ISS Market Intelligence has released the latest edition in the Windows into Defined Contribution series. The Q4 2022 edition examines the latest data on defined contribution (DC) plans released by the Department of Labor (DOL) and discusses what the recent market environment may hold for the near-term future of the retirement space.

Defined contribution plans in 2021 continued their positive upswing from the depths of the pandemic-induced downturn. The latest data on DC plans released by the DOL and collected by ISS MI BrightScope shows assets reaching record levels on the backs of rebounding capital markets and healthy labor markets driving contributions from employers and employees. The sustained recovery masked weakness seen elsewhere in the data, which depict outflows from DC plans gaining speed. The impact from 2022’s volatility is not yet clear, but the one-two punch of faltering markets and rising redemptions have brought the risks faced by DC plan providers into sharp relief. Economic uncertainty and demographics point to further challenges ahead.

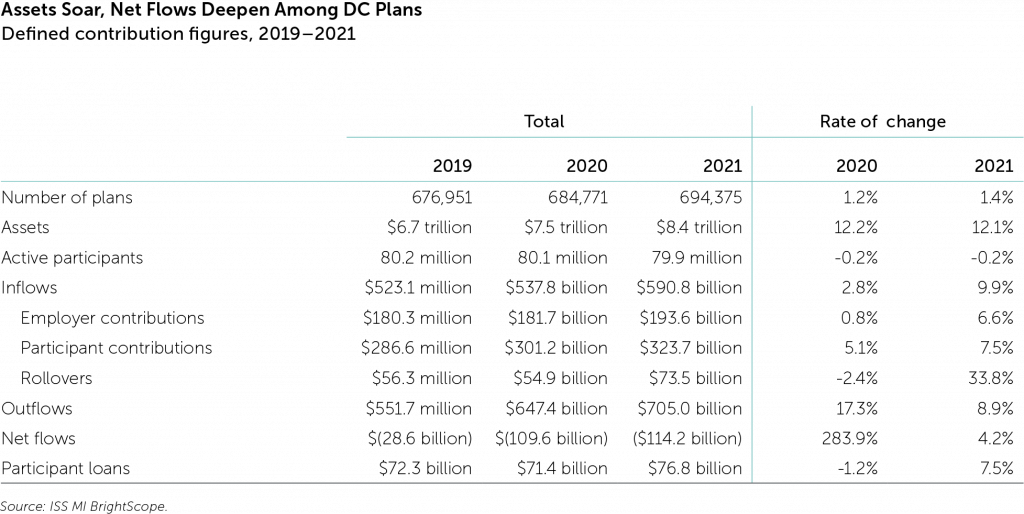

The latest batch of Form 5500 data released by the DOL shows DC assets reaching new highs in 2021. Assets in the nearly 700,000 plans tracked by ISS MI BrightScope reached $8.4 trillion at the end of 2021, up from $7.5 trillion a year earlier. Assets climbed 12% in both years, in large part thanks to strong public market returns. Without the boost from markets, DC plans would have delivered weaker growth. The table below lists key data points for defined contribution plans from 2019 through 2021. Even as participant and employer contribution rates grew, net outflows have reached new highs and put persistent pressure on plans.

One strong suit reflected in the data—the healthy state of the U.S. labor market—persisted into 2022. While growth in the number of retirement plans offered was more muted, with the total increasing by only 1.4%, increases in contributions were much more substantial. Even under the strain of 2020, contributions to retirement plans had held up and been able to record minor positive growth. Improvements in job markets and general financial conditions in 2021 translated to accelerating contributions. Inflows overall grew by 9.9% from the prior year, totaling $590.8 billion. These numbers reflected stable positions on both the firm and worker sides, with employer and participant contributions growing significantly. The U.S. labor market also recorded extensive turnover as quit rates reached historic highs during “The Great Resignation.” This activity could be seen within DC plans based on the increases in rollovers, which recorded a rare decline in 2020 but witnessed a considerable resurgence in 2021, growing by 33.8%.

While gross contributions were propelled by healthy macroeconomic conditions, redemptions also surged amid demographic pressures. After increasing by nearly $100 billion in 2020, gross outflows increased a further $50 billion across 2021 to reach $705.0 billion. This activity again outpaced growth in total contributions. Net outflows crossed $100 billion in 2020 and continued that elevated level at $114.2 billion in 2021. The pull of demographics, reflected in the steady decline in the number of active participants, has weighed on net demand in retirement plans and is likely to do so throughout the near future.

The full report is available to Simfund Enterprise subscribers for access on the Simfund research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence