Introduction

Policymakers around the globe are tackling the issue of ‘greenwashing’ by introducing sweeping ESG regulations targeting financial market participants. As examined in Part 1 of this series from the ISS ESG Regulatory Solutions team, diverging approaches among jurisdictions pose a unique challenge for financial market participants operating across global markets. To assist in navigating the ever-evolving regulatory landscape, ISS ESG has developed a suite of solutions, including the recently launched Regulatory Sustainable Investments (RSI) Solution, examined in Part 2 of this series.

The RSI solution was designed with global regulation in mind and offers a wide range of data points that can be used to support a variety of sustainable investment strategies. The solution allows users to apply either their own criteria for defining a ‘sustainable investment’ or those prescribed by regulation relevant to the markets in which they participate.

Applying the Solution

One example of regulatory-defined criteria can be found in the EU’s Sustainable Finance Disclosure Regulation (SFDR). The SFDR defines a sustainable investment as follows:

Sustainable investment means an investment in an economic activity that contributes to an environmental or social objective, provided that the investment does not significantly harm any environmental or social objective and that the investee companies follow good governance practices.

Shortened version from SFDR Regulatory Technical Standards, Annex II – Full definition contained in SFDR article 2(17)

The imminent application of the SFDR Regulatory Technical Standards (RTS) will require precontractual and periodic disclosures for Article 8 and 9 financial products of the calculated share of assets aligned with the above definition. This presents a specific use case for the RSI Solution as well as ISS ESG’s SFDR Principal Adverse Impact (PAI) Solution.

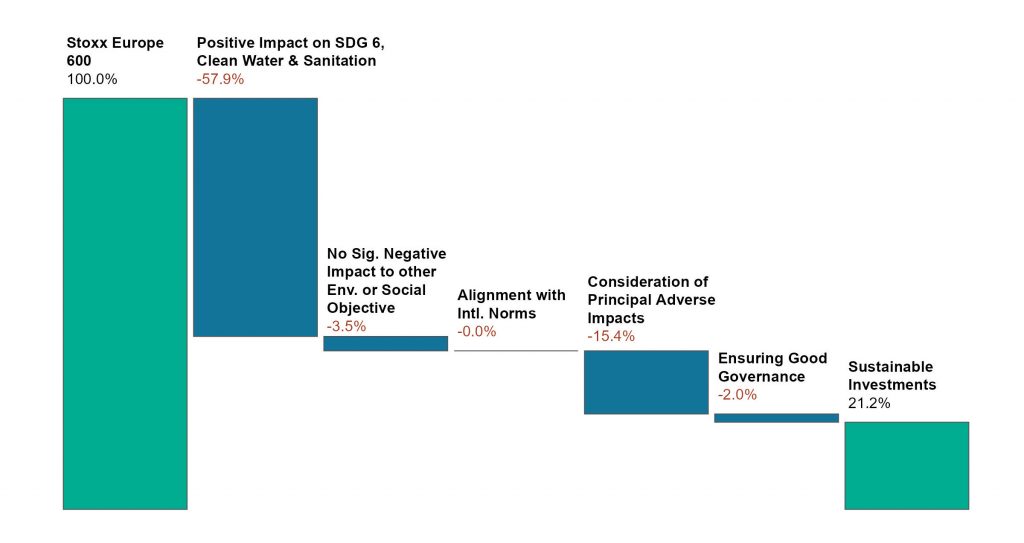

This third part of the series considers an example of how these solutions may be leveraged in determining the share of sustainable investments as defined by SFDR. Figure 1 shows the effect of each of the screening steps, starting with the STOXX Europe 600 as the parent universe and successively removing titles which are found not to fulfill the requirements of each step.

Figure 1: Results of Screening Steps for Identifying Sustainable Investments that Contribute to Clean Water & Sanitation

Source: ISS ESG

Selecting a Sustainable Objective

The first criterion established by the SFDR’s definition of a sustainable investment relates to its contribution to an environmental or social objective. This standard allows for many different approaches. Thus, the RSI Solution offers a wide scope of options to identify companies and activities that contribute to a range of possible sustainability objectives, including, but not limited to, contributing to one or more of the UN-backed Sustainable Development Goals (SDGs).

For the purposes of the above example, the selected objective was to positively impact SDG 6, Clean Water & Sanitation. Investee companies were considered to be in alignment with the objective if they had a limited-to-significant positive impact on SDG 6, as assessed by ISS ESG’s SDG Impact Rating.

Doing No Significant Harm

The SFDR also establishes the criterion of doing no significant harm (DNSH) to any other environmental or social objectives. Furthermore, the SFDR RTS identifies explicit principal adverse impacts (PAIs) as well as alignment with the minimum safeguards defined in Article 18 of the Taxonomy Regulation as factors to consider as part of the greater DNSH assessment.

To apply these standards, investee companies were first screened to ensure they caused no significant negative impact on any of the other SDGs, according to ISS ESG’s SDG Impact Rating. Next, investee companies were screened for alignment with international norms, as evaluated by ISS ESG’s Norm-Based Research.

Both these screens are provided as one-click options in the RSI Solution. Investee companies failing to align with international norms or causing significant negative impact to other SDGs were not considered sustainable in the context of this exercise.

Finally, PAIs were considered by using ISS ESG’s SFDR PAI Solution. This assessment identified companies that caused significant adverse impacts in relation to certain indicators defined in Annex I of the SFDR RTS and that were therefore disqualified from the ‘sustainable’ category.

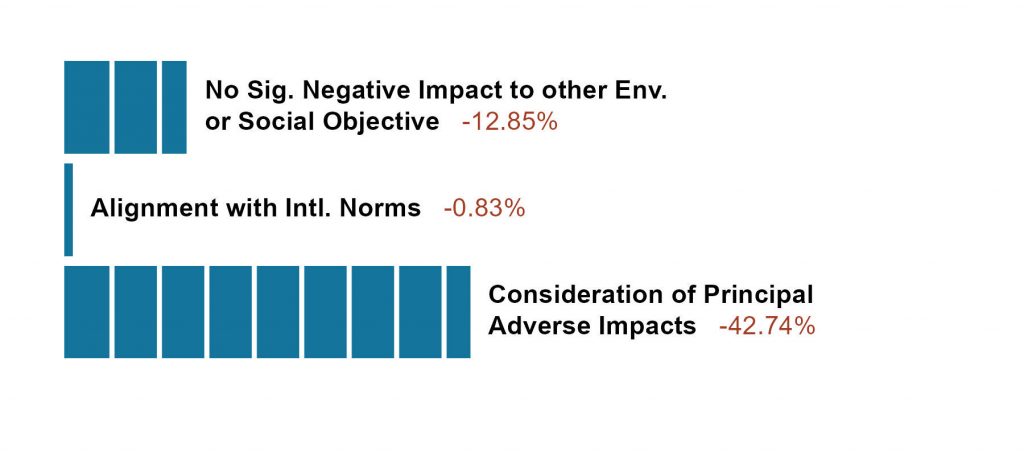

Figure 2 provides a representation of the share of companies within the STOXX Europe 600 that are considered to cause significant harm as per the above criteria, and are thus not included in the pool of potential sustainable investments.

Figure 2: Total Share of Companies Failing Each DNSH Assessment

Source: ISS ESG

Ensuring Good Governance

The last requirement spelled out in SFDR’s definition of sustainable investments is that of good governance practices. The European Commission recently clarified that the concept of good governance is an indispensable consideration for both Article 8 and 9 products. Assessing good governance is thus a vital step not only in calculating shares of sustainable investments but also in an overall investment strategy.

To apply this criterion, companies were screened for involvement in governance-related controversies as well as overall positive good governance scores. Any companies identified by this screen as involved in a controversy or as not obtaining an overall positive good governance score were not considered sustainable.

Conclusion

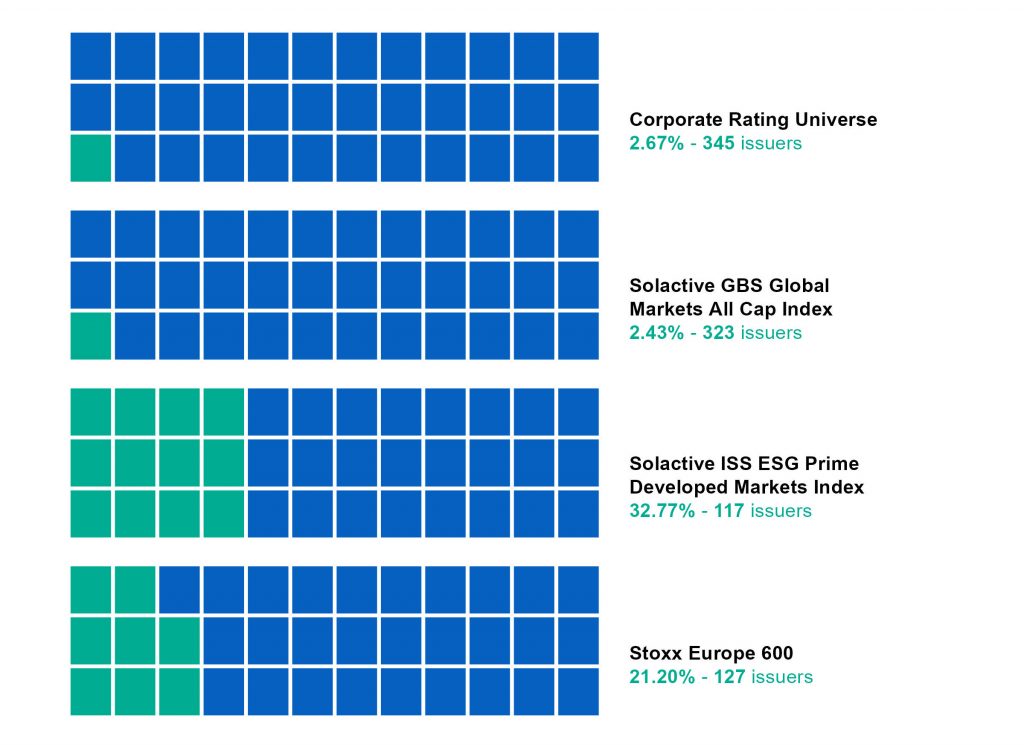

Applying the above-described assessment process to the STOXX Europe 600 reveals that approximately 20% of companies are found to contribute to SDG 6 while not causing significant harm and following good governance practices. This number is higher when starting with a pre-screened universe such as the Solactive ISS Prime Rated ESG Index Series (ESG Prime DM), but lower for other, broader markets as well as the full universe of issuers covered by ISS ESG’s Corporate Rating (Figure 3).

Figure 3: Screening Results: Sustainable Investments Contributing to Clean Water & Sanitation

Source: ISS ESG

As the definition of ‘sustainable investments’ within SFDR leaves room for interpretation, ISS ESG’s Regulatory Sustainable Investment Solution provides users with a range of factors which can be leveraged in each step of the process. Users have the flexibility to choose their sustainable investment objective, conduct analyses at the company or activity level, and decide under which conditions they will consider companies to cause significant harm or lack good governance practices.

Explore ISS ESG solutions mentioned in this report:

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- ISS ESG Index Solutions develops indices and collaborates with global index providers to create innovative solutions based on high-quality, reliable, and relevant ESG data.

By: Ronja Wöstheinrich, ESG Methodology Lead – Regulatory Solutions & Fixed Income, ISS ESG. Lorna Parkinson, ESG Methodology Specialist – Regulatory Solutions, ISS ESG. Brian Kennedy, ESG Index Design Associate, ISS ESG