Municipal bonds can play a large role in shifting capital flows to investments that address societal issues and have a tangible impact on local communities. The ISS ESG Muni QualityScore provides ESG scoring for the US municipal market at the GEO.id level, as well as at the CUSIP9 level for issuers. More background on the use and limitations of these scores can be found at the bottom of this article.

Introduction

Responsible investors have traditionally focused on the equity component of their portfolios, where disclosure on Environmental, Social and Governance (ESG) risks can be most readily obtained, and where ownership of stocks conveys the ability to influence a company’s behavior through voting and engagement. As the market matures, however, investors have increasingly sought to extend their responsible investment approaches to other parts of their portfolios, including fixed income.

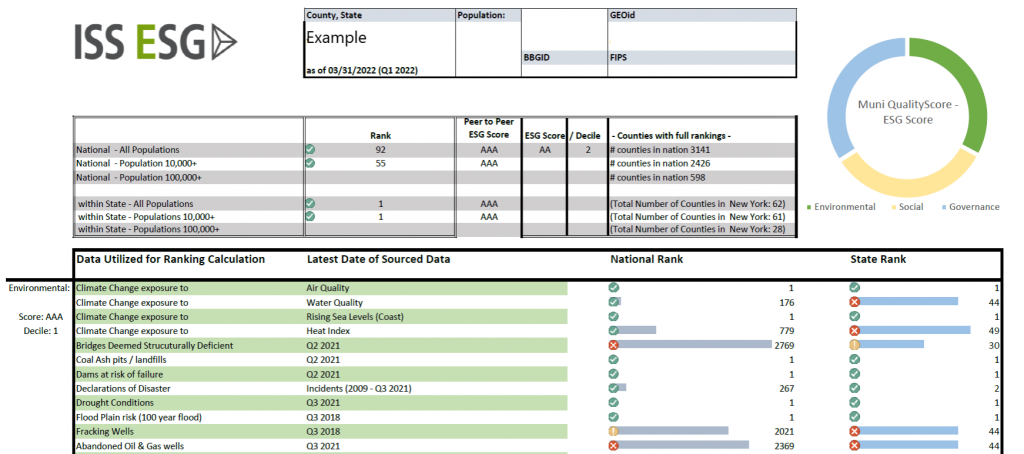

The ESG Muni QualityScore works with clients to assist in this process, providing a detailed assessment of socioeconomic risks faced by upwards of 29,000 cities and towns; 3,141 counties; and 13,500 school districts across all 50 US states. The product currently utilizes 77 scores from a range of public datasets to produce individual scores that determine the ranking for each city and town, county, state, and school district, both statewide, and nationally, for each data input.

In an exciting new development for the market, these scores and ratings are now being made available to the municipal issuers themselves, to assist them in benchmarking their performance on a range of critical quantitative ESG metrics applied equally across the nation.

Overview – ESG Scores & Standard Datasets for Municipal Issuers

There are several industry-led initiatives underway that are intended to improve the quality of ESG-related information available in the municipal securities market. However, does the availability of these voluntary, market-based initiatives enhance the ability of investors and other market participants to make relevant informed decisions?

ISS ESG can provide Municipal Bond Issuers (should they choose) both their current ESG scoring report as well as all underlying data utilized in this calculation, on an ongoing basis. Previously, the ISS ESG Muni QualityScore has been tailored to those who own, or trade in, US Municipal Issues. This new offering for Issuers would allow small towns to big cities, school districts, counties, special districts, and even revenue sector issuers to have full access to all datasets utilized in ESG Scoring (with historical data as well) that apply to their location.

This solution provides an even playing field and would benefit Issuers and Investors with verifiable, timely and cost-effective data covering risks from Climate to Crime, Heath to Infrastructure. Issuers can use this data to clarify their intent on Sustainable or Green issuance, as they can point to the risks that they are trying to address or abate.

How Does This Work?

ISS ESG has been calculating ESG Scores for US Municipal Issues and Issuers since Q1 2020. The Scores’ published equal weighted methodology does not consider E (Environmental) more important than S (Social) or G (Governance). Data is sourced from public sources (Government, NGO, Environmental Groups, and ISS ESG’s own research) and we do not screen scrape data.

Each city is scored against all cities, each county against all counties, and so on. The score and all underlying data is comparable across all locations, as we utilize the same 77 datasets (a number likely to expand) across all locations (city, state, county, school district).

Sample Report:

Because ISS ESG considers transparency a critical element in the calculation of the ESG scores, issuing clients have full access to the datasets that apply to their respective location(s) of operations. ISS ESG also provides details as to where each dataset was sourced (for example FBI, CDC, FEMA, EPA, Microsoft), as well as the actual URL, or link, to the location from where the data was sourced.

This transparency provides clarity not only to the Issuer but also to their Investment Team (Legal, Finance) and, importantly, to the purchaser of the respective issuance.

With NGO and potentially regulator pressure on the Municipal marketplace to incorporate ESG reporting, this offering provides the Issuer community the chance to leapfrog equity-style requirements and offer a standard that was not previously available, at a licensing fee lower than that required to collect this type of data on their own.

What do I get with a license?

The ISS ESG Muni QualityScore datasets and ESG scoring are updated quarterly. The following files and datasets will be provided within 30 days of each calendar quarter-end:

- Issuing clients will receive their respective ESG report(s) – PDF.

- Issuing clients will also receive all the underlying data (including history back to 2009 where available) for their respective location(s) within 30 days of each calendar quarter-end – CSV file.

- Issuing clients will also receive the rankings for each of the 77 datasets utilized in the ESG Calculation. This is the same data as provided visually in the ESG Report (PDF), but this separate file will include history, providing the Issuer the ability to track rankings and highlight the impact that a bond project is having, or how certain socioeconomic risks are being addressed – CSV file.

- Data can simply be provided by email to licensing clients.

- If clients require a different delivery option, files can be pushed to the client via SFTP, or alternatively clients can pull this data from ISS ESG via SFTP.

- Data can simply be provided by email to licensing clients.

Conclusion

The measurement of performance on environmental, social and governance factors is becoming increasingly important for all players in the finance sector. While investors in municipal debt have been accessing this information for some time, it hasn’t always been as readily available for the issuers themselves. This new initiative from the ISS ESG Muni QualityScore team supports municipal debt issuers in their efforts to benchmark their performance on issues critical to their communities, with the aim of helping drive an improvement in ESG performance across the board.

METHODOLOGY FOR CALCULATION OF RANKINGS AND ESG SCORES

The ISS ESG Muni QualityScore data is currently calculated utilizing 77 unique socioeconomic datasets and provides a material view of risk for the respective entity when measured against its respective peers.

The ranking and ESG scores provided by ISS ESG should not be interpreted as investment advice and do not provide or are intended to provide a buy, sell, or hold recommendation for any security or real estate property.

ISS ESG does not survey any of the respective entities, and relies on non-interpretive data from government, quasi-government, and special interest groups such as NRDC (National Resources Defense Council), Furman Center, and the FracTracker Alliance.

Data is provided via license and is provided on an as-is basis.

Explore ISS ESG solutions mentioned in this report:

- Extend ESG implementation processes across your US municipal bond investments with the help of the ISS ESG Muni QualityScore.

By: John McLean, Executive Director, ISS ESG