Assessing the Risk of Labor Rights Violations: Data Gaps in the Status Quo

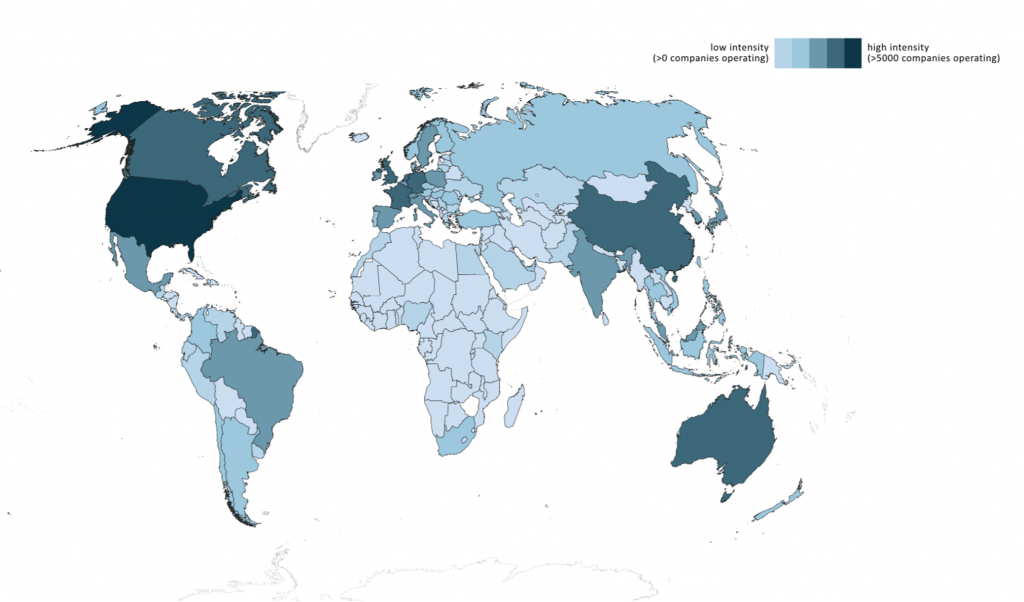

Data is supposedly the new gold. Traditional ESG products that focus primarily on listed corporates continue to leave broad empty spaces on the world map, however, while ESG products concentrating on private equity and alternative assets are still too niche to be able to fill the gaps. Figure 1 (below) demonstrates this by showing the geographical distribution of corporates covered by the ISS ESG Corporate Rating.

Figure 1: Geographical coverage of the Corporate Rating universe, by country of operation

Source: ISS ESG, 2022

Note: Data as of 6 April 2022; the darker the color, the higher the coverage of corporates

Large parts of the world remain blank, simply due to a lack of data. Other factors also contribute to this lack of coverage, however. Global supply chains are often incredibly complex, frequently involving small-scale businesses located in countries in which listed companies are rare. Additionally, the Russian invasion of Ukraine has very recently highlighted once again the importance of factoring in global macro political risks. Investors looking to diversify their portfolios beyond listed equities, as well as investors wanting to take a deeper look into specific country risk, quickly reach the limits of traditionally corporate-focused ESG products.

This paper demonstrates how a country risk analysis using the ISS ESG Country Rating presents a new opportunity for investors to assess prevalent ESG risks – for example labor rights violations – along a company’s supply chain.

Opaque Supply Chains Bearing ESG Risks

The ILO estimated in 2017 that around 25 million people globally are working under forced labor conditions, while around 152 million children are involved in child labor. The COVID-19 pandemic has only exacerbated this situation, plunging millions of vulnerable workers worldwide into poverty, reinforcing existing power asymmetries in global supply chains. The private sector is increasingly under pressure to address labor rights violations along its supply chains, as has again been highlighted during the public discussion of forced labor in the Chinese province of Xinjiang.

More and more developing countries are becoming major economic hubs that receive a considerable flow of foreign direct investment and form important nodes in the global supply chain. While it is not news that many consumer goods are sourced from South-East Asia, the manufacturing sector in Africa has also grown consistently in recent decades. On the one hand, these developments provide opportunities for growth and open interesting new investment opportunities for investors. On the other hand, responsible investors need to pay close attention to specific country risks.

Many countries in these blank spaces are notorious for their poor track record on labor rights. For example, in the Democratic Republic of Congo – which produces a large share of the world’s cobalt, a key component of lithium-ion batteries —government and corporate enforcement of labor laws is lacking. The mining industry is especially prone to forced labor and child labor conditions, and workers frequently work long hours without any protective equipment in a polluted environment. Similarly bauxite, another key component of the automobile industry, is largely exported from Guinea where mines allegedly not only employ child workers but also do considerably harm to the environment in the absence of proper management systems. Several major chocolate brands are facing a lawsuit in the US over exploitation of cocoa workers in Cote d’Ivoire. Cocoa farming is also prominent in countries such as Ghana, Nigeria, and Cameroon, all of which have a poor ESG track record, particularly in terms of labor and human rights violations. None of these geographics are covered properly by traditional ESG products focused on listed corporates.

As traditional ESG products leave such large data gaps in their analyses, it is imperative for responsible investors to find new data sets that can bridge these gaps. ISS ESG Country Ratings and Country Controversy Assessments are well positioned to create such proxies to assist investors conduct material and holistic country risk assessments.

Fill in the Blanks with a Country Risks Assessment

The ISS ESG Country Rating provides a highly relevant and material assessment of a country’s environmental, social, and governance performance. Since February 2022 the Country Ratings have covered 179 countries and sovereign issuers, including Hong Kong, Taiwan, and the European Union – a truly global coverage. The Rating includes two labor-relevant topics, one relating to general labor rights such as freedom from forced labor or child labor, and the other covering the provision of good working conditions such as decent working hours and a decent minimum wage, as well as enforcement of health and safety regulations.

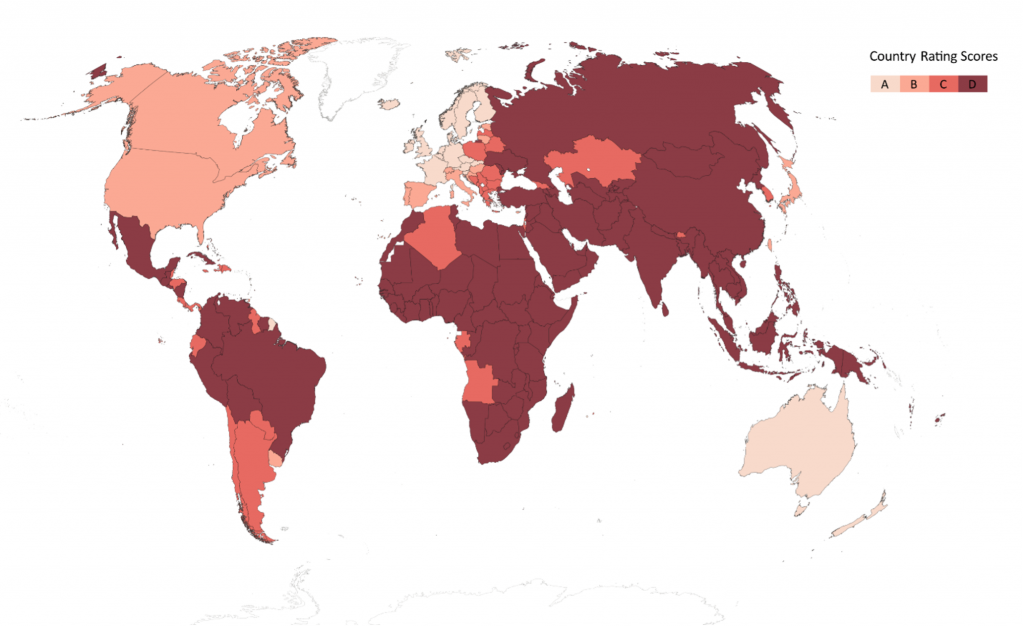

Figure 2: Poor labor rights are still the global norm rather than the exception

Source: ISS ESG

Note: Measured using the ISS ESG Country Rating grade for the labor rights topic on a scale of A (best) to D (worst).

As is evident from Figure 2, countries with labor rights risks are the norm and not the exception. Responsible investors can use this information to identify countries in which more stringent human or labor rights due diligence beyond Tier 1 suppliers should be required to ensure the well-being and safety of workers.

It is widely known how poorly managed or monitored supply chains can become real business risks. Therefore, assessing location-based risks is an important tool for investors examining existing ESG risks. The global coverage of the ISS ESG Country Rating is ideally positioned to assist investors in this endeavor.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By Janina Magdanz, Lead Analyst Country Ratings, ISS ESG. Punkhuri Kumar, Analyst Country Ratings, ISS ESG.