Below is an excerpt from ISS EVA’s recently released paper “EVA and Governance QualityScore – Emerging Markets”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

In a post-pandemic world, investors are focusing on identifying the right governance and ESG topics. A key element in this decision is understanding financial materiality and governance quality at investee companies and potential new investments. In this report we combine Economic Value Added (EVA) and the ISS Governance QualityScore (GQS) for Emerging Market firms to identify financial materiality and governance quality.

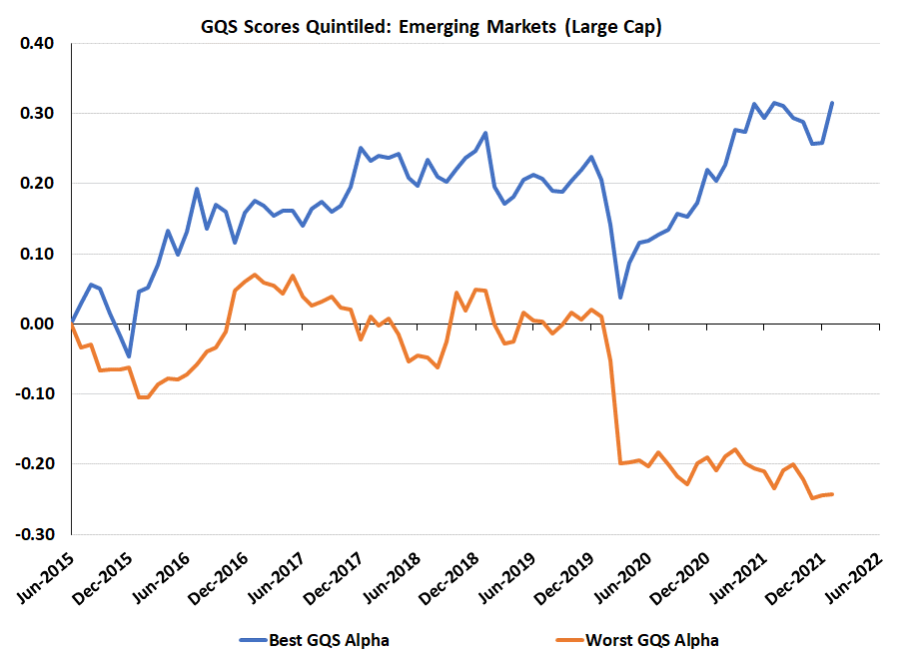

This paper provides a backtest of our GQS score, with the Emerging Market Large Cap universe divided into quintiles based on their raw GQS scores. Figure 1 plots the performance of the top and bottom quintiles against the equal-weighted index returns (y=0 line is the index). The top quintile has averaged 71bps/month of alpha over the bottom quintile since June 2015. After the pandemic drop, the good GQS firms rebounded quickly while the poor GQS firms underperformed the market.

Figure 1: GQS Backtest. Quintiles/Benchmark are Equal-Weighted Returns

Explore ISS ESG solutions mentioned in this report:

- Understand the F in ESGF using the ISS EVA solution.

- Use ISS ESG Governance Data to drive investment, engagement, and voting decisions.

By Casey Lea, Executive Director, Research, ISS EVA