Key Takeaways

- In the age of AI, the materiality of human capital management to business outcomes may be greater than ever, as shown by recent academic research.

- Recognizing the materiality of human capital, this article illustrates a potential approach to selecting human capital leaders using ISS STOXX Sustainability metrics.

- The article identifies companies that rank highly with respect to training, work-life balance, working conditions, pay and benefits, and labor rights, as well as alignment with human capital SDGs.

- Nearly 600 issuers across all 11 sectors from a global universe of over 3,900 stocks rank highly on these metrics, indicating that strong human capital management is not specific to just a few industries.

The Business Case for Human Capital

Technological advances have underpinned dramatic improvements in standards of living since the beginning of the 20th century. Along with organizational elements such as strategy and leadership, innovation is one of the key drivers of firm performance and long-term value creation.

At its core, innovation is a human endeavor—making the quality of human capital a fundamental determinant of a firm’s success. The ability to attract, develop, and retain talent is therefore essential to sustaining competitive advantage and driving meaningful performance outcomes.

In the age of AI, the importance of human capital management may be greater than ever, as recent academic research suggests that higher levels of human capital are positively associated with higher future AI adoption. The authors note that: “This effect is driven by the most human-capital-intense firms and explains up to half of the observed differences in AI-adoption across European countries and industries.”

A 2019 meta-analysis of hundreds of studies from Saïd Business School at Oxford University finds a strong positive correlation between workers being happier and being higher performers who are more creative and motivated at work. The research shows positive correlations specifically between measures of worker well-being and various business outcomes, such as higher productivity and reduced absenteeism, improved customer satisfaction, increased profitability, and lower staff turnover at the firm level.

A 2023 paper by De Neve, Kaats, and Ward from the Wellbeing Research Centre at Oxford studied employee well-being from around 1 million employee surveys across 1,782 publicly listed companies in the United States and found that higher employee well-being correlates positively with greater collaboration and firm profitability and value. Moreover, longitudinal analysis revealed that the relationship between employee well-being and firm performance is not only contemporaneous but also predictive, which suggests that well-being metrics can serve as leading indicators of future business success. Last, the research found that a portfolio of companies with high workplace well-being outperformed U.S. stock market benchmarks.

Many corporations have recognized the importance of employee well-being. According to Aon’s latest Global Wellbeing Survey of more than 1,100 companies, organizations are increasingly investing in the well-being of their employees. Eighty-three percent of respondents have a well-being strategy, up more than 25 percentage points since the pandemic year of 2020. Furthermore, 41 percent of organizations said they had a well-being strategy that was fully integrated into their overall business strategy.

Among investors, interest in human capital is also rising. In research conducted by the International Sustainability Standards Board (ISSB) involving 158 investor organizations, respondents expressed a strong demand for information on human capital-related risks and opportunities, regardless of the investors’ jurisdiction, investment geography, size, or strategy. The motivation behind this interest was to evaluate potential risks and returns of the investment.

Interest in human capital thus underscores the growing recognition of human capital as a material factor in financial performance. Investors sought information on risks and opportunities that fall within a range of human capital topics such as working conditions and exploitation; health, safety, and well-being; diversity and inclusion; pay and benefits; recruitment and retention; and workforce composition. As of July 2025, ISSB has started research into standardizing and organizing key concepts for human capital-related financial disclosures.

Identifying Human Capital Leaders Using ISS STOXX Sustainability

Recognizing the materiality of human capital to financial performance, this section illustrates a potential approach to selecting human capital leaders using ISS STOXX Sustainability metrics. This approach identifies companies that rank highly on indicators such as labor rights, working conditions, work-life balance, training and education, and pay and benefits. The analysis then leverages alignment data on UN Sustainable Development Goals 3 (Good Health and Well-Being), 5 (Gender Equality), 8 (Decent Work and Economic Growth), and 10 (Reduced Inequalities) to refine the selection, with a focus on operations and controversies.

Finding the Leaders

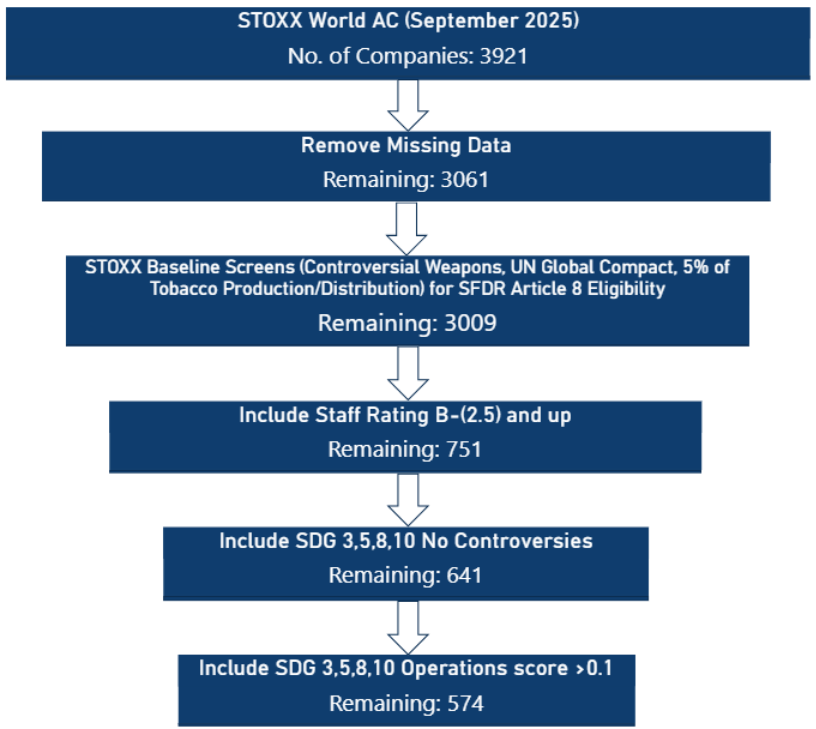

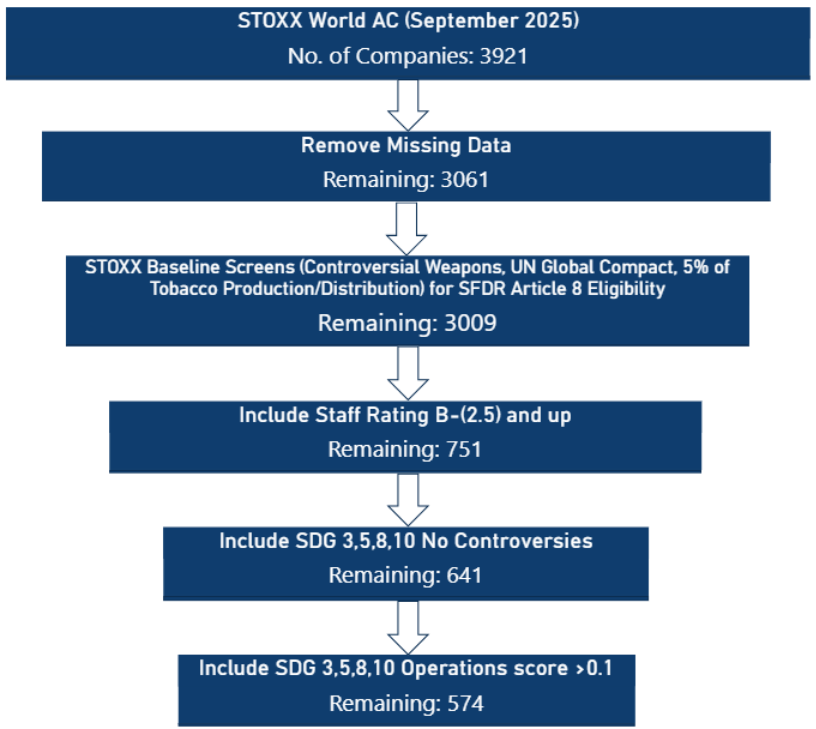

The goal is to identify companies that excel in human capital management, regardless of their industry. Figure 1 lays out the steps in this process.

Figure 1: Human Capital Screening Approach

Source: ISS STOXX.

The first step is to remove from the STOXX World AC index universe companies for which data is missing or that do not pass the STOXX Baseline screens (controversial weapons involvement, violating UN Global Compact standards, or deriving more than 5% of their revenue from tobacco production or distribution).

The next step is to select companies with ISS STOXX Staff Ratings of B- and above. The Staff Rating is one of the pillars of ISS STOXX’s Sustainability Corporate Rating and is composed of indicators for freedom of association and collective bargaining, equal opportunities and non-discrimination, health and safety, work-life balance, pay and benefits, employment security and types of employment, training and education, and additional controversies related to staff issues. These indicators are relevant not only to a company’s direct workforce but also to on-site contractors and franchise employees. They also align well with the human capital impact pathways identified by the Oxford research.

The next step is to identify the SDGs most relevant to human capital in the workplace, namely SDG 3: Good Health and Well-Being, SDG 5: Gender Equality, SDG 8: Decent Work and Economic Growth, and SDG 10: Reduced Inequalities. These goals directly align with the principles of well-being in the workplace. Leveraging the operations and controversy pillar scores of the ISS SDG Impact Rating, which evaluates companies across 3 pillars (revenues, operations, and controversies), further allowed for screening out companies with controversies related to these four SDGs.

The final step after that was to retain only those companies that received scores above 0.1 on the Operations Management scores of each of these 4 SDGs (range -10 to +10). This step makes it possible to assess how companies’ day-to-day operations align with those SDG goals.

Examining the Results

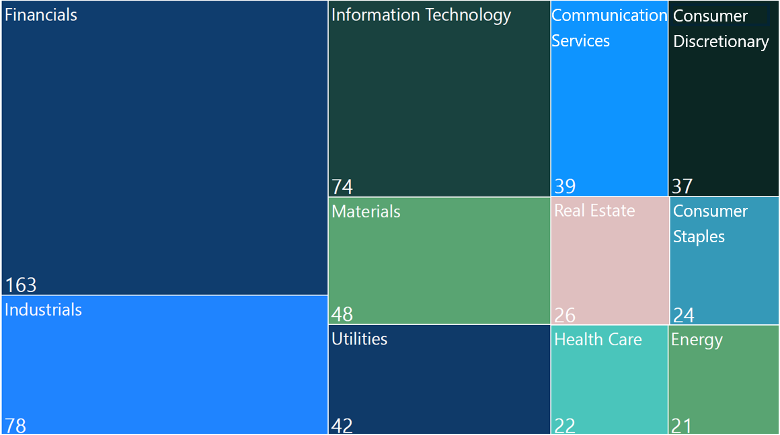

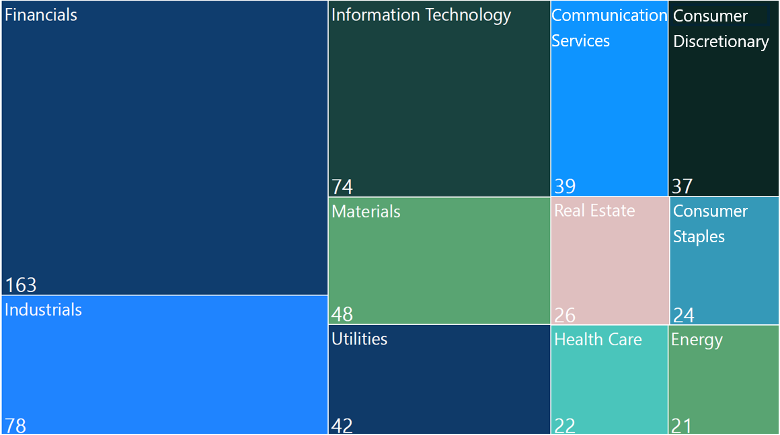

Following the steps above, the number of selected securities was 574, out of a potential universe of 3,921 stocks. As shown in Figure 2, the results include companies from all sectors, illustrating that strong human capital management is not specific to a few industries.

Figure 2: Human Capital Leaders by Sector

Source: ISS STOXX

Broad representation helps support portfolio diversification and mitigate sector bias for investors seeking exposure to firms with strong human capital performance in a balanced portfolio. This approach can also be conducted using region or country starting universes such as Europe, Asia, or the United States to create regional portfolios.

As an example of challenges when evaluating financial performance, it’s worth noting that high-performing firms often benefit from structural advantages that support both employee well-being and financial success, confounding any assessment of the causal relationships between them. Information technology companies, for instance, are frequently overrepresented in “Best Places to Work” lists, suggesting that sector-specific dynamics may also influence well-being outcomes.

Conclusion: A Data-Driven Approach to Finding Human Capital Leaders

Academic research points to human capital as a driver of measurable business outcomes and perhaps even a predictor of future firm performance. While concepts such as “happiness at work” may seem abstract and subjective, ISS STOXX leverages robust datasets and expertise to quantify factors material to workplace well-being. These include metrics related to training & education, work-life balance, working conditions, labor rights, and pay and benefits, not only for a company’s direct workforce, but also for on-site contractors and franchise employees.

For investors integrating human capital-related risks and opportunities into their investment processes, the ISS STOXX Sustainability metrics offer a granular, data-driven, globally diversified toolkit. At a high level, the data enables alignment with sustainability goals. At a more granular level, it can help identify companies that prioritize workforce well-being—an increasingly critical factor in driving financial performance and resilience. Last, while the business community explores the potential of AI in day-to-day operations, companies with greater human capital may be better able to deftly accelerate its implementation.

Explore ISS STOXX solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS SDG Solutions Assessment and SDG Impact Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using Norm-Based Research.

By:

Hernando Cortina, CFA, Managing Director, ISS Sustainability Solutions

Moe Phyu, Senior Associate, ISS Sustainability Solutions