This week FC Market Insights looked at the rise in inflows to small-cap US equity funds among UK investors:

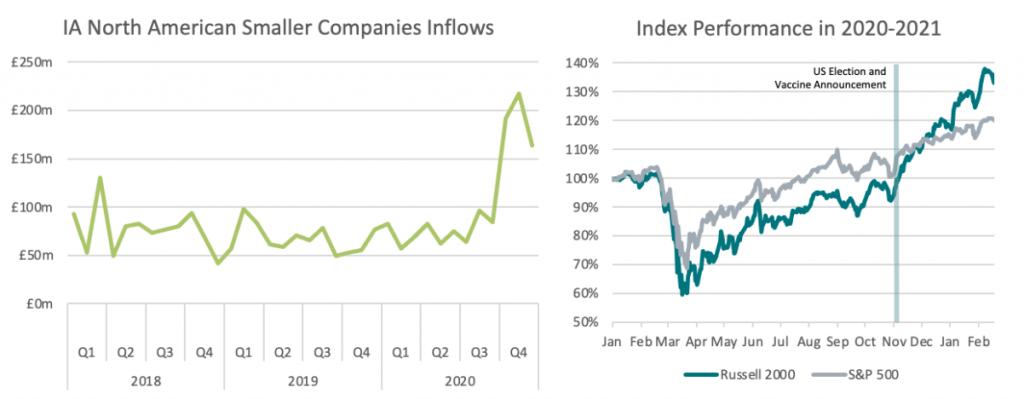

Historically, portfolios of stocks with small market capitalisations outperform portfolios of large-cap stocks. However, the last decade has proven to be an exception to this rule. The well-documented underperformance of small-cap stocks in recent years, particularly in the US, goes a long way in explaining why IA North American Smaller Companies is one of the most unloved fund sectors among UK investors. Monthly retail inflows to the sector in 2019 fell slightly from the previous year and hovered around the £70m mark.

During the market turmoil in March last year, small-cap companies fared much worse than their large-cap counterparts. The Russell 2000, an index of US small-caps which acts as a benchmark for the performance of smaller public companies, fell by 42%. Meanwhile, the S&P 500 which is comprised of only the biggest listed US companies fell by 33% and rebounded a lot sooner than the Russell 2000. There is a multitude of reasons why the recovery of smaller stocks lagged behind that of big multinationals in the six months following March’s sell-off. So-called blue chips tend to have a bigger presence overseas, heftier balance sheets and a strong ability to raise capital quickly.

October brought good news for the demand for smaller stocks in the form of favourable election polls for Democrats. As a Biden White House and blue senate became the most probable outcome, more government spending in the form of new stimulus measures was forecasted by many. Inflows to US small-cap funds from UK investors increased by over 125% in October in anticipation of the election results. The news of Biden’s victory was followed swiftly by the news of highly effective Covid-19 vaccines. Stocks markets responded emphatically. Cyclical stocks, ones that are correlated highly with the broader health of the economy, outpaced the market in response to the news. These stocks account for a large portion of the stocks within the Russell 2000 and contribute significantly to the index’s outperformance in the months following the November election. UK investors continued to move money into US small-cap funds as inflows to the sector ballooned to £570m in Q4, a 180% increase relative to the average monthly inflows seen in 2019. As the Biden administration focusses both on the vaccine rollout and on re-energising the US economy, it will be interesting to see how these smaller stocks perform. One big question will be if they can convince the sceptics that the small-cap effect is still profitable today.

For More Information Contact: ISS MI Financial Clarity at sales@financial-clarity.com

By ISS MI Financial Clarity Team