Below is an excerpt from ISS ESG’s recently released paper “India: Trends in ESG Practices and Transparency”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

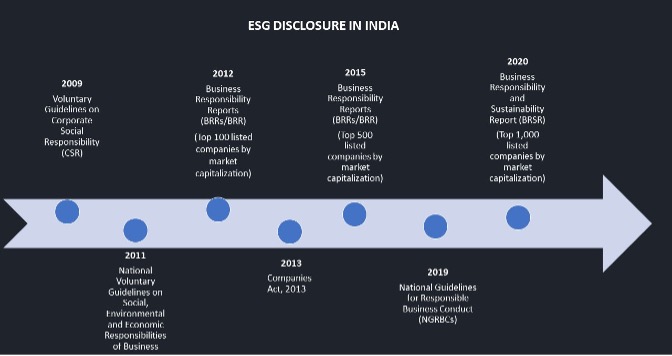

- India has been strengthening its regulatory requirements around environmental, social, and governance (ESG) criteria, especially since the onset of the COVID-19 pandemic.

- Regulators are making it mandatory for larger corporations to disclose on ESG standards.

- Institutional investors have been placing greater emphasis on responsible investment practices in recent years.

- Investors in India are welcoming progress made on the UN-backed Sustainable Development Goals, particularly in the areas of energy, water, and sanitation.

Source: ISS ESG Research

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By: Diya Sengupta, Vice President, Data Strategy, ISS ESG.