KEY HIGHLIGHTS

- Energy management is a key pillar of corporate climate resilience. Companies that integrate energy-efficient technologies into their operations can contribute to achieving the Paris Agreement’s 1.5°C target and can enhance their operational resilience.

- Integrating energy-efficient technologies into corporate practice, along with other climate mitigation measures, will likely require substantial private investment.

- In the Technology, Media, & Telecommunications (TMT) and Energy, Materials, & Utilities (EMU) sectors, energy management holds significant weight and plays a major role in influencing overall ISS ESG performance.

- Investors seeking to assess corporate energy management can consult the ISS ESG Corporate Rating, which provides information on companies’ energy management practices, and the ISS EVA tool, which provides information on financial performance.

Introduction

Energy management is a key pillar of corporate climate resilience. Energy management offers businesses a strategic opportunity to optimize energy consumption, mitigate operational risks, and enhance long-term competitiveness. Companies that integrate energy-efficient technologies into their operations not only can contribute to achieving the Paris Agreement’s 1.5°C target but can enhance their operational resilience and position themselves to meet evolving regulatory frameworks and their customer sustainability requirements.

Integrating energy-efficient technologies into corporate practice, along with other climate mitigation measures, will likely require substantial private investment. The International Renewable Energy Agency (IEA) has estimated that reaching the 1.5°C target will require $5.7 trillion in annual energy investments through 2030, highlighting the need for both public and private sectors to mobilize resources.

A combination of private and public sector funding has emerged as a critical enabler in this transformation, directing capital toward projects that focus on energy management, energy-efficient technologies, and low-carbon innovations through mechanisms such as green bonds, impact investing, and ESG-driven capital flows.

Investors seeking to assess corporate energy management may be interested in which companies are performing well in this area. The ISS ESG Corporate Rating provides information on companies’ energy management performance, while the ISS EVA tool provides information on financial performance.

Energy Management as a Material Factor in ESG Performance

The ISS ESG Corporate Rating highlights energy management as a critical factor in driving ESG performance, particularly within the Technology, Media, & Telecommunications (TMT) and Energy, Materials, & Utilities (EMU) sectors. In both sectors, energy management holds significant weight and plays a major role in influencing overall ESG performance.

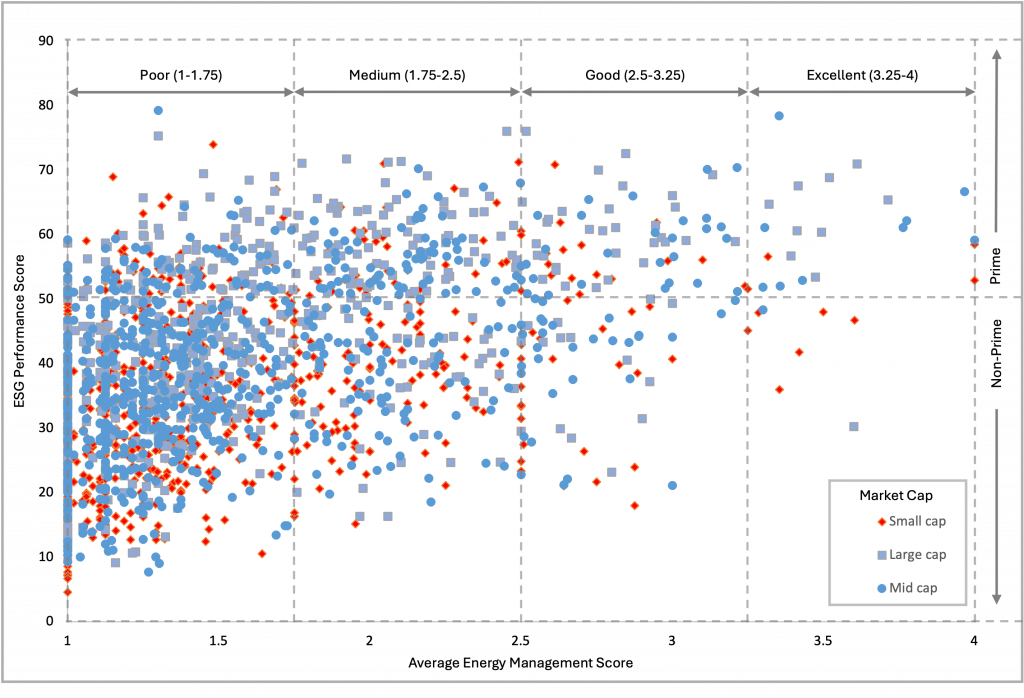

Figure 1 shows the distribution of companies in the TMT and EMU sectors based on their energy management scores and ESG performance scores.

Figure 1: Distribution of Energy Management Scores of Companies vs Their Overall ESG Performance Scores

Notes: Companies are awarded Prime Status if the overall ESG Corporate Rating letter grade meets or exceeds the industry-specific Prime threshold defined by ISS ESG’s Industry Classification Matrix. The ESG performance score is the normalized numerical representation of the alphabetic ratings (D- to A+) on a scale of 0 to 100. A performance score of 50 represents the Prime threshold across all industries: ≥50: Prime, <50: Not Prime.

Source: ISS ESG

As illustrated, energy management plays a significant role in influencing ESG performance, with companies that achieve a higher energy management score having a higher proportion of companies with a better ESG performance score.

Nevertheless, a significant majority of both Prime and non-Prime companies for the EMU and TMT sectors fall in the medium-to-poor performance categories, as shown in Table 1.

Table 1: Sector-Wise Distribution by Energy Score and ESG Performance Score

| Energy Score | Excellent | Good | Medium | Poor |

| EMU | 1% | 7% | 20% | 72% |

| Non-Prime (<50) | 0% | 4% | 15% | 64% |

| Prime (>50) | 1% | 2% | 5% | 7% |

| TMT | 2% | 7% | 20% | 71% |

| Non-Prime(<50) | 0% | 2% | 9% | 57% |

| Prime(>50) | 1% | 5% | 11% | 13% |

Note: Percentages might not add up precisely because of rounding.

Source: ISS ESG

This underscores a substantial opportunity for improvement in energy management and corporate resilience across companies within these sectors.

Energy Management Performance by Industry

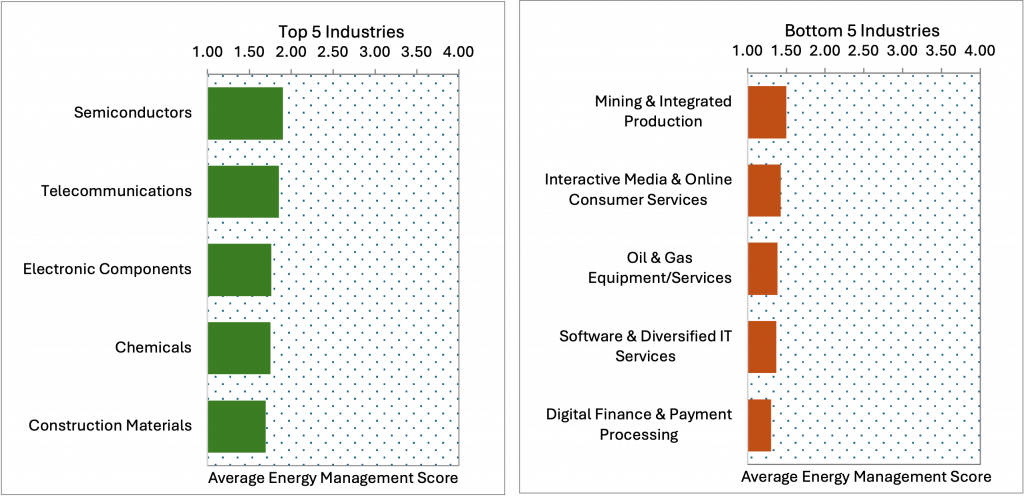

The industries within the TMT and EMU sectors are evaluated based on their energy management performance. By comparing their energy management scores, industries are classified into two categories: Leaders (top 5 industries) and Laggards (bottom 5 industries), as shown in Figure 2.

Figure 2: Industry Leaders and Laggards in Energy Management

Source: ISS ESG Corporate Rating

Leaders are industries that provide transparent disclosures on areas such as energy management systems, energy usage, and the adoption of energy efficiency practices. Laggards are industries that either lack effective energy management systems, struggle with the implementation of energy efficiency practices, or fail to provide transparent disclosures on such topics.

The highest-ranking Industry is Semiconductors, while the Digital Finance & Payment Processing industry is the laggard.

Energy Management Performance and Economic Value Added

Comparing the industries’ energy management scores with their EVA Margin (%) provides a view of how industries with different levels of energy management are performing financially. The EVA Margin is the profit margin that results after all operating expenses, taxes, and capital charges have been paid and is found using the ISS Economic Added Value (EVA) solution.

Using these two scores, Figure 3 categorizes the industries into four groups: Leaders, Laggards, strong EVA/Energy Management Laggards, and Energy Leaders/EVA Laggards.

Figure 3: Energy Management Performance of Industries vs Their EVA Margin (%)

Source: ISS ESG

Semiconductors and Electronic Devices & Appliances are industries which, based on their company disclosures, are leading in energy management and are also performing well financially compared to other industries. This is likely due to adoption of renewable energy sources positively impacting the energy-intensive nature of their manufacturing processes.

Conclusion

Despite some industries performing well in energy management, most still face challenges in fully optimizing their energy management practices. With substantial room for improvement across industries, companies adopting effective energy management strategies can reduce costs, improve sustainability, and significantly improve their operational resilience.

The proper implementation of energy-efficient technologies and energy management practices may well be a key factor driving corporate resilience and financial performance in the coming years. As regulatory pressures increase and demands for green practices rise, companies that prioritize energy management could gain a competitive advantage, presenting promising opportunities for forward-thinking companies.

Investors who identify and engage with companies that are proactively investing in these areas may be able to improve their sustainability-specific risk profile. ISS STOXX can assist investors seeking to align their objectives by integrating the ISS ESG Corporate Rating and ISS EVA into their investment processes.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the F in ESGF using the ISS EVA solution.

By:

Laxman Gaikwad, Analyst, ISS ESG

Kriti Baruah, Analyst, ISS ESG

Mehak Baveja, Sr. Associate, ISS ESG

Dipti Alex, Sr. Associate, ISS ESG

Roberto Lampl, Managing Director, ISS ESG