The solar energy sector has seen a dramatic expansion over the last decade, with an annual growth in solar photovoltaic (PV) power generation of 26% in 2022. By the end of 2022, the global renewable energy capacity stood at 3372 gigawatts. More than 80% of the capacity addition in the energy sector that year was accounted for by renewable energy, with solar and wind power accounting for almost the entire renewable capacity addition. The increase in solar power was largely the result of increased solar PV power.

While solar PV energy offers the promise of mitigating climate change, it also raises social concerns. Solar energy specifically raises concerns about the risk of forced labor entering into its supply chain.

Every stage of the solar supply chain sees a substantially large contribution coming from China, most of it from the Xinjiang Uyghur Autonomous Region (XUAR). XUAR is home to the Uyghurs, a Muslim ethnic minority numbering more than 10 million. The region also has been allegedly linked to forced labor. The workers in XUAR are reportedly engaged in the manufacturing of a wide spectrum of products, ranging from garments to machinery, for minimal or no pay.

Solar PV Power’s Concentrated Supply-Chain

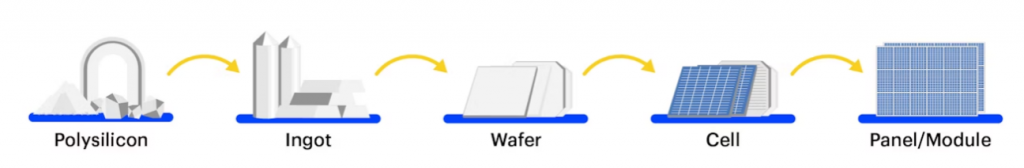

The production of solar PV power begins with energy-intensive processes to vaporize metal silicon, which is further cooled down into crystalline silicon. This polysilicon is a crucial building material, and polysilicon from China goes into over 95% of global solar panels. Next, polysilicon is formed into ingots, which are further sliced into thin wafers, which are used to make solar cells. The cells are then assembled into an aluminum frame, forming modules. These modules are connected to inverters and other electrical equipment, forming a line-up that generates solar electricity.

Figure 1: Key stages in the main manufacturing process for solar PV

Source: Solar PV Global Supply Chains, IEA (2022)

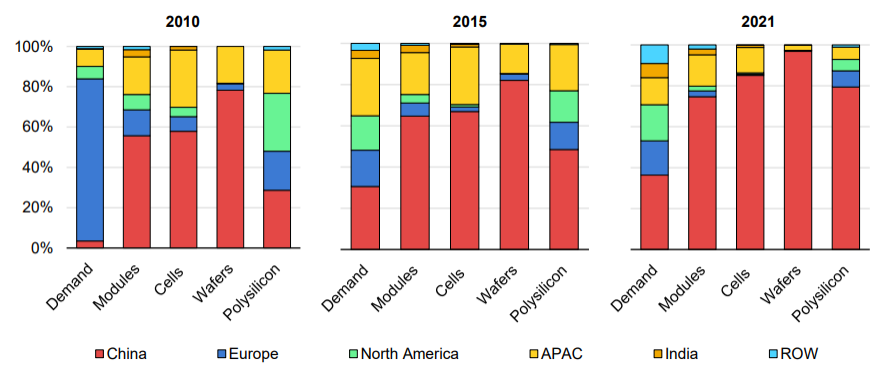

China’s role in the solar PV supply chain is substantial. Seven out of the top 10 polysilicon producers are from China, including the top three producers. China has a collective share of more than 80% of solar PV manufacturing globally. It holds an unwavering lead in all the individual stages. The 2021 solar PV manufacturing capacities across countries show that China held a share of 79.4% in polysilicon, 75% in the manufacturing capacity of modules, 85% in cells, and a whopping share of 97% in wafers. XUAR is responsible for over 54% of the polysilicon production in China.

Figure 2: Solar PV manufacturing capacity by country and region, 2010-2021

Source: IEA analysis based on BNEF (2022a), IEA PVPS, SPV Market Research, RTS Corporation, and PV InfoLink

Solar energy can play a crucial role in the energy transition and has even been called the ‘energy of freedom.’ However, a transition which involves forced labor can raise questions about the transition’s legitimacy. The booming scope of solar energy, China’s dominant role in its manufacturing, and the issue of forced labor deep rooted in its supply chain call for urgent scrutiny into the entire matter.

Regulatory Framework, Traceability Issues, and Corporate Due Diligence

Because of growing concerns over the human rights situation in Xinjiang, a range of governments and industry actors have called on companies to disengage from XUAR. To boost domestic solar manufacturing capacity, and therefore reduce dependence on China, the US Inflation Reduction Act of 2022 includes substantial tax incentives for clean energy projects. The EU is expected to follow suit.

Another approach to the issue is supply-chain regulation. This approach was central to the adoption of the Uyghur Forced Labor Prevention Act (UFLPA) by the U.S. Congress in December 2021. The act, which took effect from late June 2022, bans the import of all goods, wares, articles, and merchandise mined, produced, or manufactured, wholly or in part, by forced labor from XUAR. In 2021, under section 307 of the Tariff Act of 1930 (which prohibits the import of any product made by forced labor), the United States had previously denied entry to some XUAR-linked products, including goods made with silica produced by certain manufacturers. Under UFLPA, all products connected to XUAR through their value-chain shall fall under that provision, being presumed the result of forced labor. For solar PV, each step of the Chinese-dominant supply chain could potentially be relevant. The prohibition does not apply, however, if the importer shows, with clear and convincing evidence, that the goods are not the product of forced labor.

The European Commission presented a similar proposal in 2022 for regulation aimed at prohibiting products made with forced labor from entering the EU internal market. Although not focused only on Xinjiang, the regulation fits into the concern over business accountability when it comes to modern slavery risks and would apply to any product, relying on national authorities for the monitoring and identification of potential violations. Further, in June 2023, the European Parliament approved the Corporate Sustainability Due Diligence Directive (CSDDD), which emphasizes the need for companies to establish appropriate due diligence procedures covering not only their own activities but also their subsidiaries and supply chains.

Despite recent regulation, established supply-chain tracing and standard due diligence may be challenging to execute. Independent verification to prove forced labor allegations is difficult. Also, multiple supply chains may take shape: “clean” supply chains may emerge to supply markets, such as the U.S., which require slavery-free goods while other supply chains continue to use forced labor when supplying markets that have not adopted bans or strict due diligence rules. With such a “bifurcated” supply chain, providers using forced labor could simply switch their supply to different markets, such as the domestic Chinese market, thus getting around regulatory attempts to reduce modern slavery in global solar energy production. Recent regulation thus might not produce a net reduction in forced labor in the solar PV market.

Considerations for Investors

While buyers and sellers are the focus of regulation, investors can also play a role in influencing sourcing within the solar PV market. The U.S. Department of Energy, in its Solar Future Studies, identifies ESG ratings as a tool for investors to “preferentially rank socially responsible PV suppliers” and therefore help incentivize transparency and human rights due diligence.

Investors concerned with human rights in the solar PV market can draw on ISS ESG Norm-Based Research, which assesses corporate alignment with international norms on environmental protection, anti-corruption, human rights, and labor standards, as set out in the UN Global Compact and OECD Guidelines. Norm-Based Research has linked several companies throughout the solar supply chain to XUAR-related forced labor controversies. The companies’ performance in the relevant metrics has been mapped by the ISS ESG Corporate Rating, which provides in-depth insights to help investors minimize ESG risks and incorporate sustainability into their investment decisions.

Human Rights Policy and Supplier Standards for Labor Rights and Working Conditions

Considering the human rights risks associated with these companies’ operations, issuers need to have very strong commitments at the policy level to receive a high grade on the ISS ESG Corporate Rating Policy on human rights indicator. Yet 33% of companies involved in XUAR-related forced labor controversies lack commitments to respect internationally recognized human rights. In the semiconductor industry, which is responsible for the PV manufacturing phase, this percentage is as high as 80%.

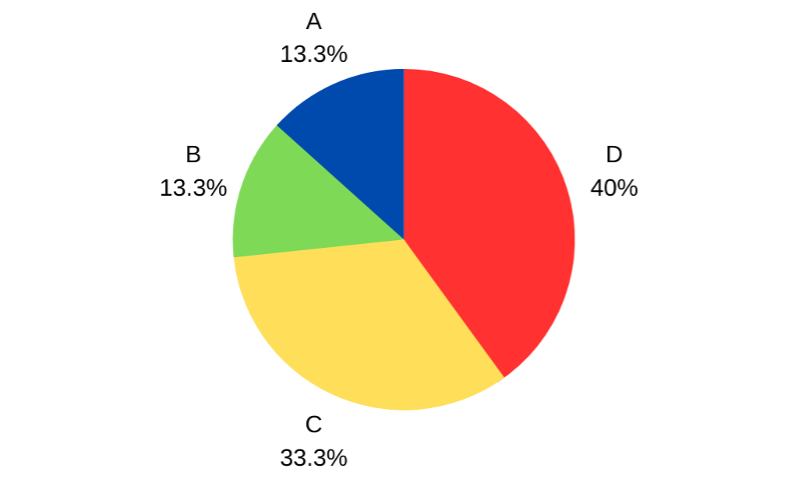

Further, given the difficulties surrounding the verification of forced labor allegations in the solar supply chain, addressing possible investor concerns about human rights might require companies to have detailed, enforceable rules governing their procurement processes. The ISS ESG Corporate Rating analyzes companies’ Supplier standard with regard to labor rights and working conditions. Issuers are expected to have a binding set of rules demanding the alignment of their suppliers to relevant international standards, such as the International Labour Organization (ILO) Declaration on Fundamental Principles and Rights at Work and the ILO Forced Labour Convention (No. 29) and Abolition of Forced Labour Convention (No. 105). Most companies involved in forced labor controversies do not have a sufficiently comprehensive Supplier standard with regard to labor rights and working conditions, with more than 70% lacking a detailed prohibition of forced labor (Figure 3).

Figure 3: Performance, by companies involved in XUAR forced labor controversies, on ISS ESG Corporate Rating Supplier standard with regard to labor rights and working conditions

Note: A = highest performance; D = lowest performance.

Source: ISS ESG Corporate Rating

Procedures to Ensure Compliance with Supplier Standards on Labor Rights and Working Conditions

Under the ISS ESG Corporate Rating Procedures to ensure compliance with the supplier standard on labor rights and working conditions indicator, companies are required to be equipped with adequate procedures to ensure compliance with the Supplier standard with regard to labor rights and working conditions. While 87% of the companies have performed poorly on this metric, only 13% of the companies have addressed the issue comparatively better.

The primary step towards compliance is conducting supplier risk assessments and on-site audits. 40% of the companies linked to XUAR forced labor controversies either do not undertake risk assessments or have minimal risk-assessment procedures. Less than one-third of the companies concerned conduct sufficient risk assessments. The only compliance procedure where the companies concerned have performed better is conducting supplier audits, with almost 70% of the companies running on- and off-site audits.

Supplier assessments and audits allow companies to design the corrective actions and re-audits required to improve their compliance measures. However, more than half of the companies have minimal or no corrective action procedures in place. Only around 7% of the companies concerned have detailed corrective action plans. Adding to the concern is that 80% of the companies do not have protective mechanisms for whistleblowers in their supplier standards. Moreover, only 40% of the companies train their purchasing department employees to be familiar with their Supplier standard with regard to labor rights and working conditions.

Human Rights Due Diligence

The right not to be subject to forced or compulsory labor is a basic human right. Coupling a strict supplier standard with a comprehensive due diligence system that enforces the issuer’s human rights policy signals a company’s commitment to avoiding forced labor in both its own operations and its supply chain.

Efforts to combine expanded solar power with respect for human and labor rights could benefit from companies precisely mapping the potential and actual impact of their activities on these fundamental rights. Having detailed human rights due diligence systems could allow accurate mitigation strategies to materialize. However, around 86% of companies involved in forced labor controversies have little to no provision for due diligence.

ESG investors concerned about forced labor risks in the solar PV supply chain may wish to have detailed information on companies’ performance in the areas discussed above: labor rights, working conditions, and human rights issues. In-depth analysis by ISS ESG Corporate Rating regarding a company’s policies and due diligence measures, coupled with the scrutiny undertaken by ISS ESG Norm-Based Research, gives investors a reliable overview of company performance in these areas.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

Authored by:

Roberta Amoriello, Associate, Utilities, ISS ESG

Arushi Sharma, Junior Analyst, Utilities, ISS ESG