Below is an excerpt from ISS ESG’s recently released paper “Genetic Engineering: ESG Risks and Opportunities”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- While the industry has made considerable progress in terms of managing its public image, the use of genetic manipulation remains a consumer concern, and therefore a regulatory target, in many global markets.

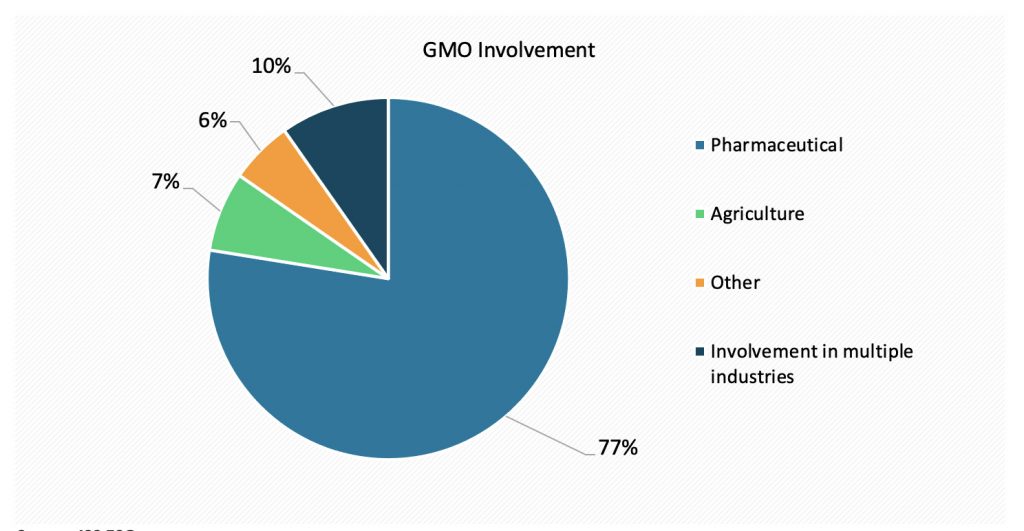

- The healthcare sector has the most companies involved in genetic manipulation, followed by agriculture.

- Consumer acceptance and market risks carry across sectors. GM drugs face less public resistance due to the medicinal advantages attributed to these products, whereas the consumer perception with GM food is mainly focused, rightly or wrongly, on their health and environmental impacts, as well as ethical concerns associated with global food production systems.

- Investing in GMO-related industries requires careful consideration of a range of potential risks, before decisions can be formed around profitability, sustainability, and public perceptions. ISS ESG’s Sector-Based Screening offers data investors can use when considering portfolio exposure to GM risks and opportunities.

Figure 1: Company Involvement in GMOs, by Application Category

Source: ISS ESG

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By: Maura Mercedes Santos, Sector Based Screening Analyst, ISS ESG. Prachi Pandey, Sector Based Screening Analyst, ISS ESG