Introduction: The New Geography of Investment Risk

For real asset investors—those allocating capital to asset classes such as infrastructure, real estate, and natural resources—the physical world directly impacts asset values, making it a source of significant financial risk. The recent intensification of extreme weather events and growing regulatory expectations around disclosure have placed physical climate risk at the forefront of investment decision-making.

Yet measuring and monitoring these risks remains one of the most complex challenges in finance. Climate models were designed for large-scale analysis rather than for understanding risks at the level of a single asset, grid connection, or property boundary.

Today, advances in geospatial data and artificial intelligence (AI) are changing that, enabling investors to observe, model, and anticipate climate-driven impacts at unprecedented resolution.

This new generation of geospatially enabled tools can integrate climate model outputs, satellite data, and other datasets into a coherent analytical whole, bringing climate science directly into the language of finance.

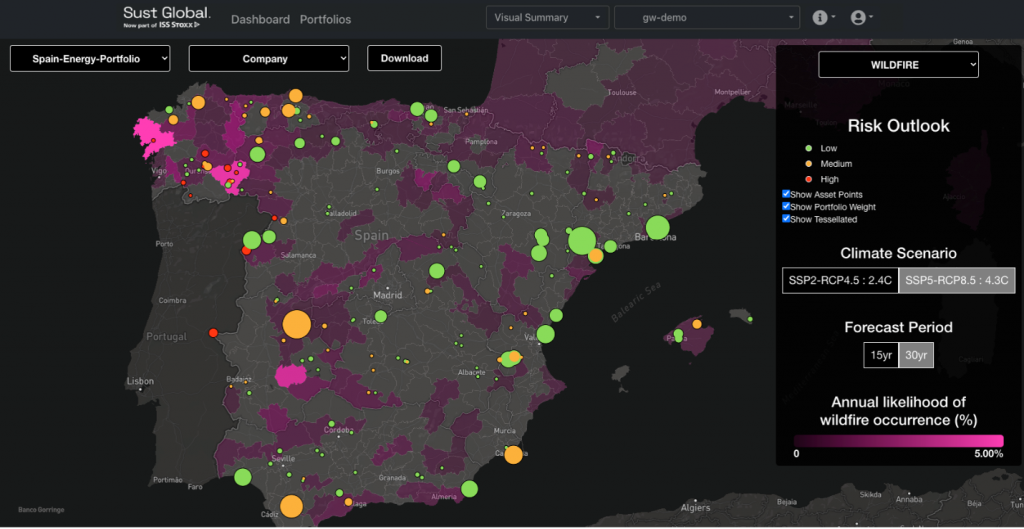

ISS STOXX’s Geospatial Asset Analytics platform is one such tool for integrating geospatial data into investment analysis. Figure 1 provides a sample of how the platform shows physical climate risk, in this case across a portfolio of Spanish energy generation sites.

Figure 1: Geospatial Analysis Sample: Physical Climate Risks to Spanish Energy Generation Sites

Note: In the foreground, users can see each power plant’s qualitative risk outlook, and each site’s size is weighted by its power generation capacity. In the background, users can see wildfire risk exposure at the administrative boundary level.

Source: ISS STOXX Geospatial Asset Analytics

Why Real Asset Investors Need Geospatial Intelligence

Real asset portfolios are inherently location-based. Across wind farms, transmission lines, commercial real estate, and logistics centers, performance is impacted by geographic and environmental context, as well as financial and operational factors.

Physical climate hazards such as flooding, heatwaves, drought, cyclones, and wildfire can disrupt operations, reduce asset value, and threaten long-term yields. Meanwhile, factors such as renewable energy deployment, water scarcity, and urban population shifts reshape where and how assets can operate sustainably.

To manage these risks, investors require decision-ready geospatial data that connects climate science with financial metrics. For example, these datasets can reveal the following:

- Which investor assets sit within zones of acute flood, cyclone, or wildfire risk

- How changing wind speed patterns could affect renewable generation yields

- Where changing heat stress, water availability, or sea-level rise may impact portfolio value

- How population migration or regional policy shifts may alter future asset utilization

However, integrating these diverse data sources has historically been a challenge. Each data source has distinct spatial scales, temporal resolutions, and scientific assumptions. This is where AI-driven geospatial modeling provides a significant new opportunity.

From Global Models to Asset-Level Insights

At the core of climate science are Global Circulation Models (GCMs). These simulate the earth’s atmosphere and oceans under different greenhouse gas scenarios (known as SSPs or RCPs). But they operate at coarse resolutions—typically 50 to 100 kilometers per grid cell—far too coarse to inform investment in a single tangible asset.

To make these models actionable for investors, data scientists perform downscaling, a process that translates global climate projections into local conditions. Traditionally, this process involved statistical techniques that relate large-scale variables (such as temperature or pressure) to finer-scale outcomes.

Today, AI and machine learning methods are transforming the downscaling process. Convolutional neural networks (CNNs) and diffusion-based architectures can super-resolve coarse climate data into high-resolution fields, capturing local variations that traditional models often miss. For example, AI downscaling can refine wildfire projections from 100km grids to 300-meter estimates.

AI downscaling allows for asset-level exposure modeling across portfolios, even when observational data are sparse. However, investors must recognize that every model involves assumptions and uncertainty. Different algorithms may yield slightly different outcomes; the range of projections forms a probabilistic distribution rather than a single deterministic number. It is essential to understand and account for this uncertainty—using ensemble approaches and sensitivity analyses—to quantify average estimates and tail risks.

The Expanding Universe of Geospatial Datasets

The landscape of relevant geospatial data has grown rapidly, encompassing both Earth Observation (EO) and socioeconomic sources. Some of the most valuable datasets for investors include the following:

- Climate model projections from ensembles such as the 6th Coupled Model Intercomparison Project (CMIP6), which provides forward-looking views of temperature, precipitation, and extreme events under multiple emission scenarios.

- Hydrological and topographic layers, including digital elevation models (DEMs) that reveal flood pathways and coastal inundation potential.

- EO data from satellites such as ESA’s Sentinel and NASA’s Landsat that capture land surface temperature, soil moisture, and vegetation indices.

- Population and socioeconomic models—for example, census tract data or population models— that can show human and economic activity.

- Geospatial Asset Databases that map the precise coordinates of energy facilities, buildings, and transport systems.

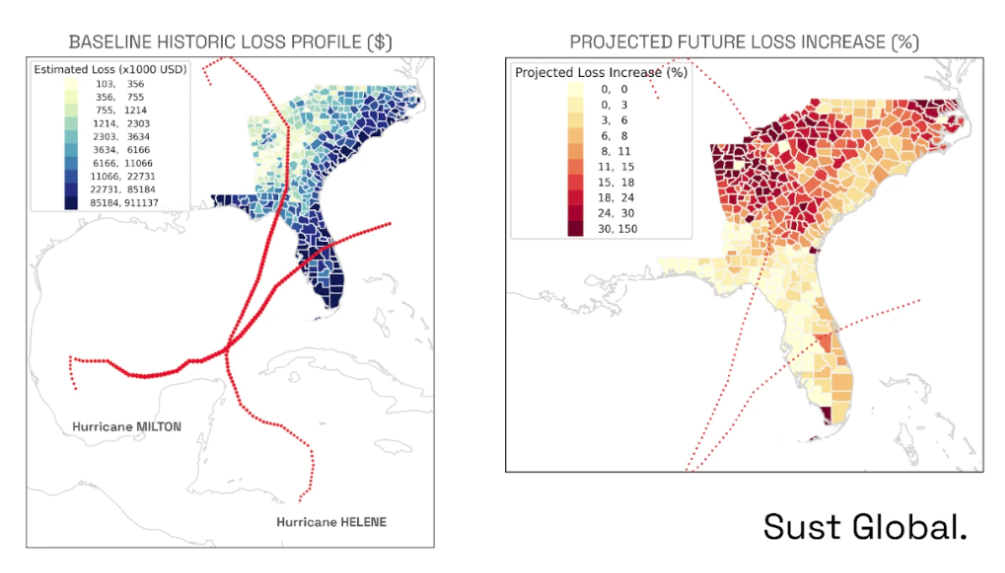

Integrating these layers allows investors to construct a multimodal understanding of risk: not just where hazards occur, but who and what is exposed, and how those exposures evolve over time. Figure 2 provides an example of how ISS STOXX’s Geospatial Asset Analytics tool can be used to analyze projected increases in climate-related losses, in this case from hurricanes.

Figure 2: Projected US Financial Losses from Hurricanes

Source: SustGlobal

Infrastructure Example: Wind and Renewable Energy Assets

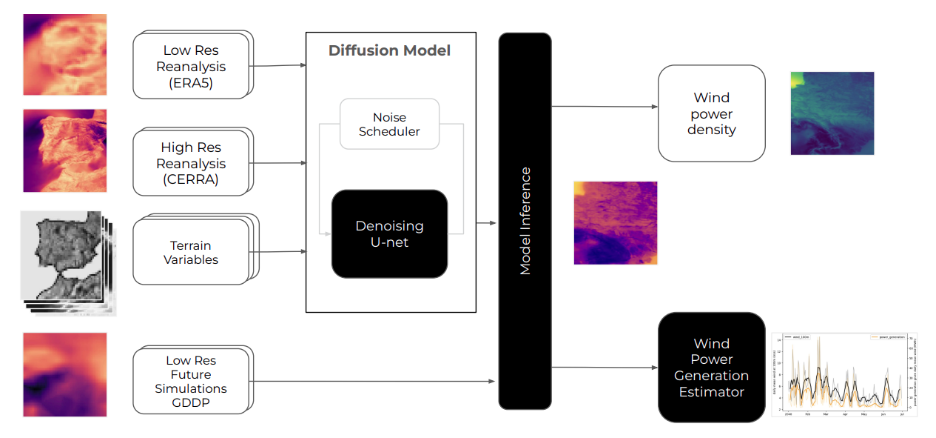

In renewable infrastructure investment, geospatial AI can now be central to performance forecasting.

Wind power projects, for instance, depend critically on local wind regimes. Even modest variations in average wind speed (0.3–0.5 m/s) can materially affect annual energy output and investor returns. Using reanalysis datasets such as ERA5 and applying proprietary AI models for diffusion-based downscaling, analysts can access fine-scale wind resource models that capture local effects of terrain, surface roughness, and climatic shifts.

These models allow investors to do the following:

- Forecast expected yield and power generation curves under different climate scenarios

- Identify future high-potential zones for new turbine installations

- Assess long-term wind variability risk, informing asset valuation and hedging strategies

Evaluate infrastructure resilience—for instance, how wind extremes might affect turbine blade fatigue or transmission reliability.

Figure 3: ISS STOXX’s Geospatial AI Workflow to Generate Projections of Future Wind Speed and Power

The same techniques could be applied to solar, hydro, or grid infrastructure, linking geophysical patterns to asset performance and risk-adjusted returns.

Real Estate Example: Structural and Financial Resilience

In real estate, physical climate risk is increasingly influencing underwriting, insurance premiums, and asset valuation.

Geospatial AI enables investors to map and quantify property-level exposure to hazards such as flooding, heat stress, wildfire, and tropical cyclones. By combining high-resolution hazard maps with structural damage and business interruption metrics, investors can assess both hazard probability and damage potential.

For example:

- Flood modeling can be combined with damage curves to estimate potential water depth and structural damage from flooding, which can inform adaptation measures and insurance coverage.

- Heatwave exposure can be modeled to evaluate energy efficiency and cooling needs for data centers.

- Cyclone risk can be evaluated and compared to regional production or GDP numbers, enabling an accurate view of potential damage from storms.

Such assessments not only support climate risk disclosures (e.g., TCFD, SFDR) but also enable proactive portfolio management. Such management can enable the prioritization of adaptation investments, adjustment of asset allocation weighting, and the integration of resilience premiums into valuation models.

Integrating Probabilistic Outcomes into Investment Models

A key advantage of climate hazard models and geospatial AI is the ability of these models to produce probabilistic forecasts, reflecting a range of possible futures rather than a single scenario.

For investors, this probabilistic structure is critical. It allows integration of physical risk into stochastic portfolio models, Value-at-Risk (VaR) frameworks, or Monte Carlo simulations. Rather than relying on binary risk/no-risk classifications, investors can assign likelihoods and potential financial impacts to a spectrum of outcomes.

For example, in a portfolio of real estate assets, investors can estimate the following:

- A 10% probability of >15% asset devaluation due to heat-related deterioration

- A 25% probability of moderate flood disruption within 20 years

- A central scenario showing 2–3% performance drag due to chronic heat stress

These insights enable risk-adjusted pricing, insurance structuring, and improved disclosure alignment with frameworks such as the EU Taxonomy and ISSB standards.

The Role of Geospatial AI in Portfolio Monitoring

Physical risk is dynamic—it evolves as both the climate system and the built environment change. Investors therefore need ongoing monitoring, not just one-off assessments.

Modern geospatial AI platforms, such as the ISS STOXX Real Asset Solution, can deliver quarterly or annual updates based on new EO, reanalysis, and climate model data. Investors can access risk metrics through APIs, cloud data warehouses, or interactive dashboards, integrating them directly into asset management workflows.

Regularly updated data provide investors with the following options:

- Portfolio surveillance for new or emerging hazards

- Scenario-based stress testing for regulatory or internal reporting

- Dynamic exposure mapping, as new assets are acquired or sold

- Comparability across asset classes, with standardized geospatial indicators

By embedding this intelligence into portfolio operations, investors can transition from reactive disclosure to proactive risk management.

Managing Uncertainty and Model Disagreement

While AI-driven models provide remarkable new capabilities, they are not without limitations. Every downscaling or hazard estimation involves assumptions about physics, data coverage, and algorithmic bias.

For instance, one model may predict a 10% increase in wind variability by 2050, while another forecasts stability or decline. Similarly, flood models may disagree on the extent of flooding due to differences in elevation inputs or precipitation assumptions.

Nevertheless, investors can treat this type of variation not as a flaw but as useful information that reflects real uncertainty in the climate system. Integrating multiple models can allow generation of ensemble averages. Displaying this spread across the different outputs can allow decision-makers to understand the level of model agreement (or disagreement) and how this can impact on potential asset exposure to extreme scenarios.

Transparency around model lineage, training data, and validation can help navigate different data results. Investors increasingly demand explainability and a methodological “glass box.” Such transparency enables investors to understand how a given climate or hazard score was produced and what scientific assumptions underpin it.

Towards a Unified Geospatial Risk Framework

In the future, real asset investing can benefit from collecting and assessing disparate datasets and models across geospatial, financial, and climate-derived models. The latest generation of models enable investors to integrate climate science into operational intelligence and investor workflows.

ISS STOXX’s physical risk platform, enhanced by Sust Global’s geospatial AI capabilities, is designed to meet this need by providing global coverage, annual projections through 2100, and flexible delivery via API, Excel, or web analytics dashboard.

The Strategic Imperative for Investors

Physical risk is now a mainstream financial variable. Regulators and asset owners increasingly require disclosure and quantification, while insurers, lenders, and tenants factor resilience into pricing. The integration of Earth observation, AI, and financial modeling represents a structural evolution in sustainable finance that connects the physical and financial worlds in a way that was previously unattainable.

Investors who leverage physical climate risk data and geospatial AI may have an advantage not only in meeting compliance requirements but also in identifying undervalued opportunities, optimizing risk-adjusted returns, and supporting the global transition to resilient infrastructure and real estate systems.

Explore ISS STOXX solutions mentioned in this report:

- Integrate geospatial data into investment analysis with the ISS STOXX Geospatial Asset Analytics platform.

By: Josh Gilbert, Head of Geospatial Strategy, ISS STOXX