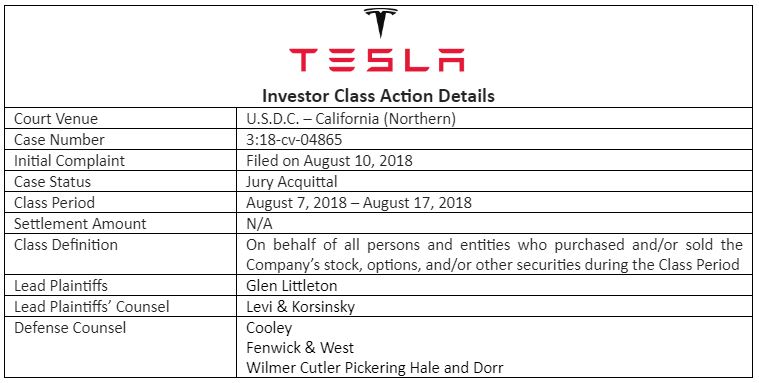

In what is an anomaly for securities class actions, investors took their case involving Musk’s infamous August 2018 tweets all the way to trial and to verdict. After a three-week trial, a 9-member federal jury in the Northern District of California reached a unanimous decision that Elon Musk and Tesla, Inc. were not liable for tweets Musk made in 2018 about a Tesla buyout.

On August 7, 2018, Musk tweeted he is considering taking Tesla private at $420 per share, with his infamous “funding secured” statement. This tweet along with another that followed – which added “investor support is confirmed” – created the impression that a take-private was virtually certain, according to investors. Funding, however, allegedly was far from secured, as Musk had engaged in only preliminary discussions with Saudi Arabia’s sovereign wealth fund and no cash had been committed. Investors also argued the Tesla Board bore responsibility for ensuring statements made on Musk’s Twitter account – an official channel of communication for Tesla – were truthful.

Tesla’s stock price soared following the initial tweets, but then declined by almost 9%, erasing over $5 billion in market capitalization, following a New York Times article reporting funding had not been secured. In addition to common stockholders, options traders and investors who were short Tesla stock suffered significant losses – collectively to the tune of $12 billion dollars, according to plaintiff’s expert.

On the stand, Musk testified that his Saudi backers – who refused to appear at trial – were “unequivocally” behind his plans to take the company private, and that he was dismayed to find out later via text they “backpedaled.” Part of Musk’s defense was also that a reasonable investor would not believe or act on the information just because he tweeted it. In summation, Musk’s lawyers argued investors only cared that Musk was considering a buyout – the case centered on “bad word choice,” but a “bad tweet doesn’t make it fraud.”

The jury’s verdict finding investors had not proved their 10b-5 claims for both Twitter statements comes in spite of a favorable pretrial ruling for plaintiffs. Judge Edward M. Chen had previously held that the statements were false and Musk made the statements recklessly. However, Judge Chen refused to hold on summary judgment that Musk’s tweets affected Tesla’s share prices, leaving the jury to decide whether the tweets were material to the market and caused investors’ economic losses. While nothing has been filed yet, it is possible the class plaintiff will soon ask the federal judge to set aside the jury verdict.

A shareholder class action making its way to trial is an incredibly rare feat. Of the thousands of cases filed against public companies since the passage of the Private Securities Litigation Reform Act in 1995, it is believed that only 16 have resulted in trial verdicts (where the alleged wrongdoing was also post-PSLRA), including Mr. Musk’s recent win. A majority of cases are dismissed, while the remaining actions settle prior to trial.

Kevin LaCroix of The D&O Diary recently stated “these kind of cases rarely go all the way to trial. In part because you are putting all of the outcome determination in the hands of a bunch of strangers.” Following a defendant’s failure to succeed in its motion to dismiss, a vast majority of companies look to resolve litigation and avoid a trial, where significant risk of financial damages may be awarded. Indeed, securities class actions are often thought of as ‘“bet the company’ cases, and very few corporate defendants are willing to gamble to the same extent as Mr. Musk,” according to Brad Foster of Haynes and Boone LLP.

A few examples of shareholder class action trial verdicts include:

- Dakota Plains – a verdict for the plaintiffs in 2022 against the one defendant (former company co-founder, Michael Reger, who refused a prior settlement)

- Puma Biotechnology – a verdict for the plaintiffs in 2019; later agreeing to a $54.2 million payout

- Vivendi Universal – a verdict for the plaintiffs in 2010; later agreeing to a $78 million payout

Interestingly, shortly after Mr. Musk’s tweets on this topic, both he and Tesla agreed to resolve allegations of wrongdoing with the United States Securities and Exchange Commission. The SEC announced – on September 29, 2018 – a $40 million settlement resolving fraud charges against Mr. Musk and failing to have required disclosure controls and procedures relating to Musk’s tweets with Tesla. Payment terms included $20 million each from Mr. Musk and Tesla.[1]

It will be interesting to see if Mr. Musk’s success at trial spurs other defendants to avoid settling with shareholder plaintiffs and risk added liability from a jury, or if Musk’s willingness to roll the dice is an outlier. ISS Securities Class Action Services will continue to closely monitor actions against Mr. Musk’s companies – including a handful of active cases involving Twitter – and all other shareholder class actions… and communicate updates to its clients and the investment community, as developments occur.

Note:

[1] In 2022, Mr. Musk attempted to terminate the settlement, however a federal judge rejected his arguments.

By: Jeff Lubitz, Managing Director, ISS Securities Class Action Services, and Jarett Sena, Director of Litigation Analysis, ISS Securities Class Action Services