Below is an excerpt from ISS ESG’s recently released paper “Ensuring a Least-Cost Climate Transition: The Role of Stress Testing and Scenario Analysis”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- Financial institutions fund other industries that may face diverse climate related risks, such as physical risks from extreme weather. They are therefore indirectly exposed to the climate risks of their borrowers.

- Regulators are increasingly encouraging financial institutions to consider climate risk. Reporting finance-related emissions is difficult, however, because it requires the borrower to measure their own emissions. More comprehensive data on borrower emissions and climate transition plans would be valuable for the financial sector.

- Testing various climate scenarios improves understanding of climate risks’ potential impact on borrowers’ capacity to repay loans. Regulators are increasingly turning to Network on Greening the Financial System (NGFS) scenarios for climate stress tests, with local adaptation.

- The Bank of England’s first biennial climate stress test confirmed that transition to a low-carbon economy is achievable, and while costly, will not threaten the financial system’s solvency. Delays will result in increased costs, however.

- If the transition to a low-carbon economy is not achieved, lending may decrease and customers may bear the consequences, as banks and insurance providers pass on future costs, particularly in the mortgage market.

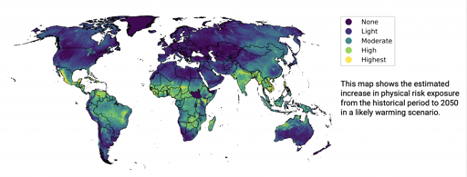

- Reliable data, whether on emissions or the location of physical assets, is a priority for the sector, as is the need to develop models such as those for gauging physical risks. ISS ESG’s methodology establishes over 800 proprietary models to estimate emissions.

Figure 1: Exposure to Physical Risks from Climate Change

Source: ISS ESG Climate Solutions

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Use ISS ESG’s Second Party Opinion (SPO) Services to provide sustainability, green and social bonds with a credible and independent assessment of their sustainability quality.

- Understand the F in ESGF using the ISS EVA solution.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

Simona Cristofanelli, ISS ESG Climate Solutions

Yuka Manabe, Senior Associate, ISS ESG Bespoke Research & Advisory Solutions

Patricia Pérez Arias, Climate Stress Test Lead, ISS ESG