Introduction

Electric power generation is a prominent contributor to global greenhouse gas emissions, with the electricity and heat generation sector witnessing the largest surge in carbon emissions in 2022, according to the IEA’s CO2 Emissions Report. Aligning the electricity sector with the Paris Agreement’s 1.5°C goal will likely require substantial investments in the energy transition.

Clean energy investment has gained a strong lead over fossil fuel investment in recent years. The rapid growth in clean energy investment is attributable to a confluence of factors, such as favourable economic conditions amidst volatile fossil fuel prices, robust policy support such as the U.S. Inflation Reduction Act and the EU REPowerEU plan and Fit-for-55 package, new initiatives in China and India, and energy security concerns incentivizing policy makers to reduce dependencies on fossil fuels. Global investment in clean energy set a new record, reaching $1.6 trillion in 2022. It was driven by renewables, especially solar PV; energy efficiency; grids; and energy storage projects.

Capital expenditure (CAPEX) serves as a valuable indicator for possible future business expansion. ISS ESG’s Energy & Extractives Screening Green and Brown Expansion dataset includes data on expansion plans for both renewable (Green) and fossil-fuel based (Brown) power within the electric utilities sector.

By analyzing the Green and Brown Expansion dataset, this post explores the trend of CAPEX investments based on the financial information reported by companies. Green investment is surging globally, especially in solar and wind, but Brown investment patterns suggest a continued reliance on fossil fuels.

Green and Brown Expansion, by Region

This post analyzes 478 corporate issuers in the Alternative Power and Electric Utilities industry for the fiscal year 2022. Of these, 264 issuers are involved in Green and Brown Expansion.

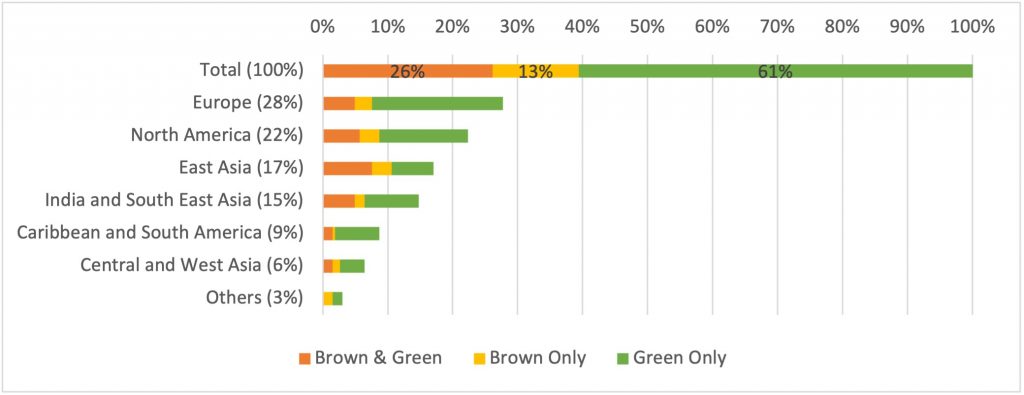

The distribution of Green and Brown Expansion projects reveals that about 61% of the issuers participated exclusively in Green Expansion, 26% participated in both Brown and Green Expansion, and 13% participated exclusively in Brown Expansion (Figure 1).

Figure 1: Alternative Power and Electric Utilities Companies Involved in Green and Brown Expansion, by Region

Notes: Percentages represent the percentages of companies covered by the Green and Brown Expansion dataset.

Source: ISS ESG Data

Europe leads in energy expansion efforts, accounting for 28% of the total 264 issuers participating in Green and/or Brown Expansion, followed by North America (22%), East Asia (17%), and India and South East Asia (15%), among others.

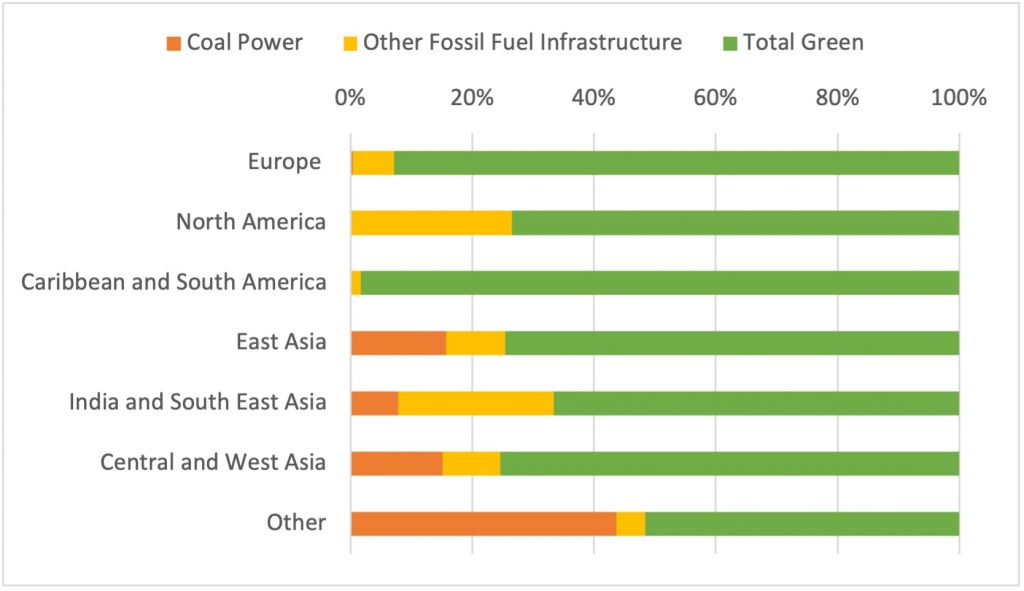

Overall, most regions invest the majority of their CAPEX in Green Expansion of renewables rather than in Brown Expansion of coal power and other fossil fuel infrastructure projects. This pattern is consistent with the global trend of preferring investment in clean energy over fossil fuels.

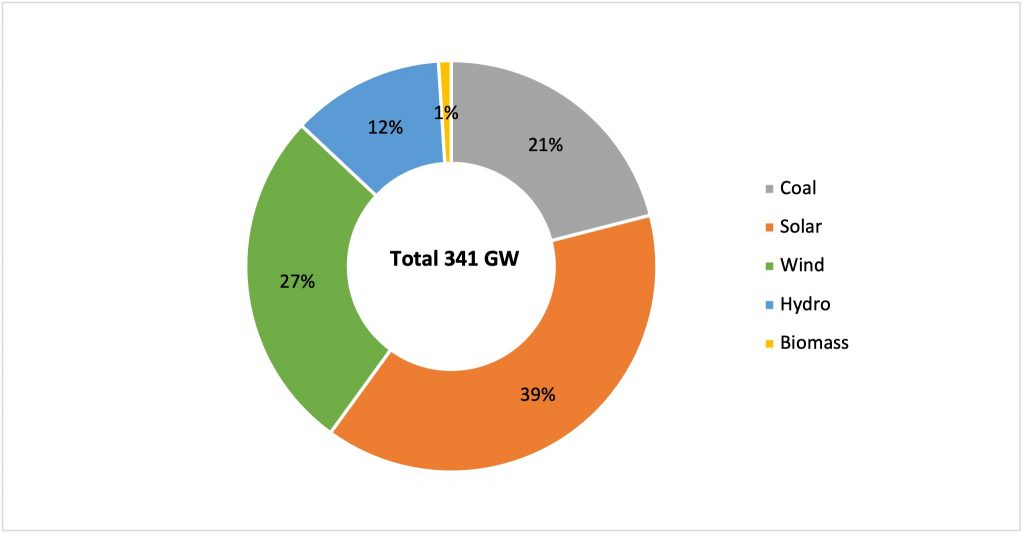

In addition, the planned expansion capacity of the 264 companies by fuel source also fits with the global CAPEX focus on renewables. In 2022, the total planned solar capacity accounted for 39% of the total planned capacity, followed by wind (27%) and hydropower (12%). Coal power accounted for 21% and biomass lags at 1% (Figure 2).

Figure 2: Planned Expansion Capacity, by Fuel Source

Source: ISS ESG Data

European and North American electric utilities companies allocate about $53.1 billion into new renewables development, primarily development of solar (60.9 GW) and wind (57.1 GW). The Green and Brown Expansion dataset reveals that Europe and North America are significant contributors to Green CAPEX, accounting for nearly 50% of total Green CAPEX spending in 2022.

Figure 3 shows these and other regions’ focus on renewable expansion. This emphasis on renewables is supported by a variety of factors, including volatile fossil fuel prices caused by the Russian war in Ukraine, as well as enhanced policy frameworks for clean energy.

Figure 3: Green and Brown Spending Distribution, by Region

Source: ISS ESG

In Asia, the electric utilities industry invests approximately $29.5 billion in renewable energy expansion. The planned solar capacity is 65.6 GW and hydropower is 36.4 GW, while wind power stands at 26.7 GW. Investment in renewable energy is primarily driven by a few key players such as companies in China, Japan, India, and the Middle East.

This green surge emphasizes a shift away from traditional energy investments in Asia. However, this trend is not evenly spread across the continent and may have not fully reached all corners of Asia just yet. The transition to renewable energy faces a challenge in many countries due to the combination of large upfront costs and rising interest rates, which can make financing renewable projects more expensive.

Further, the Asia-Pacific region stands out for its continued involvement in Brown projects. Notably, planned coal expansion remains concentrated in Asia, driven by China (37.0 GW), India (23.1 GW), and countries in South East Asia, and South Africa. Natural gas and oil power projects also persist within the Brown investments, highlighting the mixed picture of Asia’s energy landscape.

Other countries such as the United States, Japan, and South Korea primarily invest in gas power. In Europe, Brown projects consist of building new gas power plants, retrofitting coal-powered plants to being natural-gas fueled, and adding natural gas power capacity to existing plants.

Conclusion

In summary, the ISS ESG analysis reveals differences in energy investment approaches across regions. Investment in renewables is surging globally, a prominent trend in today’s energy landscape. This trend is led by advanced economies such as those in Europe and North America, as well as China. Substantial capital investment flows into solar and wind expansion. Hydropower growth is concentrated in China and India, while Europe invests marginally in biomass.

However, while other regions move away from coal, Asian companies continue to plan a significant increase in coal power to meet their growing electricity demand. In Europe and North America, many companies are prioritizing investment in natural gas, focusing on retrofitting existing coal power plants to run on gas and building new gas power plants. This suggests a continued reliance on fossil fuels in these regions despite a growing push for renewable energy.

Various crucial factors contributing to this divergence involve geopolitical anxieties regarding energy security and economic constraints, such as rising borrowing expenses and debt loads, particularly since clean energy takes substantial initial investments. Also, uncertainties in energy policies create challenges for long-term investments.

ISS ESG’s Energy & Extractives Screening Green and Brown Expansion research captures actual CAPEX spending employed for renewables and fossil fuels expansion projects, which provides insight into energy transition plans on a company level. The Green and Brown dataset helps investors to determine how a company’s strategy aligns with the growing demand for clean energy.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Energy & Extractives Screening to assess companies’ involvement in the extraction of fossil fuels, and the generation of power from fossil fuels, nuclear and renewable sources.

By:

Ahra Jung, Associate, Energy & Extractives, ISS ESG

Aparna Joshi, Associate, Energy & Extractives, ISS ESG

Pravin Ubale, Analyst, Energy & Extractives, ISS ESG