Green Energy Transition

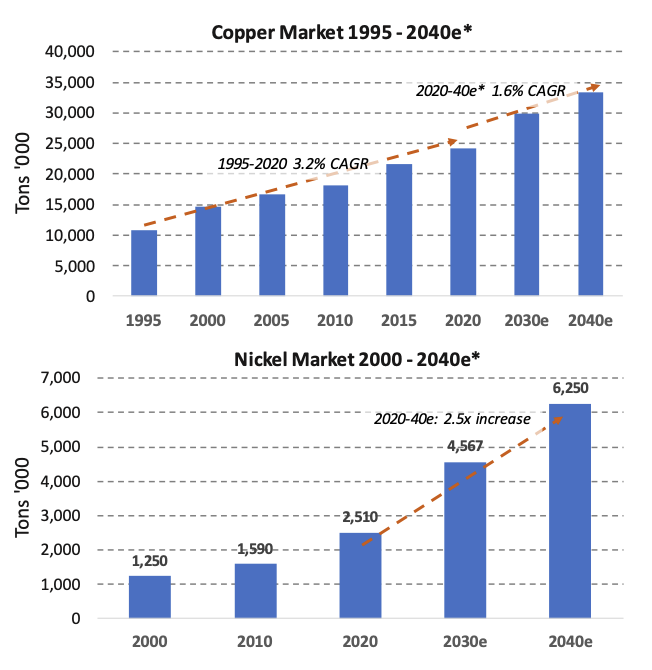

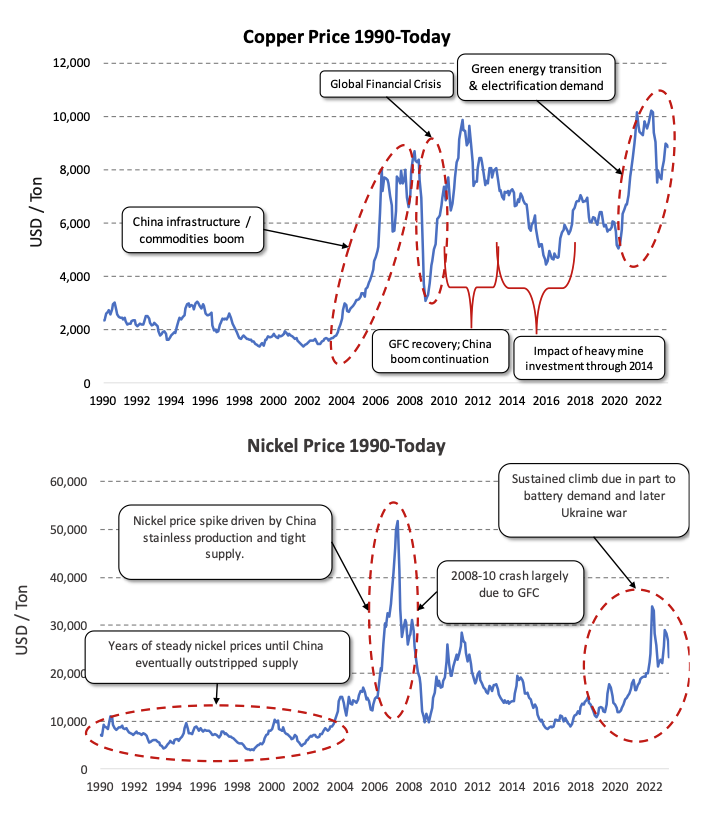

The green energy transition requires a considerable increase in metal mining, which raises questions about the potential risks and opportunities around deep-sea mining. The energy transition replaces fossil fuel-based energy with other commodity-intense energy sources. The IEA’s report on critical minerals outlines some of the significant areas of growth: e.g., electric vehicles require six times the mineral inputs compared to a conventional car. Coupled with increasing metal demand are supply difficulties driven by declining ore quality and the difficulty of starting new mines. The result is long-term potential for dramatically tighter supplies and higher metal prices (see Figures 1 & 2). Given this situation, there is now significant interest in new metal supplies, including untapped resources at the bottom of the sea.

Figure 1: Critical Metal Demand Should Grow Significantly, as Shown Here for Copper and Nickel

*Forecasts based on IEA Sustainable Development Scenario

Source: USGS, ISS ESG

Figure 2: With Rising Demand, Prices Have Also Risen Significantly in Recent Years

Source: St. Louis Federal Reserve, ISS ESG

Deep-sea mining focuses mainly on retrieval (or dredging) of polymetallic nodules containing critical metals such as cobalt, copper, nickel, manganese, and zinc. The concept has been around for decades, with over 30 exploration permits issued since 2001. Yet rules defining environmental protections, royalty regimes, monitoring, and clean-up requirements have yet to be approved. The International Seabed Authority (ISA) produced a governing document draft, but countries disagree on key points. The Pacific nation of Nauru announced its intention to allow seabed mining, as did Papua New Guinea previously (although the nation later reconsidered this decision). The ISA theoretically has until July 2023 to complete its deep-sea mining rulebook, but that deadline seems unlikely to be met, given disagreement among nations.

The International Energy Agency forecasts continuing rapid critical metal demand growth through 2040. To power the green energy transition and electrify current fossil-fuel processes, e.g., heating and transport, will require either significantly greater supply (more mining) or significantly higher metal prices to crowd out other sources of metal demand. Deep sea mining could be an additional source of green metals, yet there remain more questions than answers at this point. Plowing up sediment to collect polymetallic nodules risks harming deep-sea species and the environment over large areas, as well as releasing carbon stored in the detritus on the ocean floor. The risks to biodiversity and climate seem potentially serious. Deep sea ecosystems and carbon sinks are not particularly well understood. Balancing the needs of the green transition and decarbonization versus the potential damage to the oceans remains an open question.

A False Start in Papua New Guinea, with Nauru Now a Potential Mining Site

Initiatives started over a decade ago with Papua New Guinea granting the first deep-seabed mining license to a mining company. The project aimed to mine deposits 1.6 km below the ocean surface. Due to challenges on multiple fronts, the company ceased operations. Papua New Guinea’s government reconsidered its deep-sea mining policy and voiced support for a moratorium on deep-sea mining.

Nevertheless, the project prompted regulatory work by the International Seabed Authority (ISA), an organization established under the 1982 United Nations Convention on the Law of the Sea (UNCLOS) and a 1994 agreement related to UNCLOS. The ISA’s draft regulation for the exploitation of deep-sea minerals incorporates numerous components, including requirements for definition of a given project, the establishment of contracts defining responsibilities and rights, and (of most interest to many stakeholders) risk assessment, damage prevention, and preservation of the marine environment.

Deep-sea mining operations could commence this year. More recently in July 2021, Nauru announced it would issue a license to commence seabed mining, triggering a required two-year period for the ISA to complete its mining code. The ISA has a draft regulation for the exploitation of seabed minerals that was discussed earlier this year during negotiations held in Jamaica. After extended negotiations, no agreement emerged. Theoretically, Nauru would be permitted to commence deep sea mining in a matter of months, regardless of an absence of published regulations.

As a union of 1,400 organizations, including governments, NGOs, business associations, and others, the International Union for Conservation of Nature (IUCN) voted in favor of a deep-sea mining moratorium in September 2021; the moratorium resolution highlighted unacceptable risks and inadequate regulation. While the union has the support of several governments (including France), it does not have authority to enact such a non-binding moratorium.

Regulation

Mineral exploitation of the deep seas will be subject to the ISA regulations, but enforced by the sponsoring state while the exploitation project is carried out. To date, mining licenses have been sponsored largely by small island states such as Nauru. A Pacific island with about 10,000 inhabitants, Nauru’s economy is dependent upon the exploitation of single resources such as phosphate. The exhaustion of these mined resources has left Nauru in a difficult situation, with around 80% of the island currently uninhabitable and ecologically degraded. Whether this country would have the means or political will to effectively enforce ISA regulation is an open question.

To manage negative externalities, all contract applications are accompanied by comprehensive Environmental Impact Assessments (EIA). A full assessment covers the potential impacts of the proposed activities, including descriptions of previous oceanographic and baseline environmental studies in accordance with ISA standards. Impact assessments are a common risk management feature of terrestrial mining applications.

However, the deep oceans remain one of the least researched or understood environments on the planet. By some estimates, more than 75% of the seafloor is currently unmapped and unobserved, and less than 1% of the world’s deep ocean has been explored. Conservationists argue that any comprehensive impact assessments or mitigation techniques are therefore unreliable, given the current lack of data on or understanding of baseline scenarios and possible spillover effects.

ESG Risks

Deep-sea exploration is ongoing, but information on baseline conditions in these areas is limited, making risk assessment difficult. This discussion of ESG risks refers mainly to polymetallic nodule mining in the Clarion-Clipperton Fracture Zone (CCZ), a region in the Central Pacific containing significant nodule deposits. However, these same risks can also apply to cobalt crust and sulfide deposit mining.

Biodiversity Risks

Much about deep-sea ecosystems remains unknown. New species and their interactions with the ecosystems are still being discovered in the deep ocean. Studies and exploration in the CCZ have been ongoing for about two decades. Key processes in the ecosystem, such as bioturbation, are still poorly understood. It is difficult to assess what the impact of commercial scale mining might be. Evidence from exploration and pilot extraction has been inconclusive.

Mining vehicles seem likely to damage deep-water ecosystems. Over a 30-year mining license period, it is estimated that an area of 8,000 – 9,000 square kilometers will be churned by mining vehicles. Living creatures in the path of mining vehicles will likely be crushed, along with fauna on the surface of the seabed, as nodules are dredged, along with life living on the nodules themselves. This last effect of mining is particularly significant, as organisms living on polymetallic nodules are considered crucial for maintaining food web integrity in the CCZ area.

Mining vehicles would create sediment plumes spreading across tens of kilometers before settling. An estimated 500 million cubic meters of wastewater would be produced during 30 years of exploitation for each deep-sea mining operation. When discharged back into the water, such plumes would spread across up to thousands of kilometers before settling on the seabed, depending on the depth at which the plumes are discharged. These could smother species, release toxic metals, harm filter-feeders, and disorient deep-sea creatures. This effect represents a significant impact on seabed ecosystems, while also impacting components further up the water column.

Noise Pollution

Vibration and light pollution are additional risks to deep-water ecosystems. In addition to dredging and wastewater plumes, noise and light can also create dislocations. Studies show that sea creatures are negatively affected by man-made noise, e.g., they change their feeding and communication patterns as they become disoriented. Some species suffer ear damage or even death. Many seabed species rely on sound to perform critical functions, such as locating food, and would not be able to escape the noise. The entire water column suffers from noise and vibrations.

Mining appears to have long-term impacts. Experiments to date have shown little evidence of deep-sea ecosystem recovery after pilot mining activities and exploration. With commercial-scale mining, a much larger area is affected, with full rehabilitation unlikely. Even partial recovery could take centuries. While the justification for deep-sea mining is to supply materials for the energy transition, it could have a meaningful negative effect on climate change, as carbon stored in the seabed could be released by the extraction process. This could change the carbon cycling processes in the deep sea, although this risk has not been sufficiently researched to be certain. A range of scientific and NGO studies have argued that the disturbance of complex oceanic environments and release of sea-bed carbon stocks will likely produce unforeseen consequences that include exacerbating climate change.

Social Risks

Deep-sea mining arguably presents fewer social risks than terrestrial mining for certain metals, e.g., cobalt. An argument for deep-sea mining is that it minimizes social risks such as the labor rights violations associated with cobalt, which were discussed in a previous post. However, deep-sea mining’s long-term social impacts are unknown due to the indirect nature of such mining for social dynamics. There are some concerns about the cultural importance of the seabed. For some coastal indigenous groups, the ocean and the seabed have cultural and spiritual importance. Some ocean areas have cultural significance due to the remains of those who died there and historical artifacts found on the seabed.

Investor Perspective

Conditions currently limit investors to observing deep-sea mining, as large publicly traded companies appear to be taking a wait-and-see approach. In the future, however, investors could be able to shape deep-sea mining impacts, as publicly traded companies may consider M&A to enter the deep-sea mining space.

Multiple forms of mining could create a new form of competition among companies and countries. As ISS ESG discussed previously, western countries are trying to decrease their dependence on China for their critical minerals supply. Deep-sea mining is seen by some as a means for the UK and EU to compete with and to become less dependent on China. That said, China has sponsored more exploration licenses than any other ISA member state: China-sponsored licenses account for 18% of the CCZ exploration area.

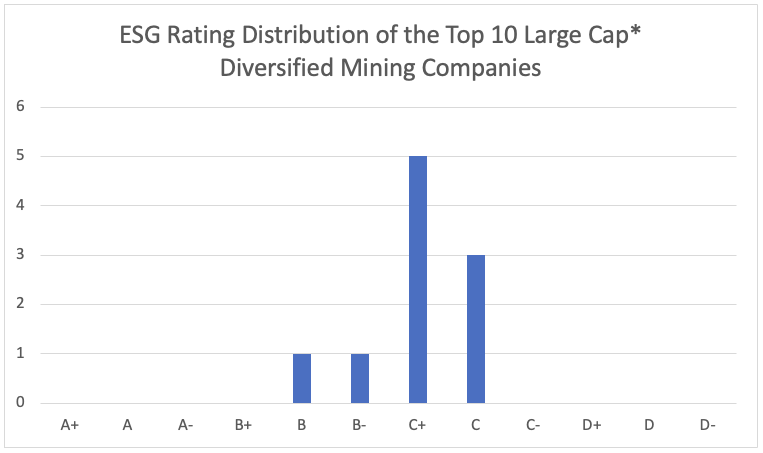

Anticipating possible future deep-sea mining opportunities, investors may wish, for instance, to be aware of mining companies’ ESG performance. The aggregated ISS ESG Corporate Ratings for the top 10 large cap diversified mining companies are presented in Figure 3, with Australian companies accounting for the largest portion of them.

Figure 3: ESG Ratings for Leading Mining Companies

*Large cap > $20 billion market capitalization

Source: ISS ESG

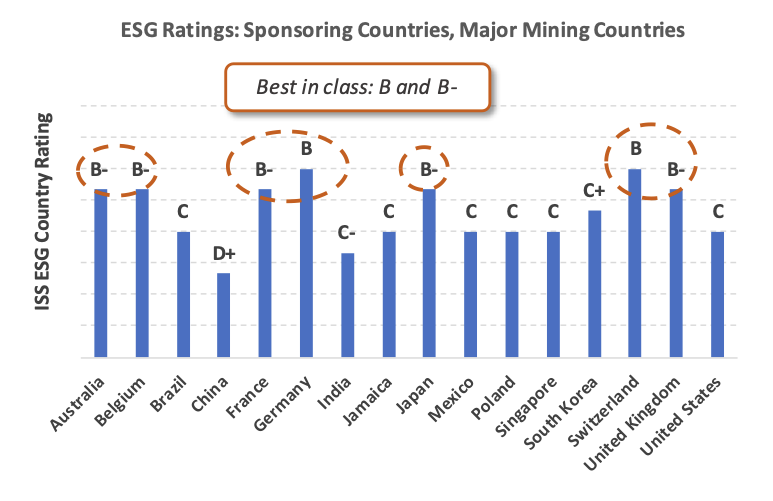

Also of likely interest to investors are those countries with best-in-class ESG ratings, where regulation and oversight of deep-sea mining could be expected to be relatively robust. Figure 4 illustrates the ISS ESG Country Ratings for countries that have sponsored significant deep-sea exploration, as well as for countries that have historically had significant mining operations, e.g., Australia, Chile, Peru, South Africa, etc.

Figure 4: ESG Ratings for Countries Involved in Deep-Sea Mining and Other Major Mining Operations

Source: ISS ESG Research

While deep-sea mining may be perceived as an alternative to terrestrial mining, it presents significant ESG-related risks, whose long-term consequences are not yet entirely clear. For that matter, investors may wish to actively monitor the developments and impacts of this practice going forward. The ISS ESG Corporate Rating and ISS ESG Country Rating tools can support investors in this process.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

Authored by:

Nicolaj Sebrell, CFA, Head of Energy, Materials, & Utilities, ISS ESG

Filip Veintimilla Ivanov, Analyst, Metals & Mining, ISS ESG

Arthur Kearney, Analyst, Metals & Mining, ISS ESG