Below is an excerpt from ISS ESG’s recently released paper “Cruelty-Free Portfolios: How To Approach Animal Testing In Investments?”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- Animal testing-related ESG assessments can be challenging, due to the diversity of types of animal testing, regulatory frameworks, and company commitments and performance found in the space.

- A lack of company disclosures on this uncomfortable topic makes the task of analysing involvement in animal testing even more complex. Quality insights are based on issue expertise as well as a region- and sector-specific approach.

- Animal testing is a values-based issue, and investors’ approaches to incorporating it in their ESG strategies will vary considerably.

- Access to granular, high-quality data helps to apply more nuanced investor approaches to animal testing.

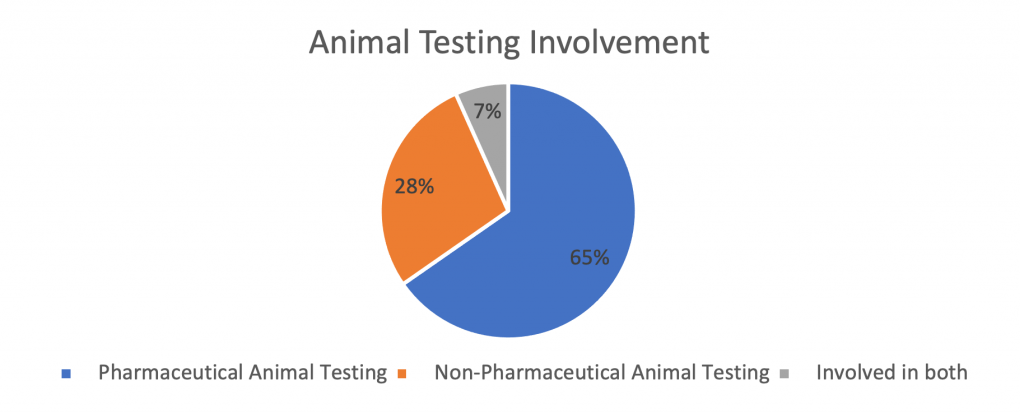

As of July 2021, ISS ESG’s Sector-Based Screening identifies more than 2,000 companies involved in animal testing activities:

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By Dominika Dobielewska, Associate, Research, ISS ESG. Maura Mercedes Santos, Analyst, Research, ISS ESG. Claudia Kirschner, Associate Vice President, Research, ISS ESG.