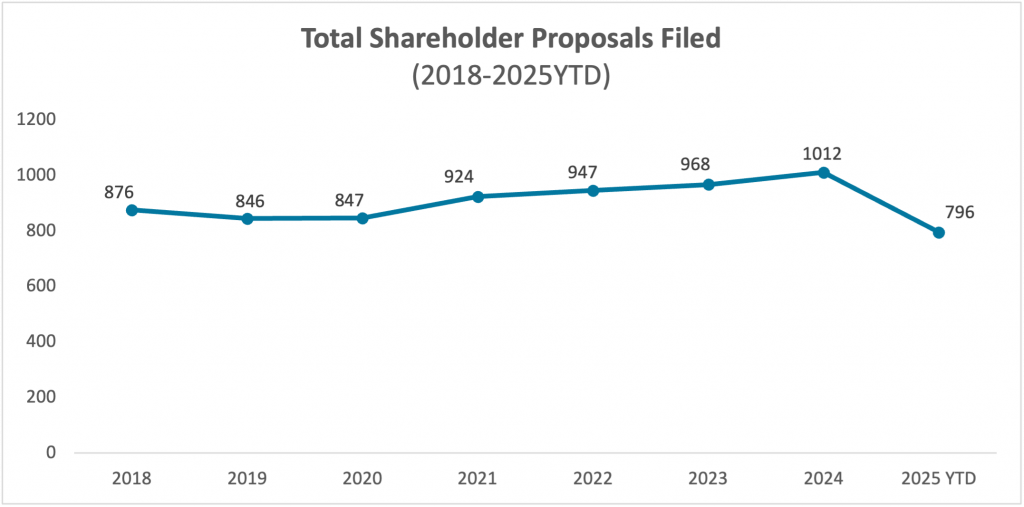

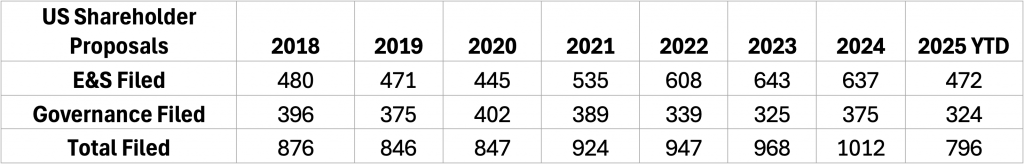

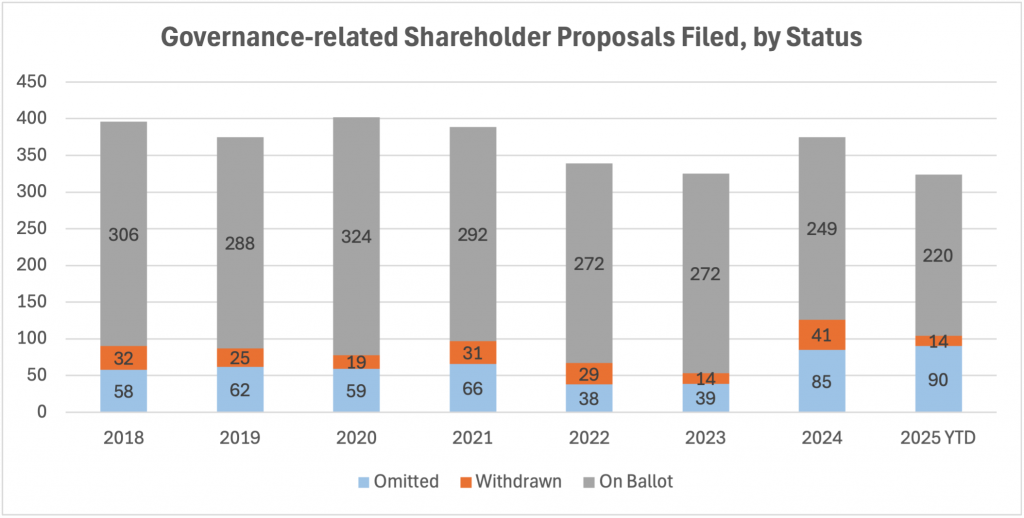

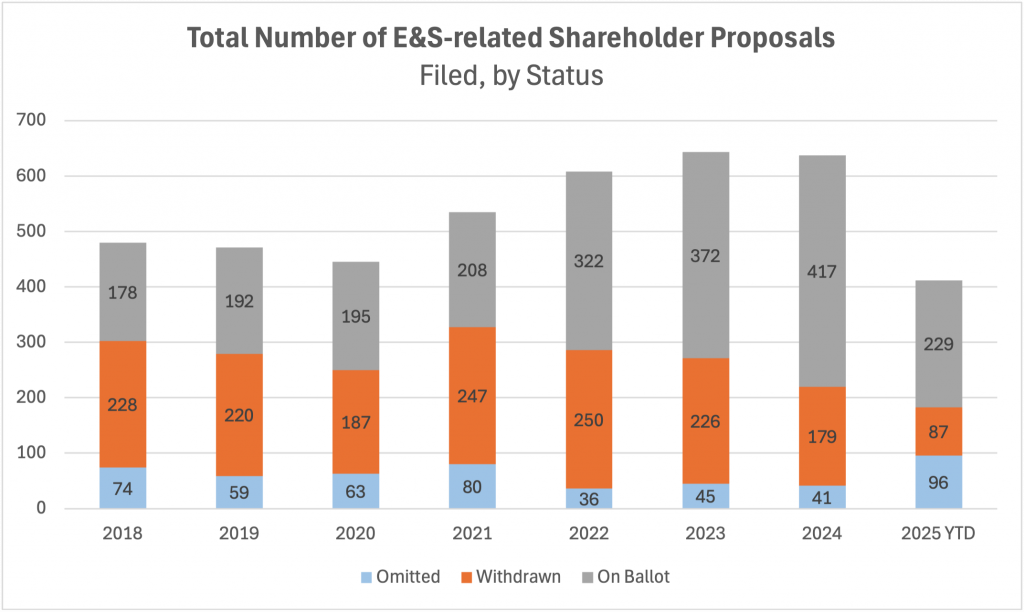

At the halfway mark of the U.S. 2025 proxy season, the total number of shareholder proposals filed has fallen to the lowest number seen in the last 8 years, looking back to 2018. There are, however, marked differences between the movement in numbers of proposals on governance-related topics and those on environmental and social (E&S)-related topics. In particular, in the last two years, the number of governance-related shareholder proposals filed has reduced less significantly, while shareholder proposals on environmental and social (E&S) topics have declined much more significantly, in spite of including a growing number of so-called anti-ESG proposals (referred to as “E&S-skeptic” herein).

Source: ISS Governance Research & Voting

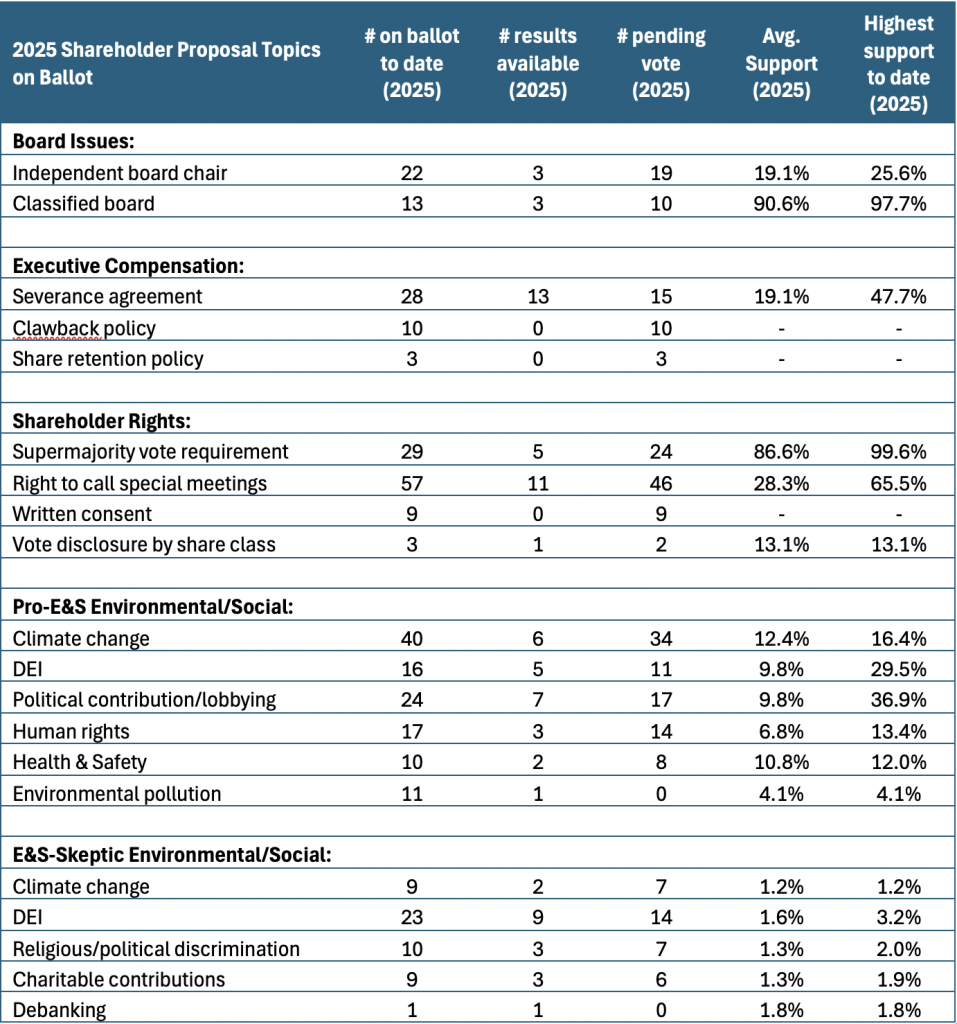

Amongst the governance-related shareholder proposals on ballot so far this year, there have been 57 proposals seeking to adopt or amend a special meeting right, 29 proposals seeking the elimination of supermajority vote requirements, 22 proposals calling for an independent board chair, and nine proposals relating to action by written consent.

Source: ISS Governance Research & Voting

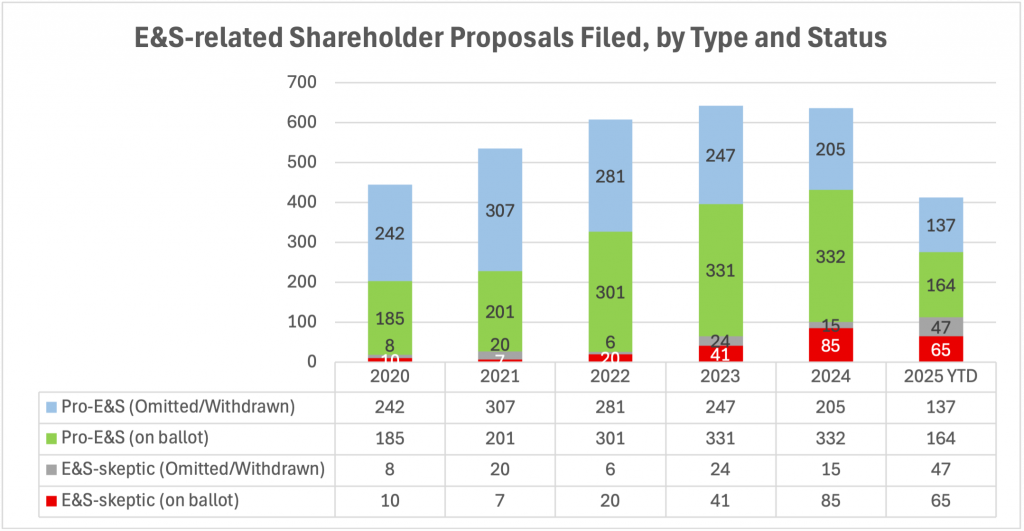

On E&S-related proposals, a closer look at this year’s numbers reveals that overall volume of E&S shareholder proposals has been somewhat buoyed by a surge in E&S-skeptic proposals. To date, a record 112 E&S-skeptic proposals have been filed, partially offsetting the dip in other E&S proposal levels this year.

Source: ISS Governance Research & Voting

The number of E&S shareholder proposals omitted so far in 2025 has hit a record high, given Staff Legal Bulletin 14M, issued on February 12, 2025, that stated that the SEC would be granting companies No Action relief based on a broader definition of what would be excludable. Specifically, the number of E&S proposal omissions recorded so far this year–96 omissions–represents nearly a twofold increase compared to the 15-year annual average of 55.

Source: ISS Governance Research & Voting

On this year’s pro-E&S proposals on ballot, there have been 40 shareholder proposals on climate change, 16 proposals on diversity, equity and inclusion, and 24 proposals relating to political contribution/lobbying. Meanwhile, the top E&G-skeptic proposals of interest are on topics such as climate change, DEI, religious/political discrimination, debanking concerns and charitable contributions.

Through April 30th, average shareholder support for all E&S proposals that had been voted on had dropped to 8.6 percent this year from 15.9 percent the same time last year. Support for pro-E&S proposals was, however, 13 percent through April of this year, compared to 20.8 percent same time last year.

Source: ISS Governance Research & Voting, data pulled on May 1, 2025

With respect to executive compensation topics, included under governance-related proposals, the number of shareholder proposals seeking shareholder ratification of severance payments has continued to decline. In 2023, we saw an increase to a record high of 39 such proposals, two of which received majority support. The number of proposals regarding executive severance agreements declined this year to 28 (from 33 in 2024), and so far, none of these proposals have received majority support.

By: ISS Governance