Introduction

Across the globe, sustainable investment products are becoming subject to new naming, labelling, and disclosure rules through which policymakers aim to protect customers and prevent greenwashing.

Following a post on the European Union’s policy measures, this post examines the United Kingdom. The UK Financial Conduct Authority (FCA) published its consultation paper for Sustainability Disclosure Requirements (SDR) and investments labels (CP22/20) in October 2022. This consultation paper followed a discussion paper on the topic published the previous year (DP21/4). The consultation period ended in January and final rules are expected to be set in a Policy Statement released in Q3 2023.

The FCA proposal for SDR contains the following measures:

- Sustainable investment labels, underpinned by qualifying criteria and principles, to help consumers navigate the complex landscape of investment products. Three label categories are proposed: Sustainable Focus, Sustainable Improvers, and Sustainable Impact.

- Naming and marketing restrictions on the use of sustainability-related terms in names of products for retail customers.

- Consumer-facing disclosures that include key sustainability-related features of a product.

- Detailed disclosures targeted at institutional investors and consumers seeking more information, which will be included in pre-contractual, ongoing sustainability-related performance and sustainability entity reports.

- Requirements for distributors to ensure that investment labels and consumer-facing disclosures are communicated to retail investors.

- A general ‘anti‐greenwashing’ rule that reiterates existing rules to clarify that sustainability-related claims must be clear, fair, and not misleading.

The ‘anti-greenwashing’ rule will apply to all FCA-regulated firms and come into effect directly after the Policy Statement’s publication in Q3 of this year. Other elements of the proposal will follow a staggered implementation, potentially starting one year after publication and applying only to investment funds marketed to retail investors in the UK and firms that manage and/or distribute those products. These rules do not currently apply to overseas products nor FCA-regulated asset owners, but these last two elements may be included in the future.

In this piece, the ISS ESG Regulatory Solutions team examines the proposed sustainable investment labels. The Regulatory Solutions team leverages its data specifically to analyse various practical implementation options for the ‘Sustainable Focus’ label. The analysis, which uses the STOXX Europe 600 as an example, shows that, depending on the chosen approach, the share of assets which can be considered sustainable can vary drastically. This finding calls into question the merit of the 70 percent threshold included in the label requirements and underlines some of the market feedback the FCA has received. The piece also discusses how ISS ESG can support investment product providers seeking to adopt these labels.

Sustainable Investment Labels to Help Retail Investors Navigate the Market

To support retail customers in identifying investment products which align with their preferences and to prevent greenwashing, the FCA proposes three sustainable investment labels (Figure 1).

Figure 1: Three Proposed Sustainable Investment Product Labels

Source: FCA

Notably, only products which have a sustainability objective can fall within one of the three categories. Products that use strategies such as ESG integration to account for ESG risks and opportunities that may be material for the future financial performance of investments but that do not have a sustainability objective cannot be classified under any of the below categories.

Sustainable Focus: This label is for products which invest in assets that already comply with sustainability requirements. Assets can either be selected based on a general sustainability standard or in accordance with a specific environmental or social theme.

Sustainable Improvers: This label is for products which invest in assets which may not be sustainable today but aim to improve their sustainability performance over time, including through stewardship activities.

Sustainable Impact: This label is for products which aim to achieve a pre-defined, positive, and measurable environmental and/or social impact, including through investments in solutions to environmental or social challenges in underserved markets.

Testing the Waters: How to Meet the Requirements for the Sustainable Focus Label

For an investment product to be labelled ‘Sustainable Focus,’ at least 70 percent of the product’s assets must meet a ‘credible’ environmental and/or social sustainability standard or align with a specific environmental and/or social sustainability theme. This requirement is reminiscent of the European Securities and Markets Authority (ESMA)’s proposed fund naming rule, whereby funds with the word ’sustainable’ or any derived term in their name must allocate at least 50 percent of their investments to sustainable investments, as defined by article 2(17) of the Sustainable Finance Disclosure Regulation (SFDR).

How one decides if an asset meets a credible standard, aligns with a sustainability theme, or counts towards the sustainable investment share is largely down to the product provider’s interpretation. The practical implications of following different interpretations are highlighted in the below analysis, using the STOXX Europe 600 as an example.

Meeting a Credible Sustainability Standard

The FCA notes that – once developed – the UK Green Taxonomy could be a credible standard to draw on. At this point, however, the regulator does not prescribe any particular standard but simply requires that the chosen standard be “robust, independently assessed, evidence-based and transparent.”

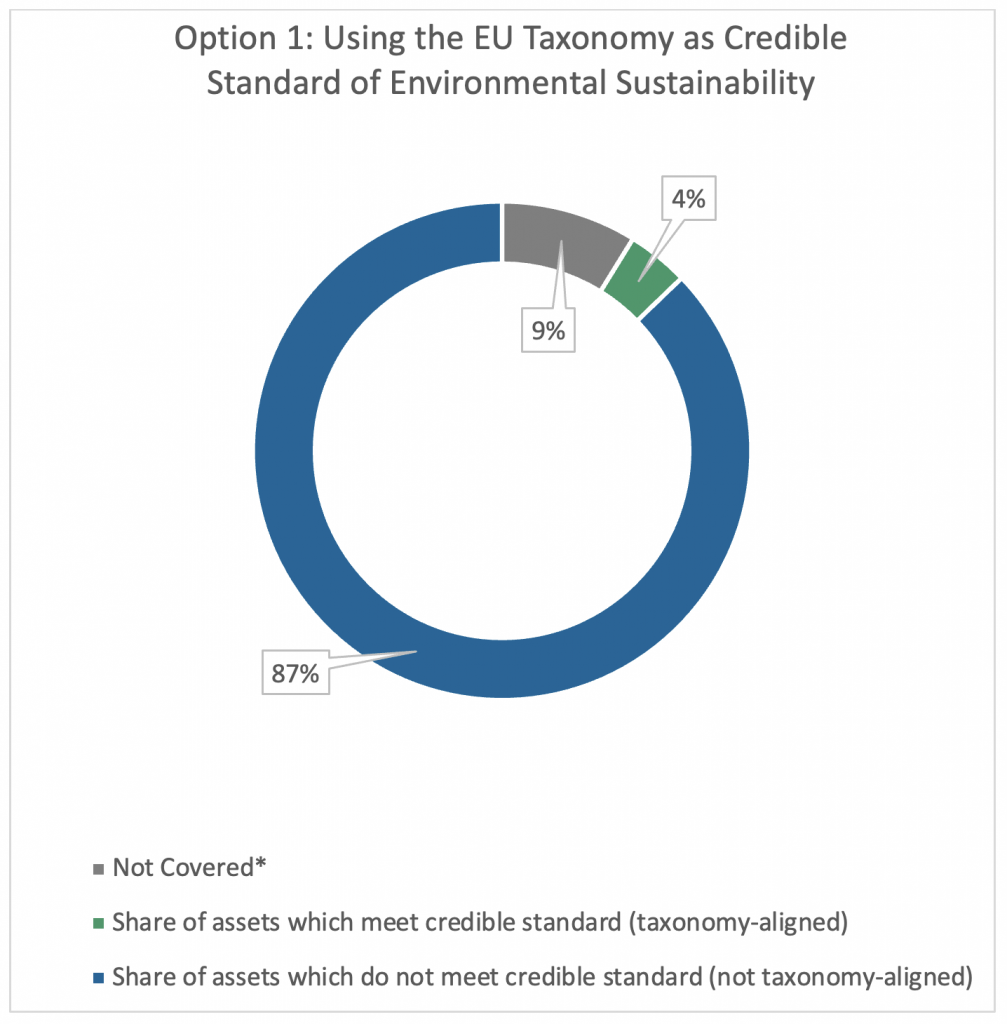

An option for product providers seeking to obtain the ‘Sustainable Focus’ label would be to use the EU Taxonomy. Using data on taxonomy-aligned revenue shares from ISS ESG’s EU Taxonomy Alignment Solution for the STOXX Europe 600, however, reveals that alignment with the EU Taxonomy lies at only 4 percent. Thus, drawing on a standard such as the EU Taxonomy which is (still) relatively narrow in scope but at the same time comprises complex requirements will make it difficult to achieve the 70 percent threshold.

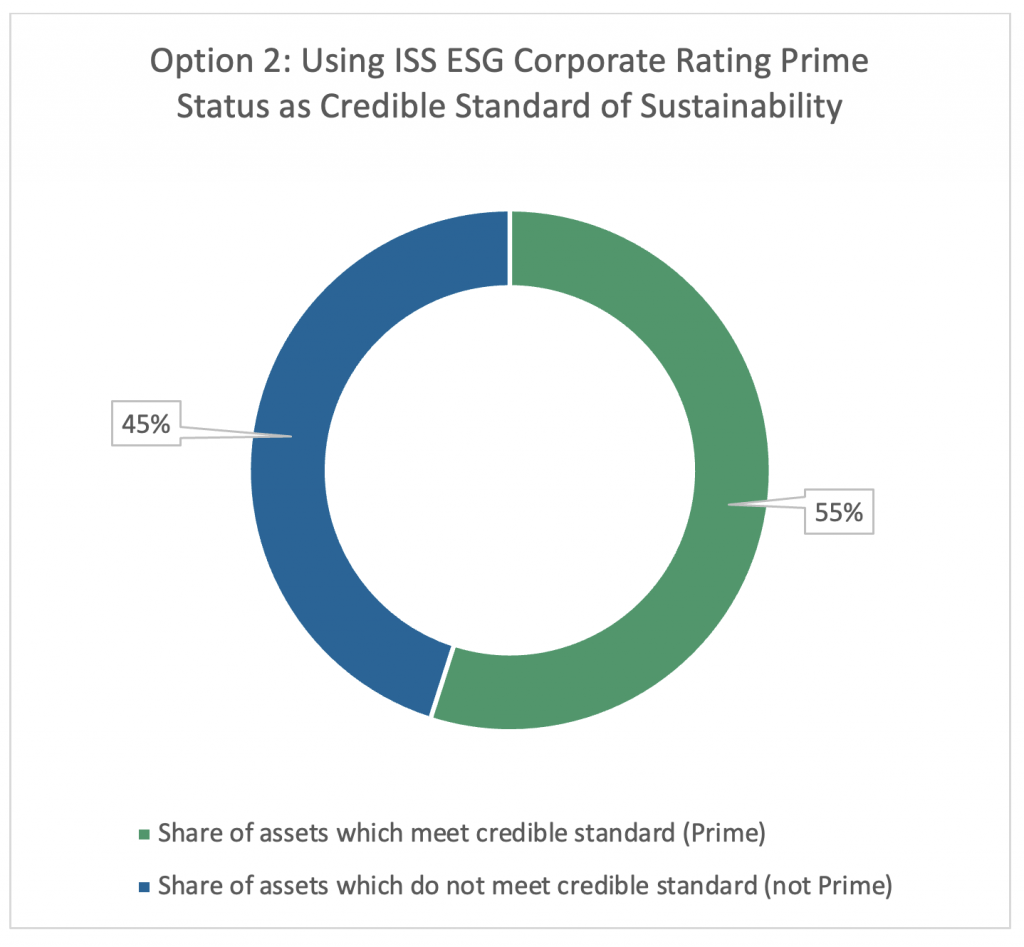

In contrast, the ISS ESG Corporate Rating’s Prime Status is a more holistic measurement of sustainability performance. The ISS ESG Corporate Rating gives Prime Status to companies with leading performance on managing industry-specific ESG risks and seizing opportunities offered by transformations towards sustainable development. If one uses the ISS ESG Corporate Rating Prime Status as evidence of meeting a credible sustainability standard while also removing companies which are identified by ISS ESG Norm-Based Research as failing to respect OECD Guidelines for Multi-National Enterprises, 55 percent of the STOXX Europe 600 can be considered aligned.

Figure 2: Different Approaches to Identifying Assets Which Meet a Credible Standard of Environmental and/or Social Sustainability

*Financial companies are not yet required to report their alignment with the EU Taxonomy and are not covered by ISS ESG’s modelled data; hence, these show as not covered for Option 1.

Source: ISS ESG

Aligning with an Environmental or Social Sustainability Theme

The proposed labelling scheme does not further define what themes may be used or how to measure alignment with a sustainability theme.

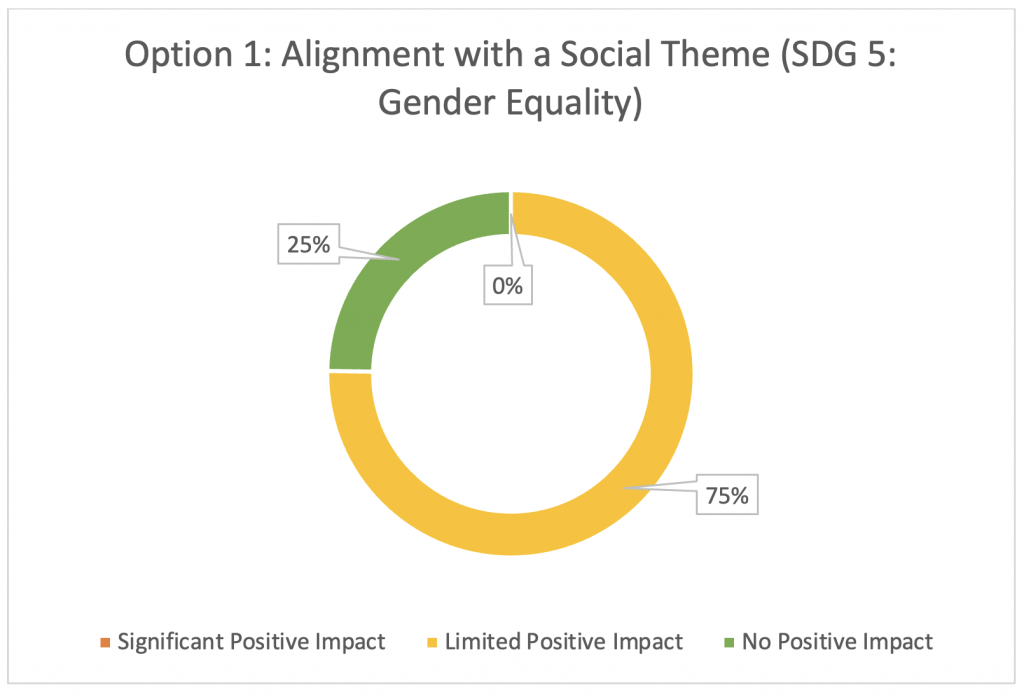

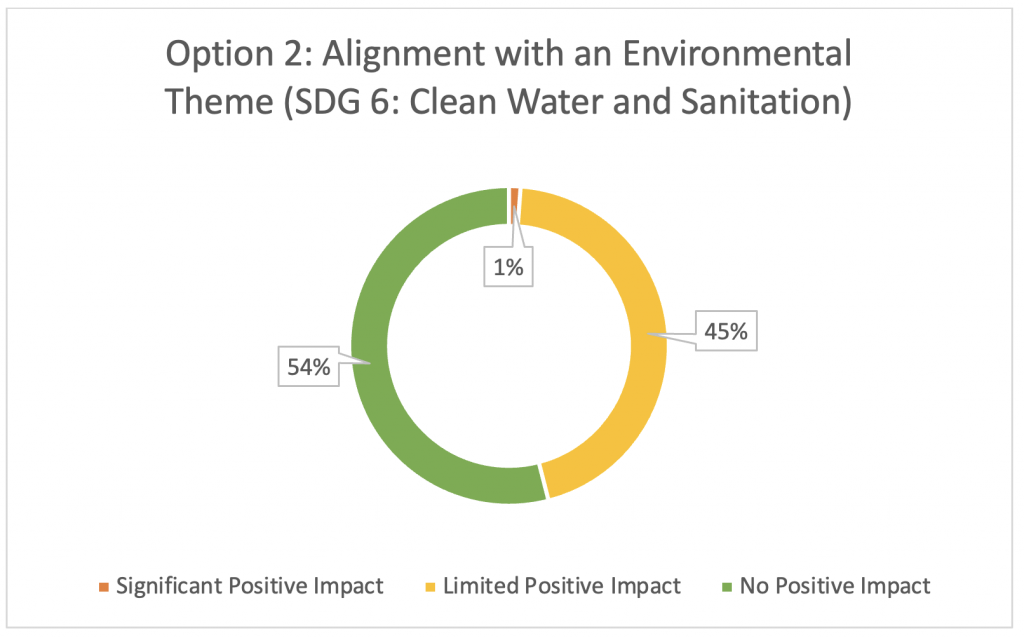

A commonly used thematic framework is the United Nations Sustainable Development Goals (SDGs). ISS ESG’s SDG Impact Rating provides a holistic assessment of companies’ impact on the SDGs.

Using SDG 5 (Gender Equality) and SDG 6 (Clean Water and Sanitation) as examples, an analysis of the STOXX Europe 600 shows that very few companies (0 and 1 percent, respectively) are classified as having a significant positive impact on the selected SDGs. If these companies are combined with companies that have a limited positive impact, a much larger share of the index (75 and 46 percent, respectively) can be considered aligned with the chosen themes (Figure 3).

Figure 3: Assessing Alignment with Environmental or Social Sustainability Themes Using the ISS ESG SDG Impact Rating

Source: ISS ESG

The analysis shows that the proposed ‘Sustainable Focus’ label leaves room for interpretation to the asset manager. If the threshold of 70 percent of assets meeting the chosen credible standard or aligning with a sustainability theme is maintained in the final Policy Statement, however, some interpretations will be more viable than others. Product providers opting for a credible standard with a narrow scope or an ambitious interpretation of sustainability may find it difficult to achieve the threshold.

Possible Future Directions for FCA Final Rule

With its SDR and investment labels, the UK is developing a disclosure and classification regime comparable in scope to the European Union’s Sustainable Finance Disclosure Regulation. Being the second mover in this field, the FCA can build on some lessons from the EU. In contrast to the SFDR, the SDR’s proposed classification and labelling regime more clearly separates disclosures from labels and introduces product categories, which more explicitly address different investment approaches, including transition finance and impact investing.

The analysis presented here, however, shows that the SDR’s ‘Sustainable Focus’ label, in its current state, presents a similar challenge as SFDR and ESMA’s proposed naming rules. As previously discussed for the EU case, both classifications attempt to combine a quantitative threshold for asset allocation with a definition that is open to interpretation by product providers. Such a definition can incentivize the use of more permissive interpretations over others.

Not prescribing any particular ‘credible standard of sustainability’ or pre-defined methodology for assessing alignment with an environmental or social theme risks a variety of approaches emerging in the market, limiting the comparability of reported asset allocation shares, and leaving it to investors to decide for themselves which approaches align with their preferences. A more prescriptive approach, however, may preclude effective approaches to sustainable investment from obtaining the label and may restrict the room for innovation.

These challenges in determining sustainability have attracted attention from the UK Treasury Sub-Committee on Financial Services Regulations, which is tasked with scrutinizing draft financial services regulation.

The Sub-Committee’s crucial concern was that the Sustainable Disclosure Requirements, as written, risk limiting UK investors’ choices. The disclosure requirements pose such a risk, because of similar challenges to those involved in applying the Sustainable Focus label. By the FCA’s own account, as many as one-third of funds currently claiming to be sustainable would no longer qualify for a sustainable label. A further third may decide not to use the label. During a Sub-Committee evidence session, the FCA conceded that it had not conducted analysis of the proposal costs borne by retail consumers. This issue may have contributed to the delay of the FCA Policy Statement until Q3 2023. The effective dates for the final regulation will be adjusted accordingly.

The FCA notes that its mission is investor protection but that it “recognizes and takes account” of any practical challenges the in-scope firms may face. As such, it is looking to refine some of the specific criteria for the labels and clarify how different products, asset classes, and strategies can qualify for a label. The FCA also notes that the final Policy Statement will clarify that “primary and secondary channels for achieving sustainability outcomes are not prescribed, and that [the FCA does] not require independent verification of product categorisation to qualify for a label.”

As it pursues further changes to the proposed labeling regime, the FCA is likely, given the responses to CP22/20, to closely examine the following areas:

- To what degree to permit/restrict the use of certain terms, such as ESG-related terminology, in fund names and marketing materials

- Whether to defer to other regulatory frameworks for overseas funds marketed in the UK

- Accommodating funds that invest in a blend of Sustainable Improver and Sustainable Focus assets

- Moving away from a focus on asset-level requirements to portfolio-level outcomes, especially given index investing

- Clarification or elimination of the requirement for products with a sustainable focus label to demonstrate “continuous improvement” through stewardship of the product’s environmental and/or social sustainability

- Potential guidance on KPI impact measurement, including well-recognized KPI metrics based on best industry standards

- Whether to require firms to disclose “unexpected investments” and, if so, then how

- Clarification on alignment with the UK Green Taxonomy, the Transition Plan Taskforce (TPT), and ISSB disclosure regimes

- Extension of the implementation timeline for the labeling regime, potentially into 2025

Implications for Investors

Further refinements of the FCA’s SDR regime are expected. While investors and investment product providers wait for the final regulations, ISS ESG can assist them in navigating the present sustainable investment labels.

Product providers seeking to label their investment products as ‘Sustainable Focus’ can leverage ISS ESG data to identify issuers that meet a credible standard of sustainability or align with an environmental and/or social theme. They can do so, among other approaches, in the following ways:

- Use ISS ESG Corporate Rating Scores to select companies with high absolute ESG performance

- Identify assets aligned with the EU Taxonomy using data from ISS ESG’s EU Taxonomy Alignment Solution

- Leverage ISS ESG’s SDG Solutions Assessment or SDG Impact Rating to identify companies which positively impact the Sustainable Development Goals (SDGs)

To qualify for the ‘Sustainable Improvers’ label, product providers will need to identify issuers with credible transition strategies and track their progress against chosen Key Performance Indicators (KPIs). ISS ESG can support this process in various ways:

- Product providers can leverage ISS ESG data on companies’ environmental and social targets, as well as their transition strategies, to select suitable assets.

- They can rely on ISS ESG’s engagement services to facilitate stewardship activities and accelerate improvements in the environmental and/or social performance of assets.

- They can track performance of investments against ESG KPIs using ISS ESG’s performance data.

Products in the ‘Sustainable Impact’ label category will need to identify opportunities to invest in relevant solutions as well as measure and track their impact. ISS ESG’s offering can support product providers in the following way:

- ISS ESG’s SDG Solutions Assessment identifies companies offering solutions that help tackle global environmental and social challenges.

- ISS ESG’s Alternative Research can help investors to evaluate and quantify the impact of their listed and/or non-listed investments.

ISS ESG’s Regulatory Solutions team continues to monitor the evolution of the UK’s sustainable finance regulation and is committed to supporting financial market participants active in the UK in navigating the emerging regulatory regime.

Explore ISS ESG solutions mentioned in this report:

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

Authored by:

Ronja Wöstheinrich, ESG Methodology Lead – Regulatory Solutions & Fixed Income, ISS ESG

Mathilde Krief, Team Lead of ESG Regulatory Solutions – Product Manager, ISS ESG

Karina Karakulova, Head, Regulatory Affairs, ISS