While the general public inched toward a post-pandemic normal in 2021, U.S. fund investors pushed full steam ahead. Sales surged—long-term flows crossed the $1-trillion mark for the first time—and markets soared, driving assets under management (AUM) zoomed from $23.5 trillion to nearly $28 trillion.

The year capped a half-decade of well-above average returns: Long-term AUM averaged 13% per year from 2017 through 2021—twice the 21st century’s average annual growth rate.

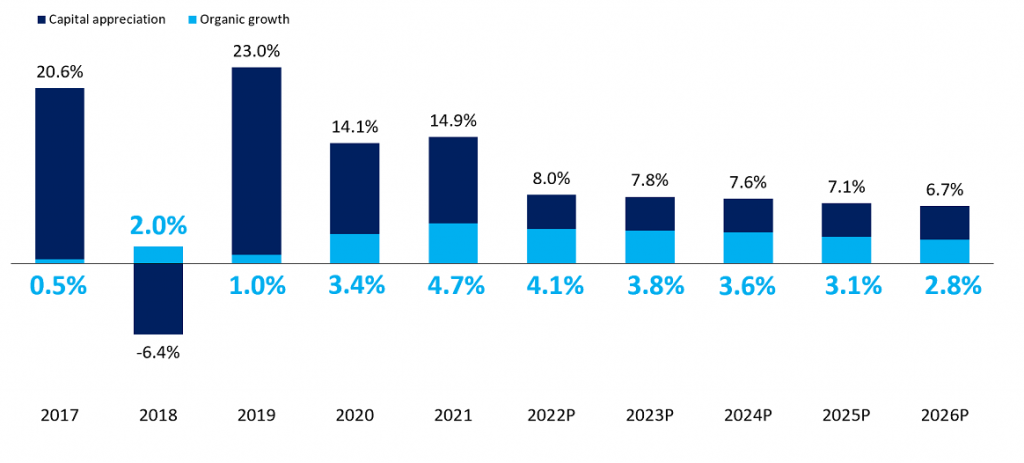

Growth is likely to slow, however, as markets deliver smaller gains (Figure 1 below). Meanwhile, shifts in technology, investor demand, and distribution will force managers to rethink how they manage assets. With these challenges will come opportunity, however. Demand should remain relatively strong. And interest in products like active ETFs will provide managers new ways to distribute their investment capabilities. Even with decelerating growth over the next half decade, ISS Market Intelligence’s State of the Market: Future of Retail Products Report estimates long-term AUM will be approximately $11 trillion higher, reaching nearly $39 trillion in 2026. What do these dynamics mean for asset managers? Here are some key takeaways, drawn from our live February 2nd webinar Five Things You Need to Know for the Next Five Years: A Look Ahead for U.S. Fund Managers.

Do not expect markets to do the heavy lifting

Since 2017, two U.S. managers—Vanguard and BlackRock—have won 85 cents of every dollar in net new sales according to Simfund data. Many rivals were starved for sales: 10 of the 20 largest managers suffered net outflows. These firms were not necessarily starved for AUM growth, though, because markets rose sharply.

Figure 1: Tepid Markets Drive Down Long-Term AUM Growth, Organic Growth More Important Driver Long-term asset growth and organic growth, 2017-2026P

With weaker markets likely over the next half decade, about 40% of expected AUM growth will come from flows. While potential trouble for managers with weak organic growth, those with the right product and distribution mix should not lack opportunity. U.S. households remain flush with cash, and tight labor markets and higher income should keep the reservoir that helped fund 2021’s sales boom far from running dry. An estimated $5.4 trillion will flow into long-term funds over the next half decade.

The future of the ETF is bright, but the mutual fund remains a force—for now.

Many obituaries have been written for the mutual fund, but fund buyers, but even with declining market share, the vehicle will still represent an estimated two-thirds of long-term assets in 2026.

Financial advisors, especially in the broker and bank channels, still see the mutual fund as relevant for active management and risk control. “I like the active management and the diversification that comes with open-end mutual funds,” one advisor wrote in a survey conducted by ISS MI division Market Metrics. However, when we asked to name their vehicle of choice if the same strategy was available through a mutual fund, ETF, or SMA, nearly 50% of surveyed advisors named the ETF as their top choice.

The opportunity set is rarely the same, though. While fund managers have launched active ETFs at breakneck speed, much of the money management infrastructure remains built around mutual funds. Many advisors still rely on fund-heavy platforms or advise clients with fund-only defined contribution plans, for instance. As barriers to distribution fall, expect active ETFs to gain steam.

Active ETFs may live up to the hype but know your odds of success.

Managers are betting active ETFs will rev their growth engines. Our outlook offers reason for optimism: We estimate they will generate around $590 billion in net sales through 2026—an organic growth rate of 9% a year. And their future growth runway is long: Despite more than doubling over the period, active ETFs will represent a still-small 2.5% share of long-term assets.

No wonder active ETFs have dominated managers’ product development efforts. ETF launches shattered previous records in 2021, and a majority were actively managed. If history is any guide, most will fail to reach meaningful scale, especially outside of fixed income. Just 44% of U.S. equity funds launched in 2018 reached $100 million in assets by 2021, while just 21% of alternatives funds did.

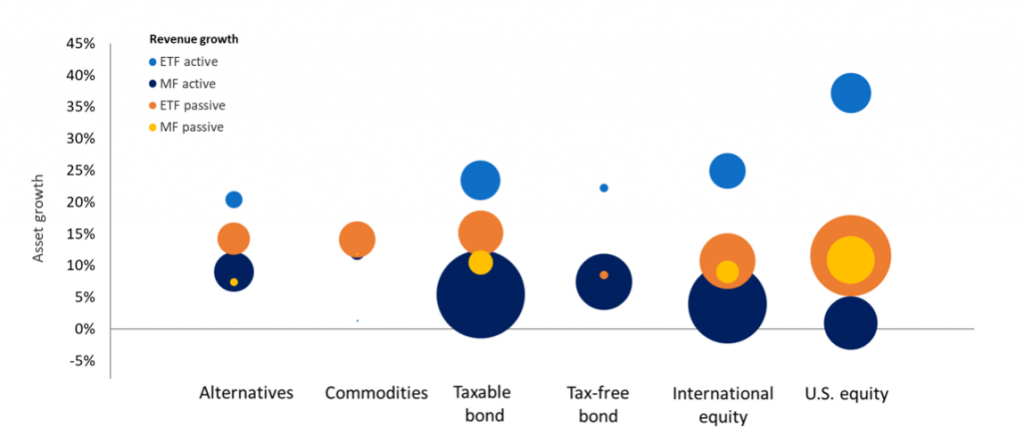

Asset growth and revenue growth aren’t the same thing

Managers care about asset growth because their business models are built on AUM-based fees. With index funds growing assets more quickly, the AUM lens gives active mangers more reason to worry. But revenues are based on assets and fees. And active funds can charge much more than passive ones. This premium means active funds don’t need as much asset growth to generate as much in revenues. What they lack in volume, they can make up on price.

Figure 2: Slower AUM Growers Still Revenue Powerhouses Projected asset growth and long-term revenue growth, 2022-2026

Source: Calculations based on ISS MI Simfund data

Thanks to higher expense ratios, the average actively invested dollar generated 4.5 times more revenues than a dollar invested in index funds. This active price premium, which has grown from 3.5 times in 2012, explains why despite accounting for just a third of the industry’s asset growth over the next five years, we estimate active funds will generate about 60% of its revenue growth. Active fixed income and international equity managers will garner an outsized share, and even with a fraction of the assets, active U.S. equity ETFs will generate just as much in revenue growth as active U.S. equity mutual funds (Figure 2).

Prepare for asset-less asset management

One major reason asset managers have bundled the “software” of the investment portfolio’s code with the “hardware” of the mutual fund or ETFs is because it has been both cost prohibitive and logistically daunting to invest in large numbers of securities directly. Automated trading technology and the emergence of commission-free brokerage platforms increasingly will unbundle execution from the investment product, enabling a mass audience to customize their portfolios to their specific needs. As managers market their capabilities alone, the hardware that turns investment selection into reality will move to intermediaries. Instead of holding a mix of funds, investors will access a portfolio of asset management services, much as a company today might license different software providers like Salesforce, Zoom, and Workday to power different business functions.

The customization wave probably happens over years or decades. The fund structure is unlikely to disappear altogether; some strategies will be too complex or impractical to execute outside it. For the foreseeable future, funds and customizable solutions will co-exist. Investment managers will need to be able to meet investor needs in different ways at the same time—through funds and ETFs, SMAs, model portfolios, or other tools. Regardless of the means, though, the purpose of asset managers will not change. Investors will still need their capabilities to meet their financial goals

A recording of the February 2nd webinar is available for on-demand access.

Simfund Enterprise subscribers can access the State of the Market: Future of Retail Products Report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence