Introduction

The investment case for the global tobacco industry is far from simple. Negative trade-offs come in the form of health, environmental, and social risks, to name but a few; investors have to be aware of these risks within an ever-changing investment landscape. The industry itself has undergone a plethora of changes within the last decade, from increasing government legislation to evolving consumer demands and industry consolidation. Tobacco firms have had to adapt to these changes to survive. Tobacco companies have historically been highly profitable businesses, generating strong cash flow which has been returned to shareholders, giving attractive dividend yields. For income investors in particular this is hard to ignore. However, in a world with greater government scrutiny, health-aware consumers, and industry controversies, investors can benefit from awareness of risks that could impact the industry’s currently favorable financial position.

Global Tobacco Trends

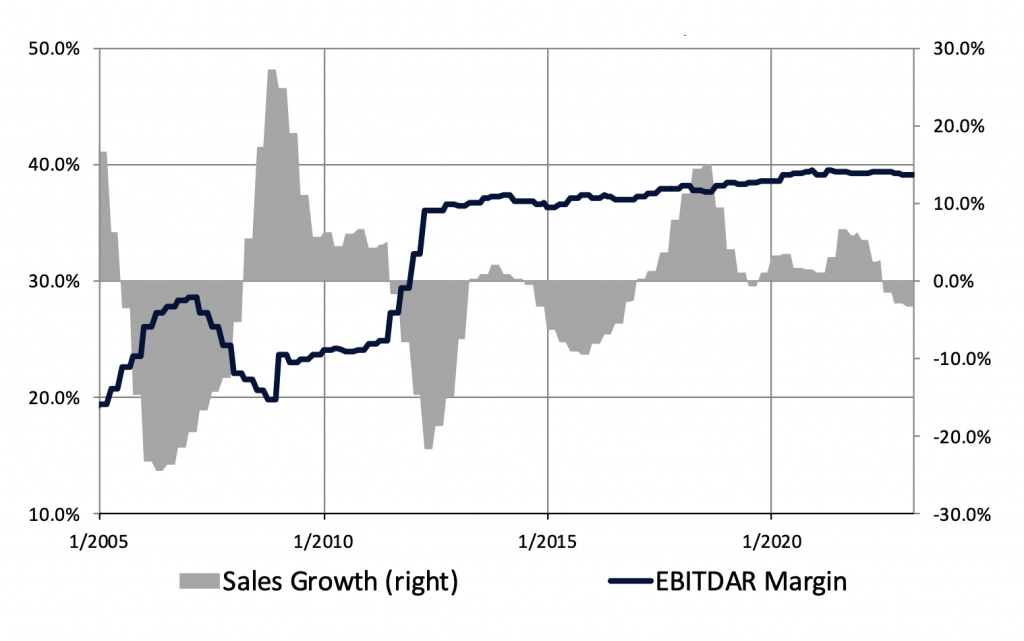

The revenue size of the global tobacco products market was $912 billion as of 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.75% from 2023 to 2028. This demand has primarily been sustained by the increasing number of smokers in the developing markets of Asia and Africa. The World Health Organization (WHO) reports that 80% of the world’s 1.3 billion tobacco consumers live in low- and middle-income countries. Socio-economic, cultural, and market demographics are some of the key factors that influence the difference in tobacco prevalence between developing and developed markets. Figure 1 illustrates the aggregate sales growth and underlying economic profitability trends of publicly listed tobacco firms globally, on a trailing four-quarter basis.

Figure 1: Sales Growth and EBITDAR Margin Trends for the Global Tobacco Industry

Source: ISS EVA

From 2012, sales growth significantly weakened, dipping to historically low levels within the first half of the year, with the subdued sales environment continuing through to 2015. The sales slowdown was influenced by lower demand for cigarette products in developed markets such as North America and Europe. Many public institutions enforced smoking bans in public places, which was one of many factors that have dampened demand over a longer timeframe. Estimates have shown a protracted reduction in the global smoking rate, from 33.3% in 2000 to 22.3% in 2020. Top-line expansion has had a relative recovery post-2017, but the industry saw comparatively weak sales growth during the early stages of the global COVID-19 pandemic. Sales growth turned negative in June 2022 and looks to have potentially reached a bottom at the start of 2023.

Figure 1 also charts the aggregate EBITDAR Margin (blue line) for the industry. Within the Economic Value Added (EVA) framework, EBITDAR Margin is the cleaned-up version of the traditional EBITDA Margin: it measures the industry’s operating profit as a percentage of its revenues, after a series of EVA-related adjustments have been applied to the as-reported financial data. For example, the EVA add backs being made to EBITDA enable investors to make an apple-to-apple comparison across companies regardless of whether a firm owns or leases its assets, which is not possible to do in traditional accounting. Currently, the global tobacco industry’s aggregate profitability remains historically strong, at a level which has been driven by higher product pricing and structural changes in the product mix.

Amidst the transition away from traditional cigarette products into alternatives such as e-cigarettes and smokeless offerings, tobacco companies are likely to see underlying profitability support from the comparatively higher gross margins relative to traditional cigarettes. Even with the undercurrents of stricter government regulation and taxation policies, tobacco firms have generally achieved strong operating cash conversion, a function of operating cash flow and earnings, which has often resulted in favorable dividend payouts. However, it remains to be seen whether the underlying financial strength of the industry sustains going forward, given the ever-evolving ESG risks within the tobacco markets.

ESG Risks and Investor Concerns

When assessing the ESG performance of firms within the global tobacco industry, the ISS ESG Corporate Rating team has identified five key sustainability-related issues:

- Consumer health and responsible marketing

- Sustainable agricultural practices

- Prevention of deforestation

- Labor standards in the supply chain

- Transparency on lobbying activities

Health-related risks surrounding prolonged tobacco consumption, such as increasing risks of cardiovascular diseases, cancers, and respiratory illnesses, have been thoroughly examined. However, there are key disparities between different geographic markets that are driving observed industry trends.

When it comes to consumer behavior, there is a clear divide between developed and developing markets. Government-mandated restrictions in developed markets such as North America have aided significant declines in adult smoking rates over time. Health-related knowledge, driven primarily by public education measures, has translated into consumers who are aware of the risks related to tobacco consumption. However, this does not seem to be the case in developing markets. While developing countries have higher population growth and increasing disposable incomes that lead to higher absolute increases of tobacco consumers, there is a notably lower presence of successful government interventions that have resulted in smoking cessation within poorer countries.

Amid increased regulative scrutiny of traditional tobacco products, the industry is developing product portfolios that transition into alternative, or smokeless, categories. The long-term success of such products, with their associated campaigns and portfolio development, depends upon both government and public acceptance of these new generation products. These alternative products may be seen as a potentially safer alternative to traditional tobacco offerings. Such acceptance, however, is uncertain. For example, in June 2022, the US Food and Drug Administration issued marketing denial orders (MDOs) that created a ban on JUUL products, an electronic nicotine-delivery system (ENDS). The ban is in response to lawsuits against the manufacturers for marketing to underage users, and may also reflect an FDA commitment to tackling vaping. As per a Vital Strategies report, tobacco use among teens aged 13 – 15 years has increased in 63 of 135 countries, with approximately 50 million young people smoking cigarettes or using smokeless tobacco products.

Investors may wish to be aware of product-related risks, given that legislative mandates for import or consumption bans may affect future demand flows. Sales of all types of e-cigarettes are banned in 26 countries, and four countries prohibit the sale of e-cigarettes containing nicotine. The latest case is of Australia, which has banned the importation of non-prescription vaping products, including those that do not contain nicotine. The Australian government has stated that these reforms aim primarily to reduce the usage of vapes within younger generations.

When it comes to agricultural sustainability, tobacco crop cultivation has been directly linked to various environmental risks. There is intensive use of agrochemicals by farmers to increase crop yields, given that tobacco plant monocultures have high vulnerability to a range of diseases and pest damage.

Limited studies have suggested that there can be neurological, respiratory, and psychological effects on tobacco farming communities as a result of intensive chemical use within surrounding environments.

Furthermore, tobacco firms often use contractual farming to employ and engage with tobacco farmers for crop cultivation. Research has shown that strict contract conditions have often created a cycle of indebtedness for local farmers, because of high input-costs and low resultant profits from crop sales. Large tobacco firms are able to consolidate buying power within local markets, leaving little room for open, demand-driven price discovery mechanisms.

Harm Reduction vs. Triggering Risk: Different Perspectives on E-Cigarettes

Research led by the University of Oxford, and funded by Cancer Research UK, has found vaping can help people to quit smoking better than traditional nicotine replacement therapies such as patches and chewing gums. However, studies also found that e-cigarettes often had short-to-medium-term side effects such as throat or mouth irritation, headache, coughing, and nausea.

In response to this research, the UK government aims, as part of the Tobacco Control Plan for England, to reduce the smoking rate below 5% (2030 was later set as the target date for this goal), partly by urging smokers to swap cigarettes for vapes. Through this scheme, 1 million smokers will be provided with a free vaping starter kit along with behavioral support to encourage them to quit tobacco. According to the government, cutting down the smoking rate will reduce the number of smoking-related illnesses, in turn reducing the pressure on the National Health Service (NHS).

Other research points in a different direction. Tobacco Induced Diseases reports that only low-certainty evidence suggests that e-cigarettes may be effective in smoking cessation for adult smokers. In contrast, e-cigarettes used by adolescents might be associated with subsequent smoking initiation. According to the NHS, there has been an increase in the percentage of children in the UK aged 11-15 smoking e-cigarettes: from 6% in 2018 to 9% in 2021.

The Financial Picture: Strong Economic Profitability Over Time

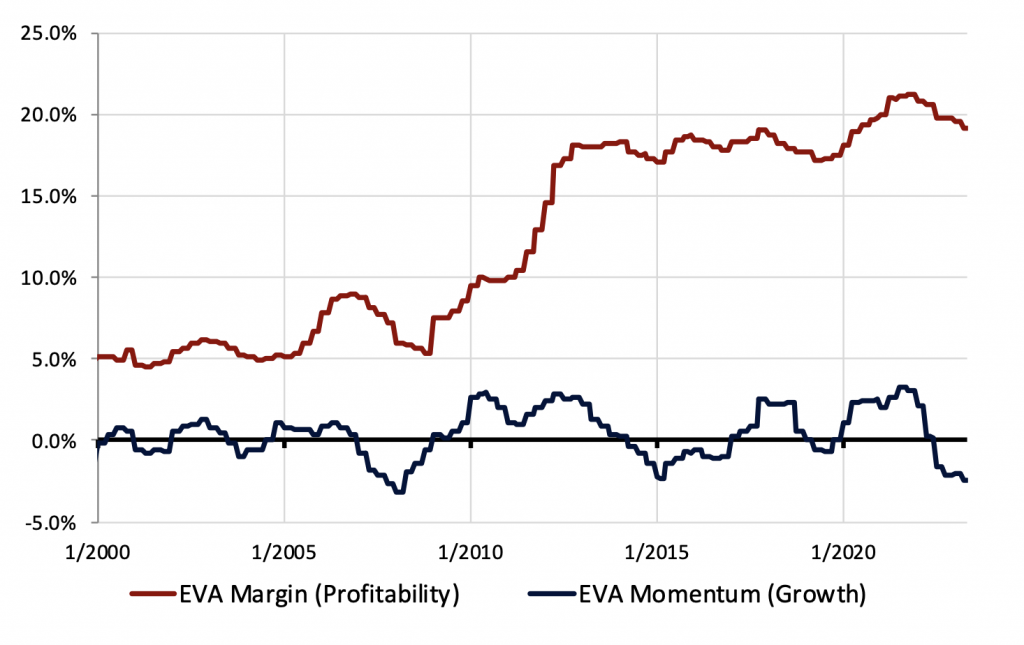

Simply defined, Economic Value Added (EVA) is a function of sales, less operating costs, less capital costs. Figure 2 shows the aggregate EVA Margin (profitability, red line) and EVA Momentum (growth of incremental value creation, blue line) metrics for 33 global tobacco firms under coverage.

Figure 2: Aggregate Global Tobacco Industry EVA Fundamentals

Source: ISS EVA

EVA converts accounting profit into economic profit by reversing accounting distortions and measuring the dollar value profit after all costs, including the cost of giving shareholders a fair return on invested capital, are considered. ISS ESG uses EVA to measure financial materiality. EVA Margin (profitability) can be utilized to gauge economic profitability: from 2011 through to September 2012, the EVA Margin for the industry expanded by 760 basis points, indicating a significant improvement in aggregate profitability.

Despite weak sales growth during the period, an underlying EBITDAR Margin expansion and improved asset efficiency resulted in improved economic profitability. EVA Margin has ranged between 17.2% and 21.3% over the last decade. In contrast, the global Consumer Staples sector has ranged from 2.2% to 4.2% during the same period. EVA Momentum, which measures growth of incremental EVA creation, has had periods of expansion and contraction and is currently negative, having significantly decelerated from 2022. This pattern is indicative of the downward pressures on the industry’s current levels of economic profitability. All things being equal, more EVA is better.

Within developed markets, there have been volume declines in the smokable products segment while consumer disposable incomes have been pressured, given the global inflationary backdrop. Firms have, thus far, managed to lever product pricing to offset higher input-costs, which has sustained the high levels of profitability seen currently. However, tobacco leaf prices have continued to show signs of increases in 2023, adding further downward pressure on profitability. With a focus on product pricing power, investors must be aware of the ongoing trade-down risk present within the global tobacco space as a result of consumer price sensitivity. Potentially weaker pricing power could translate into lower underlying profitability, going forward.

Investor Expectations

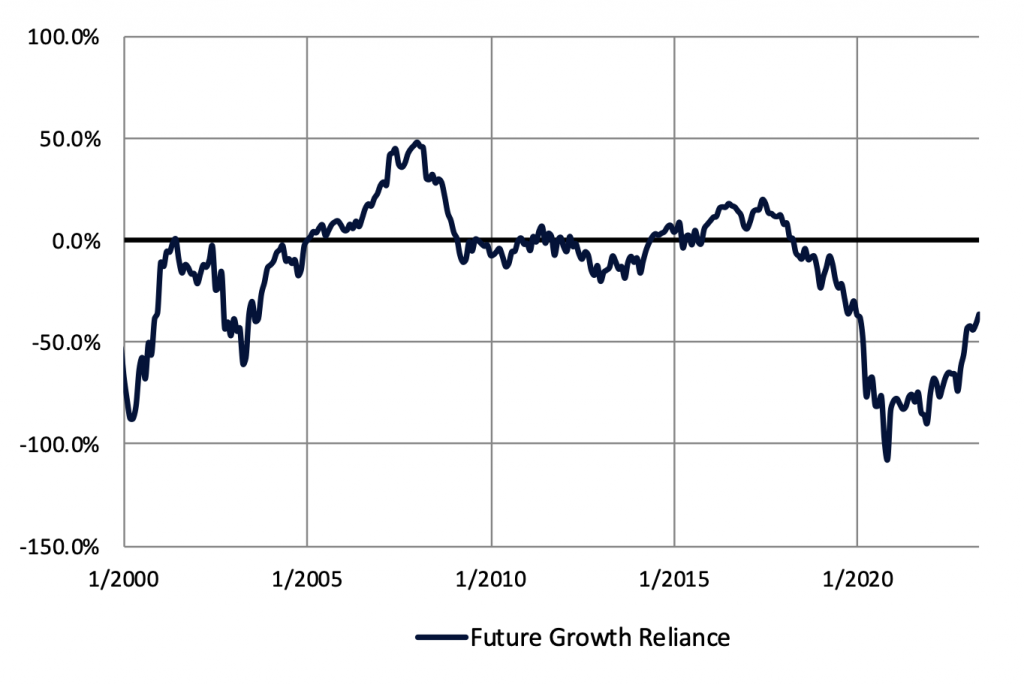

Figure 3 charts the global tobacco industry’s aggregate Future Growth Reliance (FGR). FGR measures the percentage of the industry’s market value that is dependent on future growth in EVA. Investors can utilize FGR to determine the level of premium, or discount, that a sector, industry, or company is trading at, making relative comparisons respective to historic levels.

Figure 3: Market Expectations for Global Tobacco Industry

Source: ISS EVA

The industry’s FGR has traded at near historical lows from June 2020, well below the levels seen prior to 2019, as investors have continued to attach a discount to the industry, expecting value destruction from the current levels of profitability. Since September 2022, market expectations have increased, with investors still expecting deterioration in value creation but pricing-in a relatively less bearish outlook on future growth than at the bottom in September 2020.

Scenario Development: What Lies Ahead for the Industry?

Figure 4 gives a theoretical view of which factors may influence the global tobacco industry’s growth over the long term.

Figure 4: Scenario Development within Global Tobacco Markets

| Industry Drivers within Developed Markets – Clear political consensus, limiting tobacco consumption over time. – Using legislative frameworks and policy to mitigate industry growth. – Greater health awareness of consumption risks, leading to a downtrend in traditional tobacco demand. – Technological change, with consumption driven by alternative products. – Product mix de-leveraging away from traditional cigarette offerings. | Industry Drivers within Developing Markets – Weak political consensus on the tobacco industry. – Governments continuing to rely on industry revenue through taxation, to help ease fiscal pressure. – Increases in absolute number of tobacco consumers driving top-line growth. – Weak labor-related frameworks, with limited mitigation of child-labor risks. – Greater influence of tobacco industry through government lobbying. |

Source: ISS EVA

As studied in past research literature, there is a clear divergence in the future pathway of global tobacco firms within developed and developing markets. The factors come down to political consensus, strong (or weak) legislative mandates, socio-economic trends, and technological development. However, the underlying determinant is government action or inaction.

Within developed markets, it is evident that the political and legal environment maintains a strong preventative view of growth within the industry. In Europe, for example, governments have implemented smoking bans in public areas and stricter enforcement of marketing or advertising standards, while investing in public health-awareness campaigns.

However, many developing economies do not share the same legislative outlook. As prior studies have noted, public authorities in developing markets may have greater exposure to the economic benefits of the tobacco industry. For example, governments of developing economies often use tobacco revenues to help ease fiscal pressure, through taxation and industry policy. Such reliance on tobacco revenue poses a conflict of interest as governments face a trade-off between tobacco industry growth (and therefore greater economic support); and limiting the industry’s financial trajectory in favor of mitigating health, social, and environmental risks.

Creating a Holistic Investment View: Financial Materiality and ESG

For a holistic investment view of the tobacco production and distribution industry, investors may wish to consider the Financial quality (i.e., a company’s risk-adjusted profitability) and the ESG quality (i.e., the quality of a company’s management approach to ESG risks or opportunities) of a company in their due diligence (Figure 5). Such integration of ESG and fundamental financial analysis can be conducted through the ISS ESGF rating.

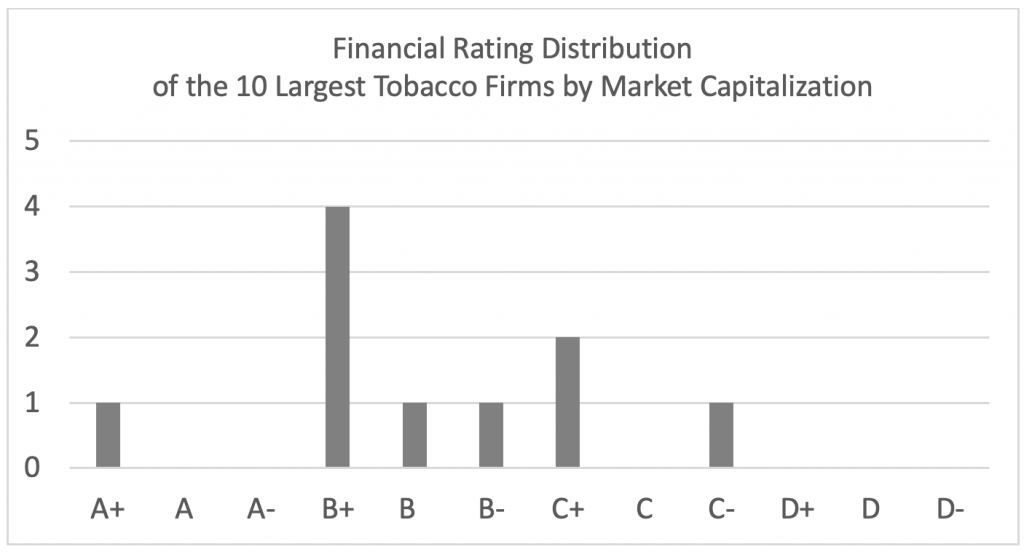

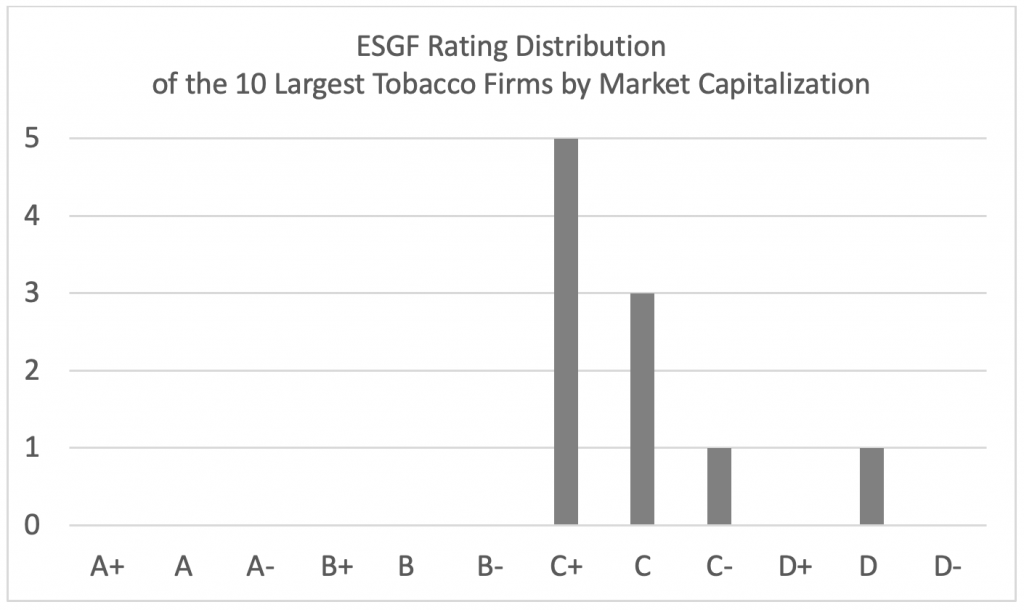

Figure 5: Financial Rating Distribution and ESGF Rating Distribution of the 10 Largest Global Tobacco Firms (by Market Capitalization)

Source: ISS EVA

The ESGF model is structured to make sure that poor ESG performance cannot be overly compensated by good financial performance. This is achieved using a weight distribution of 2:1 between ESG and F.

In practical terms, companies with poor ESG performance cannot obtain a good or very good ESGF performance rating (A or B rating). While the Financial Rating can be used as a standalone measure of a firm’s risk-adjusted profitability (quality), to understand the full view of quality, the combined ESGF rating is utilized. The 10 largest tobacco firms have on average a medium ESGF rating which is lower than the Financial Rating on its own, reflecting the ESG risks in the industry.

Although the global tobacco industry is profitable, it also inherently presents significant ESG risks. Tools such as the ISS ESGF rating, the Economic Value Added (EVA) framework, and the ISS ESG Corporate Rating support ESG investors in gaining a deeper awareness of the industry’s risks.

Explore ISS ESG solutions mentioned in this report:

- Understand the F in ESGF using the ISS EVA solution.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

Authored by:

Vishwam Naik, Junior Analyst, ISS EVA

Pratik Akash, Analyst, ISS ESG

Israt Jahan, Analyst, ISS ESG