The European Securities and Markets Authority (ESMA) published, on May 14, 2024, its final report on guidelines on Fund names that use ESG- or Sustainability-related terms. ESMA aims to protect investors from the risk of greenwashing arising from the use of ESG/sustainability-related terms in the fund names. To achieve this, ESMA has laid down clear criteria for fund managers to ensure that fund names are fair and clear and are not misleading. Applying these criteria is open to various interpretations, however.

Scope of Applicability

The scope of the ESMA guidelines extends to fund documentation and marketing communications for the following:

- Undertakings for Collective Investment in Transferable Securities

- European Venture Capital Funds

- European Long Term Investment Funds

- Money Market Accounts

- European Social Entrepreneurship Funds

- Alternative Investment Funds

These guidelines apply to fund managers domiciled in the EU as well as to external fund managers that market funds in the EU. Furthermore, the index-tracking funds need to ensure that the benchmark methodology aligns with these guidelines.

Figure 1: Timeline of ESMA Guidelines Applicability

Source: ESMA 2024

Minimum Requirements

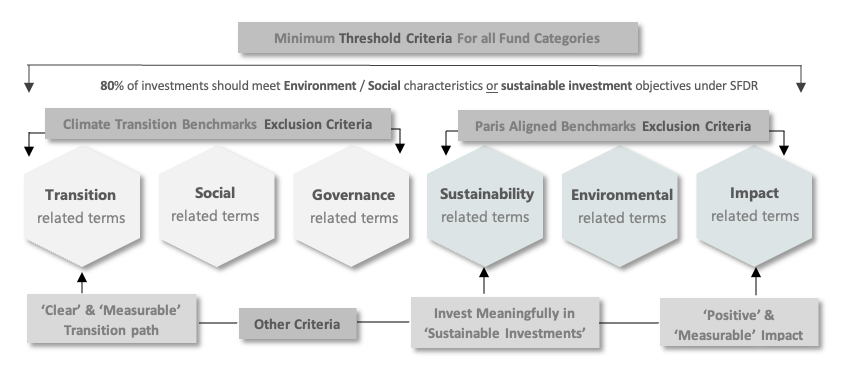

Per the guidelines, ESG/sustainability terms in fund names are categorized into six distinct groups: ‘transition’-related, ‘environmental’-related, ‘social’-related, ‘governance’-related, ‘impact’-related, and ‘sustainability’-related. For each group, the guidelines comprise recommendations to fund managers.

Figure 2: ESMA Fund Minimum Requirements

Notes: Please refer to Article 12(1)(a) to (g) of CDR (EU) 2020/1818 for more details on exclusion criteria.

Source: ESMA 2024

There are two main requirements laid down under these guidelines: a minimum investment threshold and exclusion criteria.

Minimum Investment Threshold

The guidelines require that a minimum of 80 percent of investments in a fund meet environmental or social characteristics or sustainable investment objectives in accordance with the fund’s investment strategy. Moreover, for funds using transition- or impact-related terms, the investments counted towards the minimum threshold must also meet additional requirements, such as a clear and measurable path to social or environmental transition or the objective to generate a positive and measurable social or environmental impact alongside a financial return. Funds with sustainability-related terms must invest meaningfully in ‘sustainable investments,’ as defined under article 2(17) of the Sustainable Finance Disclosure Regulation (SFDR).

Exclusion Criteria

The guidelines mandate extension of exclusion criteria that were originally set out under Article 12(1) of the Commission Delegated Regulation (CDR) EU 2020/1818. These exclusions criteria are currently applicable to Paris Aligned Benchmarks (PAB) and Climate Transition Benchmarks (CTB). Following the guidelines coming into effect, these exclusions will also be applicable to funds with ESG/sustainability-related names (whether PAB or CTB exclusions apply to funds depends on the precise fund names; see Figure 2).

Under these exclusion criteria, funds must not invest in companies that are involved in any of the following:

- Activities related to Controversial Weapons (PAB & CTB criteria)

- Cultivation and production of Tobacco (PAB & CTB criteria)

- Violations of United Nations Global Compact (UNGC) principles / Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises (PAB & CTB criteria)

- Deriving revenues of 1% or more from involvement in Coal-related activities (PAB criteria only)

- Deriving revenues of 10% or more from involvement in Oil-related activities (PAB criteria only)

- Deriving revenues of 50% or more from involvement in Gas-related activities (PAB criteria only)

- Deriving revenues of 50% or more from Electricity Generation with a GHG intensity of more than 100 g CO2 e/kWh (PAB criteria only)

Interpreting PAB & CTB Exclusions

PAB exclusion criteria are very significant as they require funds with ‘Sustainability-’, ‘Environmental-’, or ‘Impact-’related terms in their names to either i) divest from companies that generate a certain portion of their revenues from ‘fossil fuel related activities’ or ii) change their fund names. Further, funds with names falling into any of the six categories face a similar predicament with companies involved in activities related to controversial weapons or tobacco or that are in violation of UNGC principles or OECD Guidelines, due to the CTB exclusion criteria.

These criteria are open to interpretation. For example, methodologies for determining what constitutes a violation of UNGC principles or OECD guidelines may vary. Similarly, revenue shares stemming from electricity production exceeding the emission threshold are not commonly reported, and some level of approximation will thus be required.

Finally, some level of interpretation is required for the involvement and revenue-based exclusion criteria related to controversial weapons, tobacco, and fossil fuels to determine exactly which type of activity ought to be considered. Table 1 outlines two alternative interpretations of the controversial weapons and fossil fuel-related exclusions.

Table 1: Differing Interpretations of the Guidelines

| Exclusion Criteria | Baseline Interpretation | A More Stringent Interpretation |

| Involved in activities related to Controversial weapons | Includes a broad range of activities such as development, production, maintenance, stockpiling, etc. Weapons coverage is based on the weapons prohibited by one or more EU member states: anti-personnel mines, biological weapons, chemical weapons, cluster munitions, depleted uranium, nuclear weapons | Weapons coverage can also include those that are not prohibited but can be considered controversial, such as incendiary weapons and white phosphorus weapons |

| Fossil Fuel-related activities | Exclusion is based on revenue from exploration, mining, extraction, manufacturing, or distribution of fossil fuels | Exclusion is also based on revenue from services to the fossil fuel sector |

Source: ISS ESG

To better understand the impact of such differing interpretations, ISS ESG conducted the following analysis of the impact from the minimum requirements under these guidelines on EU Funds as well as the impact on a few global indices.

Analysing the Potential Impact on EU Funds

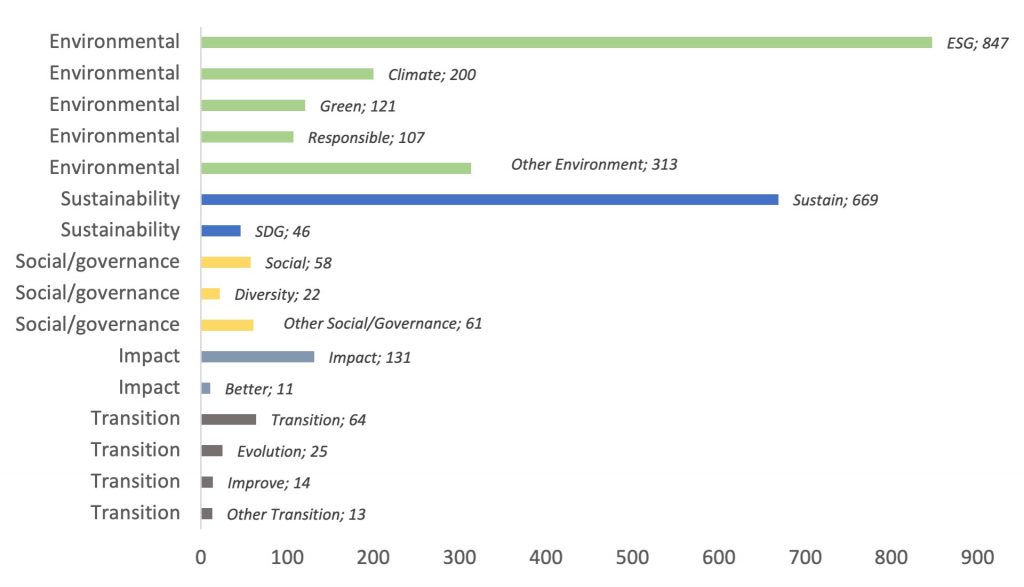

The analysis scope consisted of 28,000+ funds within the ISS ESG research universe. To determine the universe of funds that would be impacted by the implementation of the new guidelines, ISS ESG curated a list of terms (complementing the list provided by ESMA) to be flagged in fund names that were either domiciled or registered for sale in the EU.

Overall, 2,103 funds were found to be affected by the guidelines; that is, these funds contained one or more of the six categories of relevant keywords within their name. Figure 3 showcases the reference keywords used and the number of funds found to be relevant under each terminology category.

Figure 3: Funds with Terms from ESMA Fund Name Guidelines in Their Names

Notes: Text in italics are specific keyword-related terms and the number of times they are used in fund names.

Source: ISS ESG

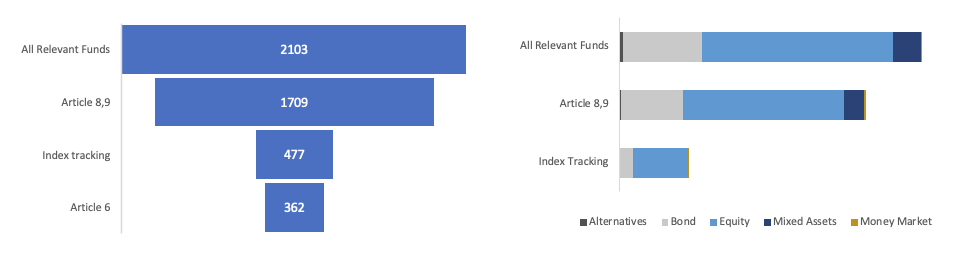

Some other fund characteristics considered for analysis were whether the fund is available for sale in EU countries; whether it is an Article 8 or 9 fund per the EU Sustainable Finance Disclosure Regulation; and whether a fund follows an index tracking strategy. Over 300 Article 6 funds identified below will either need to change their name or report under Article 8 or 9, as highlighted by ESMA in their impact analysis.

Figure 4: ESMA-Relevant EU Funds and Asset Mix

Note: EU Funds = Funds for sale or domiciled in the EU

Source: ISS ESG

Equity (63%), followed by Bonds (26%), lead the asset mix of all relevant funds that are either domiciled or available for sale in the EU. The relevant Article 8 or 9 and index tracking funds follow a similar pattern.

Impact of CTB Exclusion Criteria

When considering the impact new guidelines will have on the portfolios of funds using ESG or sustainability-related terms in their names, the room for interpretation discussed above needs to be evaluated more closely.

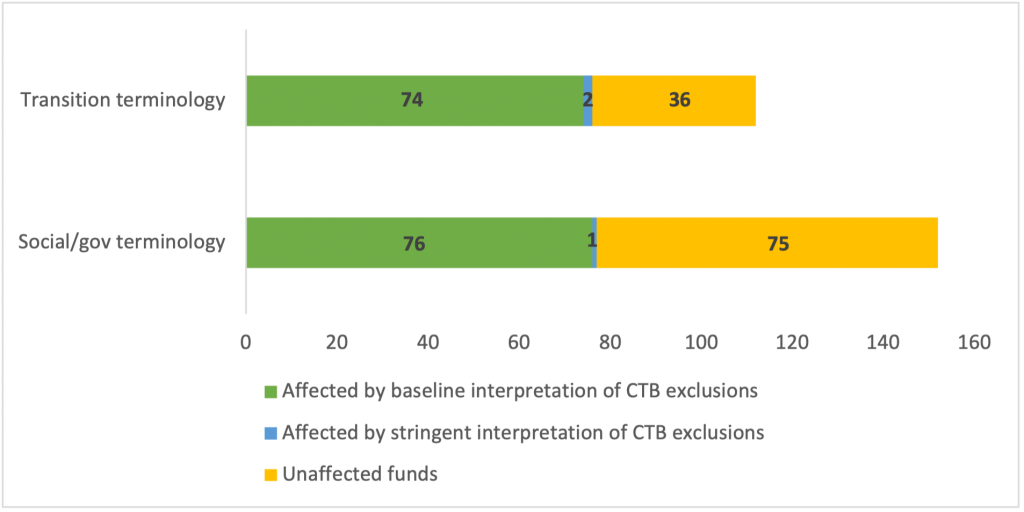

Of the 2,103 funds included in our universe, 264 were identified as having social, governance, or transition terminology in their names. Of these, 56 percent included at least one company breaching CTB exclusion rules, using the baseline interpretation shown in Table 1.

The exclusion criteria for controversial weapons can have varied interpretations across financial market participants as the regulation does not provide a list of weapons that are considered controversial. A more stringent interpretation to also exclude companies with involvement in incendiary weapons or white phosphorus leads to a greater number of funds with holdings in breach of the CTB exclusion rules. A breakdown of the shares of funds with Transition and Social/Governance terminology that would be in breach of the CTB exclusion rules can be seen below.

Figure 5: Number of Funds with at Least One Position in Breach of CTB Exclusion Criteria

Source: ISS ESG

Impact of PAB Exclusion Criteria

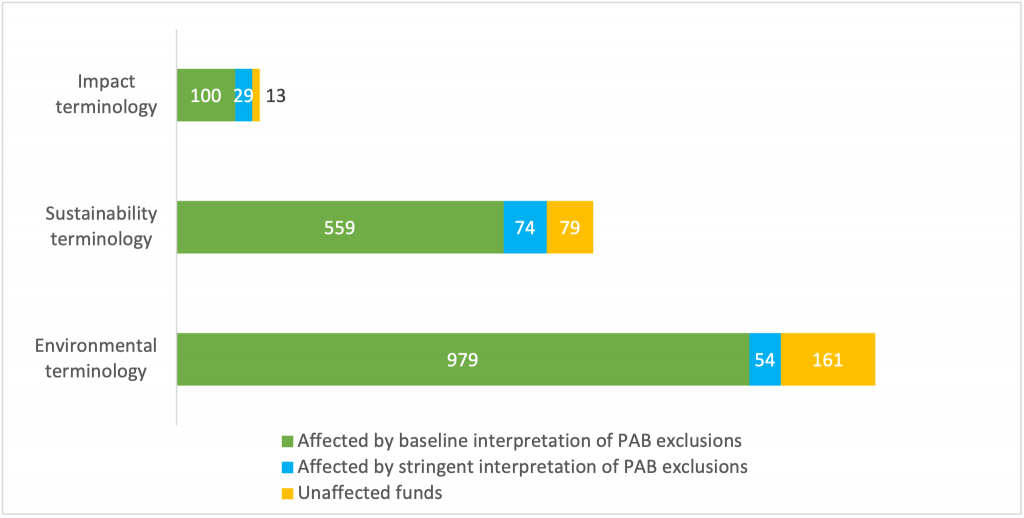

For the 2,047 funds identified that include environmental, sustainability, or impact-related terms in their names, 80 percent held at least one company breaching PAB exclusion rules, as interpreted by the baseline interpretations shown in Table 1. Involvement in fossil fuel-related activities was identified as being the most impactful aspect of the exclusion criteria, with nearly 70 percent of funds having at least one position in breach of the exclusion threshold.

This analysis further explores the impact of including companies with exposure to or involvement in the fossil fuel sector further down the value chain; that is, companies that provide services to the fossil fuel sector. Though this goes beyond the baseline interpretation of the guidelines, Figure 6 shows that roughly 90 percent of funds from each category would need to divest at least one position from their portfolio to become compliant.

Figure 6: Number of Funds with at Least One Position in Breach of PAB Exclusion Criteria

Source: ISS ESG

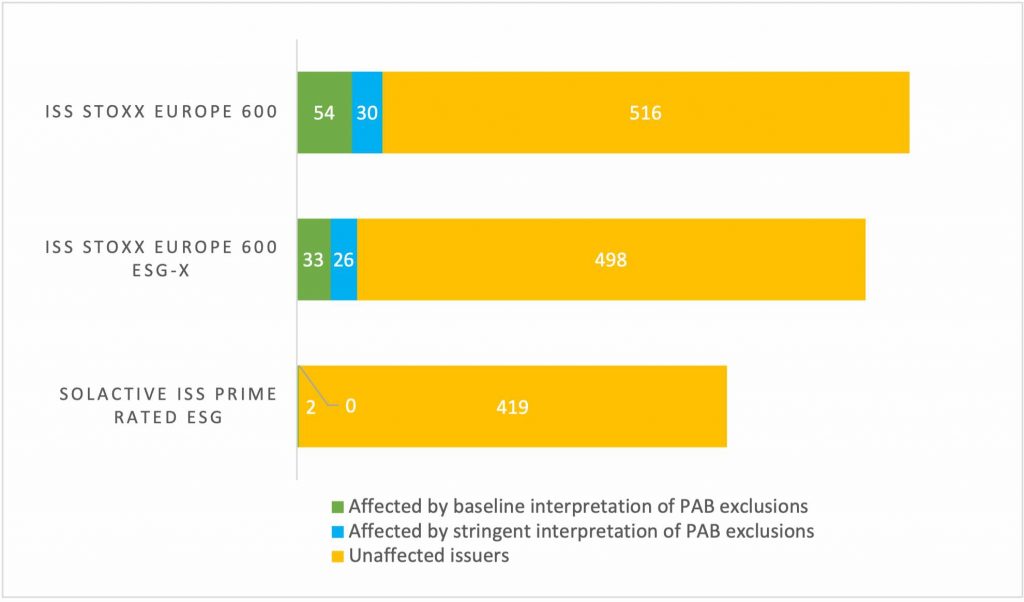

The same exercise was also performed on some significant ESG indices in the market that are used by index tracking funds, accounting for nearly 22 percent of all funds considered relevant for this analysis. For indices with an ESG-tilt in their strategy considered in the analysis (Solactive ISS Prime Rated ESG and ISS STOXX Europe 600 ESG-X), a large portion of constituents is compliant with the baseline and more stringent interpretations of PAB exclusion rules.

Index-tracking funds that rely on indices without such an ESG-tilt would have to strengthen their inclusion thresholds, as evident from ISS STOXX Europe 600. More than 9 percent of ISS STOXX Europe 600 constituents breach PAB exclusion rules, as per the baseline interpretation (Figure 7). Here too, the most impactful criterion is the exclusion of companies involved in fossil fuel-related activities. If companies that provide fossil fuel services are also considered for exclusion, the share of holdings that need to be excluded increases to 14 percent.

Figure 7: Number of Issuers with at Least One Position in Breach of PAB Exclusion Criteria in Indices

Source: ISS ESG

Overall, the impact on indices seems to be limited as compared to funds. It is possible that a few companies, especially in the energy sector, are held across a large section of ESG or sustainability funds. In this context, some issuers and sectors may become subject to divestment from multiple funds because of the implementation of the guidelines as ultimately funds will need to either change their fund names or divest positions that breach applicable exclusion criteria.

How ISS ESG Can Help EU Funds in Meeting These Guidelines

ISS ESG plans to launch a dedicated solution in 2024 to support investors who need to comply with the fund naming guidelines. The new solution will help clients rebalance/reconstruct their fund portfolios in line with the guidelines and meet the reporting obligations for each fund name category.

Explore ISS ESG solutions mentioned in this report:

- Quickly and effectively evaluate & benchmark the ESG performance of equity and bond funds globally using the ISS ESG Fund Rating service.

By:

Ria Modh, Associate, ESG Methodology, ISS ESG

Navaneet Desai, Senior Associate, ESG Regulatory Solutions – Product Manager, ISS ESG

Rupali Goyal, Analyst, ESG Methodology, ISS ESG

Bharat Juyal, Associate, ESG Methodology, ISS ESG