2023 delivered a banner year for investor recoveries, as the $7.9 billion[1] in settlement funds across the globe was the highest total in the last five years. The $5.8 billion[2] specifically secured in securities-related class actions in the U.S. was also up 18% from 2022.

In this ISS Insights post, ISS Securities Class Action Services, an industry pioneer and expert in global claims filing, portfolio monitoring, and research solutions, will highlight the largest settlements achieved during the year 2023. A substantive year in review will be documented in ISS SCAS’ forthcoming “Top 100 U.S. Class Action Settlements of All-Time” report, to be published in January 2024. In fact, four settlements in the calendar year were large enough to be featured within SCAS’ forthcoming Top 100 Report, including the $1 billion fiduciary duty-related settlement on behalf of Dell shareholders.

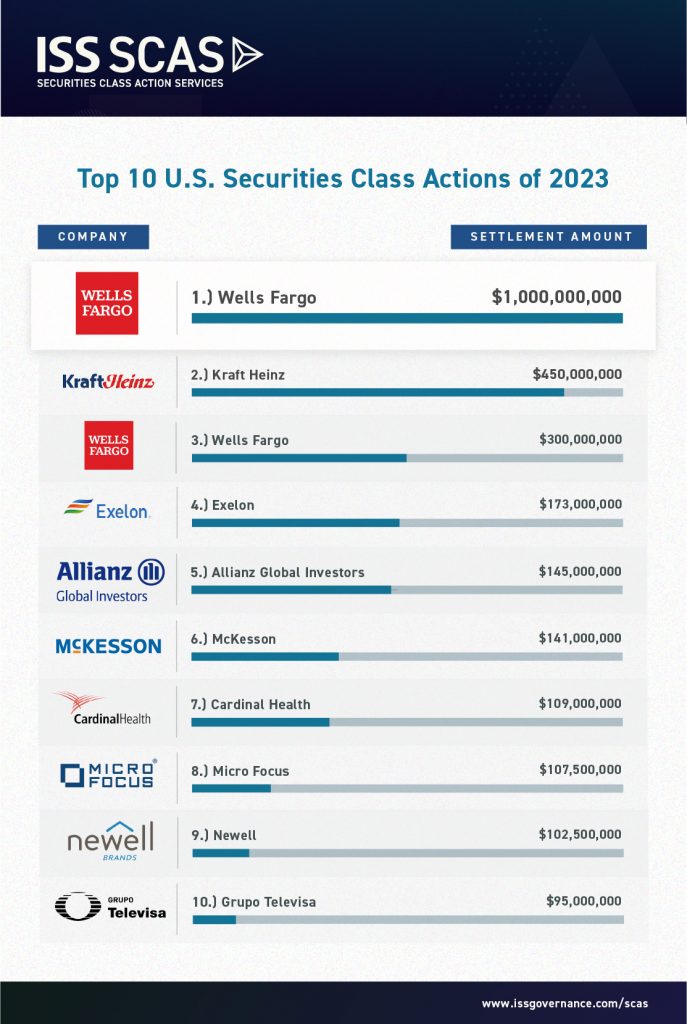

The high-profile securities class actions resolved in 2023 include two against Wells Fargo for an aggregate value of $1.3 billion, as well as a $450 million settlement with Kraft Heinz. The mega-settlements continue to drive up investor recoveries, as the top 10 largest securities settlements this year comprised $2.6 billion.

Mega ESG-related settlements such as those with Exelon and Grupo Televisa remain an important part of the landscape, as do cases related to merger integration issues, of which there were four in this year’s Top 10 (Kraft Heinz, Cardinal Health, Newell Brands, and Micro Focus).

Top 10 U.S. Securities Class Actions of 2023[3]

A brief synopsis of the largest 2023 U.S. securities class action settlements follows:

1.) Wells Fargo

Investors’ $1 billion settlement against Wells Fargo comes in the wake of years of scandal and resolves allegations that the bank concealed its inability to clean up its act. After a decades-long history of alleged “reckless” and “unsound” practices, including the opening of millions of fake accounts, federal regulators imposed punitive consent orders on Wells Fargo, requiring a compliance and corporate oversight overhaul. In 2018 and 2019, Wells Fargo is alleged to have repeatedly told investors that it was implementing and developing the required governance reforms. In reality, however, Wells Fargo’s compliance overhaul allegedly failed to get off the ground and was nowhere near meeting the federal regulators’ requirements. The truth began to be revealed in March 2020 when the House Financial Services Committee released a 113 report, describing Wells Fargo’s risk management plans as “materially incomplete” and “woefully short.” During the Congressional hearings that followed, Chairwoman of the HFS Committee Maxine Waters asked the Department of Justice to consider criminal charges against former CEO Timothy Sloan for inaccurate and misleading statements. The class action – initially filed in June 2020 – survived a motion to dismiss in part and then settled while class certification was pending. The $1 billion settlement – approved by the Southern District of New York on September 8, 2023 – is one of the Top 20 largest of all time. Shareholders were represented by co-lead counsel firms Bernstein Litowitz Berger & Grossmann and Cohen Milstein Sellers & Toll.

2.) Kraft Heinz

The $450 million settlement against Kraft Heinz arises out of the tumultuous merger in 2015 that created the company. The merger was allegedly orchestrated by prominent buyout firm 3G Capital Partners with a plan to extract $1.5 billion in cost savings. For years following the merger, 3G and Kraft purportedly touted these “synergies” to the market, reiterating that they were committed to sustainable cost-cutting and brand investment. In reality, however, there allegedly were fewer savings to be had. Instead, Kraft Heinz implemented extreme cost-cutting measures that decimated its supply chain and innovation, allegedly harming critical relationships with vendors and customers. According to the complaint, the undisclosed cost cuts ultimately led to a massive $15.4 billion impairment write-down of the value of Kraft and Oscar Mayer in February 2019. Kraft Heinz’s stock price also drastically declined from $56.20 in November 2015 to $26.50 in August 2019, wiping out about $36 billion in market capitalization. The settlement was agreed to following the denial of the defendants’ motions to dismiss in their entirety and extensive discovery. The $450 million shareholder-related settlement is the second largest ever reached in the Northern District of Illinois. Bernstein Litowitz Berger & Grossmann and Kessler Topaz Meltzer & Check served as lead counsel for the class.

3.) Wells Fargo

The second settlement against Wells Fargo resolves allegations that the bank hid from investors that it was unnecessarily charging customers for auto-collision protection insurance. From about 2006 to 2016, Wells Fargo allegedly enrolled more than 800,000 of its auto loan customers, without their knowledge, in insurance they did not need or want. The practices allegedly pushed approximately 274,000 of its customers into delinquency and resulted in 27,000 vehicle repossessions. According to the complaint, Wells Fargo was aware of the illicit practices by 2016, but purportedly concealed these issues from investors for more than a year. A week after a New York Times article exposed some of the practices in July 2017, the company admitted in a SEC filing that it had been aware of the problems previously. The settlement was reached about a week before trial scheduled for February 2023. Construction Laborers Pension Trust for Southern California and Robbins Geller Rudman & Dowd represented the class as lead plaintiff and lead counsel, respectively. Wells Fargo has also paid $3 billion to the SEC to resolve broader conduct, including $500 million of which was earmarked to investors as part of a Fair Fund.

4.) Exelon

The $173 million Exelon settlement arises out of an alleged eight-year bribery scheme by its subsidiary Commonwealth Edison to influence Illinois lawmakers to enact favorable energy legislation. Specifically, senior executives of ComEd allegedly made payments and gave “do nothing” jobs and vendor contracts to the political associates of former Illinois House Speaker Michael Madigan. In exchange, ComEd received rate hikes providing the company in excess of $150 million, and potentially billions in subsidies for its financially troubled nuclear power plants. The securities class action alleged Exelon concealed the bribery and corruption scheme from investors, and falsely attributed the legislative victories to legitimate lobbying activities. In July 2020, ComEd admitted to the bribery and corruption scheme and agreed to a $200 million criminal penalty with the DOJ. In May 2023, the former ComEd CEO and three lobbyists – the so-called “ComEd Four” – were convicted of bribery, conspiracy, and falsifying records. The securities class action – initially filed in December 2019 – survived a motion to dismiss in April 2021. The settlement is the seventh largest securities-related settlement in the Seventh Circuit. Robbins Geller Rudman & Dowd represented shareholders as lead counsel.

5.) Allianz

Allianz Global’s $145 million payout benefits shareholders of collapsed mutual funds that Allianz managed. The SEC had charged AllianzGI with abandoning its investment and risk management strategies in the management of the Structural mutual funds. This allegedly subjected investors to “undisclosed risk and ultimately led to the massive losses the funds incurred in February and March of 2020,” when the COVID-19 pandemic roiled markets. In May 2022, Allianz pled guilty to charges from the SEC regarding the management of its Structured Alpha strategies and agreed to pay more than $6 billion in restitution, including over $1 billion in an SEC Fair Fund, which was made available to investors. The securities class action accused Allianz of similarly harming investors, and provides a recovery to those investors.

6.) McKesson

The $141 million settlement with McKesson resolves allegations it misled investors about profits from a price-fixing conspiracy amongst generic drug manufacturers. The drug price-fixing conspiracy – which became the focus of investigations by the Department of Justice, 49 state attorney generals, and Congress– has embroiled the generic pharmaceutical industry. The crux of the shareholder class action is that McKesson allegedly knew that the price-fixing conspiracy increased generic drug prices and improved its bottom line, and yet failed to disclose that to investors. Instead, McKesson is alleged to have falsely attributed the price increases to unrelated factors such as supply disruption, and asserted it was working to drive the prices down. As the government closed in on the price-fixing scheme, the collusive behavior was curtailed and McKesson reported weaker than expected pricing estimates in late 2015/early 2016, which caused significant declines in its stock price. The $141 million settlement was reached after the Court granted the defendants’ motion for partial summary judgment. The Pension Trust Fund for Operating Engineers served as lead plaintiff and Robbins Geller Rudman & Dowd as lead counsel for the class. In 2022, Teva Pharmaceutical Industries Ltd. also settled shareholder allegations related to the price-fixing scheme for $420 million.

7.) Cardinal Health

The $109 million settlement with Cardinal Health resolves allegations concerning the acquisition and integration of Cordis Corporation from Johnson & Johnson for $1.9 billion in 2015. Cardinal Health allegedly misled investors by assuring them that they were transforming Cordis’ business with Cardinal’s inventory management technology and supply chain expertise. However, in reality, Cardinal Health allegedly concealed inventory management and tracking problems plaguing Cordis for two and a half years after the acquisition. According to the lawsuit, Cordis carried $300 million in excess and obsolete inventory in its warehouses. Its inventory management system also completely shut down in July 2017 in what is known as the “Blackout Period.” In May 2018, Cardinal Health reported disappointing earnings due to inventory and sales issues and its stock fell over 21% as a result. The settlement in the Southern District of Ohio was reached after extensive discovery and while the motion for class certification was pending. Robbins Geller Rudman & Dowd represented investors as lead counsel.

8.) Micro Focus

In July 2023, the Superior Court of California approved the $107.5 million settlement with Micro Focus International plc. The global settlement resolves allegations in state and federal court relating to the British-based enterprise software provider’s 2017 merger with HPE Software. In the offering documents, Micro Focus allegedly failed to disclose problems undermining Micro Focus’ business, including inherent compatibility issues with the merger of the two companies. In the weeks and months following the merger, Micro Focus announced significant revenue declines and its stock price dropped more than 54% from the $28.81 per ADS merger closing price. A substantially similar case in the Southern District of New York was subsequently dismissed and appealed. The parties in the federal action then attempted to effectuate a $15 million settlement, while the state case proceeded into discovery and obtained class certification. In December 2022, following mediation, the parties reached a global resolution of the state and federal action.

9.) Newell Brands

The Newell action also brought in state court (Superior Court of New Jersey) resolves allegations concerning its 2016 merger with Jarden Corporation. Newell allegedly concealed in offering documents that its core sales growth was stalling as well as talent gaps and functional deficiencies, which posed a risk to Newell’s ability to successfully integrate Jarden. The truth was revealed through a series of 2017-2018 announcements that caused Newell’s stock price to decline approximately 50% from its price at the time of the merger. The $102.5 million settlement was reached after extensive fact and expert discovery and summary judgment briefing. Scott + Scott represented shareholders as lead counsel.

10.) Grupo Televisa

The $95 million settlement with Grupo Televisa S.A.B. resolves allegations of a bribery and corruption scheme of FIFA officials. Televisa allegedly paid millions of dollars in bribes in exchange for the broadcasting rights of World Cup tournaments. The securities class action specifically alleges the Mexican multi-media company made false and misleading statements about its internal controls over financial reporting and its code of ethics, while failing to disclose the illicit bribery scheme. The wide-ranging FIFA corruption probe came to light in 2015 and has led to U.S. indictments of at least two dozen individuals and entities from 20 different countries. The settlement was reached about two weeks after the Second Circuit rejected the defendants’ attempt to appeal the district court’s order defining the class and before a decision on summary judgment. The settlement is the largest U.S.-based shareholder class action of a Mexican publicly traded company. Boies Schiller Flexner represented investors as lead counsel.

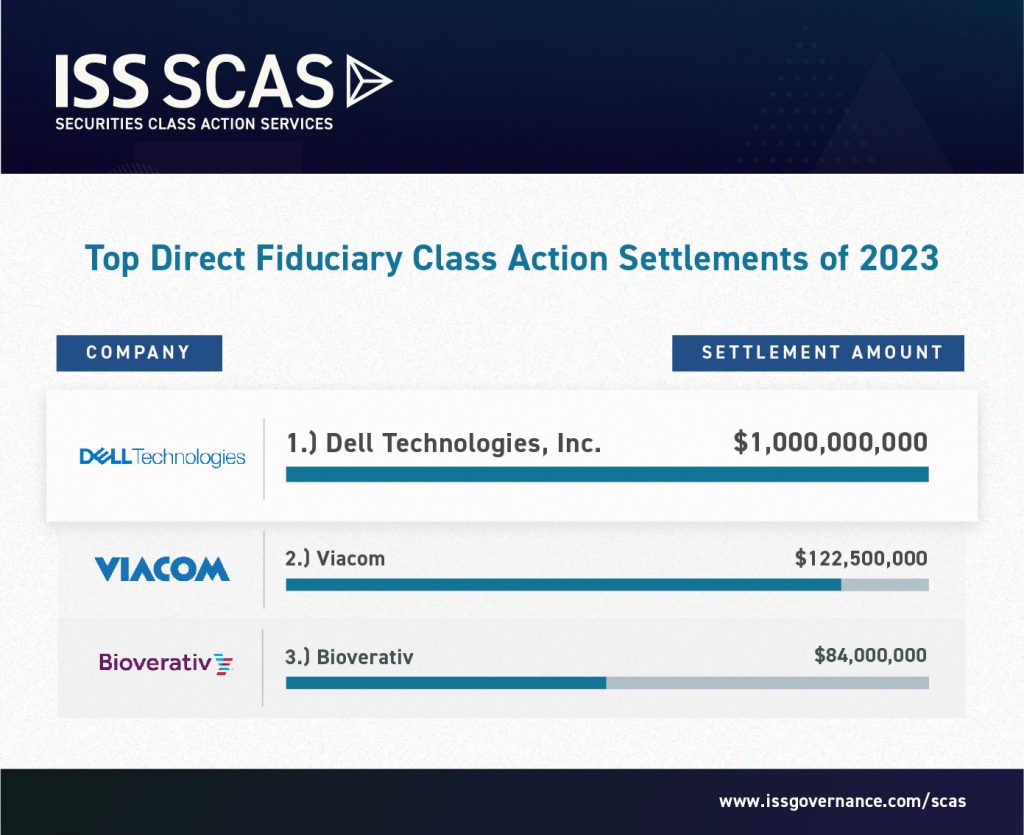

Shareholder Directly Asserted Fiduciary Duty Cases

There also have been significant settlements asserting various breaches of director and officer fiduciary duties. These cases, which are often brought in the Delaware Court of Chancery, can be asserted directly or derivatively on behalf of the corporation. While the settlement proceeds in a derivative action typically go back to the company, investors may receive the funds directly in a direct action. ISS SCAS tracks and covers the direct cases because investors benefit from the recoupment of their losses.

1.) Dell Technologies

The $1 billion settlement with Dell shareholders resolves allegations that they were short-changed billions of dollars for their Class V stock in connection with a 2018 transaction that turned Dell into a public company. In the asserted transaction valued at $24 billion, Dell’s controlling shareholders – Michael Dell, Egon Durban, and the private equity firm Silver Lake – allegedly expropriated $10.7 billion from public Class V shareholders by forcing them to convert their shares into cash or privately held shares of Class C common stock at an unfair price. Class V stock was a publicly traded “tracking stock” that tracked the performance of VMware, Inc.’s publicly traded shares. However, according to the complaint, the purported $120 per share consideration fell well below the market price of the VMware stock that the Class V stock was intended to track. The settlement – reached three weeks before the scheduled trial in Delaware Chancery – is the largest shareholder-related action to be resolved in a U.S. state court. Quinn Emanuel Urquhart & Sullivan LLP and Labaton Sucharow served as lead counsel for the class.

2.) Paramount Global

The $122.5 million payout resolves allegations related to the $30 billion merger between CBS and Viacom in 2019, which created what is now known as Paramount Global. The lawsuit filed on behalf of Viacom shareholders asserted breach of fiduciary duty claims against Redstone-controlled media company National Amusements Inc. and the members of the special Viacom committee that approved the merger. At the center of the allegations is media mogul Shari Redstone and her “unrelenting” desire to “re-unify” the two “family” businesses and rival the legacy of her late father, Sumner Redstone. To secure Redstone’s governance priorities, the Viacom board allegedly agreed to accept a lower price than what it was worth – $1 billion less than it had bargained for a year earlier.

3.) Bioverativ

The partial settlement of $84 million for former Bioverativ shareholders resolves allegations that officers and directors breached their fiduciary duties in the sale to Sanofi S.A. in 2018. According to the complaint, the conflicted board agreed to sell the biotechnology company to Sanofi for $105 per share, despite Bioverativ’s financial advisor estimating its standalone value at over $150 per share a few months earlier. The claims against Bioverativ director Alexander Denner and his hedge fund, Sarissa Capital, for insider trading are still ongoing with a trial set for April 2024.

Largest Investor-Related Antitrust Settlements of 2023

There were also six complex U.S. antitrust actions that partially settled for value in 2023. The common theme amongst all these actions is that defendants were alleged to have manipulated various forms of currency and/or pricing. The four largest settlements all involved allegations of price fixing of various interest rate benchmarks for financial instruments on global markets by the banks who set the rates.

For example, in the Euro Interbank Offered Rate action, big banks, including Société Générale which agreed to a $105 million payout, allegedly conspired from 2005 to 2011, to rig the prices of Euribor, which is used to reflect the interest rate charged on loans between European banks. In the Relevant LIBOR-Based Financial Instruments action, the banks were alleged to have manipulated the London Interbank Offered Rate for U.S. dollars during the financial crisis. The banks on the U.S. dollar panel were specifically alleged to have artificially lowered the rate, such that purchasers did not receive as much in interest payments from the banks as they should have. Similarly, in the Swiss Franc LIBOR-Based Derivatives action, the panel banks that set Swiss franc LIBOR allegedly made submissions to set the rate to increase the banks’ profitability rather than reflect the true cost of borrowing.

The complicated components of antitrust actions often lead to a significantly longer lifecycle of litigation. In fact, the six cases that settled for value in 2023 average 10.8 years from the initially filed complaint through to the settlement date.

As all of the above large settlements indicate, investors had opportunities to recover significant lost assets in 2023 resulting from securities-related fraud. ISS Securities Class Action Services will continue to monitor and file claims on behalf of its institutional investor clients, as they move toward disbursement.

[1] This figure includes shareholder-related class actions across the globe, as well as investor-related antitrust settlements.

[2] This figure includes securities and direct fiduciary duty class actions, but excludes antitrust, as well as SEC fair fund settlements.

[3] The data in the tables and charts throughout this report was compiled via ISS SCAS’s fully transparent client platform, RecoverMax, available at https://recovermax.issgovernance.com/recovermax

By: Jarett Sena, Esq., Director of Litigation Analysis, ISS Securities Class Action Services