Each month ISS ESG’s team of specialist analysts releases an update on the ESG risks associated with a specific industry sector. The InFocus reports focus on the ISS ESG Corporate Rating for companies within each sector, and also provides headline results from other ISS ESG product lines. This month, the InFocus is on: Energy

KEY TAKEAWAYS

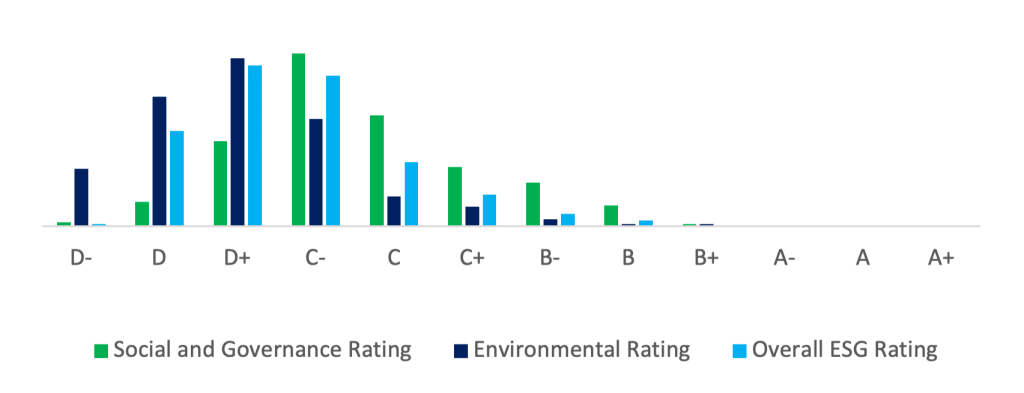

ESG Ratings Results

The Energy sector is characterized by relatively poor ESG performance and limited positive contributions to the achievement of the UN Sustainable Development Goals (SDGs).

- The Energy sector comprises the Oil, Gas & Consumable Fuels (OG&CF) and the Oil & Gas Equipment/Services (OGES) industries.

- The Energy sector is a major contributor to global climate change and environmental degradation. Investors are focused on the sector’s approach to the challenge of reducing emissions in accordance with the Paris Agreement.

- Only 4.2% of OG&CF companies and 2.4% of OGES companies achieve Prime status; meaning they fulfill ambitious sector-specific performance requirements as defined by ISS ESG.

- The most ambitious climate targets have been set by European companies. These companies only contribute a minor share of global fossil fuel production, however.

- Net Zero targets are becoming increasingly prevalent, although these targets are not expected to align with the “well below 2°C” target set in the Paris Agreement.

- The most common breaches of global norms in the OG&CF industry are related to controversial environmental practices; and labor rights violations in OGES.

- OG&CF companies are slow to transition to a low-carbon economy, thus posing a long-term financial risk.

- Facing challenges in the form of workforce restructuring; investor-led pressure for climate action; and net-zero targets, will the Energy industry be able to keep its profitability throughout the necessary transition towards renewable energy?

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Understand the F in ESGF using the ISS EVA solution.

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By Raphaela Huber, Analyst, ISS ESG Barbara Hof, Associate, ISS ESG Bonnie Lord, Analyst, ISS ESG Pier Paolo Cosenza, Analyst, ISS ESG Johann Gruen, Associate Vice President, ISS ESG