Below is an excerpt from ISS ESG’s thought leadership paper “Freshwater & Finance: Investor Action in the Face of a Global Crisis”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- Freshwater is a scarce resource. Major world events have recently driven home the implications of climate change for both water scarcity and also water-related disasters.

- Investors are increasingly taking notice of the risks that water scarcity pose for investments in a number of sectors, as highlighted by the recent announcement of the Ceres-backed Valuing Water Finance Initiative.

- When looking at water risks in their portfolios, investors are able to consider both the risk to an investee’s business and the risks to water supplies arising from the business’ operations.

- With the launch of the new Water Risk Rating, ISS ESG clients have access to thorough coverage of how companies in their portfolios depend on or affect freshwater resources. This coverage can help them with their investments, from asset selection and retention through engagement and active ownership practices.

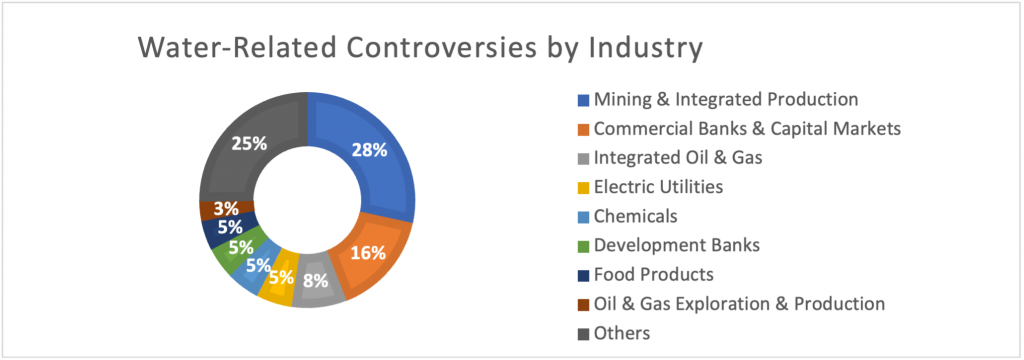

Industries Involved in Water-Related Controversies

Source: ISS ESG Norm-Based Research

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with ISS ESG’s Norm-Based Engagement Solution and Thematic Engagement Solution.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By: Cosima Reiff, Associate Vice President, Methodology, ISS ESG

Erina Molina, Analyst, Norm-Based Research, ISS ESG

Erin Wood, Associate, Stewardship & Engagement, ISS ESG

Mirtha Kastrapeli, Sector Head, Consumer, ESG Ratings, ISS ESG

Emily Faithfull, Climate Analytics Consultant, ISS ESG