On October 21, 2024, a class action complaint was filed in the U.S. District Court for the Middle District of Tennessee (the “Complaint”) against Acadia Healthcare Company, Inc. (“Acadia” or the “Company”) and various of Acadia’s executives (together with Acadia, the “Defendants”), alleging securities fraud under the Securities Exchange Act of 1934 and asserting a class period of between February 28, 2020 and October 18, 2024, inclusive (the “Class Period”).1

The gravamen of the Complaint’s allegations is that Acadia hid from investors its alleged practices of locking up psychiatric patients against their will—when detaining them was not medically necessary—in order to maximize insurance payouts and thereby boost the Company’s revenues. Furthermore, the Complaint alleges that when these practices were revealed, Acadia’s stock price dropped, harming investors. The case has been assigned to Judge Aleta Arthur Trauger, a Clinton appointee, and Magistrate Judge Jeffrey S. Frensley.

The Complaint asserts that Acadia operates 253 behavioral health facilities with over 11,000 beds in 39 states and Puerto Rico, providing services such as inpatient psychiatric hospitals, specialty treatment facilities, residential treatment centers, and outpatient clinics.

On September 1, 2024, the New York Times published an article on an investigation it conducted of Acadia (the “Article”), which the Complaint cites at length. The Article noted that since the pandemic, “the [C]ompany’s revenue has soared,” but warned that Acadia had “lured patients into its facilities and held them against their will, even when detaining them was not medically necessary.” The Article stated that in 12 states, “dozens of patients, employees and police officers have alerted the authorities that the [C]ompany was detaining people in ways that violated the law”. Shockingly the Article noted that “patients were often held for financial reasons rather than medical ones” and that “Acadia goes to great lengths to convince insurers that the patients should stay as long as possible”. For example, the Article quoted one former Acadia employee who stated, “[i]f there were insurance days left, that patient was going to be held[.]” The Complaint cited instances from the Article of further alleged mistreatment of patients, including assault and neglect. On September 3, 2024, the first trading day after the publication of the Article, Acadia’s share price fell $3.72 or 4.5%.

The Complaint alleges that on September 27, 2024, Acadia filed a current report on Form 8-K with the SEC which stated that the Company had “received a voluntary request for information from the United States Attorney’s Office for the Southern District of New York as well as a grand jury subpoena from the United States District Court for the Western District of Missouri [] related to its admission, length of stay and billing practices.” The Company also “anticipate[d] receiving similar document requests from the” SEC and might “receive additional document requests from other governmental organizations.” The Complaint alleges that on this news, Acadia’s stock price fell $12.38 or 16.4%.

The Complaint alleges that Acadia’s share price closed down $7.29, or approximately 12.3%, on October 18, 2024, after the New York Times reported that U.S. Department of Veterans Affairs was investigating whether the Company had been defrauding government health insurance programs by holding patients longer than medically necessary. This article also noted that agents from the FBI and the inspector general’s office of the federal department Health and Human Services had interviewed, “[s]everal former Acadia employees in Georgia and Missouri.”

The Complaint asserts that a variety of Defendants’ statements, principally sections of the Company’s risk disclosures in SEC filings, were materially false and misleading. While risk disclosures are not necessarily the best statements to hang a case on, it is likely that more statements would be added in a future complaint. Essentially the Complaint alleges that Defendants concealed the Company’s practices from investors, and that investors were harmed after Acadia’s share price dropped on September 1, September 27, and October 18, 2024, when the truth was revealed.

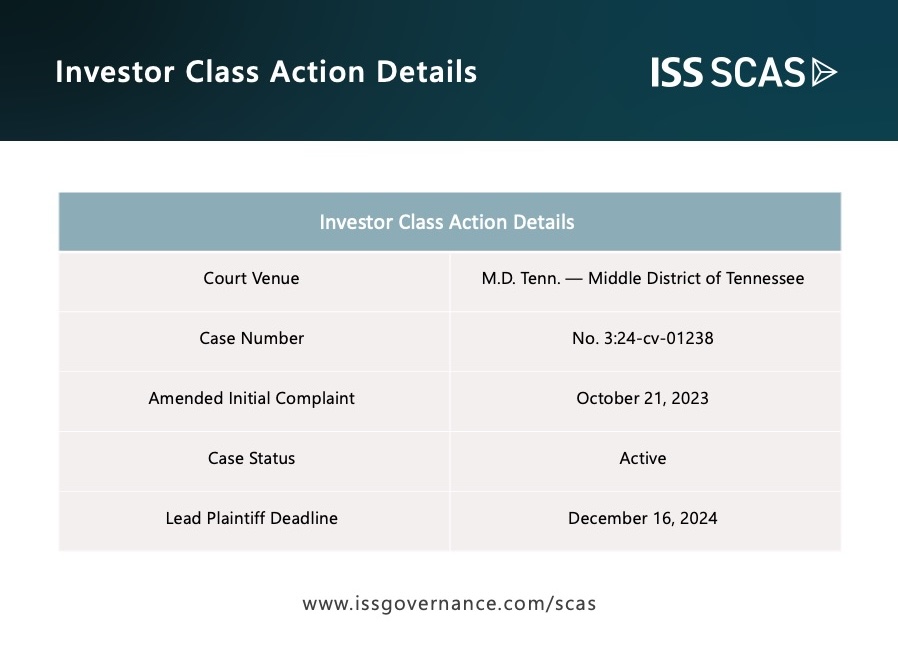

A number of plaintiffs’ litigation firms have issued press releases about this case, and the deadline to move for lead plaintiff is December 16, 2024. Notably, several prominent firms known for recently taking on larger, stronger securities fraud class actions—including, e.g., Kessler Topaz Meltzer & Check (co-lead counsel in a $450 million settlement in 2023 with Kraft Heinz), Robbins Geller Rudman & Dowd (lead counsel in a $350 million settlement in 2024 with Google parent Alphabet), and Bleichmar Fonti & Auld (lead counsel in a $420 million settlement in 2022 with Teva)—have issued press releases related to this case.

The interest of many plaintiffs’ firms, including firms with a history of recent settlements of over $100 million, suggests that these firms believe there is significant merit in this case. Several other facts imply that this may be a stronger case.

First, the Complaint alleges that Acadia’s share price has fallen more than $23 per share in total due to revelation of the Company’s fraud, representing as much as an over $2 billion drop in market capitalization, and the alleged Class Period spans more than four years. This suggests that actionable damages may be high enough to result in a high eight-figure recovery or even a larger one. Second, the presence of multiple governmental investigations can help a private case by investors.

Third, there is another securities class action pending—St. Clair County Employees Ret. Sys. V. Acadia Healthcare Company, Inc., No. 3:18-c-v-00988 (M.D. Tenn.)—against the Company in the same U.S. District Court involving somewhat analogous allegations for a class period between April 30, 2014, and November 15, 2018 inclusive. The complaint in that case claims that Acadia misrepresented to investors the quality of its care, the adequacy of its staffing to provide appropriate care, that its facilities were in compliance with relevant regulatory requirements, and that its U.K. business would achieve substantial revenue and earnings growth. Lead plaintiff in this case further alleged that Acadia placed patients with the goal of maximizing profits opposed to the best interest of patients, understaffed facilities, and had no basis to believe its statements about the U.K. business’ revenues and earnings. The complaint in this case alleged that Acadia’s fraud was revealed through a series of disclosures, which included the release of a short seller report, and an analyst letter on Seeking Alpha.

The court in this case denied Acadia’s motion to dismiss and later granted class certification in full. With the case proceeding through discovery—with a close of fact discovery set for December 13, 2024, and motions for summary judgment due by May 23, 2025—the case is likely to settle within the next year or two unless Acadia prevails at summary judgment.

However, the factual allegations of the Complaint are similar to those made in a securities fraud case against Universal Health Services (“UHS”), Teamsters Local 456 Pen. Fund v. Universal Health Services, No. 2:17-cv-02817-LS (E.D. Pa.), case that did not proceed”. There lead plaintiffs alleged that UHS “illicitly bolster[ed]” “financial results” because UHS’s mental health facilities had “manipulated and fabricated patient intake assessments [] in order to admit thousands of patients for psychiatric care that was not medically necessary” and had “ke[pt] patients locked up, regardless of medical necessity, for as many days as insurance would cover.” Like the pending case against Acadia, the complaint in this case alleged that media exposes, here Buzzfeed articles, were corrective disclosures and that there were governmental investigations of UHS for related issues. Although the case ultimately settled for $17.5 million (while the case was on appeal), the court had granted UHS’s motion to dismiss and had denied leave to amend the complaint. While this case was in a different district and circuit, Defendants could argue this should be treated as persuasive authority to the court in the newly filed Acadia case to defeat plaintiffs.

The facts in this newly filed matter are still developing, and time will tell who is appointed lead plaintiff and lead counsel and whether they are able to uncover any further relevant facts through an investigation. Overall, the allegations are interesting (compared to say some dry accounting matter), damages could be large, plaintiffs’ firms are circling, and there is an existing case against the Company with somewhat similar allegations that is rapidly approaching trial. Accordingly, notwithstanding potential pitfalls, there is chance that this could someday result in a sizeable settlement.

1 Kachrodia v. Acadia Healthcare Company, Inc., et al., No. 3:24-cv-01238 (M.D. Tenn.), at ECF No. 7. The same plaintiff had filed a complaint (ECF No. 1) against the Company on October 16, 2024, alleging a class period of between February 28, 2020 to September 26, 2024 inclusive, but the Complaint now alleges a drop in Acadia’s share price on October 18, 2024 as a corrective disclosure, which the first complaint did not.

“No portion of this insight constitutes legal advice, and no attorney-client relationship is intended or is established.”

Author: Donald Grunewald, Director of Litigation Analysis, ISS SCAS