ISS Market Intelligence has released the latest edition in the Windows into Defined Contribution series. The Q1 2023 edition covers the defined contribution (DC) market by sector, examining the divide between services and goods industries throughout the last decade.

Large technology firms have had an outsized impact on public market returns in recent years, but as economists often remind us, the stock market is not the economy. Analysis of public data released by the Department of Labor, collected by ISS MI BrightScope, and organized using the U.S. Census Bureau’s industry codes shows a broader set of industries driving the retirement market, both in total assets under management and stark outflows. While companies in service sectors have grown their share of employees and assets, areas like manufacturing remain surprisingly fertile ground.

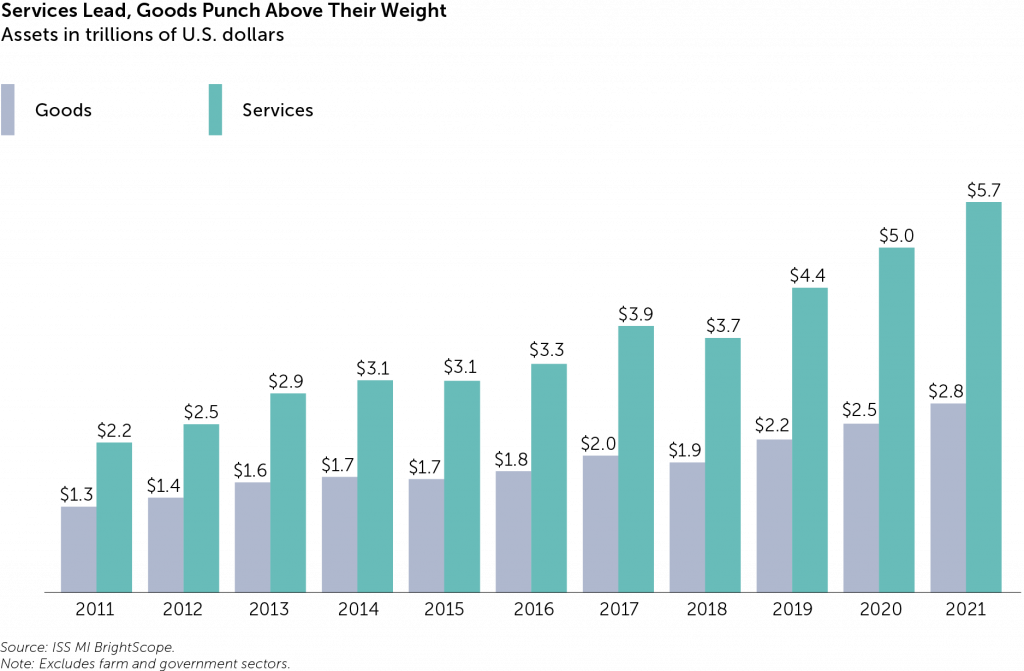

Service-focused industries, such as education, finance, and health care, accounted for a solid majority of employed American workers through the 20th century. Their share has grown further through the new millennium, with services accounting for 83.7% of private nonfarm employment as of the end of 2021 according to the Bureau of Labor Statistics. Assets in DC plans have reflected the employment shift towards service sectors, as these firms more than doubled AUM over the course of the last decade to land at $5.7 trillion as of year-end 2021. That accounted for a compound annual growth rate in assets of 10.0% over the past ten years. Asset growth in goods-producing DC plans trailed, but still saw a healthy annual increase of 8.2% over the same period.

Goods-producing sectors are, as with employment figures, a relative minority, but represent an outsized proportion of DC assets. They accounted for 23% of active participants in defined contribution plans as of year-end 2021 (the latest year for which data is available from the DOL) but made up 32% of industry assets over the same period.

Sectors like manufacturing have had a significant role in driving the retirement market, having been a large source of private unionization and defined benefit (DB) adoption. Manufacturing accounted for the bulk of DC activity within goods-producing industries, making up 27% of DC assets at the end of 2021, even as manufacturers represented just 10% of private nonfarm employees. The long history of leading manufacturers has allowed them to gather participants across generations and transition to defined contribution investments as DB plans were frozen or dropped.

While the ability to build up plans over time and across generations has been a boon for asset growth in these sectors, that demographic mix has also contributed to more significant outflow pressure. As the American workforce has aged, DC markets overall have faced increased redemptions. This has fallen much more heavily on goods-producing industries. Manufacturers’ DC plans registered outflows of $68.6 billion across 2021, effectively half of net outflows for the DC market that year.

The full report is available to Simfund Enterprise subscribers for access on the Simfund research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

Authored by:

Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence