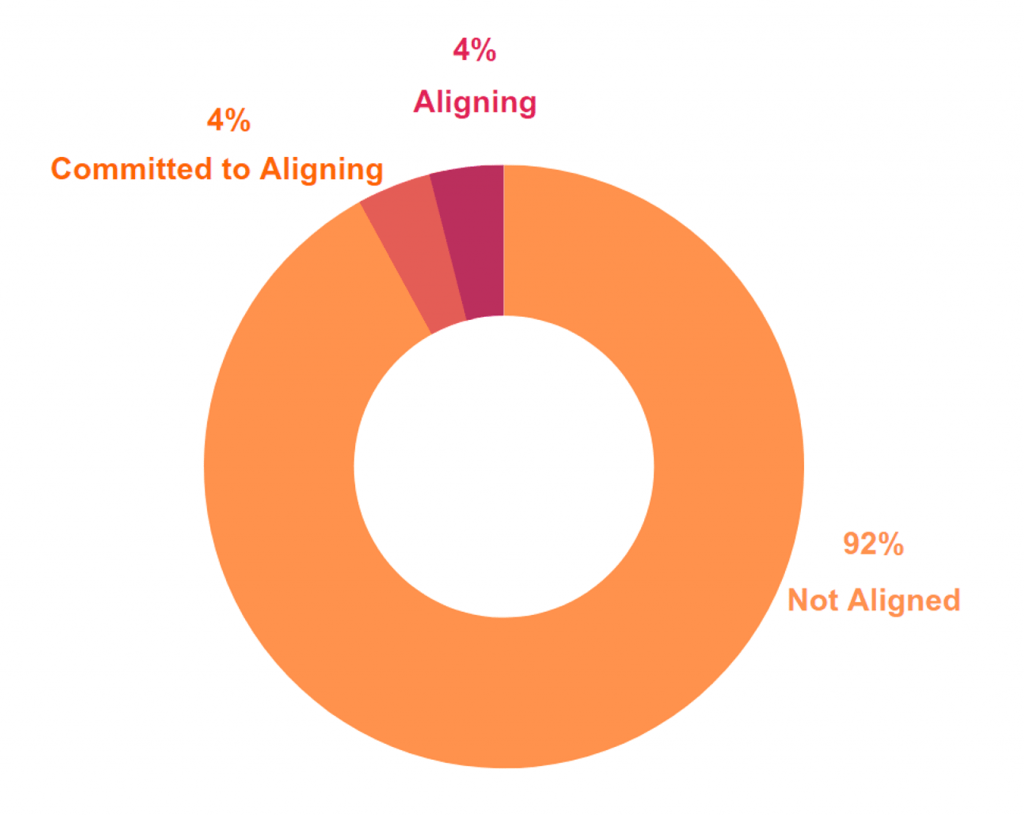

Research on 850 companies in the Americas region shows that only 4% of these companies are categorized as Aligning, with an additional 4% being Committed to Aligning (Figure 6). The remaining 92% of the companies assessed were determined to be Not Aligned. The majority of Aligning companies were based in the United States and Canada.

Figure 6: Americas: Net Zero Alignment Status of Companies

Source: ISS ESG

Conclusion

ISS ESG’s research shows that only 29% of companies in the Americas region have made commitments to achieve Net Zero emissions, leaving a significant number of companies still to establish comprehensive Net Zero targets. These numbers suggest that aligning the Americas region with the Paris Agreement will require sustained efforts and accelerated action. Recent measures such as the U.S. Inflation Reduction Act (IRA) and an SEC proposal to standardize climate-related disclosures may encourage a greater number of companies to commit to Net Zero in the future.

ISS ESG supports and prepares investors for evolving business dynamics through detailed company assessments. Tools such as ISS ESG’s Net Zero Solutions can help clients and investors to integrate Net Zero ambitions with their investment and decision-making processes.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

Authored by:

Eeshan Kulkarni, Climate Research Analyst, ISS ESG

Tanish Gangurde, Climate Research Analyst, ISS ESG