South Korea is among the countries introducing new ESG disclosure regulations in an effort to help close the gap between investors’ demand for information and current corporate reporting. When mandatory disclosure requirements come into effect, South Korean companies may find themselves unprepared. Thus, regulators are also currently focusing on helping companies navigate the constantly evolving ESG reporting landscape. Along with providing guidance, curbing “greenwashing” and building market trust have become regulatory priorities.

Regulatory Developments

K-ESG Guidelines

Lack of clear guidance has been identified as a major challenge for South Korean companies preparing their ESG disclosures. The K-ESG Guidelines released by the Ministry of Trade, Industry and Energy in December 2022 were an early attempt to provide clarity.

After reviewing over 3,000 indicators from 13 major ESG rating agencies, the Ministry came up with 61 indicators for the Guidelines (Table 1). By homing in on the most widely recognized aspects of sustainability, these Guidelines aim to serve as a starting point for companies evaluating their own sustainability performance and developing ESG management strategies in line with market expectations.

Table 1: K-ESG Guidelines Indicators, by Topic

| Topic | # of Indicators | Indicator Examples |

| Information Disclosure | 5 | • P-1-3: Scope of Sustainability Disclosure • P-2-1: Key ESG Issues and Related KPIs • P-3-1: Data Assurance |

| Environmental | 17 | • E-3-1: Scope 1 & 2 GHG Emissions • E-4-1: % of Renewable Energy in Total Energy Consumption • E-5-1: Water Usage |

| Social | 22 | • S-2-3: Voluntary Turnover Ratio • S-7-1: Employee Initiatives for Community Engagement • S-3-3: % of Employees with Disabilities |

| Governance | 17 | • G-2-1: Attendance Rate for Board Directors • G-5-1: Board Member Expertise |

Source: Ministry of Trade, Industry and Energy of South Korea

Mandatory ESG Disclosure

South Korea’s Financial Services Commission (FSC) previously announced its plan to make ESG disclosures mandatory. The requirement was initially planned to be implemented in phases, first starting in 2025 with Korea Composite Stock Price Index (KOSPI)-listed companies with an asset size over KRW 2 trillion. By 2030, the requirement would apply to the rest of the KOSPI-listed companies.

However, the FSC announced in October 2023 that it will now postpone the mandatory disclosure “until after 2026,” to be more in line with global regulatory timelines. The exact scope of required ESG disclosures is yet to be unveiled.

K-Taxonomy

In December 2021, the Ministry of Environment released the Korean Green Taxonomy (K-Taxonomy). By clarifying what constitutes “environmentally sustainable business activities,” the K-Taxonomy is designed to foster the development of sustainability-linked financial instruments in the country and to accelerate capital inflow towards the green transition.

Similar to the EU Taxonomy, the K-Taxonomy classification system considers an economic activity to be “environmentally sustainable” if it meets the following three criteria:

- The activity substantially contributes to one or more of the six environmental objectives of

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity

- The activity does no significant harm to any of the other six objectives

- The company carrying out the activity complies with all relevant laws and regulations on human rights, labor rights, safety, anti-corruption, and protection of cultural properties

The 74 economic activities currently eligible fall into two categories:

- Green Category: environmentally friendly economic activities that play a crucial role in the transition to a low-carbon economy

- Transition Category: activities deemed necessary for the transition

In the final amendment to the K-Taxonomy in September 2023, the Ministry announced that it will include nuclear investment in the K-Taxonomy. Research and development for nuclear energy is now labelled as a Green Category activity. New nuclear power plants and the operation of existing plants will be recognized as Transition Category activities until 2045.

Voluntary ESG Rating Guidelines

In May 2023, the FSC announced the ESG Evaluation Agency Guidance, which is designed to provide a self-regulatory framework for the ESG evaluation market. Developed by three domestic ESG rating agencies—the Korea ESG Standards Institute (KCGS), Sustinvest, and the Korea ESG Research Institute—this Guidance refers to guidelines and best practices intended to foster enhanced transparency in methodology and effective management of conflicts of interest, among other objectives. Following the comply-or-explain approach, providers are required to declare their adherence to the code or provide an explanation in case of non-compliance.

The ESG Evaluation Agency Council, a self-regulatory body launched by the above-mentioned domestic ESG rating agencies, is responsible for monitoring the effectiveness of the Guidance and issuing recommendations or new Guidance, if deemed necessary. Other ESG rating agencies operating in South Korea can also submit their applications to join the council. Besides the three domestic agencies that developed the Guidance, the FSC, Korea Exchange (KRX), and the Korea Capital Market Institute (KCMI) also participate in the council as observers, to provide guidance during the early stages of Guidance implementation.

The FSC stated that it will continue to closely monitor the market and determine if further measures, including legislative regulations, are necessary.

ESG Bond Certification and Evaluation Guidelines

Underscoring its emphasis on improving transparency in the market, the Financial Supervisory Services in South Korea (FSS) introduced another set of Guidelines on ESG bond certification and evaluation in January 2023.

In South Korea, ESG Bonds are rated by credit rating agencies. The supervision over the overall certification process is limited given the absence of specific regulations. The FSS also pointed out that all the ESG bonds issued in South Korea so far have received the highest grade from these agencies, raising doubts over the effectiveness of the agencies’ ratings.

Based on the International Organization of Securities Commissions (IOSCO)’s recommendations on Environmental, Social, and Governance Ratings and Data Products Providers, the Guidelines set forth the rules and principles for credit rating agencies. It also requires them to disclose the minimum investment ratios required for their certification and introduces post-issuance verification.

ESG Fund Disclosure Standards

Starting in December 2023, funds labelled as ESG or claiming to incorporate ESG into their investment process in South Korea will face new disclosure standards.

ESG-themed funds are required to specify their investment goals and strategies as well as specific investment risks associated with them and to provide information on the overall investment process, such as selection criteria and ESG evaluation methodology. They will also have to explain how their investment approaches are related to ESG and what resources they have for implementing their ESG strategies. Last, investment progress and performance must be disclosed by these funds on a regular basis.

By providing better transparency, FSS expects that the new disclosure standards will help investors make more informed decisions, thereby facilitating sustainable investment in the country.

Outstanding Challenges

Supply Chain Due Diligence Guidelines

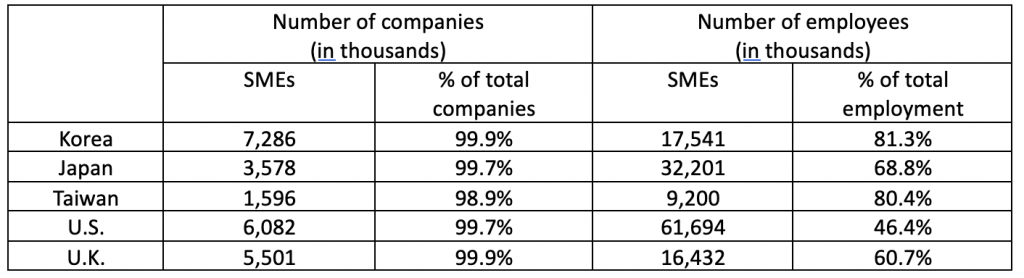

Although the South Korean economy is dominated by large conglomerates with familiar names, the country also includes a large presence of Small and Medium Enterprises (SMEs). South Korea has over 7 million SMEs, which together account for over 80 percent of employment in the country (Table 2). A vast majority of South Korean SMEs act as suppliers of larger corporations with global footprints, which makes them part of those corporations’ supply chains.

Table 2: Number of SMEs and their Employees, by Country

Source: Korea Federation of SMEs

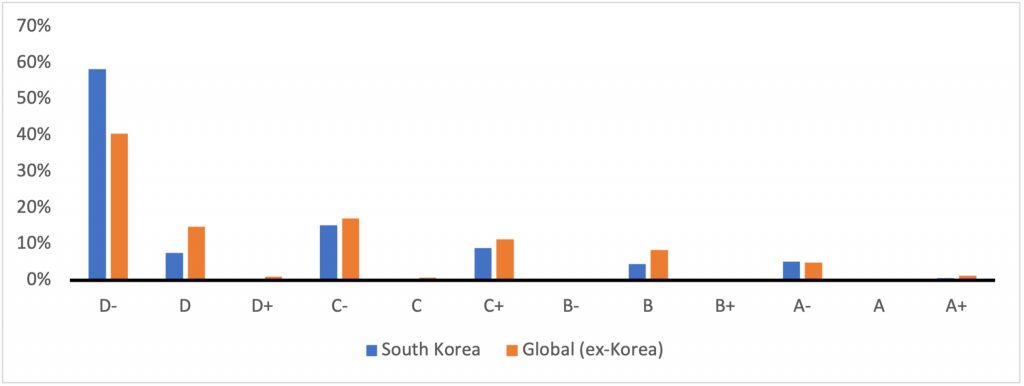

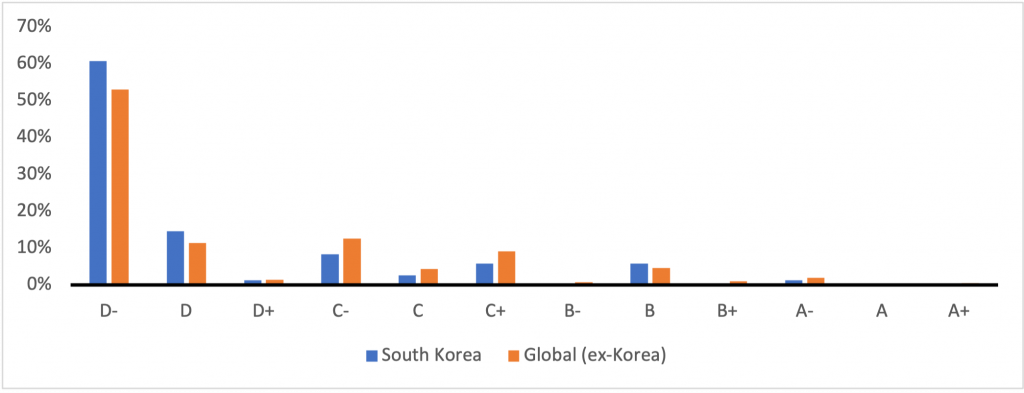

Evaluated by the ISS ESG Corporate Rating tool, South Korean companies are currently below the global averages for managing supply-chain risks, both in the content of the labor rights and working conditions standards for their suppliers and in the compliance procedures for these standards (Figures 1 and 2).

Figure 1: Performance on Supplier Standards for Labor Rights and Working Conditions

Source: ISS ESG

Figure 2: Performance on Compliance Procedures for Supplier Standards for Labor Rights and Working Conditions

Source: ISS ESG

However, investors and regulators around the world are paying more attention to supply chain sustainability. Supply chain due diligence is becoming a mandatory requirement in some jurisdictions already and investors are likely to see more countries following suit. As increased scrutiny moves down through multiple layers of production, suppliers may eventually need to undergo sustainability audits and other obligations and those failing to meet the new requirements may face material business risks.

The SMEs in South Korea are apparently aware of this risk: A recent survey conducted by the Korea Chamber of Commerce and Industry (KCCI) indicated that more than half of the 300 participating companies believed that there is a high chance of business disruptions due to a lack of proper ESG management. Regarding governmental policies, over one-third of respondents answered that industry-level supply chain due diligence guidelines should be the top priority.

The Supply Chain Due Diligence Guidelines released by the Ministry of Trade, Industry and Energy were a direct response to this growing concern. Tailored for local SMEs, the Guidelines prioritize areas for quick improvements, where large capital expenditures are not required. The Ministry also plans to provide a consulting service to SMEs.

Conclusion

Promoting corporate ESG disclosures in South Korea is an ongoing process marked by a variety of regulatory initiatives. New guidelines have been released to help companies improve their sustainability disclosures and prepare themselves for the mandatory requirements, while local regulators aware of the risk of “greenwashing” are also pushing for increased transparency.

As investors try to discern South Korean companies’ ESG performance, the ISS ESG Corporate Rating solution can serve as an effective tool to monitor a company’s sustainability performance and track its progress in improving its disclosures.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By: Rudy Kwack, Senior Associate, Financials & Real Estate, ISS ESG