The Russian invasion of Ukraine is shaking the world. While the investment community is mainly discussing the direct fallout from sanctions for commodity markets and the implications for global supply chains, the crisis also points to a crucial moment for the assessment of global macro risks.

In the Russian case this relates both to sovereign and country risk. While the former aims to capture a government’s ability to repay its debt, the concept of country risk encapsulates the challenges associated with financing and conducting business in a given country.

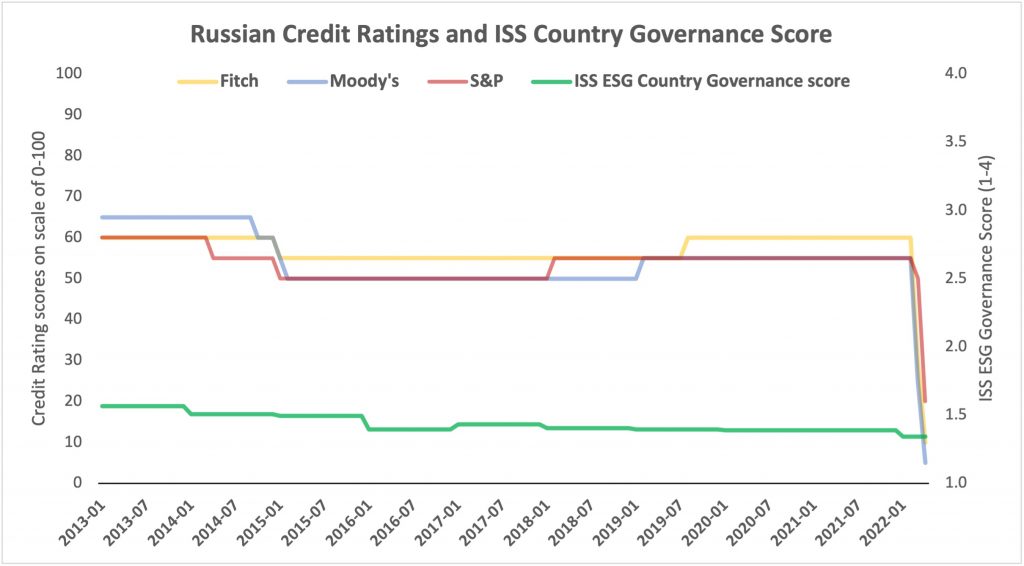

Russia attempted to meet its foreign bond obligations on March 17, but it was uncertain whether sanctions allowed the interest payments to be passed on to bondholders. The methodologies of credit rating agencies appeared to be insufficiently prepared for a rapid sanction-induced cut in Russia’s ability to repay its debt, as the currency reserves and strong government finance fundamentals suggested a medium risk only.

Source: Fitch, Moody’s, S&P, ISS ESG, 2022

Since the likely Russian default is tied to the sanctions and not to Russia’s inability to acquire sufficient resources to meet obligations, factors such as governance conditions, the rule of law, respect for human rights, and political stability appear to have been underrepresented in mainstream financial ratings. Though credit rating agencies had revised their opinion on Russia somewhat following the annexation of Crimea in early 2014, all major agencies allowed for upgrades to Russia’s long-term credit rating afterward. Have the agencies missed a macro-political black swan?

At the very least, political and governance risks do not seem to be captured too well. ISS ESG’s Country Rating score on Russian governance performance had been continuously low and declining well before the conflict turned into a full-scale war. The overall Governance score includes 37 quantitative and qualitative assessments covering, inter alia, the following topics:

| ISS ESG Country Rating Topic | Russian Federation | United States of America | European Union |

| Political System | D- | B- | A- |

| Conflicts & Armaments | D- | D+ | B- |

| Human Rights and Fundamental Freedoms | D | C+ | B+ |

Source: ISS ESG 2022; Scale from A+ (best) to D- (worst)

The Ukraine crisis also highlighted the linkages between sovereign risk and broader country risk. Russia had to introduce capital controls, various exchanges suspended trade in Russian stocks, and international companies queued up to withdraw from Russian operations across all sectors, with their revenues taking a consequential hit. Investors have written off large numbers on Russian exposure.

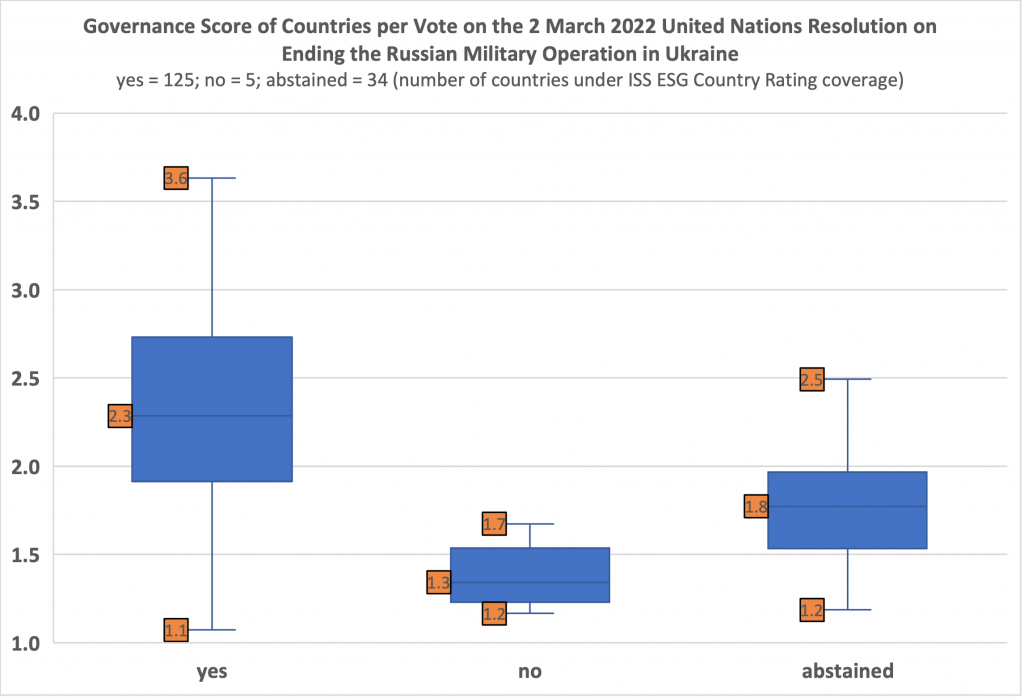

As parallels have already been drawn with China, and also business with and in authoritarian regimes, there is likely to be greater attention paid in the future to capturing macro-political risks. This may hold especially true if the world economy is split again into two camps. There is a difference between the ‘free’ and ‘non-free’ worlds in terms of governance metrics, as can be shown by the following box plots on ISS ESG’s Country Governance scores, grouped by their respective votes in the United Nations General Assembly on the recent Russian aggression.

Source: UN, ISS ESG Country Ratings data

While only a few nations voted directly against condemning Russia’s aggression, a sizeable number of countries abstained, including large economies such as China and India. While the camp voting to end the war on Ukraine is diverse, ranging from established democracies to war-torn failed states, the abstaining side by and large performs less well on governance indicators.

Incorporating factors such as democracy, the rule of law, government accountability, human rights, discrimination, military expenditures, and assessment of conflict involvement, may have tempered some investor losses in Russia, and at the same time made for more ethical portfolios, not only in Russia but globally.

While financial rating agencies may have undervalued the financial materiality of political concerns and governance factors, investors can hardly claim they did not know what they were funding. Even Russian bond issuance prospectuses pointed to the “material adverse impact” of geopolitical risks, as described by Bloomberg. In future, investors valuing the debt of countries with problematic international reputations would be well served by looking at the issue through a macro-political risk lens.

Explore ISS ESG solutions mentioned in this report:

- Extend your ESG policies to your fixed income portfolio with the ISS ESG Country Rating and the ISS ESG Country Controversy Assessments.

By Hendrik Leue, Head of Bespoke Research & Advisory Solutions, ISS ESG. Janina Magdanz, Lead Analyst Country Ratings, ISS ESG.